Every investor understands the need for a strong foundation in their portfolio. S&P 500 ETFs often serve as this reliable cornerstone. Among these, two titans stand out: the iShares Core S&P 500 ETF (IVV) and the Vanguard S&P 500 ETF (VOO).

To the casual investor, these two might seem interchangeable. After all, if you’re looking at the long game and minor performance fluctuations don’t unsettle you, either of these could serve you well.

However, savvy investors know that it’s often the finer details that matter.

In this thorough comparison of IVV vs VOO, we’ll explore which one might be a better fit for your investment game plan.

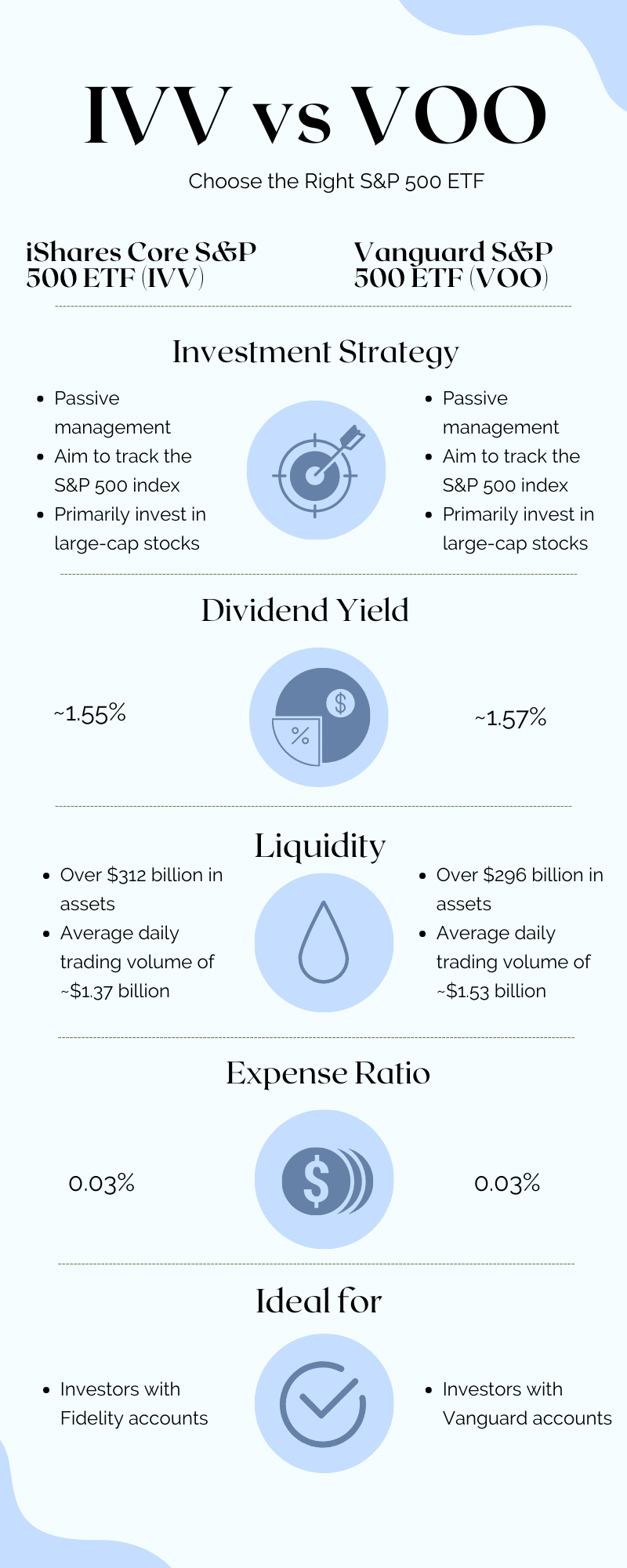

In a Hurry? Check Out This Quick Infographic!

IVV and VOO: A Closer Look

Let’s take a closer look at IVV and VOO. These are both offerings from giants in the field, BlackRock and Vanguard respectively.

IVV, a standout product from BlackRock, is all about keeping it simple and sticking to the basics. It’s not trying to beat the market with fancy tactics or expert predictions. Instead, it’s all about providing a mirror image of the S&P 500 index, nothing more, nothing less.

Vanguard’s VOO follows a strikingly similar game plan. The aim is to eliminate the risks tied to choosing the wrong stock or making a bad timing decision.

They follow the S&P 500’s lead, using a market-capitalization weighting approach. This means a company’s influence within these ETFs is tied to its size, as measured by its market cap. Bigger companies like Apple or Microsoft hold more sway, influencing the overall performance of these ETFs far more than their smaller counterparts.

IVV vs VOO: Similarities

Investment Strategy

Since IVV and VOO are designed to reflect the S&P 500 – composed of the 500 largest U.S. companies – they’re naturally inclined towards large-cap stocks. There’s a degree of risk protection in this, as the biggest corporations often have proven business models, strong financial positions, and multiple sources of revenue.

However, focusing solely on these top-tier companies comes with its own set of challenges. One significant hurdle is the limited exposure to mid-cap and small-cap sectors. In contrast, more encompassing index funds like the Vanguard Total Stock Market ETF (VTI), for example, diversify across around 4000 stocks. By including smaller-cap stocks in your portfolio, you can widen your market reach and potentially tap into new growth opportunities.

