As a slightly bullish and neutral options trading strategy, the Jade Lizard can help investors profit in a stagnant market and eliminate the risk associated with rising prices.

This strategy leverages the decline in an underlying asset’s volatility and the erosion of time value in options. If you believe implied volatility is too high and there’s minimal risk of a stock experiencing a substantial drop, the Jade Lizard could be an excellent choice.

In this informative blog post, we will assess its potential rewards and risks and discuss the best stocks and ETFs for Jade Lizard. We will also examine the factors contributing to a successful Jade Lizard trade.

What is the Jade Lizard Options Strategy?

The Jade Lizard option strategy is composed of three distinct components. Aptly named “Jade Lizard,” this strategy metaphorically represents a lizard with its long body and short wings, which correspond to the sold put option and the call credit spread, respectively.

Sell a Put Option: The first component entails selling a naked (uncovered) put option on the underlying security.

Sell a Call Option: The second component involves selling a call option with a higher strike price than the current stock price. This element forms part of the call credit spread.

Buy a Call Option: The third and final component is purchasing a call option with an even higher strike price than the one sold in step 2. This step establishes a call credit spread, limiting the risk associated with selling the call option in step 2. By buying this call option, you cap your potential losses if the stock price experiences a significant increase.

When combined, these components give rise to a Jade Lizard strategy with a net credit. The net credit represents the total premium collected from selling the put and call options, minus the cost of purchasing the call option.

Please ensure the final net credit received is greater than the width of the call spread. Otherwise, returns will be negative when the stock price rises substantially.

