The Wheel Options Strategy, also known as the Triple Income Strategy, offers a unique opportunity for investors to minimize risks associated with stock investments while securing a consistent source of income. This approach is highly regarded for its low-risk profile in the realm of options trading.

By employing the Wheel Options Strategy, investors can purchase stocks or ETFs at more favorable prices and sell them at higher prices, effectively maximizing their returns. In this article, we aim to provide an engaging and comprehensive overview of the Wheel Options Strategy, its components, and its associated rewards and risks. Additionally, we will explore the best stocks for the Wheel Strategy and discuss the factors that contribute to the success of this strategy.

What Is the Wheel Options Strategy?

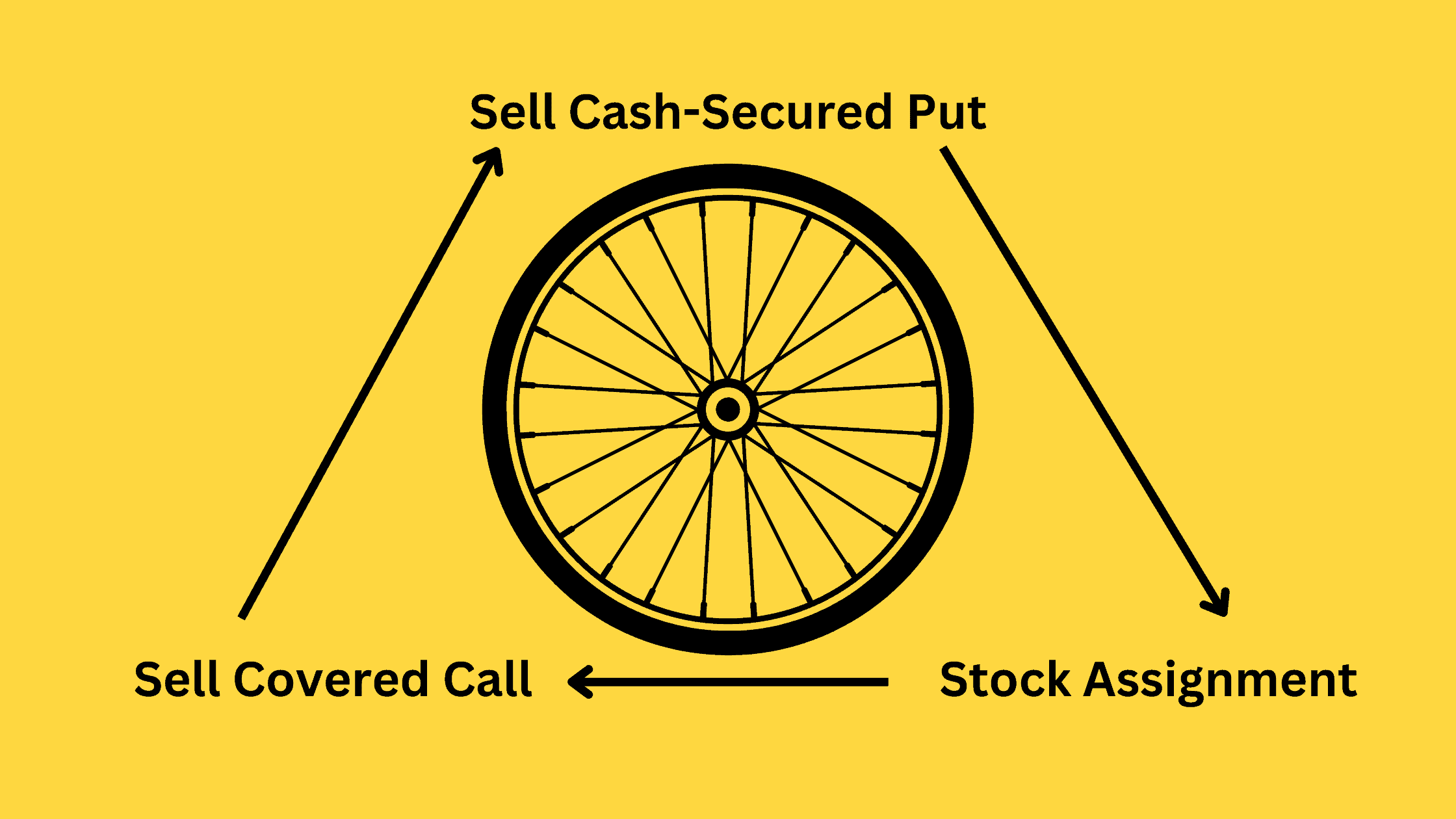

The Wheel Options Strategy comprises three main components: selling cash-secured put options, stock assignment, and selling covered call options.

