Generally speaking, we buy or sell stocks based on the current market conditions at that time, which also includes our guesses about future market trends. But the market’s direction is not only a simple rise and fall. Horizontal price movement is also widespread. At this time, we can use hedging strategies to magnify the profits and limit the risk. This article will introduce one of the most straightforward and practical options trading strategies: covered call options trading strategy. If you can master this strategy, you can significantly amplify your profits in the stock market.

What is the covered call options trading strategy?

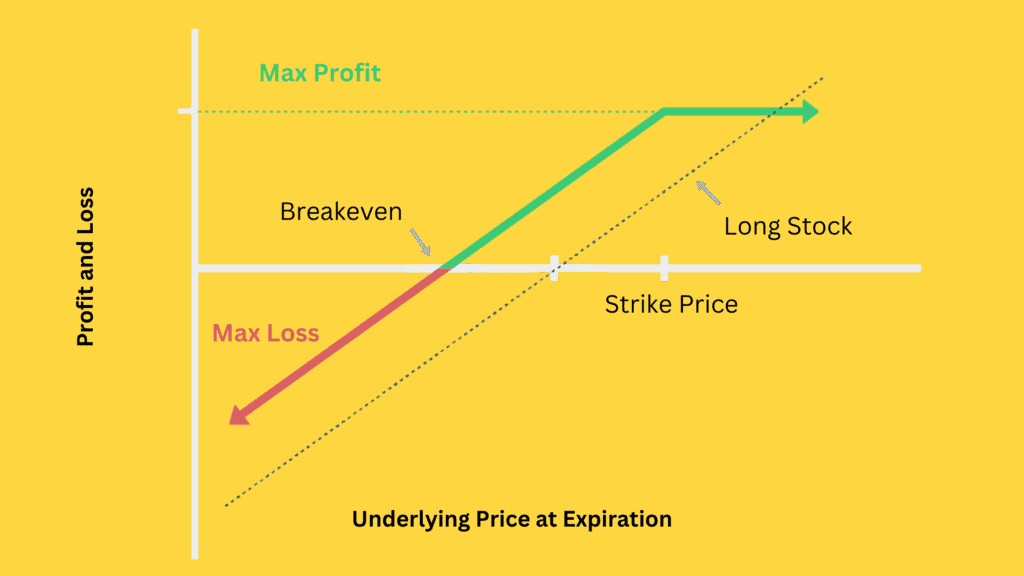

The covered call options trading strategy is a combination strategy. It is a strategy to make profits by combining stocks and calls. If there is no stock, a simple short call cannot be called a covered call strategy. That is a “Naked Call” because there is no underlying stock position.

Looking back at the characteristics of the simple short-call option strategy, you will find that its risks can be infinite.

But the risk is minimal if we own the target stock and sell an equal number of calls. This combined strategy is the covered call strategy.

Example

For example, we own 100 shares of TSLA (Tesla Inc) at $190. TSLA stock has fluctuated between $180 to $200 for more than half a month. Suppose we judge that TSLA’s stock price will not break through $220 in the next month. We can sell a call option that expires in one month with a strike price of $220 at a premium of $525.

If TSLA’s stock price does not exceed $220 a month later, we can earn $525 in the premium.

If the stock price of TSLA exceeds $220 a month later, the buyer of the options will exercise the option to buy 100 shares of TSLA at $220 from us. We earn a gain on the stocks plus the premiums of $525. But the profit on the stocks over $220 does not belong to us anymore.

When should you use the covered call options trading strategy?

Generally speaking, the purpose of constructing a covered call is to expect that the stock price will not rise too much in the future. You can earn premiums from short calls to increase profit if you have some stocks. In addition, If you think the stocks may fall but don’t want to sell, you can get the premiums from selling call options to make up for the loss.

Increase income through the covered call strategy

For example, I bought TQQQ (ProShares UltraPro QQQ) a few days ago and planned to hold it for a long time. But the price was unlikely to rise sharply in the short term. The probable situation was that it would go sideways or drop slightly. If the ETF has horizontal price movement for a long time, capital utilization will be very low.

