As many of us know, the world of cryptocurrency is deep and complex. Trading in the crypto market is similar to stock trading but has some key differences. In stock trading, there are market closures, limitations on price increases and decreases, and relatively minor fluctuations. In contrast, the crypto market operates 24/7. Besides, the crypto price change has no boundaries and has much more significant volatility. Given these unique characteristics, a new trading tool emerged: a quantitative crypto trading bot.

These bots use algorithms and data analysis to make trades, aiming to maximize profits and minimize risk. This article will delve into the world of quantitative crypto trading bot. Explore how they work, the benefits, and the potential challenges. Whether you’re a seasoned trader or just getting started in the crypto market, understanding the role of quantitative trading bots helps you navigate this ever-evolving industry.

What is quantitative trading?

Quantitative trading is an advanced investment method. It uses modern statistical and mathematical techniques, along with computer technology, to execute trades. By analyzing vast amounts of historical data, quantitative researchers identify patterns and events with a high probability of excess returns. Then, they incorporate these patterns and events into a quantitative model. After validating, these quantitative models can guide investments to achieve consistent, stable, and above-average returns.

Relying on these models, people can make trades based on quantitative data rather than human discretion. Decision-making becomes faster and more efficient. All of these can result in a competitive edge in the market. However, this trading method also has its risks. For example, models may become ineffective as market conditions change, or a lack of data may cause the model to overfit.

What is a quantitative crypto trading bot?

The potential for high returns in crypto trading has attracted many participants to the market. However, many new traders struggle to navigate the complex rules and regulations of the market.

In this scenario, cryptocurrency quantitative trading bots emerged. These bots partner with well-known exchanges such as ZB, Huobi, Binance, OKEx, and Gate. They allow for the simultaneous trading of multiple currencies and require no human intervention. The bots use core quantitative technology and algorithms, big data computation, and innovative features such as automatic profit tracking and stop-loss. At the same time, the trading cycle is significantly shortened, with trades can be as frequent as every 0.05 seconds.

These bots run on cloud servers. Once users establish the initial settings and parameters, the bot will execute trades according to the programmed strategy. Buying or selling will be automatically based on predetermined conditions. This allows traders to achieve returns without the need for constant market monitoring.

Understand the principle of quantitative crypto trading bot

To understand the principle of a quantitative crypto trading bot, let’s take the example of buying eggs.

Let’s say the price of an egg is $5 currently. And the trading bot buys one for $5.

When the egg price drops to $4, the bot buys two more eggs for $8.

When the price drops to $3, the bot buys four more eggs for $12.

When the price drops to $2, the bot buys eight more eggs, costing $16.

The bot eventually buys a total of 15 eggs for $41, averaging $2.73 per egg. If the egg price rises to $3, the bot can then sell all the eggs for a profit.

The difference between this and manual trading is that in manual trading, we need to keep a constant eye on the market. It can be very tiring. We need to buy at $5 and sell at above $5 to make a profit.

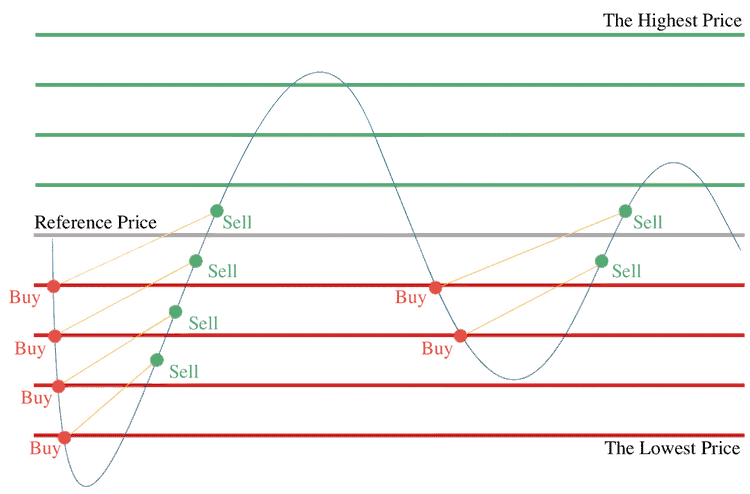

But the robot uses a “grid trading” strategy. The initial position of the robot’s purchase is tiny. Every time the price drops $1, it will buy more. But if it detects a spike, it won’t buy. Therefore, the average cost of the position is much lower than that of manual trading. We don’t need to monitor the market constantly. The robot can work at a milliseconds level to make trades and earn profits.