A. Selling Cash-Secured Put Options

The initial step of the Wheel Options Strategy involves selling cash-secured put options. As an option seller, you agree to purchase a stock or ETF at a predetermined price (the strike price), while the option buyer reserves the right to sell the stock or ETF to you at that price before the expiration date. By selling the put option, you receive an option premium, representing the first avenue to generate the wheel options strategy’s returns.

If the option expires out-of-the-money or at-the-money, it becomes worthless, allowing you to keep the entire premium and repeat step A. Once the option is in-the-money upon expiration, you will be assigned, advancing to the next step.

B. Stock Assignment

When the put option is exercised, you are assigned the stock, making you its owner. This requires you to purchase the stock at the agreed-upon strike price. Holding the stock at this stage allows you to profit from both the stock’s price appreciation and dividend income, representing the second method of generating the wheel strategy’s returns.

C. Selling Covered Call Options

As a stock owner, you can now sell covered call options. This implies that you agree to sell the stock at a specific price (the strike price) to the option buyer, who has the right to buy the stock at that price before the expiration date. When selling the call option, you receive another option premium, which serves as the third means of realizing returns in this strategy.

If the call option expires out-of-the-money or at-the-money, you can retain all the premium from selling it. You can then continue with step C, selling another covered call option to collect premiums until the sold call option ultimately lands in-the-money. If the sold call option becomes in-the-money, you will sell the underlying asset at the strike price and recommence with step A.

Related Reading: Covered Call Options Strategy – Deep Analysis

The Wheel Options Strategy Example

Selling Cash-Secured Put Options:

You sell a cash-secured put option for XYZ stock with a strike price of $50, expiring in 30 days. In return, you receive a premium of $2 per share.

Stock Assignment:

a) If the XYZ stock price remains above $50 at expiration, the put option expires worthless. You keep the $2 premium and return to step 1, selling another put option.

b) If the XYZ stock price falls below $50 at expiration, the put option is exercised, and you buy 100 shares of XYZ stock for $50 per share (the strike price).

Selling Covered Call Options:

Now that you own 100 shares of XYZ stock, you sell a covered call option with a strike price of $55, expiring in 30 days. You receive a premium of $1.50 per share.

a) If the XYZ stock price remains below $55 at expiration, the call option expires worthless. You keep the $1.50 premium and return to step 3, selling another covered call option.

b) If the XYZ stock price rises above $55 at expiration, the call option is exercised, and you sell your 100 shares of XYZ stock for $55 per share (the strike price). After that, you return to step 1 and restart the Wheel Strategy process.

Profits and Losses of the Wheel Options Strategy

As the Wheel Strategy consists of two separate components – selling cash-secured put options and selling covered call options – it is challenging to provide a specific profit and loss calculation like other option strategies. However, we can still analyze each part separately.

