What is Profitability Index?

The Profitability Index (PI), also known as the Profit Investment Ratio (PIR) or the Value Investment Ratio (VIR), is a vital instrument for evaluating the appeal of an investment venture.

The PI indicates the value you stand to receive for each dollar invested. A PI exceeding 1.0 suggests that the value to be gained surpasses the investment. Conversely, if the PI is below 1, it is prudent to reassess the venture’s viability.

In instances where there are multiple investment alternatives, the PI proves to be exceedingly beneficial. It allows for selecting projects with higher PIs, which are commonly associated with more lucrative investments.

How to Utilize the Profitability Index Calculator

The PI Calculator is an efficacious instrument engineered to appraise a project’s anticipated return on investment. It incorporates the principle of Present Value coupled with the initial investment to compute the Profitability Index. Below is an elaborate guide on employing the PI Calculator for your project appraisal:

1. Input the Initial Investment: Locate the ‘Initial Investment’ field, and enter the sum initially invested in the project. This represents the capital you allocate to the project at the outset.

2. Input the Discount Rate: Seek out the ‘Discount Rate’ field, and provide the discount rate. This percentage embodies the time value of money. It serves to bring future cash flows to their current worth. The discount rate may encompass the capital’s cost or a projected rate of return.

3. Input the Project’s Duration: In the ‘Number of Years’ field, indicate the duration in years you anticipate obtaining cash flows from the project. The calculator will, in turn, spawn fields for entering yearly cash flows, corresponding to the number you’ve entered.

4. Input Yearly Cash Flows: Populate the fields with each year’s expected annual cash flow. This encompasses various monetary transactions such as revenues, expenditures, taxes, and others that are germane to the project.

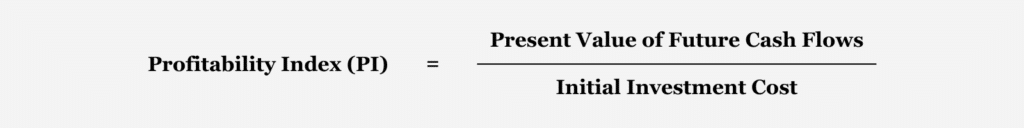

5. Compute the Profitability Index: With all pertinent data entered, press the ‘Calculate Profitability Index’ button. The calculator will employ this data to ascertain the Present Value of the cash flows. It will then take this value and divide it by the Initial Investment to yield the Profitability Index.

By following the steps above, you can proficiently employ the Profitability Index Calculator to evaluate your project’s prospective return on investment.

Example of Profitability Index in Investment

After employing our profitability index calculator, the next step is to dissect the results. We will clarify this through an illustration.

Picture a scenario where a company is considering two potential ventures: Project A and Project B. Project A entails the modernization of a manufacturing facility. On the other hand, Project B involves the introduction of a new range of products.

Here are the details for Project A:

- Initial Investment: $800,000

- Predicted Cash Flows: $150,000 annually for 6 years

- Discount Rate: 8%

Now, let’s look at Project B:

- Initial Investment: $1,200,000

- Predicted Cash Flows: $250,000 annually for 6 years

- Discount Rate: 8%

To assess these projects, we will compute the Profitability Index for each.

Starting with Project A:

Present Value (PV) is calculated as follows: $150,000 / (1 + 0.08)^1 + … + $150,000 / (1 + 0.08)^6. This sums up to $714,620.

Profitability Index (PI) is then computed as PV divided by the Initial Investment: $714,620 / $800,000. This equals 0.89.

Moving on to Project B:

Present Value (PV) is computed similarly: $250,000 / (1 + 0.08)^1 + … + $250,000 / (1 + 0.08)^6. This adds up to $1,071,032.

Profitability Index (PI) is PV divided by the Initial Investment: $1,071,032 / $1,200,000. This also equals 0.89.

Remarkably, both projects have identical Profitability Indexes of 0.89. As these values fall below 1.0, it implies that neither project is forecasted to yield returns surpassing the initial investments.

It’s crucial to recognize that the Profitability Index doesn’t encapsulate every aspect of an investment. It’s merely one component in a multifaceted decision-making process. Other elements, such as alignment with company strategy or prevailing market trends, could render one project more attractive despite the Profitability Index figures.