Maybe you’ve seen people talking about Bitcoin or Ethereum. Or you’ve read headlines about the crazy price spikes and crashes. Then, you might think to yourself, “what the hell is cryptocurrency?”

Cryptocurrency seems like a foreign concept at first, but once you wrap your head around it, it’s actually pretty cool. In this article, I will make a complete guide to cryptocurrency. So, let’s dive in and explore the interesting world.

What the Hell is Cryptocurrency?

Cryptocurrency is a digital or virtual currency that uses cryptography (secret code) to secure transactions. Unlike traditional currencies, cryptocurrency operates independently of governments, banks, and other financial institutions. That’s why cryptocurrencies are a decentralized form of money.

The first and most famous cryptocurrency is Bitcoin, created in 2009 by a mysterious person (or group) using the pseudonym Satoshi Nakamoto. Since then, massive other cryptocurrencies have been born, each with its own unique features and uses.

How Does Cryptocurrency Work?

Cryptocurrency vs. Traditional Currencies

So, what makes cryptocurrency different from traditional currencies? Well, first of all, it’s completely digital. You don’t have to worry about carrying physical cash or waiting for checks to clear. Everything is done online, and transactions are recorded on a public ledger called the blockchain.

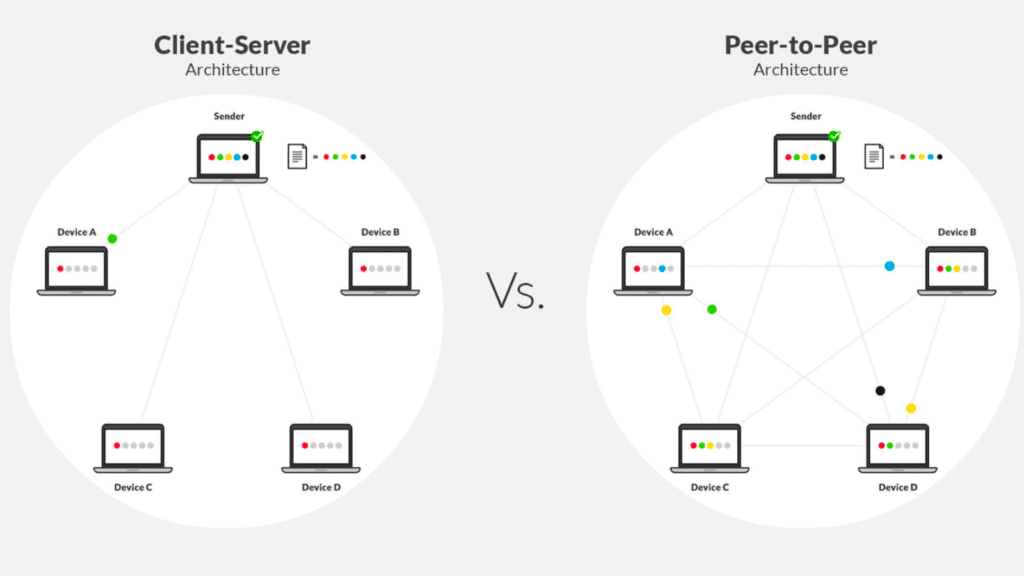

Besides, traditional currencies are issued and controlled by governments, but cryptocurrencies operate on a peer-to-peer network, meaning there’s no central authority in charge. This makes transactions faster, cheaper, and more secure, since there’s no single point of failure for hackers to target.

