Options trading can be a lucrative way to make money without having to predict the ups and downs of the stock market. We’ve previously discussed the iron butterfly, a neutral-risk tactic that can help you earn when the market is stable. However, another similar method has even lower risk – the Iron Condor strategy.

The Iron Condor is a highly successful and limited-risk approach that allows you to roll over and compound your profits continuously. In this post, we’ll give you some tips on which stocks work best for Iron Condor and how to use this strategy.

What is an Iron Condor?

Iron Condor is an options strategy that combines bullish and bearish spreads on the same stock. It involves buying and selling two call options and two put options with different strike prices but the same expiration date.

The idea is to sell call and put options closer to the at-the-money level than the options you buy. These option contracts are more expensive, so you receive a higher premium than what you pay out initially, resulting in a net credit.

The Iron Condor strategy aims to keep the entire net credit received. This happens when the stock closes between the two middle strike prices on the expiration date, and all four options expire worthless. Even if the sold options result in some loss, you can still profit as long as the loss is less than the net credit earned at the beginning.

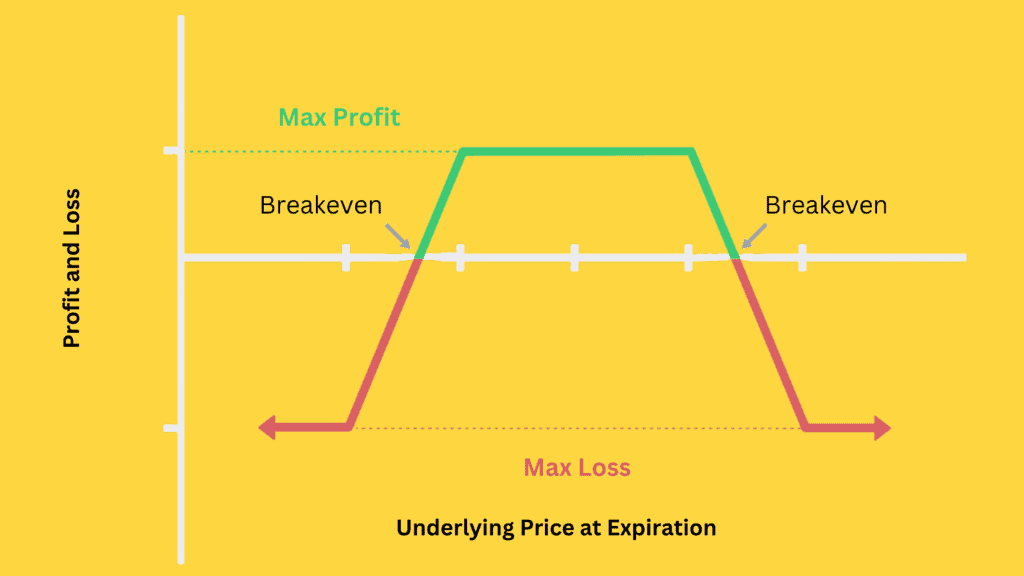

The Iron Condor is so-called due to the distinctive visual formed by the profit and loss graph, resembling the spread of a condor’s wings.

This strategy is risk-neutral and has limited profit potential. It works best on stocks that are not expected to experience significant price swings and have low volatility. The Iron Condor benefits from a decrease in implied volatility and the time decay of options.

Iron Condor Trade Example

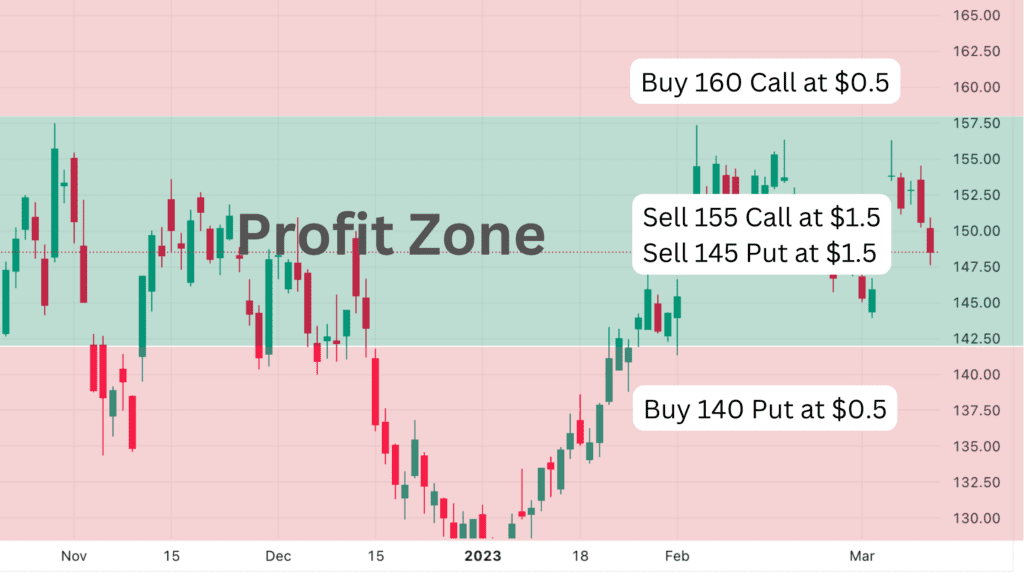

Let me explain the Iron Condor strategy using an example of trading Apple stock.