Profit Potential

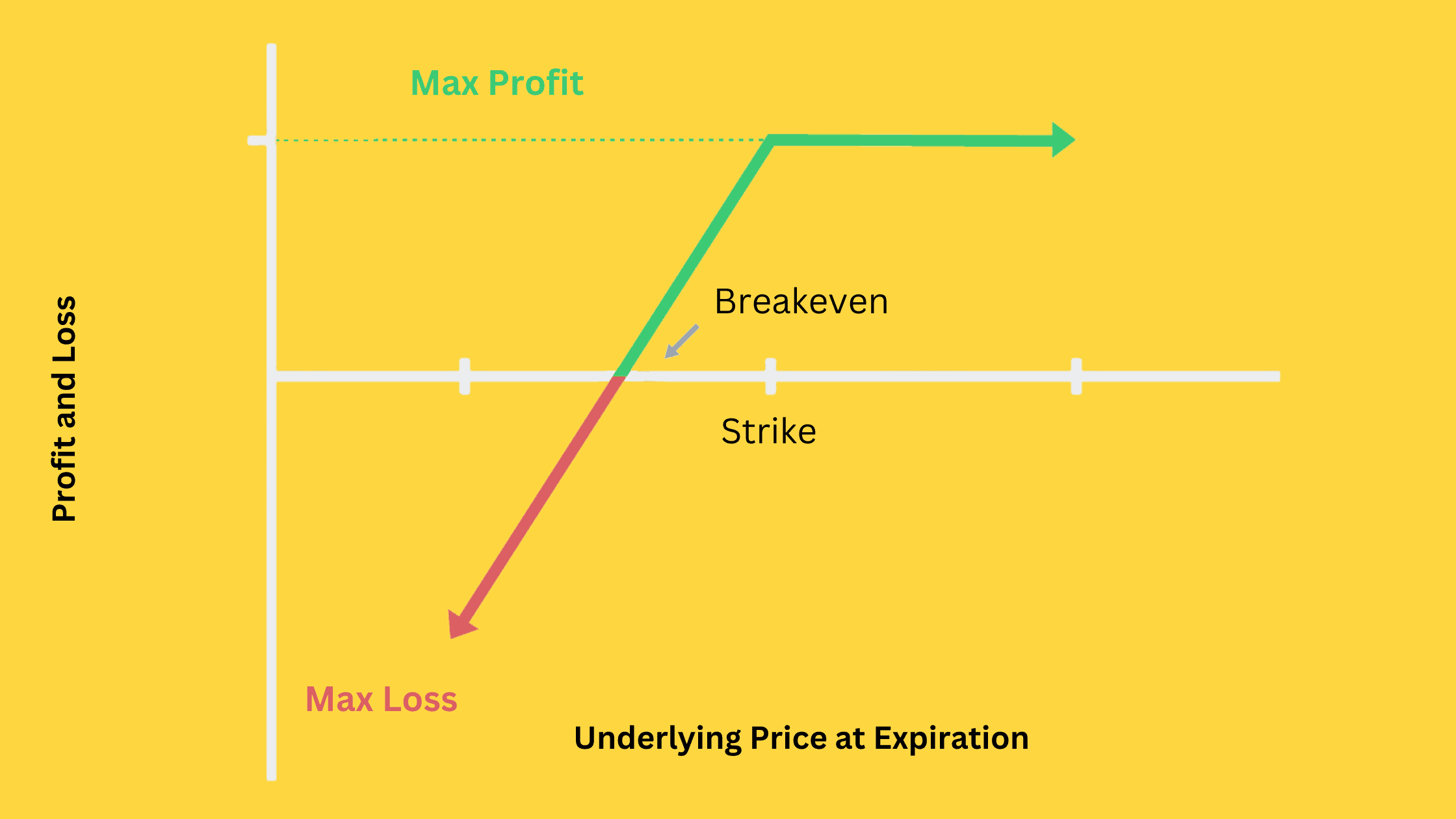

Selling Cash-Secured Put Options:

Ideally, the stock price remains at the strike price upon expiration. In this step, we achieve maximum profit, which is the option premium received. With the stock price not rising significantly, we can continue selling cash-secured put options, reducing the risk of losses due to a sharp price increase followed by a pullback.