Blockchain and Mining in Cryptocurrency

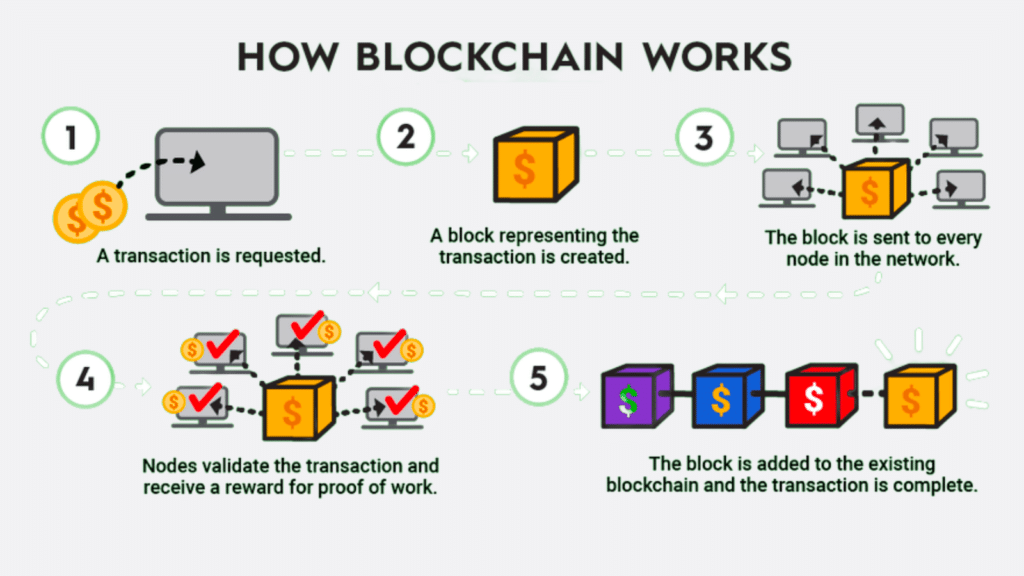

The blockchain is a ledger of all transactions with a particular cryptocurrency. It is a continuously growing list of records, called blocks, linked and secured using cryptography. Each block contains information about the previous block, forming a chain of blocks, hence the name blockchain.

When someone wants to send cryptocurrency, they broadcast the transaction to the network. The network of users, or nodes, then validates the transaction and adds it to the next block in the blockchain. People call this validation process “mining.”

Miners are individuals or organizations who use their computers to validate transactions and add blocks to the blockchain. As a reward, they receive a small amount of cryptocurrency.

Since the blockchain is decentralized and secure, it is nearly impossible for anyone to manipulate or counterfeit the currency. All transactions are transparent for anyone to view on the blockchain.

The Rise of Bitcoin

Now, Bitcoin is a well-known concept. Actually, at first, no one took Bitcoin seriously.

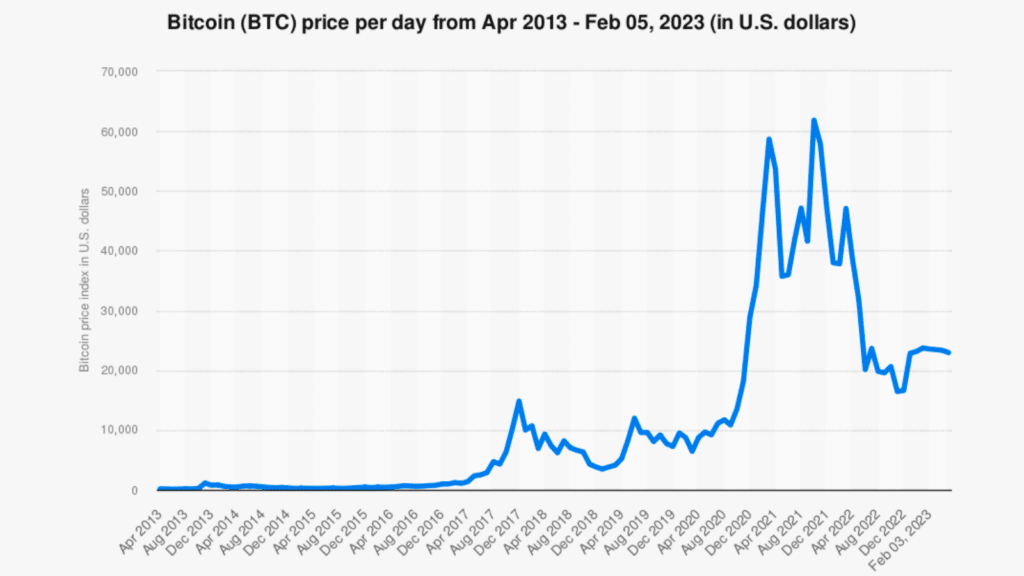

The initial price of Bitcoin was almost zero, as only a few adopters traded it. The first recorded price was $1 for 1,309.03 Bitcoin on October 5, 2009.