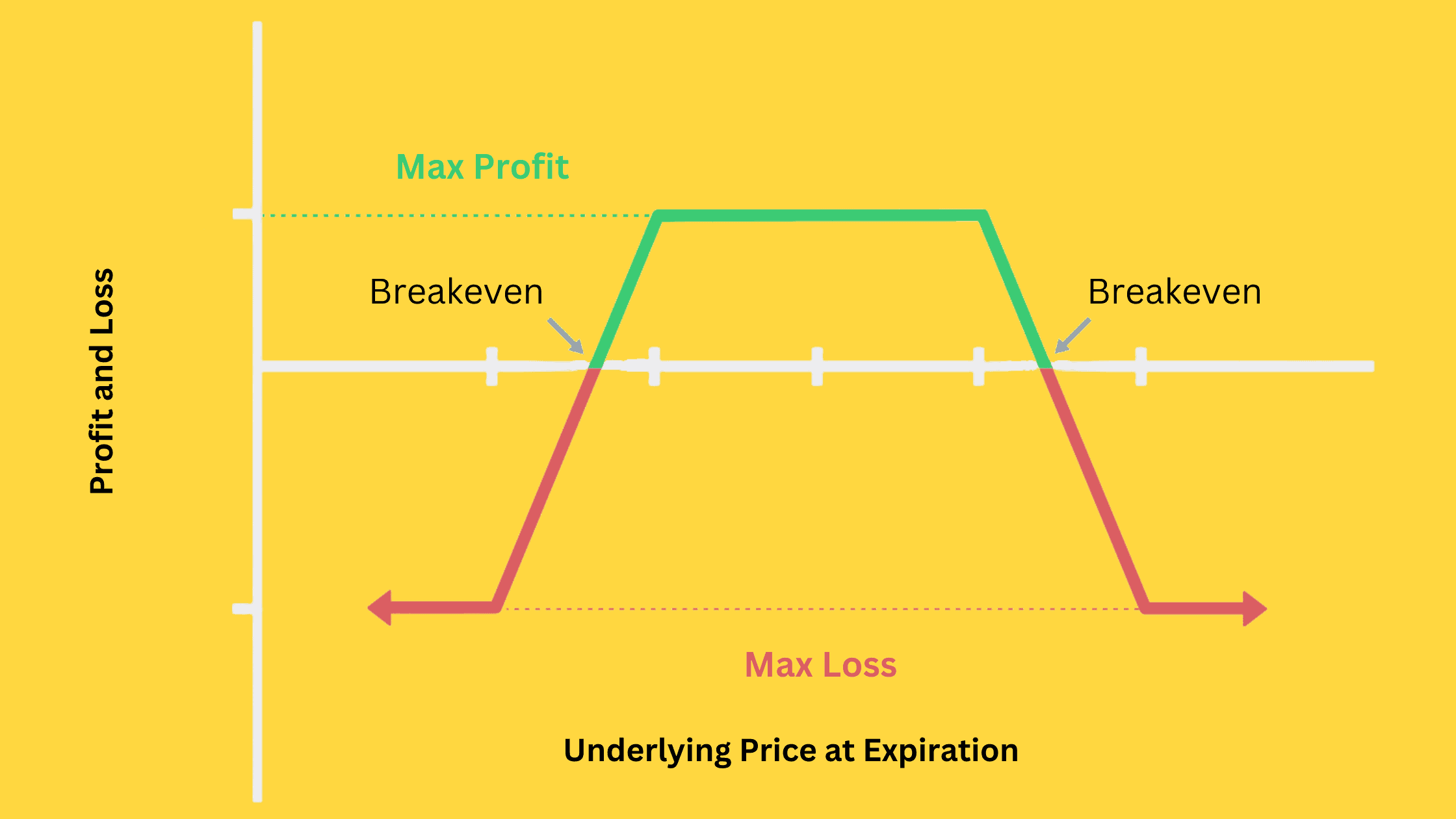

Profit & Loss Analysis for the Jade Lizard Options Strategy

To effectively manage and evaluate the Jade Lizard option strategy, it is crucial to comprehend how to calculate its profit and loss, as well as the breakeven point. Let’s delve deeper into these calculations:

Maximum Profit

The maximum profit for the Jade Lizard strategy corresponds to the net credit. This profit is realized when the stock price at expiration lies between the strike prices of the sold put and the sold call options, causing all options to expire worthless.

Maximum Profit = Premium received from selling the put option + Premium received from the short call spread

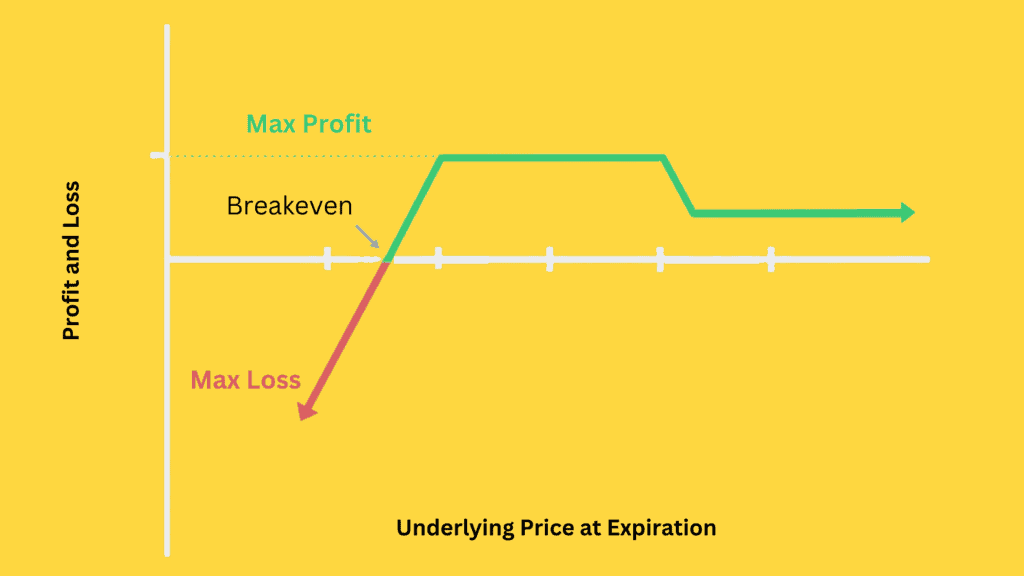

Maximum Loss

The maximum loss for the Jade Lizard strategy only occurs on the downside. It transpires when the stock price plunges to near zero. The maximum loss can be determined as the strike price of the sold put option minus the net credit received.

Maximum Loss = Strike price of sold put option – Net credit received

It is worth noting that there is no risk to the upside, as the call credit spread restricts the potential loss.

Breakeven Point

The breakeven point arises when the loss generated by the sold put option due to a decline in the stock price precisely counterbalances the net credit received.

