Are you an options trader looking to make the most of limited price movements in stocks or ETFs? If so, the short strangle options strategy might be just what you need. This advanced trading approach can help you generate consistent income while effectively managing risks.

In this blog post, we’ll explore the ins and outs of the short strangle, including its key principles, profit potential, risk factors, best practices for managing your positions, and discovering the best stocks for short strangles. So, let’s dive in and start unraveling the mysteries of the short-strangle strategy.

What Is a Short Strangle Options Strategy?

If you’re looking for a way to profit from a stable market, the short strangle strategy might be your new best friend. This tactic involves selling an out-of-the-money (OTM) call option and an OTM put option on the same underlying security with the same expiration date. But, what exactly does “out-of-the-money” mean? Let’s break it down:

Out-of-the-money call option: A call option with a strike price higher than the current market price of the underlying asset.

Out-of-the-money put option: A put option with a strike price lower than the current market price of the underlying asset.

The short strangle shines brightest in a stable market with low volatility, as wild price swings can lead to significant losses.

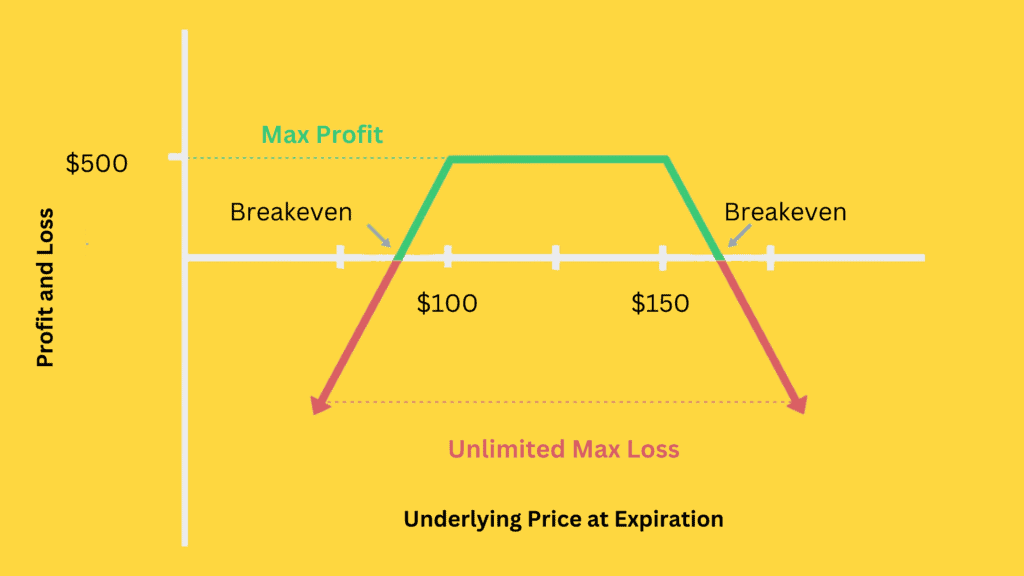

Risk and Profit Potential in Short Strangles

Maximum profit

The best-case scenario for a short strangle is when both the call and put options expire worthless. In this situation, you retain the entire premium collected from selling the options as profit. For example, if you sell a call option for $2 and a put option for $3, your maximum profit would be $500 (total premium of $5 x 100 shares), minus any transaction costs.

Maximum Loss

While short strangles can offer attractive returns, they also carry the potential for unlimited loss. If the stock price rises significantly, the call option becomes in the money, leading to substantial losses. Conversely, if the stock price drops sharply, the put option becomes in the money, resulting in significant losses. For instance, if the stock price surges to $120 while you sold a call with a strike price of $110, your losses would increase with each additional dollar the stock price rises.

Breakeven Point at Expiration

To determine the breakeven points for a short strangle, use the following formulas:

- Higher strike price plus total premium received

- Lower strike price minus total premium received

For example, if you sell a call option with a $115 strike price and a put option with a $100 strike price, both for a total premium of $3.50, the breakeven points would be:

- $118.50 ($115 + $3.50)

- $96.50 ($100 – $3.50)

As long as the stock price remains between these two breakeven points at expiration, you will not incur a loss.

Market Factors Influencing Short Strangles

In this section, we’ll explore how various market factors influence the outcome of a short strangle strategy. We’ll specifically discuss the volatility fluctuations and time decay on short strangles.

Volatility Fluctuations

Volatility represents the extent of a stock’s price variation over time. As volatility increases, option premiums and strangle prices rise, potentially causing losses for short strangles. On the other hand, when volatility decreases, short strangles often profit due to the lower premiums.

Keep an eye on the implied volatility of the underlying asset, as changes in implied volatility can significantly impact the value of a short strangle. Generally, selling strangles when implied volatility is high and buying them back when it’s low can be a profitable approach for you.

