Options are considered one of the most versatile and exciting financial instruments. They allow you to trade not just the underlying assets but also the passage of time and uncertainty. This makes them an excellent tool for both hedging and speculation. In this article, we’ll dive into the two key concepts that make options contracts such a powerful tool – intrinsic value and time value of options.

Intrinsic Value – The Heart of an Option

Intrinsic value is the inherent worth of an option, and it’s the cornerstone of option pricing. It’s the amount by which an option is in-the-money, meaning that the option has real value that can be exercised for a profit.

Let’s say you hold a call option on a stock with a strike price of $50. The stock is currently trading at $60. In this case, the intrinsic value of the call option is $10 because if you were to exercise the option, you’d be able to buy the stock at $50 and immediately sell it for $60, pocketing a $10 profit.

Intrinsic value represents the “in-the-money” portion of the option. For call options, when the price of the underlying asset is higher than the strike price, the option has intrinsic value and is said to be “in-the-money.” When the underlying’s price is equal to the strike price, the option is said to be “at-the-money.” Otherwise, the option is said to be “out-of-the-money.” When an option is “at-the-money” or “out-of-the-money,” it means that it has zero intrinsic value. For put options, it is completely the opposite.

It’s important to note that intrinsic value is a dynamic concept – as the stock price moves, the intrinsic value of the option changes. When the stock price goes above the strike price, the call option becomes more valuable, and its intrinsic value increases. Conversely, if the stock price falls below the strike price, the call option becomes less valuable, and its intrinsic value decreases.

Time Value – The Frosting on the Option Cake

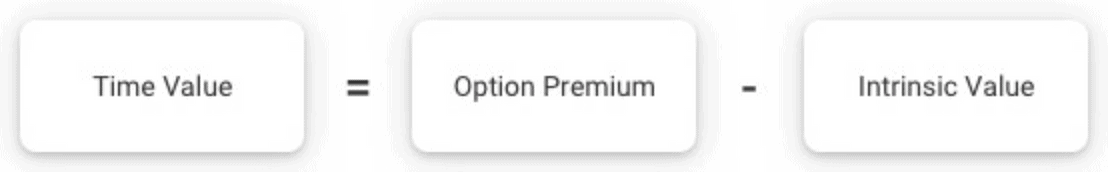

Time value, also known as extrinsic value, is another portion of an option’s price. It represents the value of the option due to factors such as volatility, interest rates, and the passage of time. Time value is an essential component of option pricing because it takes into account the uncertainty of the future, which is impossible to predict with certainty.

For example, let’s say you hold a call option on a stock with a strike price of $50 and an expiration date six months away. The stock is currently trading at $60, so the intrinsic value of the option is $10. But because the option still has an amount of time until expiration, the option is worth more than $10. This extra value is the call option’s time value, and it’s what makes options such a versatile tool.

Time value decreases as expiration approaches. This is because there’s less uncertainty about the future, so the option becomes less valuable. When the option reaches expiration, it either has intrinsic value, or it doesn’t – but, it can’t have any time value.

Story Time – Understanding Intrinsic Value and Time Value through Real-Life Examples

Let’s illustrate the two concepts with a few real-life examples.

Example 1: Hedging with Options

Suppose you own a portfolio of stocks, and you’re concerned about a potential market downturn. To hedge your exposure, you purchase put options on the S&P 500 index with a strike price of $4,000. The spot price of the S&P 500 is $3,500, and the options have an expiration date that’s six months away.

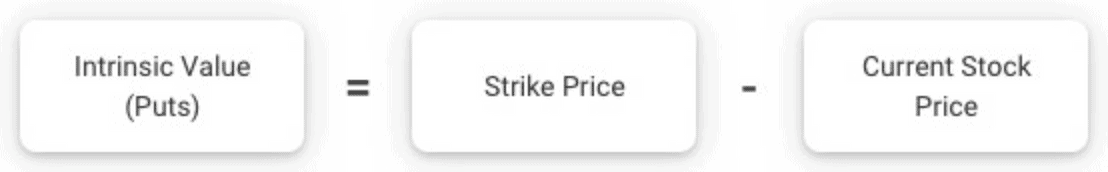

The formula to calculate the intrinsic value of a put option is subtracting the underlying asset’s current market price from the strike price. Thus, the intrinsic value of the put options is $500 ($4,000-$3500). However, due to the uncertainty of the market and the passage of time, the option premium might be more than just their intrinsic value. This extra value is the put option’s time value, reflecting the value of the option’s potential to increase due to market changes.