Breakeven Point = Strike price of sold put option – Net credit received

Jade Lizard Options Strategy Trade Example

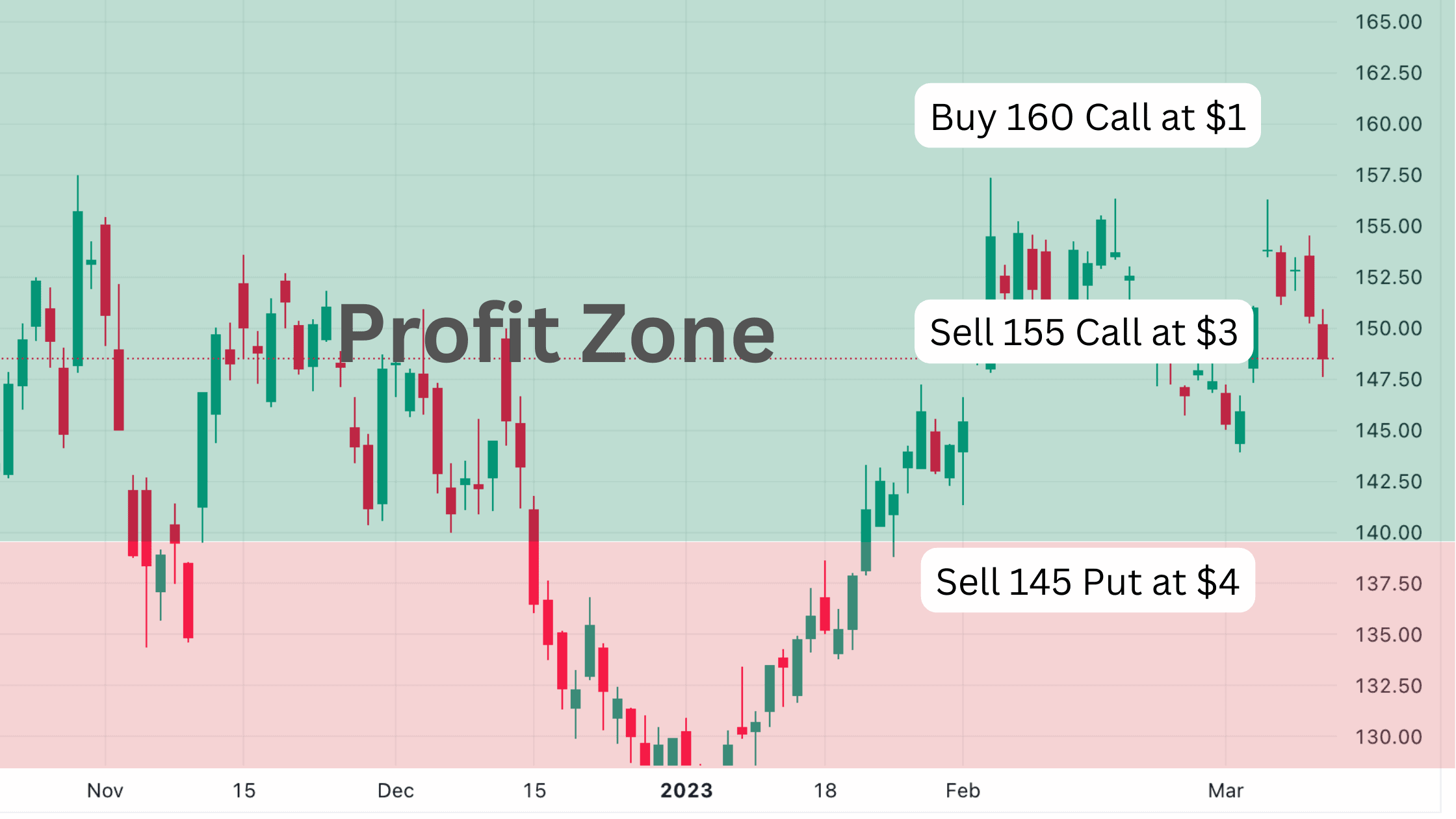

To better illustrate the Jade Lizard option strategy, let’s walk through a real-life example:

Suppose you are bullish on Stock XYZ, currently trading at $150. You believe the stock price will remain stable or increase slightly over the next month. To capitalize on this outlook, you decide to implement a Jade Lizard strategy with the following components:

Sell a Put Option: You sell an out-of-the-money put option with a strike price of $145, expiring in 30 days, and receive a premium of $4.

Sell a Call Option: You sell an out-of-the-money call option with a strike price of $155, expiring in 30 days, and receive a premium of $3.

Buy a Call Option: To limit your upside risk, you buy a further out-of-the-money call option with a strike price of $160, expiring in 30 days, at the cost of $1.

The net credit received from this Jade Lizard strategy is:

Net Credit = $4 (Premium from sold put) + ($3 – $1) (Premium from call credit spread) = $6

Now, let’s analyze the possible outcomes at expiration:

A. Stock price remains between $145 and $155

In this scenario, both the sold put and the call credit spread expire worthless. You keep the entire net credit of $6, which is your maximum profit.