IVV and VOO also concentrate mainly on the U.S. market. If you’re an investor wanting to strike a balance between domestic and global market exposure, there are other ETFs you could consider. The Vanguard Total World Stock ETF (VT) is one such fund. It gives you access to U.S. and international stock markets alike, adding a vital element of geographical diversity to your investment strategy.

Expense Ratio

An expense ratio is essentially an annual fee charged by all funds or ETFs to their shareholders. In simple terms, it’s a percentage that indicates how much of the assets get used up each financial year to cover fund expenses. These expenses include management fees, administrative costs, operating expenses, and other costs that the fund incurs based on its assets.

Now, let’s consider IVV and VOO. They both come with an expense ratio of 0.03%. This is remarkably cost-friendly. With such a low expense ratio, you don’t have to worry about fees eating away a significant portion of your investment over time. Instead, more of your hard-earned money stays invested and has a chance to multiply. This affordability and potential for growth are key reasons why many individuals consider these funds as viable options for long-term investing.

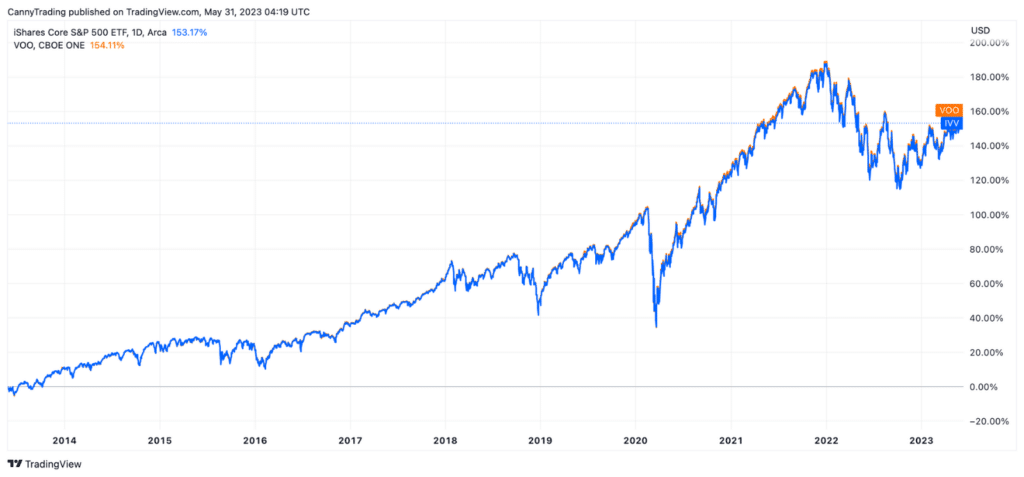

Historical Performance

Given their mandate to track the S&P 500 Index as closely as possible, it’s hardly surprising that the returns from IVV and VOO have mirrored each other over the years. An exploration of their performance from 2014 to the present day illustrates this harmony.

But, an interesting pattern emerges when you carefully contrast the two. IVV has demonstrated a marginally tighter adherence to the performance trajectory of the S&P 500 Index.

By no means does this take away from the notable performance of VOO. Yet, upon close examination, IVV seems to trail the index’s path with a slight bit more precision. This analysis merely serves to highlight the nuanced differences in their historical performances.

Liquidity

Both IVV and VOO have a commendable degree of liquidity. They clock in approximately $2 billion in daily trading volume. This considerable level of liquidity ensures that for most retail investors, trading these ETFs, whether buying or selling, remains a hassle-free experience.

That said, it’s important to touch on a crucial point here. The depth of liquidity provided by IVV and VOO may not measure up to the requirements of options trading. In this realm, you might come across a wider disparity between the bid and ask prices.

If your investment strategy involves options trading, you might want to consider an alternative. The SPDR S&P 500 ETF (SPY) could be a suitable contender. Its liquidity outpaces that of both IVV and VOO, making it potentially more fitting for investors engaged in options trading.

IVV vs VOO: Key Differences

Despite sharing a lot of common ground, IVV and VOO stand apart in one significant aspect – their managing entities. BlackRock steers the course for IVV while Vanguard is at the helm for VOO.

This divergence is not just about who’s in charge. It can also influence how investors interact with these ETFs across different trading platforms. Many trading platforms today have waved off commission fees for these ETFs. But not every platform extends the same courtesy to both IVV and VOO.

For instance, if you’re trading on Vanguard’s platform, you’ll find that VOO trades are commission-free, given that it’s a homegrown product. However, trading IVV on the same platform is not free of charge.

Conversely, Fidelity, which has a partnership with BlackRock, offers commission-free trades for IVV, while VOO does not enjoy the same privilege.

For active investors who engage in frequent buying and selling, these commission fees can add up and significantly impact your net returns. Thus, depending on your preferred trading platform and your trading frequency, this difference between VOO and IVV could be pivotal in your ETF selection.

IVV vs VOO: Deciding the Better ETF

As we’ve explored in this blog post, IVV and VOO share many similarities.

However, at the time of writing, if we consider tracking precision, IVV slightly edges out VOO by mirroring the S&P 500 Index performance more closely. Yet, these differences in performance are often minor and are unlikely to significantly impact your long-term investment outcomes.

As an investor, the most vital step is to begin investing. If your trading platform doesn’t differentiate between these two ETFs in terms of trading costs, then the decision between IVV and VOO may come down to personal preference or the minutest of details.