Example 2: Speculating with Options

Suppose you hear rumors that a tech company is about to announce a game-changing product. You believe that the company’s stock price will soar if the product is successful. However, you’re not sure when the product will be announced or how successful it will be.

To take advantage of the potential upside, you purchase call options on the stock with a strike price of $100 and an expiration date six months away. The stock is currently trading at $90.

The intrinsic value of the stock options is zero since the stock price is currently below the strike price. However, the time value of the options takes into account the potential for the stock price to rise in the future. The more uncertain and volatile the market, the more valuable the time value of the options will be.

If the product is successful and the stock price jumps to $120, you’ll be able to exercise the options and buy the stock at $100, although the current market price is higher now. In this scenario, the intrinsic value of the options will be $20, and the time value will represent the extra profit you made from speculating on the stock price.

Can Intrinsic Value of an Option Be Negative?

First, the answer is: It can never be negative.

As an options holder, you hold the key to a powerful choice – the right, but not the obligation, to buy or sell an underlying asset at a pre-determined price. In short, you’re in control! You have the ability to make a calculated decision based on market conditions, giving you an added layer of flexibility and security.

If the option is “out of the money,” meaning it’s not profitable to exercise, you can simply walk away from it unscathed.

Can Time Value of an Option Be Negative?

Actually, the time value of an option can be negative in some circumstances. Specifically, for a put option that is deep in the money, has a long time until expiration, and has a stock price close to zero, the time value component of the option’s price can be negative.

Think about it, the underlying stock can never fall below zero, so if it’s already close to that level, there’s a higher likelihood that it will go up, rather than down. And if that happens, the value of the put option would decrease. Hence, this leads to a negative time value.

It’s interesting to see how the financial market can throw us some unexpected twists and turns, isn’t it?

The Bottom Line

Intrinsic value and time value are two essential concepts that make options such a powerful financial instrument. Intrinsic value represents the inherent worth of an option, while time value considers the uncertainty of the future and the passage of time. Let’s sum up the key points:

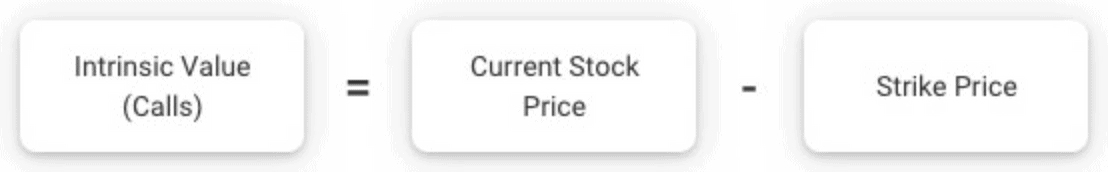

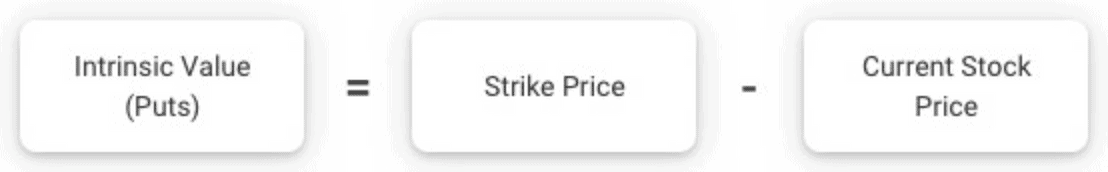

How to calculate the intrinsic value of option: Formula for calls and puts:

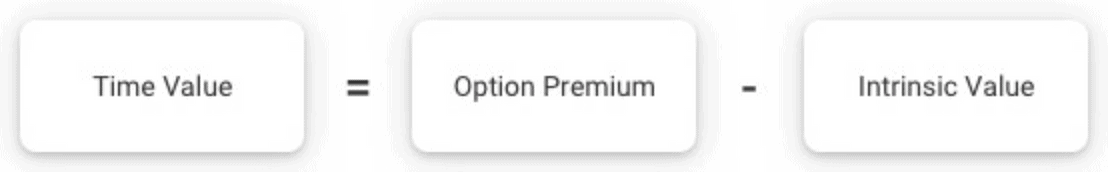

How to calculate the time value of option: Formula:

Understanding these concepts is critical to becoming a successful options trader, as it allows you to make informed decisions about when to buy, sell, or hold onto options.