Financial jargon can be puzzling. Terms like “growing annuity,” “present value,” or “present value of growing annuity formula” often leave many scratching their heads. If you’re in that boat, you’re certainly not alone. To address this, we’ve created the Present Value of Growing Annuity Calculator. Continue reading to discover how this tool functions and better understand the present value of a growing annuity.

What is a Growing Annuity

A growing annuity, sometimes referred to as an increasing or graduated annuity, is characterized by periodic payments that increase at a set rate. This characteristic offers adaptability, making the growing annuity a valuable tool in long-term financial planning. It aligns more aptly with tangible economic situations, such as inflation or the rising cost of goods.

In a growing annuity, the growth rate is set in advance. This offers both dynamism and predictability in your investment. Consider this example: if your initial annual payment is $100 with a growth rate of 5%, the payment in the second year would be $105 (calculated as 100 * 105%). For the third year, it would be $110.25, determined by multiplying $105 by 105%. The pattern continues in this manner.

Such a financial tool aids in making precise forecasts of upcoming cash flows.

Present Value of Growing Annuity

The concept of present value represents the current worth of future cash flows, adjusted to today’s currency value. However, with a growing annuity, this assessment gets a bit intricate due to an added factor: the growth rate.

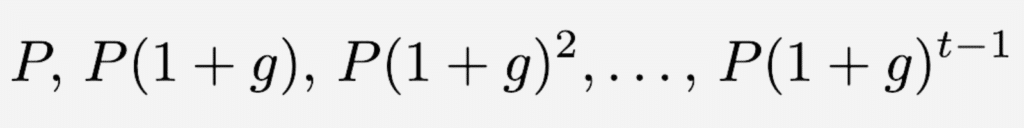

The objective of the Present Value of a Growing Annuity (PVGA) is to determine the present worth of those future cash flows that increase consistently at a rate, denoted as ‘g’. Suppose the starting payment is represented as ‘P.’ The progression of these cash flows can be illustrated as:

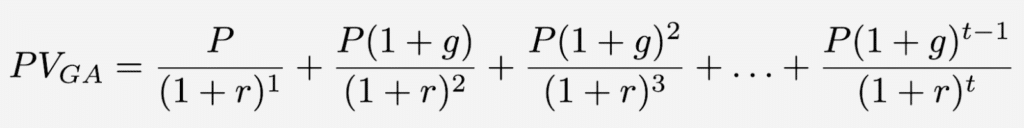

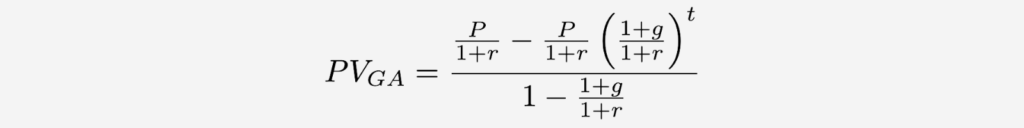

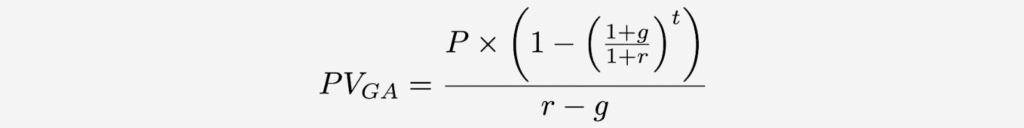

Discounted back to today’s value using a discount rate r, the PVGA is:

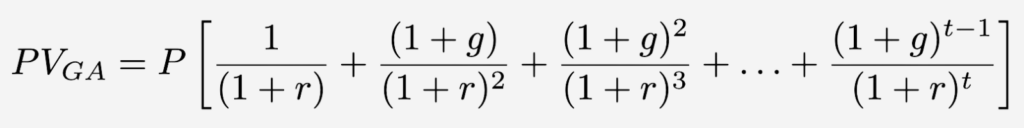

To simplify, factor out P and rewrite the equation:

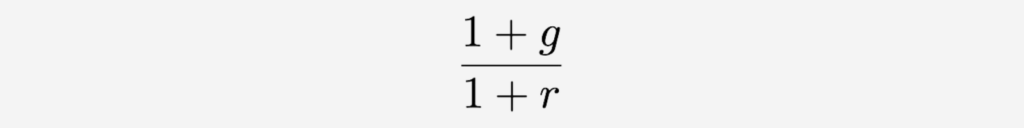

This is a geometric series with the common ratio:

Remember the Geometric Series Formula? Apply it to the equation, and now we can get a simple formula:

Multiplying the numerator and denominator by (1+r), we arrive at the final formula:

Present Value of Growing Annuity Calculation Example

The Present Value of Growing Annuity (PVGA) may initially come across as a theoretical concept. However, its real-world applications are extensive and influential. Let’s shed light on its importance with an example related to retirement planning.

Imagine you’re 40 years old and recently secured a position with an annual bonus. Your employer assures you that this bonus will see a 5% increase annually. With intentions to remain employed for another 20 years, you wish to channel these bonuses towards your retirement fund. Based on advice from your investment consultant, the applicable discount rate is approximately 3%.

To deduce the PVGA, input the initial bonus sum (P), the discount rate (r=3), the bonus’s growth rate (g=5), and the number of periods (t=20) into our Present Value of Growing Annuity Calculator. This process will render the present-day value of all projected bonuses.

Equipped with this data, you can judge if solely depending on these escalating bonuses will cover your retirement needs. You may discover a need for supplementary investments or find comfort in aligning with your financial aspirations.

Uses of the Present Value of Growing Annuity

The Present Value of Growing Annuity (PVGA) influences various economic and financial decisions. In essence, PVGA tells us the worth of a series of future cash flows (that grow at a certain rate) in today’s money. Here are some of its crucial applications in various financial fields:

Capital Budgeting and Project Evaluation

Businesses often consider long-term ventures, from launching a new product to expanding a factory. These ventures typically lead to cash inflows that grow over the years. The PVGA helps businesses bring these future, growing cash inflows to today’s monetary terms.

From there, they can derive the Net Present Value (NPV) by subtracting the initial investment cost from the discounted value. If the NPV is positive, it suggests the project could yield a return above the capital cost, making it a potential investment.

Sensitivity Analysis and Risk Assessment

Financial landscapes constantly change. That’s why financial analysts employ PVGA with different discount rates to determine an investment’s resilience to these shifts. By raising the discount rate, analysts essentially test an investment’s strength in a high-risk or high-cost capital scenario.

If the investment’s PVGA remains attractive even with a high discount rate, it’s considered more resilient to uncertainties.

Valuation of Growing Income Assets

Assets in markets like stocks often offer returns that grow with time. For instance, some companies consistently increase their dividends annually. Investors can use PVGA to understand today’s worth of these projected growing dividends.

This insight aids in selecting stocks, diversifying portfolios, and determining if an asset’s price matches its anticipated growth.

Lease Agreements and Contract Evaluations

In sectors like real estate, leases or contracts often include annual increases, be it due to inflation or agreed-upon escalations. The PVGA helps parties comprehend the real value of these contracts, ensuring that their terms align with current market conditions.

In summary, the Present Value of Growing Annuity isn’t just for retirement planning. Its broad range of applications makes it essential for multiple financial evaluations, aiding entities from corporations to solo investors in making well-informed, forward-thinking choices.

Final Words

Grasping the concept of the Present Value of Growing Annuity (PVGA) is crucial for those committed to in-depth, long-term financial planning.

As highlighted, the uses of PVGA span a broad spectrum, covering areas from personal finance to capital budgeting and risk assessment. It’s more than a mere academic idea; it’s a hands-on instrument directly bearing on your financial future. By employing the PVGA, you can foster decisions that are both economically astute and designed for the long haul.

We trust this article has enriched your understanding of the Present Value of Growing Annuity. May it serve as a beacon in your financial journey, steering you toward achieving your long-term aspirations with assurance.