Options are fascinating financial instruments. They allow you to trade the direction of stocks, indices, commodities, and other assets. You can get several benefits from options, including generating income, hedging against losses, and winning big with small. Some people turn their investments into thousands of times more within just one day through options trading. So, what is an option? How does it work?

This beginner’s guide will explore what options mean, how they work, and how you can use them to your advantage. So buckle up and get ready to dive into options trading!

What is an Option?

An option is a contract between a buyer and a seller that gives the buyer the right, but not the obligation, to buy or sell an underlying asset (such as a stock, commodity, or currency) at a specified price within a specified time frame. In simpler terms, it’s like a “choose your own adventure” book for investing. You can choose to buy or sell an asset, but you’re not required to do so.

Call vs Put Options

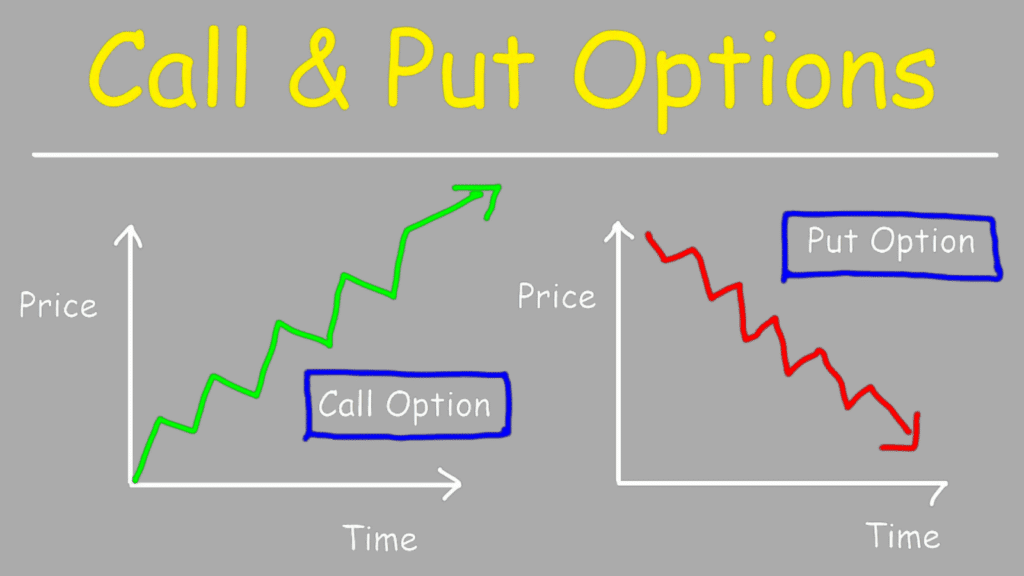

There are two main types of options: call options and put options. A call option gives the buyer the right to purchase the underlying asset at the specified price, while a put option gives the buyer the right to sell the underlying asset at the specified price.

Think of it like this: a call option is like a “get out of jail free” card for buying shares. If the stock price goes up, you can exercise your option to buy it at the lower, agreed-upon price. On the contrary, if the stock goes down, you don’t exercise the option.

A put option is like a safety net, allowing you to sell the stock if the price drops below a certain level. If the stock goes up, you have just lost the safety net cost.

Why Trade Options?

There are several reasons why you might want to trade options. Here are a few:

Generate Income

Options allow you to generate income through premiums.

For instance, let’s say you have an existing portfolio of stocks. Still, you want to earn extra income without selling any of them. One way is to “write” or “sell” options. When you sell an option, you receive a premium (the price of the option), which is yours to keep, regardless of what happens.

Of course, there’s no such thing as a free lunch. If the stock price moves in a direction you did not anticipate, and the option you sold becomes more valuable, incur a loss.

Hedge Against Losses

You can use options to hedge against losses in your portfolio. For example, suppose you own stock in a company and are concerned about a potential decline in the stock price. You can buy put options to protect yourself.