Assumptions:

Current stock price: $150

Expiration date: one month from today

Total premium received for selling call and put options: $300

Total premium paid for buying call and put options: $100

Options involved:

Sell 1 AAPL $155 call option at a premium of $1.50 (total premium received: $150)

Sell 1 AAPL $145 put option at a premium of $1.50 (total premium received: $150)

Buy 1 AAPL $160 call option at a premium of $0.50 (total premium paid: $50)

Buy 1 AAPL $140 put option at a premium of $0.50 (total premium paid: $50)

An options trader decides to implement an Iron Condor options trade on Apple Inc. stock. They believe that Apple’s stock will remain stable over the next month, as there are no upcoming financial reports. The trader also expects the implied volatility of the options to decrease gradually as the Federal Reserve has just announced its interest rate policy.

To implement the trade, the trader sells a call option with a strike price of $155 for $1.5 and buys a call option with a strike price of $160 for $0.5. They also sell a put option with a strike price of $145 for $1.5 and buy a put option with a strike price of $140 for $0.5. The credit for this position is $2 per share, or $200 in total.

To maximize their profit, the trader needs all options to expire worthless. To achieve this, Apple’s stock price must be between $145 and $155 at expiration. If the stock price is slightly above $155 or below $145, the trader can still make a reduced profit but also risks losing money. However, if the stock price is above $160 or below $140 at expiration, the trader will experience maximum losses.

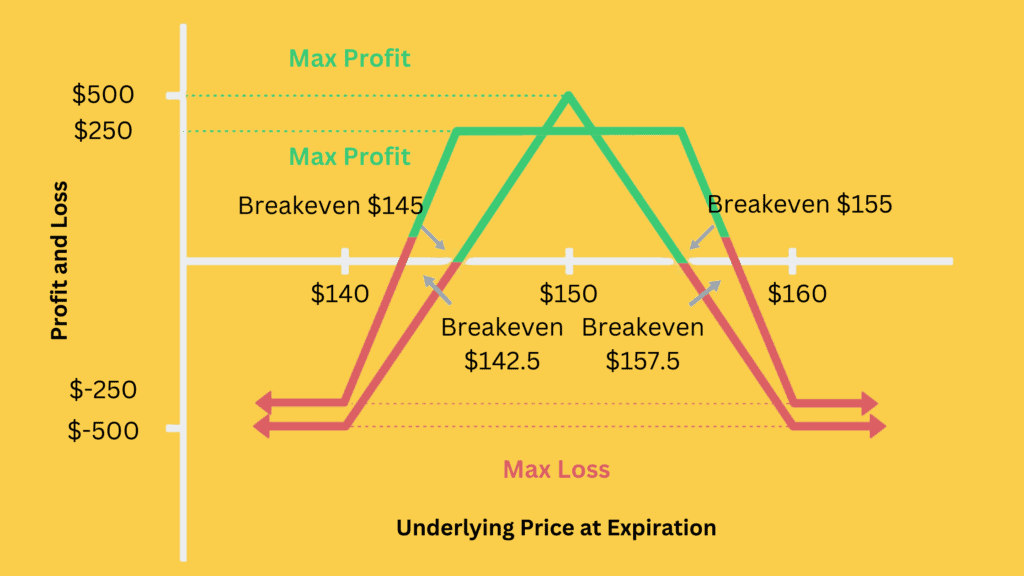

Let’s assume that the stock price at expiration is $165, which is above the higher strike price. The trader incurs a loss of $10 on the sold call option ($165 – $155) but makes a profit of $5 on the bought call option ($165 – $160). Both put options expire worthless since the stock price is above the strike prices. In total, the trader incurs a loss of $500, but they initially received $200 in credit for the position. Therefore, the maximum loss for the trader is $300.

Iron Condor vs Iron Butterfly

Fundamentally, the main difference between the Iron Condor and the Iron Butterfly strategies lies in the difference in the strike prices of the options sold.

