Welcome to the future! It’s a realm where artificial intelligence (AI) isn’t just a concept from science fiction, but an everyday reality shaping our lives. Notably, OpenAI, a globally recognized top-three AI lab, is fundamentally reshaping our understanding of what AI can do. It’s a glimpse into the limitless promise of this groundbreaking tech.

As an investor, you might wonder how to invest in OpenAI stock, especially if you’re intrigued by the possibilities of ChatGPT. Don’t worry, this guide will steer you in the right direction!

Is OpenAI Publicly Traded?

You may be surprised that OpenAI’s stock isn’t available on any traditional stock exchange. This situation arises from the fact that OpenAI operates as a private company. As such, its shares aren’t publicly traded or readily accessible for purchase by individual investors.

As it stands, OpenAI has not undertaken an Initial Public Offering (IPO). This is a process where companies offer their shares for public purchase for the first time. Often, businesses use an IPO to gather considerable capital required for expansion or other major undertakings.

Private entities like OpenAI commonly raise funds via venture capital firms, angel investors, and other institutional investors during different funding rounds. This approach affords them the liberty to concentrate on their long-term business strategies, free from the stress of short-term performance typically associated with public companies.

Can you Still Invest in OpenAI Stock?

So, does this mean you’re out of luck if you’re interested in investing in OpenAI’s promising AI technology? Not quite.

Despite OpenAI’s private status, avenues still exist to gain a foothold in the company. Some platforms, like Equity Bee, offer opportunities for investors to delve into private entities such as OpenAI, though within certain confines.

What’s more, there are publicly-traded companies that have existing partnerships with OpenAI. By investing in these entities, you indirectly partake in OpenAI’s forward-thinking advancements.

Buying OpenAI Stock Through Pre-IPO Investing Platforms

With the emergence of private share marketplaces, investors have a new avenue to purchase shares in pre-IPO companies like OpenAI.

In essence, you’re buying an employee’s stock options. This purchase can give you a stake in the company, which may yield benefits from future liquidity events.

In a liquidity event, you can convert your investments into cash. This could happen through a merger, an acquisition, or when the company goes public. Any of these scenarios could potentially lead to a return on your investment.

However, getting such shares can be complex. The number of available shares varies, and there might be eligibility restrictions for purchase. Plus, all pre-IPO investments carry a significant risk due to the company’s unproven public performance and possible long durations of illiquidity.

Yet, if you have unwavering faith in a company’s potential, this option might be worth considering.

Investing in OpenAI Through Its Collaborations

Over the years, Microsoft has evolved from a software-focused firm to a cloud technology leader. However, this transformation is not widely acknowledged, leaving an underappreciated aspect of the tech giant’s portfolio – its advanced AI capabilities.

Microsoft Azure, their flagship cloud service, does more than just offer file storage and web app hosting. It also supports powerful computing resources and sophisticated AI solutions. Azure AI demonstrates this by providing developers and data scientists with a full suite of AI services.

Moreover, Microsoft’s relationship with OpenAI isn’t new. The tech giants have been partners since 2016 and recently reaffirmed their shared vision for AI’s future. Microsoft announced a substantial $10 billion investment in OpenAI in January 2023, further solidifying this commitment.