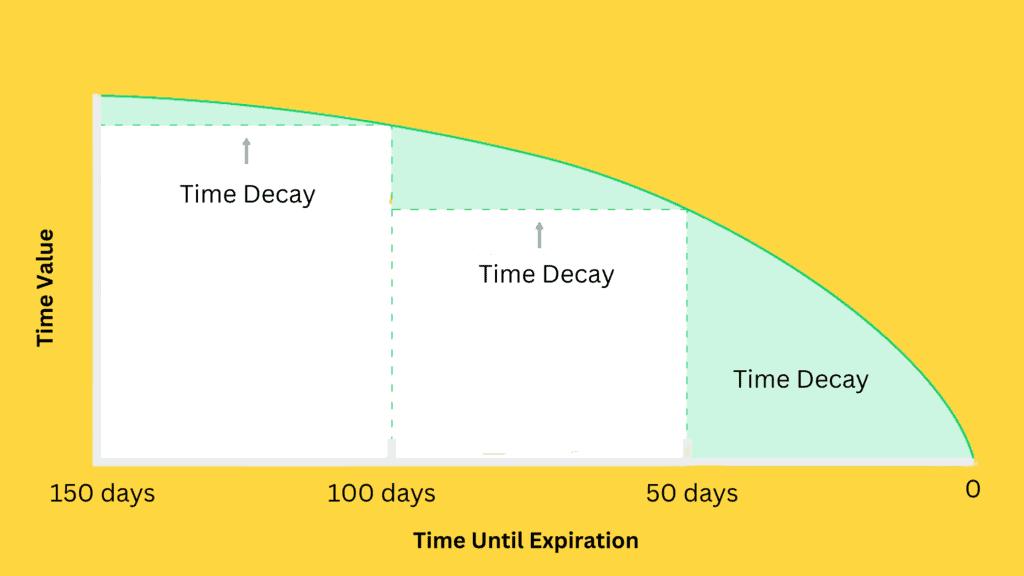

Time Decay

As options approach their expiration date, their time value decreases—a process known as time decay. Short strangles, consisting of two short options, are particularly sensitive to time decay. As time passes and the stock price remains stable, the time value of both call and put options in a short strangle diminishes, increasing the position’s profitability for you.

To capitalize on time decay, consider selling strangles with a shorter expiration time, as the time decay rate accelerates closer to the expiration date. However, it’s crucial to balance the benefits of faster time decay with the heightened risk of significant price movements in the underlying asset over a shorter period.

Selecting the Right Stocks or ETFs for Short Strangles

To succeed with a short strangle strategy, it’s crucial to pick the right stocks or ETFs. In this section, we’ll discuss the criteria for selection and provide examples of suitable assets.

Liquidity: When choosing stocks or ETFs, focusing on those with high liquidity is important. High liquidity means the asset is actively traded with significant volume. This results in tighter bid-ask spreads, allowing you to enter and exit positions at favorable prices. Additionally, higher liquidity minimizes slippage—the difference between your expected trade price and the executed price. Trading illiquid assets can increase trading costs and negatively impact your strategy.

Implied Volatility and Stability: Aim for stocks or ETFs with stable price movements and a lower likelihood of significant fluctuations. To earn higher premiums, however, look for assets with implied volatility that overestimates expected price movements. This way, you can capitalize on the discrepancy between implied and realized volatility, selling options with inflated option prices while the underlying asset remains relatively stable.

Best Stocks and ETFs for Short Strangle

Examples of suitable stocks for a short strangle strategy might include components of the Dow Jones Industrial Average. These companies are typically large-cap, value stocks with good liquidity. Their price movements are often less volatile, so when implied volatility spikes, it could present a good opportunity to employ a short strangle strategy, as the increased implied volatility might overestimate actual price movements.

For ETFs, consider the SPDR S&P 500 ETF (SPY). The S&P 500 Index is well-diversified, meaning its volatility is generally lower than individual stocks. Historically, the S&P 500 has exhibited relatively stable volatility levels. For example, over the past 20 years, the average annualized volatility has been around 15-20%. Suppose there’s a sudden increase in implied volatility due to a significant market event. In that case, it could be an excellent opportunity to use a short strangle strategy, expecting the volatility to decrease eventually.

Final Thoughts

Short strangles are a time-tested strategy, allowing you to generate returns and grow your wealth through the power of compounding by continuously rolling your positions. To succeed, it’s essential to know when to exit and sell the strangle options strategy again. A popular approach is setting a profit target, such as closing the trade when you reach 50% of the maximum potential profit. This tactic locks in gains and reduces the risk of sudden reversals in the underlying asset’s price that might diminish your profits.

Also, choosing options with the right time to expiration is crucial. Shorter-term options can boost your income from time decay and let you roll your strategy more frequently, which can be beneficial. However, extremely short time to expiration might expose you to losses due to rapid stock price fluctuations, so striking a balance is key. By carefully considering these factors, you can harness the full potential of this versatile options trading strategy and create a consistent income stream.

If you want to know more about earning in sideways markets, welcome to read our articles about Iron Butterfly and Iron Condor Options Strategy.