The Iron Butterfly strategy involves selling both a call option and a put option with the same strike price. In contrast, the Iron Condor strategy involves selling a call option with a higher strike price than the put option sold.

The Iron Condor creates a larger profit protection net by setting a larger gap in the strike prices of the short positions. Thus, you are more likely to make a profit instead of a loss. However, since the strike prices of the options sold are farther from the market price, the credit received at the beginning is smaller. The credit received is the maximum profit potential of both Iron Condor and Iron Butterfly strategies, so the maximum potential profit of Iron Condor will be lower.

Iron Butterfly, on the other hand, is a higher-risk, higher-return strategy. Selling options with strike prices close to or at the current asset price can generate more credit. Therefore, the potential maximum return of the Iron Butterfly is higher.

Overall, Iron Condor is considered a high-probability trade, while Iron Butterfly is a low-probability trade. However, these probabilities assume holding both trades until expiration, which is rarely the case. Most traders set realistic profit targets and exit the trade once they reach that target or are close to it.

Related Reading: Iron Butterfly Options: Best Stocks for It and Tips with Examples

Best Stocks for Iron Condor

Implementing the Iron Condor strategy, we hope the final stock price will fall between the strike prices of the call options and put options we sold. Therefore, we do not want the stock price to have too much volatility in the future. At the same time, it is best if the implied volatility of the options is relatively high, as this will result in higher option premiums for the options we sold. In that case, we can obtain higher credit, which translates to higher potential profit.

Thus, the most suitable stocks are those with low volatility but has occasional spikes in implied volatility. In other words, you want to choose a stock that usually doesn’t move too much, but sometimes experiences significant fluctuations in option prices.

The Dow Jones index component stocks are one of the best stocks for the Iron Condor strategy. These stocks have large market capitalization, good liquidity, and low volatility. When the implied volatility of the options of these stocks is higher than usual, it presents an Iron Condor opportunity.

Don’t worry too much about future volatility exceeding expectations. The Iron Condor strategy is very robust. Although it may seem risky at first, it has a proven high success rate in practice.

Tips on Trading Iron Condor

Selecting Large-Cap Stocks

Stocks with a higher market capitalization are less likely to have sudden price swings or be manipulated by insiders. This is why the Iron Condor strategy is often used for such stocks, as it aims to benefit from lower volatility.

In addition, stocks with larger market capitalization tend to have more liquidity in the options market, which means lower bid-ask spreads. This can result in lower trading costs. For the Iron Condor strategy, which involves buying and selling four options simultaneously, lower trading costs can save significant money and increase returns.

Choosing Suitable Expiration Date

When using the Iron Condor, you should choose options with an expiration date of at least one month away. This can help you safely capture the income generated by time decay. Moreover, options with longer expiration dates are worth more, meaning you can get more credit and increase your potential profits.

However, overly long expiration dates can reduce the efficiency of your income from time decay. This happens because the option’s theta decreases more slowly when there is still a long time to expiration.

Also, it’s best to exit an Iron Condor once you’ve made a certain profit and start a new one. You can roll this strategy over and over again. However, long expiration date will lead to less number of rolls in the future and thus lower your income.

Generally, a 30-60 day timeframe is a good starting point.

Avoiding Impending News Stocks

Information release can cause the stock price to fluctuate wildly, which is bad news for you. The Iron Condor relies on the stock price eventually settling between the strike prices of the options you sold. This is how you make the most profit.

If the stock price swings too far in one direction due to an information release, you could end up losing money. And in the worst-case scenario, if the stock price moves beyond the strike price of the options you bought, you could face a maximum loss.

Balancing Profit and Risk

Achieving a balance between profit and risk is crucial when trading options.

Suppose you want to increase your maximum profit potential. For short positions, you should choose options with strike prices closer to the current market price, as they are more expensive. Selling these options will result in a higher credit and a higher “head” in your profit diagram.

On the other hand, for long positions, you should choose options with strike prices further from the current market price, as they are cheaper. Buying these options for long positions will result in a wider “wingspan” in your profit diagram.

But it’s essential not to get too greedy for profit, as high returns also mean high risks. If you sell deep-in-the-money options or buy deep-out-of-money options, your maximum loss will increase. This is because the maximum loss equals the difference between the strike prices of the two call options (or two put options) you bought and sold, minus the initial credit you received.

Starting with Small

The Iron Condor strategy can be quite complicated, requiring a combination of four different options with varying strike prices. Managing multiple positions can be time-consuming and challenging, which increases the likelihood of errors and losses.

To avoid these problems, begin with a few positions and gradually increase the contract quantity as you become more familiar with the strategy. This approach will help you better understand the ins and outs of the Iron Condor strategy, giving you the confidence to take on more contracts over time.