B. Stock price falls below $145

If the stock price ends below $145 at expiration, you will be assigned the stock at the strike price of the sold put option ($145). Your breakeven point is $139 ($145 strike price – $6 net credit). If the stock price is above $139, you would still have a net profit. However, if the stock price falls below $139, you will incur a loss.

C. Stock price rises above $155

If the stock price exceeds $155 but remains below $160, you would keep the $6 net credit. However, the call option you sold would be exercised, and you would have to deliver the shares at the $155 strike price. Since you don’t own the stock, you would need to purchase it in the market to fulfill the obligation. The net credit received would offset the loss on the stock transaction. If the stock price rises above $160, the long call option starts to offset the losses from the short call, limiting your upside risk.

Jade Lizard vs Iron Condor

Perceptive readers might observe that the Jade Lizard strategy only sets itself apart from the previously discussed Iron Condor strategy by not incorporating the purchase of a deep-OTM put option. The Jade Lizard exhibits greater confidence that the underlying stock or ETFs will not undergo a significant drop, hence not protecting against risks stemming from a considerable decline in the stock or ETFs.

This absence of an additional option secures a higher net credit, enabling positive returns when the stock price significantly increases. In contrast, while the Iron Condor strategy does limit upside risk, its initial net credit is lower due to the extra purchased put. Consequently, if the stock price experiences a substantial surge, the Iron Condor strategy can only mitigate losses rather than yield positive returns.

Best Stock and ETFs for Jade Lizard

Protected by the long call option, we won’t face losses when the stock price skyrockets, although profits will be reduced. On the other hand, we will encounter substantial losses when the stock price takes a nosedive. Thus, the best stocks or ETFs for Jade Lizard are those exhibiting relatively low volatility. Even if their volatility were to escalate suddenly, it should tend to trend upward. Two categories of stocks naturally fit these characteristics: value stocks and index ETFs.

Value Stocks

Value stocks generally represent mature, stable companies with consistent performance. These stocks demonstrate strong resilience during market turbulence, lessening the likelihood of significant losses resulting from steep declines when utilizing the Jade Lizard option strategy.

In addition, the inherent stability of value stocks often leads to smaller fluctuations, increasing the probability of the stock price remaining between the strike prices of the two options we sold. This positioning enables us to achieve the Jade Lizard strategy’s maximum return.

Index ETFs

Index ETFs, like SPY and QQQ, are notably diversified, causing their volatility lower than individual stocks. This characteristic aligns with the Jade Lizard strategy’s volatility preference. Index ETFs are also connected to the overall macroeconomic environment, making the odds of a sharp decline comparatively low.

Moreover, index ETFs possess higher liquidity, resulting in tighter bid-ask spreads for their options and, consequently, lower trading costs. Since implementing the Jade Lizard option strategy necessitates trading three options concurrently, reduced trading costs can substantially enhance our returns.

Tips on Trading the Jade Lizard Options Strategy

Two crucial tips include selecting the right expiration date and monitoring changes in volatility. Let’s explore these techniques in more detail:

Select the Right Expiration Date

The expiration date of options significantly impacts the outcome of the Jade Lizard strategy. Options with shorter terms generally experience faster time decay, which benefits option sellers. This is because it allows them to profit more quickly from time value decay and increases the likelihood of the options expiring worthless due to the shorter time frame.

However, selling options with shorter expiration dates results in lower premiums. To achieve the same net credit, we need to sell more contracts, which increases risk. When choosing an expiration date, finding the right balance between risk and reward is vital. As a general guideline, consider selecting expiration dates between 30 and 60 days to achieve an optimal balance.

Monitor Changes in Volatility

When trading Jade Lizard, it’s essential to be familiar with two types of volatility: implied volatility and historical volatility.

Historical Volatility: As the name implies, historical volatility provides information about the daily fluctuations in an asset’s price over a specific period in the past.

Implied Volatility: Implied volatility represents the market’s expectation of the asset’s future fluctuation magnitude.

Higher implied volatility leads to more expensive options, which in turn allows for higher net credit, offering a more significant potential profit. By comparing implied volatility with historical volatility, you can analyze if the stock or ETF’s future volatility is overestimated or underestimated.

If you believe it is overestimated, consider using the Jade Lizard strategy to collect higher option premiums and exit the position after profiting from a decrease in implied volatility and time decay.