My holding cost is $18. Through analysis, it is unlikely that the price will rise to $25 in the next month, so I sold call options whose strike price is $25. Then there will be three situations:

- If the price rises above $25, the buyer of the options will exercise the call option, and part of my stock profit will be hedged. In other words, the income from TQQQ above $25 does not belong to me.

- If the price is between $18 – $25, I will pocket the premium from selling the call options and earn more than simply holding the spot stock.

- If the price fell below $18, the premium received from selling the call offset part of the loss from the stock price drop. The money lost was less than the original situation of just holding the spot stock.

Because I intend to hold TQQQ for a long time, I can sell calls to earn income on a rolling basis. It sounds like I deposit the stock in the bank and make interest monthly. The covered call strategy is essential for fundamental long-term investors, which can lower the cost of stocks.

Make up for losses through the covered call strategy

For example, I currently hold DIA (SPDR Dow Jones Industrial Average ETF Trust). Because the Dow Jones Index has risen a lot compared to the Nasdaq Index, my current position has already made a lot of profits. Even so, I don’t want to sell these positions at current prices. Because Federal Reserve Chairman Powell turned dovish and CPI tended to fall. So I don’t know if the price will go sideways, fall slightly, or break through the previous pressure level in one step.

It is an excellent time to use the covered call strategy. The current price is $345, and I sold some call options (out-of-the-money calls) whose strike price is $380 at a slightly farther expiration date. If the price breaks through the pressure level and goes directly to $380 or even higher, then parts of the income generated by my stock above $380 will be hedged by the short call. In other words, the part of profit above $380 has nothing to do with me. So I don’t want the price to go up too much directly. If the price drops sharply, the loss of my underlying stock will be partially offset by the short call. But still, my position will change from profit to loss, which is still not worthwhile. So I don’t expect the price to drop significantly either. So the best situation is that the price remains at the same place or rises and falls slightly so that I can keep the profits I earned before and collect the premium from selling call options, which is the best situation.

Risk of the covered call strategy

Risk and return are inseparable in trading, which is also true for the covered call strategy.

Losses caused by stock plummet

You need to own some stocks to construct the covered call strategies. Since you own some stocks, you need to undertake the risk of the stock price plummeting. If the stock price falls significantly, the loss outweighs the premium. You will lose money at this time.

The profit reduction caused by the rapid rise of the stock

While using the covered call strategy, the maximum profit you can obtain from the stock price rise has a maximum limit.

Once some good news stimulates the stock, the price rises rapidly, far exceeding the exercise price marked by the call. Although we can earn the premium and some money from the stock rise, we cannot obtain much more profit from the stock over the strike price.

Covered call strategy tips

Choose an excellent underlying

For the covered call strategy, the underlying selection is critical. Be sure to select bullish stocks for the long term, and don’t go up too fast. It requires some fundamental and technical analysis. It will be better if there are dividends. For beginners, it is tough to study the fundamental analysis of a company and the technical analysis of the company’s stocks. At this time, we may choose index fund ETFs, such as SPY (SPDR S&P 500 ETF Trust), IWM (iShares Russell 2000 ETF), DIA (SPDR Dow Jones Industrial Average ETF Trust), etc. The advantage of an index fund is that its fundamentals are related to macroeconomic and financial policies. These indexes are well diversified and will not rise or fall sharply. So, they are ideal targets for covered calls.

Buy stocks at low prices

For stocks or ETFs with good fundamentals and long-term bullishness, it is an excellent opportunity to enter the market at low prices when a black swan event hits the price.

Regularly sell call options at high prices

When stocks are rising, if you sell stocks, you can earn short-term income, but you maybe miss long-term opportunities forever. Frequent short-term stock trading will increase commissions and taxes expenditure. While holding stocks, keep selling out-of-the-money calls due next month (that is, the exercise price is higher than the current price, out-of-the-money calls), and you can get premiums. In that case, you will not miss long-term opportunities and can also seize short-term opportunities from fluctuations.

Conclusion

From this article, you will better understand the covered call options trading strategy. The covered call strategy is excellent for holding stocks for a long time. As time passes, the options you sell are worth less, and your assets grow in value even while you sleep. If you are a long-term value investor, don’t miss this strategy!