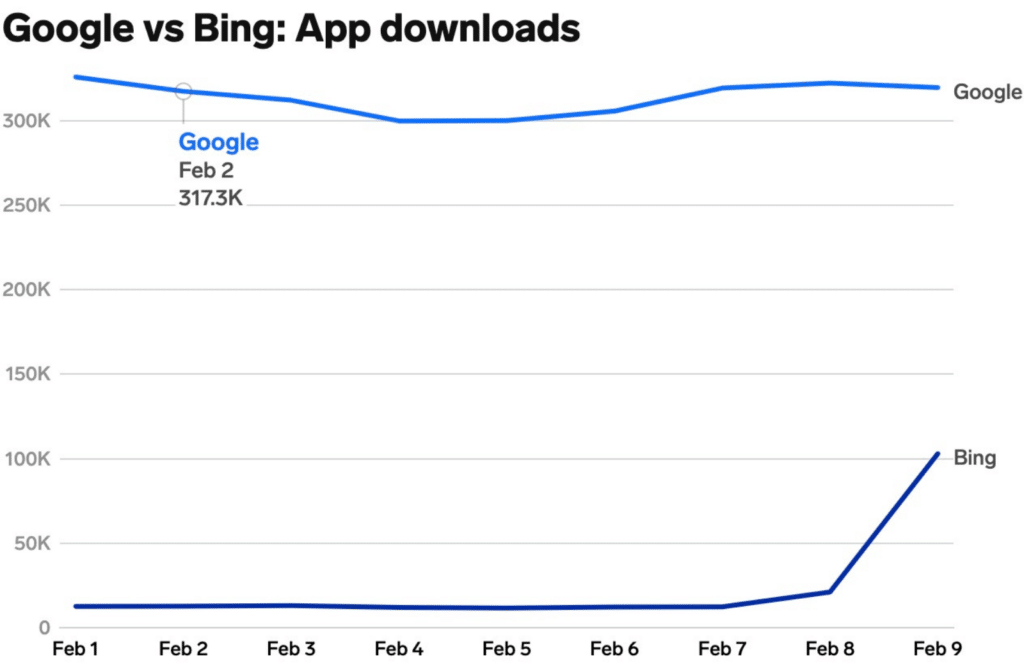

Microsoft has also integrated OpenAI’s GPT-4 model into its newly improved Bing search engine. The integration resulted in a swift and significant impact, causing Bing downloads to surge more than ten-fold. This event underscores the enormous value that OpenAI brings to Microsoft.

Therefore, if OpenAI continues to innovate and create even more sophisticated models, Microsoft will reap the benefits. By investing in Microsoft, you indirectly gain the chance to profit from OpenAI’s victories.

Investing in OpenAI Through Upstream GPU Manufacturers

At first glance, mentioning a semiconductor company like Nvidia (Nasdaq: NVDA) in the context of OpenAI might seem puzzling. However, the connection between them is more significant than you might think.

Nvidia, famous for producing some of the world’s leading Graphic Processing Units (GPUs), or in simpler terms, graphic cards, holds a crucial role in the AI industry. These GPUs are the fundamental infrastructure that allows computers and machines to carry out intricate deep learning tasks.

Imagine a state-of-the-art chip as a computer’s brain. Without it, the system wouldn’t possess the computational strength to decode and execute codes or to enhance its machine learning capabilities – an essential element of AI technology.

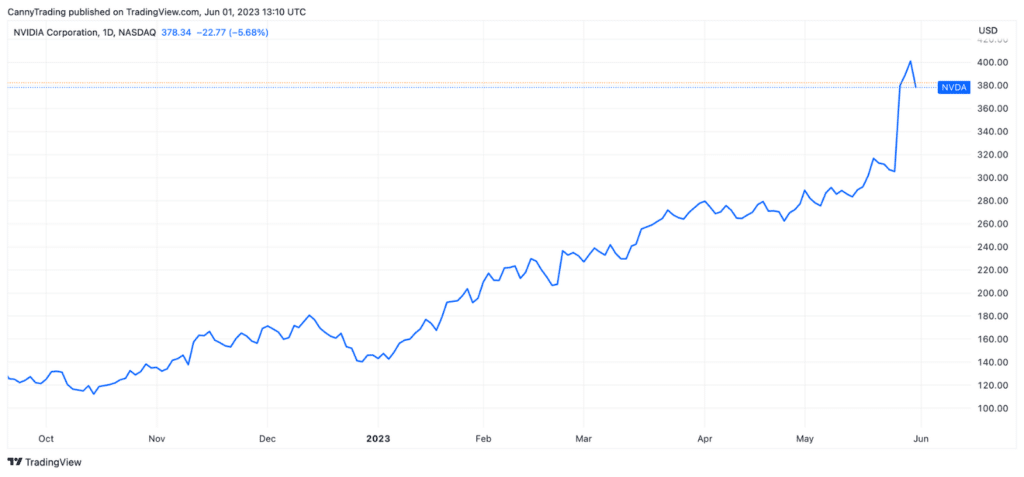

As the frontier of AI broadens, with trailblazers like OpenAI leading the charge, the demand for high-performance computing will surge. As a leading GPU manufacturer, Nvidia is well-positioned to benefit greatly from this increase. Indeed, the launch of ChatGPT has already been a blessing for Nvidia, tripling its stock price since its debut.

Investing in Nvidia allows you to indirectly participate in OpenAI’s growth. After all, every AI success story begins with the might of a proficient GPU.

Conclusion

As we reach the end of our exploration into investing in OpenAI stock and capitalizing on ChatGPT’s growth, a few key takeaways stand out.

Firstly, for retail investors, directly investing in ChatGPT or buying OpenAI stock can be a challenging endeavor. While pre-IPO investing platforms present a possible route, they’re not a guaranteed solution and carry their own complexities. Hence, this method may not be the most advisable.

A compelling, and potentially more feasible, alternative is indirect investment through Microsoft or Nvidia. These tech giants, due to OpenAI’s strategic partnerships with them and its reliance on their technologies, provide a somewhat less risky way to participate indirectly in OpenAI’s growth.

Nevertheless, prudence is key. While the AI wave is exciting, it’s worth noting that it has fueled considerable speculation in the stock market. Major corporations like Nvidia have seen their stock prices triple within a short span, hinting at a level of overenthusiasm in the market.

Although the idea of investing in OpenAI and ChatGPT might be attractive, it’s crucial to proceed with caution, understand the inherent risks, and make well-informed decisions. The secret to successful investing rests in patience, thorough research, and a balanced perspective on risk and reward. Happy investing!

2 Responses

You have a unique perspective.

Your insights are life-changing.