Suppose you own XYZ stock and are concerned that the stock price may decrease. You can buy a put option on XYZ stock with a strike price of $100. If the stock price falls below $100, you can exercise your option and sell the stock at $100, even though the market price now is lower. This allows you to protect your investment and limit your losses.

Make Big Profits with a Small Amount of Capital

Options allow you to make big profits with a small amount of capital. This is because options leverage your investment and amplify your gains.

For example, you believe that XYZ stock will rise. But you have less money, not enough to buy that stock. You can buy a call option on XYZ stock with a strike price of $100. If the stock price really rises above $100, you can exercise your option and buy the stock at $100, even though the market price now is higher. This allows you to lock in a profit.

Understand the Role of Options – A Tale of Two Traders

Let’s look at two traders, Bob and Sue, to understand options better. Bob is a conservative investor who likes to play it safe. He invests in a portfolio of blue-chip stocks and holds onto them for the long term.

Sue, on the other hand, is a more adventurous trader. She’s always looking for new opportunities and is not afraid to take calculated risks. She’s heard about options and is intrigued by their versatility and potential for profit.

One day, Sue comes across a stock she believes has tremendous upside potential. She doesn’t have enough money to buy the stock outright, but she doesn’t want to miss out on the potential profits either. That’s when she decides to buy a call option on the stock.

By buying a call option, Sue has the right to buy the stock at a predetermined price (strike price) within a specified period (before the expiration date). If the stock price rises above the strike price, Sue can exercise her option and buy the stock at the lower strike price, sell it at the higher market price, and pocket the difference as profit.

Meanwhile, Bob is sitting on his portfolio of blue-chip stocks, unaware of the exciting world of options. He’s content with his conservative approach and not interested in taking any risks.

But little does Bob know, options can also be used for risk management. Let’s say one of the blue-chip stocks in Bob’s portfolio takes a nosedive, and he’s worried about further losses. He could hedge his position by buying a put option on the stock.

By buying a put option, Bob has the right to sell the stock at a predetermined price (strike price) within a specified period (before the expiration date). If the stock price drops, Bob can exercise his option and sell the stock at the higher strike price, limiting his losses.

Win Big with a Small Gamble – The Power of Leverage

Suppose Sue bought an Acme Inc. stock option at $100 since she heard rumors that the company is about to release a new, revolutionary widget that will change the world.

The terms of the option contract specify that she has the right to buy 100 shares of Acme Inc. at $50 per share within the next three months. The current stock price is $45 per share.

Fast forward three months, and the rumors are true. The new widget is a huge success, and the stock price jumps to $60 per share. She exercises her option and buys the 100 shares of Acme Inc. for $50 each, even though they’re now worth $60 each. She’s made a profit of $10 per share, or $1,000 in total, on her just $100 investment, for a return of 1,000%.

How Do Options Work?

Options are traded on exchanges and are bought and sold just like stocks. When you buy an option, you pay a premium, which is the option’s price. The premium is essentially your cost to purchase the option and is non-refundable.

The value of an option is influenced by several factors, including the price of the underlying asset, the strike price, the time remaining until expiration, and the underlying’s volatility. The more volatile the underlying asset, the higher the premium will be.

Options have expiration dates, and once the option expires, it becomes worthless. Before the expiration date, you have several options. You can exercise your option (buy or sell the underlying asset at the strike price), you can sell the option, or you can let the option expire worthless.

Related Reading: Intrinsic Value and Time Value in Options

You should remember that options are finite resources. Once option contracts expire, they’re gone. This is why it’s critical to understand options solidly and have a well-defined trading strategy in place.

Final Words

Options are a versatile financial instrument that allows investors to generate income, hedge against market volatility, and speculate on the price trends of underlying assets. Due to the flexibility of options, traders can take advantage of market trends in a customizable and low-cost manner.

While options may seem complex at first, through persistent learning and dedication, you too can become a seasoned options trader! Once you have a deeper understanding of how they work and how to utilize them in a trading strategy, you will find them a valuable tool in your investment arsenal. Stay tuned for future articles. We’ll dive into the specifics of options trading strategy and show you how to use options to enhance your profits.