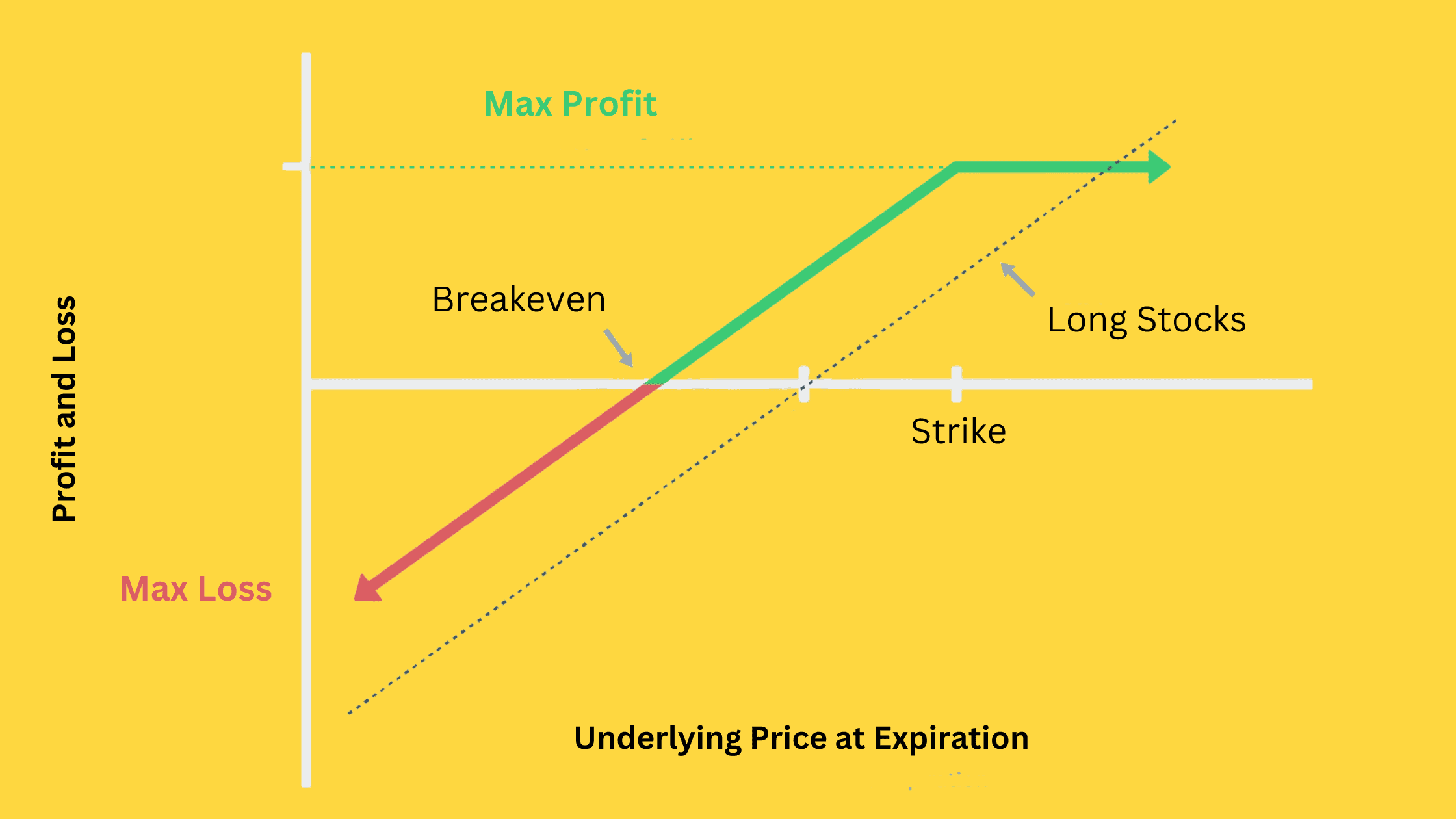

Selling Covered Call Options:

The ideal scenario here is also when the stock price remains at the strike price upon expiration. In this case, the maximum profit equals the current stock price minus the stock price when selling the covered call option, plus the option premium received.

Also, in such a situation, investors can easily choose a suitable trading strategy based on their outlook on the stock. For example, if the investor is bullish, they can hold the stock to benefit from price appreciation; if moderately bullish, they can sell out-of-the-money covered call options to gain from both price appreciation and option premium income; if no longer bullish, they can sell the stock at the current price and return to selling cash-secured put options with an appropriate strike price.

Loss Risk

Selling Cash-Secured Put Options:

The maximum loss occurs when the stock price is close to zero. In this case, the loss is the option’s strike price minus the cash-secured put option premium received.

Selling Covered Call Options:

The maximum loss also occurs when the stock price is close to zero. Since the investor holds the stock, the loss is the total value of the stock minus the covered call option premium received.

Best Underlyings for the Wheel Strategy

The main risk of the wheel options strategy lies in the possibility of substantial losses when stock prices drop sharply. As a result, it’s beneficial to choose value stocks or index ETFs as the underlying assets for this strategy.

Value stocks typically belong to mature, stable companies with consistent performance and lower risk. These stocks demonstrate stronger resilience during market fluctuations, helping to protect us from significant losses when employing the wheel options strategy. Additionally, value stocks often offer higher dividend yields, allowing us to receive stable dividend income while holding the stocks.

Index ETFs, like SPY and QQQ, are quite diversified, meaning they have lower volatility than individual stocks and a lower probability of experiencing a sharp drop in value. Historically, there have been very few instances when the S&P 500 index recorded substantial negative returns.

Furthermore, index ETFs have higher liquidity, which results in tighter bid-ask spreads for their options. This means that the cost of trading these options is lower. Since implementing the wheel options strategy requires continuous buying and selling of cash-secured puts and covered calls, lower trading costs can significantly enhance our returns in the long term.

Tips on Trading the Wheel Strategy

When implementing the wheel options strategy, understanding some trading tips can help increase the likelihood of success. Here are two essential tips that investors should pay attention to during the trading process:

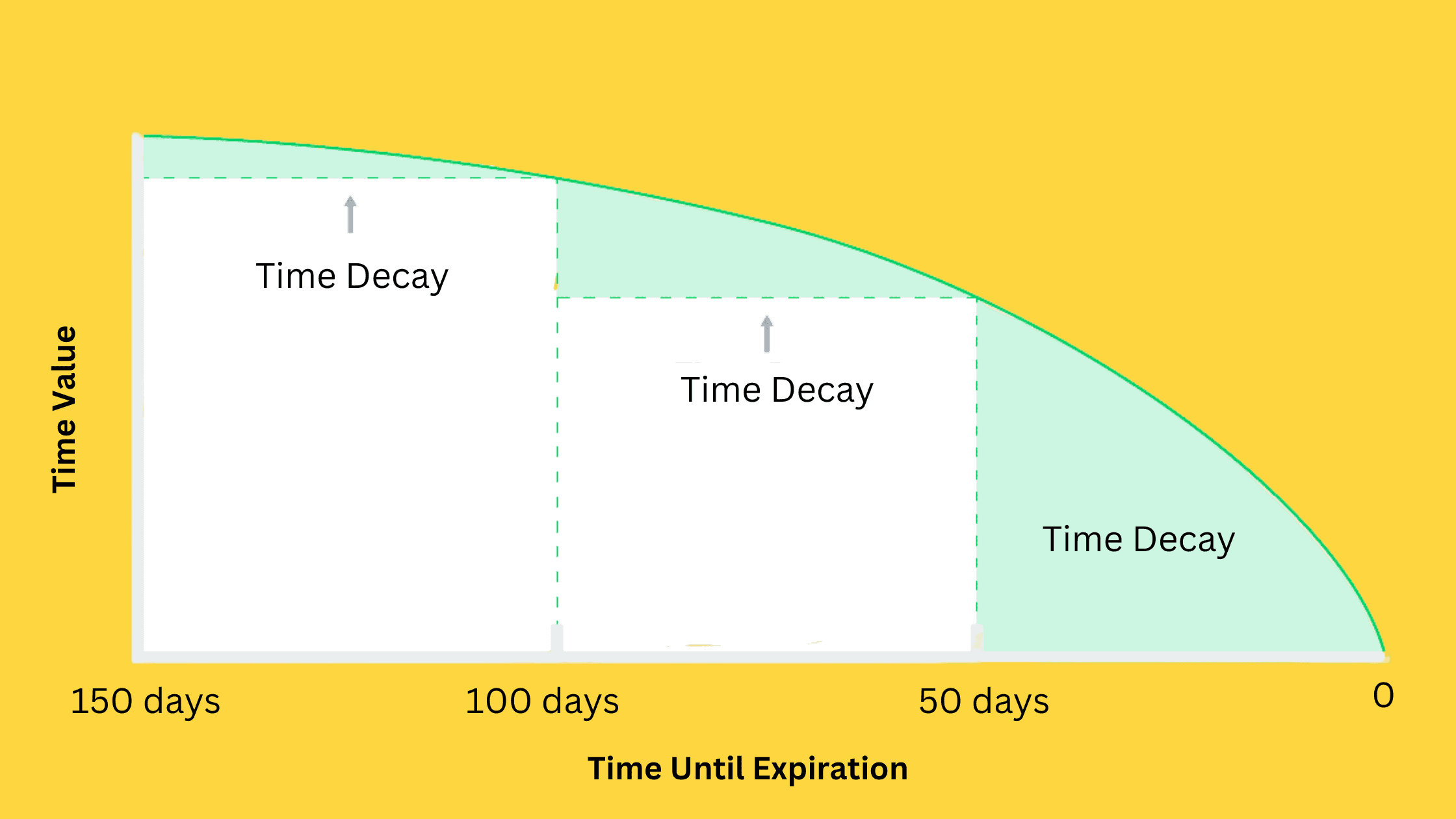

Choose Appropriate Expiration Dates

The right expiration dates can help us better utilize time decay, also known as theta decay. In the wheel options strategy, we can use theta decay to reduce the value of sold options, especially as the option expiration date approaches. For instance, we can sell short-term options with expiration dates within one to two months. By selling such short-term options, we can capitalize on the period when an option’s time value decays the fastest.

Additionally, selling short-term options with one to two months expiration dates can help us roll the strategy more frequently to achieve higher profits. However, too short options have low premiums, so we need to sell more options to obtain the same credit. This approach increases our risk, so a balance is necessary.

Pay Attention to Changes in Volatility

Volatility measures the magnitude and speed of asset price fluctuations over a given period.

When trading options, we need to understand two types of volatility:

a. Historical volatility: As the name suggests, historical volatility tells us the daily price fluctuations of an asset over a specific past period.

b. Implied volatility: Implied volatility measures the market’s expected future volatility of an asset.

With other factors remaining constant, option prices will increase with rising implied volatility and decrease with falling implied volatility.

Here, you can assess whether implied volatility is high or low relative to historical standards. To maximize profits, a good rule of thumb is to sell options when implied volatility is relatively higher than the historical average. This way, you will receive a higher option premium and benefit when implied volatility reverts to its historical average level.