But over time, as more people started using Bitcoin, its value began to rise. The increase rate exceeded what you could ever think. In late 2017, the price of Bitcoin reached an amazing all-time high of nearly $20,000.

Since then, the value of Bitcoin has become volatile, but it remains the most popular cryptocurrency. In fact, as of this writing, the market capitalization of Bitcoin is over $400 billion. That’s right, billion with a “b.”

Types of Cryptocurrency

Now you have learned about Bitcoin, the first and most well-known cryptocurrency. But do you know there are many other types of crypto out there? Let me give you a rundown of the different types you might come across.

Altcoins

First, we have the altcoins. The term “Altcoin” is derived from the words “alternative” and “coin.” Basically, any cryptocurrency that’s not Bitcoin is an altcoin.

Some popular altcoins include Ethereum, Ripple, and Litecoin. These coins offer different features or use cases than Bitcoin, such as faster transaction times or more flexible programming capabilities.

Stablecoins

Next, we have stablecoins, which aim to provide more stability than traditional cryptocurrencies. They’re pegged to a stable asset, like the U.S. dollar. Thus, they tend to have minimum price volatility.

Tether and USDC are two well-known stablecoins. If you are a conservative investor, these cryptocurrencies may be a good choice because of the high volatility of other cryptocurrencies.

Privacy Coins

Finally, there are privacy coins designed to enhance the privacy and security of transactions.

Monero and ZCash are two examples of privacy coins. Compared to other cryptocurrencies, they use more complex cryptography to keep transactions confidential.

So, those are the main types of cryptocurrency you might come across. It’s a rapidly evolving space, so keep an eye out for new and innovative coins. Who knows, the next big thing might be around the corner!

How To Get Involved In Cryptocurrency

With digital currencies rebound, it may be a perfect time to jump in. Here’s how to get started.

Educate yourself – Before investing in cryptocurrency, be sure to understand how it works. Read books, articles, and whitepapers to get a comprehensive understanding of blockchain technology and the different cryptocurrencies available.

Choose a wallet – A cryptocurrency wallet is where you store your digital coins. There are several types of wallets, including software wallets, hardware wallets, and paper wallets. Choose one that best suits your needs and offers top-notch security.

Pick a cryptocurrency to invest in – With over 7,000 cryptocurrencies in circulation, it can be overwhelming to choose one. Start by researching the top 10 cryptocurrencies by market capitalization and read about their unique features and use cases. Decide which one aligns with your investment goals and values.

Find a reputable exchange – An exchange is where you can buy and sell cryptocurrencies. Look for a trusted platform with a good reputation and secure systems in place to protect your funds.

Make your first investment – Once you’ve chosen a cryptocurrency, opened a wallet, and found an exchange, it’s time to make your first investment. Start small, and don’t invest more than you can afford to lose.

Diversify your portfolio – Don’t put all your eggs in one basket. Consider investing in various cryptocurrencies to spread your risk and potentially maximize your returns.

Keep up with the news – Cryptocurrency is a rapidly evolving space. So, stay informed about the latest developments and trends. Follow news sources and influencers in the industry to stay ahead of the game.

Final Words

Well, that’s all for the article on cryptocurrency fundamentals. I hope that by now, you have solidly understood what exactly cryptocurrency is and how it works.

Cryptocurrency is a revolutionary technology. With the rise of Bitcoin and other cryptocurrencies, people are starting to see a world where financial transactions are fast, secure, and borderless.

However, cryptocurrency can still be confusing for many people. Truly, there is a lot to learn. But fear not, with a little bit of time and effort, you too can become a cryptocurrency expert.

One thing is for sure: cryptocurrency is not going away anytime soon. It’s only getting bigger and more mainstream every day. With more and more businesses, governments, and individuals starting to adopt and invest in this field, it’s never been a better time to get involved.

So go ahead and dive in. One day, you might find yourself at the forefront of a new financial revolution.