Understanding growing annuities can be a crucial step in managing your savings effectively. Sometimes, the mathematical formulas and intricate investment calculations can seem daunting. This is where our Future Value of Growing Annuity Calculator steps in. Crafted to break down these complex calculations, our tool enables you to predict the future worth of your growing annuity. This insight aids in sound financial planning and informed decision-making.

But first, let’s delve into what a growing annuity is.

What is a Growing Annuity

As you delve into the features of our Future Value of Growing Annuity Calculator, it’s beneficial to start by defining a growing annuity.

At its core, an annuity is a series of cash payments made over a set duration, paired with an interest rate. A standard annuity has fixed payments, while a growing annuity has payments that increase over time. This increase is by a set percentage referred to as the “growth rate.”

Let’s visualize this with an example. Suppose you’ve invested in a retirement plan offering an initial annual sum of $10,000, with a consistent growth rate of 5%. In the first year, your payment is $10,000. For the second year, this sum grows by 5%, adding an extra $500. Hence, you receive $10,500 that year. Moving to the third year, the increase is calculated as 5% of the second year’s total, $10,500. This results in an addition of $525, making the third year’s amount $11,025. This pattern continues, with each year’s growth calculated based on the previous year’s total.

What’s worth noting here is that the growth is not based on the initial $10,000. Instead, it compounds annually based on the preceding year’s sum. As a result, the total amount you receive increases progressively over the years.

Such financial structures are not rare. For example, an annual fixed percentage might determine salary increments. Alternatively, mortgage payments could be set to rise over the years. Grasping the concept of a growing annuity is essential for sound financial planning.

Why Calculate Future Value?

Having grasped the concept of a growing annuity, the next question arises: Why should we calculate its future value? The reason is its practical relevance in financial undertakings. Think of scenarios like retirement planning. By computing the future value, you can project the total sum you’ll have at a specific future date. This projection assumes a consistent interest rate and regular payments that increase at a defined growth rate.

Let’s revisit the example we discussed earlier. While you may understand the annual payment structure, the total value of your investment in 10, 20, or 30 years remains uncertain. Without knowing the future value, you’re essentially moving forward without a financial roadmap. Such an approach might lead you to set vague financial objectives or potentially be underprepared for retirement.

Understanding the Future Value of a Growing Annuity (FVGA) equips you to:

- Evaluate the long-term potential of an investment.

- Effectively contrast diverse investment opportunities.

- Strategize for significant life milestones, be it purchasing a home or supporting your child’s education.

- Refine your financial plans based on solid data, rather than mere suppositions.

With the aid of our Future Value of Growing Annuity Calculator, these calculations become straightforward. This tool empowers you to make the most enlightened financial choices.

Future Value of Growing Annuity Formula

With a foundational knowledge of growing annuities and their significance, let’s now turn our attention to the mathematical formula that underpins these calculations.

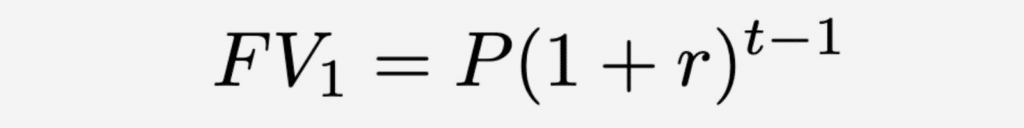

A growing annuity involves payments that increase by a fixed percentage, denoted as (g). Simultaneously, the entire series of payments appreciates due to an interest rate, represented as (r). Let’s break down how to calculate the future value (FV) of each payment. For the 1st cash flow (at the end of the first period), its future value after t periods is:

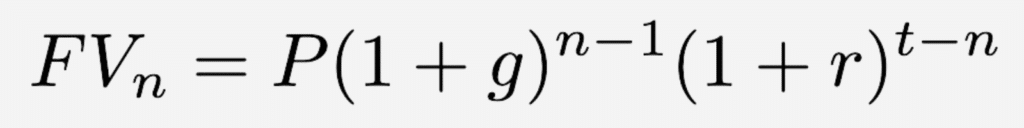

Considering the growth of each payment, we need to adjust the calculations to reflect that growth. In our calculations, let ‘n’ stand for the number of periods since the first payment.

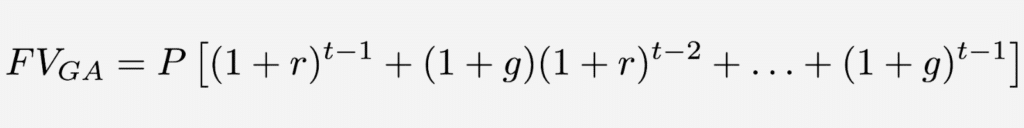

To find the Future Value of a Growing Annuity (FVGA), it’s necessary to sum up the future values of all payments.

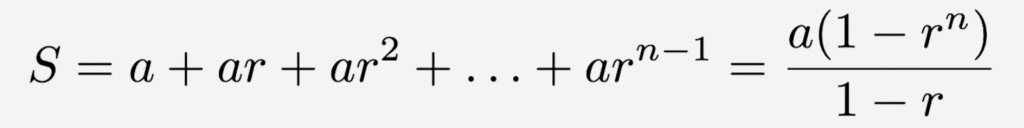

This might seem complex, but it becomes simpler when using the formula for the sum of a finite geometric series.

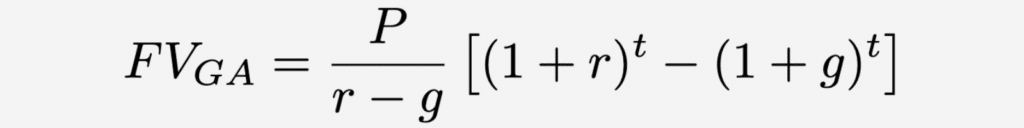

By tweaking the formula, we arrive at the final formula:

Where:

- FVGA stands for the Future Value of Growing Annuity.

- P represents the initial payment or investment.

- r indicates the interest rate per period.

- g is the growth rate of the annuity.

- t is the total number of periods.

Future Value of Growing Annuity Calculation Example

To better understand the concept, let’s take a practical approach. We’ll explore how to employ the Future Value of Growing Annuity Calculator to ascertain the future value of a growing annuity.

Background Recap:

Imagine you have a retirement plan. Your yearly payout commences at $10,000 and witnesses a steady annual growth of 5%. Now, if you’re curious about the future value of these payouts after 20 years, given they are reinvested at an annual yield of 3%, here’s a step-by-step explanation.

Setting Up the Scenario:

Annual Payout: It starts off at $10,000, with an annual increment of 5%.

Interest Rate: Every year, the payouts you receive are reinvested, garnering an annual return of 3%.

Duration: The total time frame considered is 20 years.

Using the Calculator:

Initial Payment (P): $10,000.

Interest Rate (r%): 3.

Growth Rate (g%): 5.

Number of Periods (t): 20.

Once you’ve entered these details, the calculator will provide an output. For this scenario, the future value of your growing annuity is $423,593.24. In simpler terms, by continually reinvesting your yearly payouts with a 3% return, you’d have approximately $423,593.24 after 20 years.

Final Words

Understanding the logic behind these formulas can simplify your decision-making process. Once you grasp these principles, it becomes clearer which investment options offer the best returns for your hard-earned money. Our Future Value of Growing Annuity Calculator is designed to help with this. It takes intricate calculations and presents them through a user-friendly interface.

Thank you for taking the time to read. We trust both the calculator and this article will assist you in making well-informed financial decisions.