This example just illustrates the grid trading strategy. There are many other types of robots. Due to space constraints, this article will not cover them one by one. If you’re interested in this topic, you can visit Canny Trading for more information.

Advantages of quantitative crypto trading bot

Quantitative trading offers several advantages, primarily through making investment behavior more disciplined and systematic.

- One advantage of quantitative trading is its automatic execution process. Due to this, quantitative trading executes trades at a faster rate. Opportunities are fleeting. Quantitative trading can seize these short-term trading opportunities, while traditional manual trading cannot. In volatile market conditions, this feature is much more valuable. Thus, quantitative trading is more efficient than manual trading.

- Additionally, algorithms and automation can help reduce human error and emotional biases that can negatively impact trading decisions.

- In addition, quantitative trading allows traders to backtest their strategies and evaluate their historical performance. Through backtesting, people can identify and eliminate any potential weaknesses in the strategy. Researchers can use the backtesting results to improve strategies, making quantitative models more robust.

- Finally, crypto trading takes place 24 hours a day. Manual trading is not possible when traders need to sleep. Excellent trading opportunities may slip away while you sleep. On the other hand, a cloud-based quantitative crypto trading bot can operate continuously and ensure no missed opportunities.

How to choose a quantitative crypto trading bot

When choosing a quantitative crypto trading bot, it’s essential to keep in mind that the core of a trading bot is its strategy parameters. Parameters will determine how the bot will operate. Most bots have open strategy parameters so that users can set them flexibly. Be cautious of those that don’t allow for user-defined parameters!

To choose the right bot, also focus on these factors:

- Look for a bot with a strong track record of successful operations. For example, 3Commas, TradeSanta, etc. In general, older bots that have been around for a longer time are more likely to be reliable.

- Ensure the app is user-friendly and runs smoothly without lag or glitches. A stable app shows a strong development team and a reliable system.

- Seek an experienced mentor or guide who can provide guidance and help you adjust your parameters according to different market conditions. This will help you maximize your profits, especially if you are new to trading.

You should remember that trading bot parameters are not set in stone. Parameters can change depending on market conditions. Thus, the third point is the most important. For beginners, what do you do if you don’t have any experience? You need an experienced and responsible “old driver” to guide you through the process!

How to avoid scams?

When using a quantitative trading bot for cryptocurrency, it’s essential to know the potential for scams. Here are a few tips for avoiding them:

- Make sure you keep your funds in your own exchange account. Don’t give anyone else control over them. This way, no one can touch your money without your permission.

- Be wary of platforms that require high upfront fees. Most software only charges an activation fee at most, and annual fees are typically under $200. If a platform requires a deposit of over $400, be cautious. Typical commissions are settled daily and can be withdrawn at any time.

- Make sure the bot is connected to a reputable exchange, like Huobi or Binance, rather than a smaller one.

- Check if the software allows you to set your own parameters and choose your own strategy. Avoid “all-in-one” solutions and take responsibility for your own money.

- Don’t fall for cheap deals, especially if the software is totally free. Remember, it probably is if something seems too good to be true. No one would develop a tool and give it away for free, just for the sake of charity.

Final words

In this article, we delved into the world of quantitative crypto trading bot. In short, these bots are essentially data-driven codes created for trading cryptocurrencies, much like AI. While they may not be perfect and can make mistakes due to human error, they offer sufficient advantages over manual trading.

By understanding these bots, you may gain a new perspective on cryptocurrency trading and potentially earn significant profits. However, as the internet is vast and complex, be always wary of scams. Do your research when choosing the trading bot. It’s also important to remember that investing in these bots still comes with risk. Never invest more than you can afford to lose. Be responsible for your money! We hope this article is helpful to you.