Many factors, including the commodity’s supply and demand and traders’ behavior, influence the price of crude oil. It fluctuates heavily every day, creating opportunities for day traders to make money. Day trading crude oil involves speculating on short-term price movements, rather than analyzing the long-term value of the commodity.

Traders can either go long or short, meaning they can make money whether the price goes up or down, as long as they predict the direction correctly.

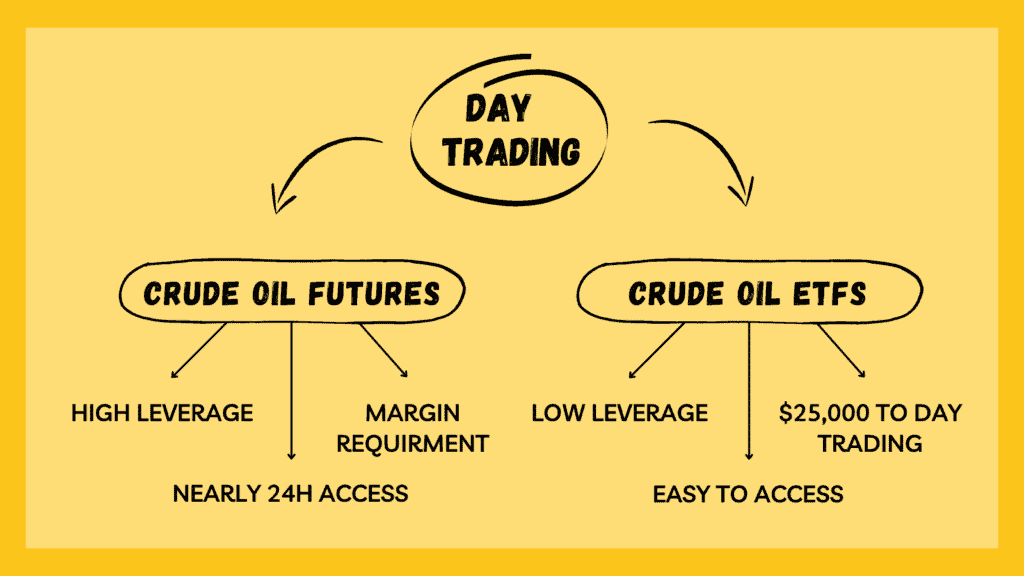

But before jumping into trading, you must choose the right trading tool that works for you. This can vary depending on your experience, budget, and personal preferences. Some popular trading tools include futures contracts and exchange-traded funds.

Day Trading Crude Oil Futures

A futures contract is an agreement to buy or sell a specific product, like crude oil, gold, or wheat, at a specific price on a future date. But as a day trader, you won’t actually take possession of the physical products.

Instead, you’ll close out all your contracts at the end of each trading day. The amount of money you make or lose on each trade is based on the difference between the price at which you bought (or sold) the contract, and the price at which you sold (or bought it back) to end the trade.

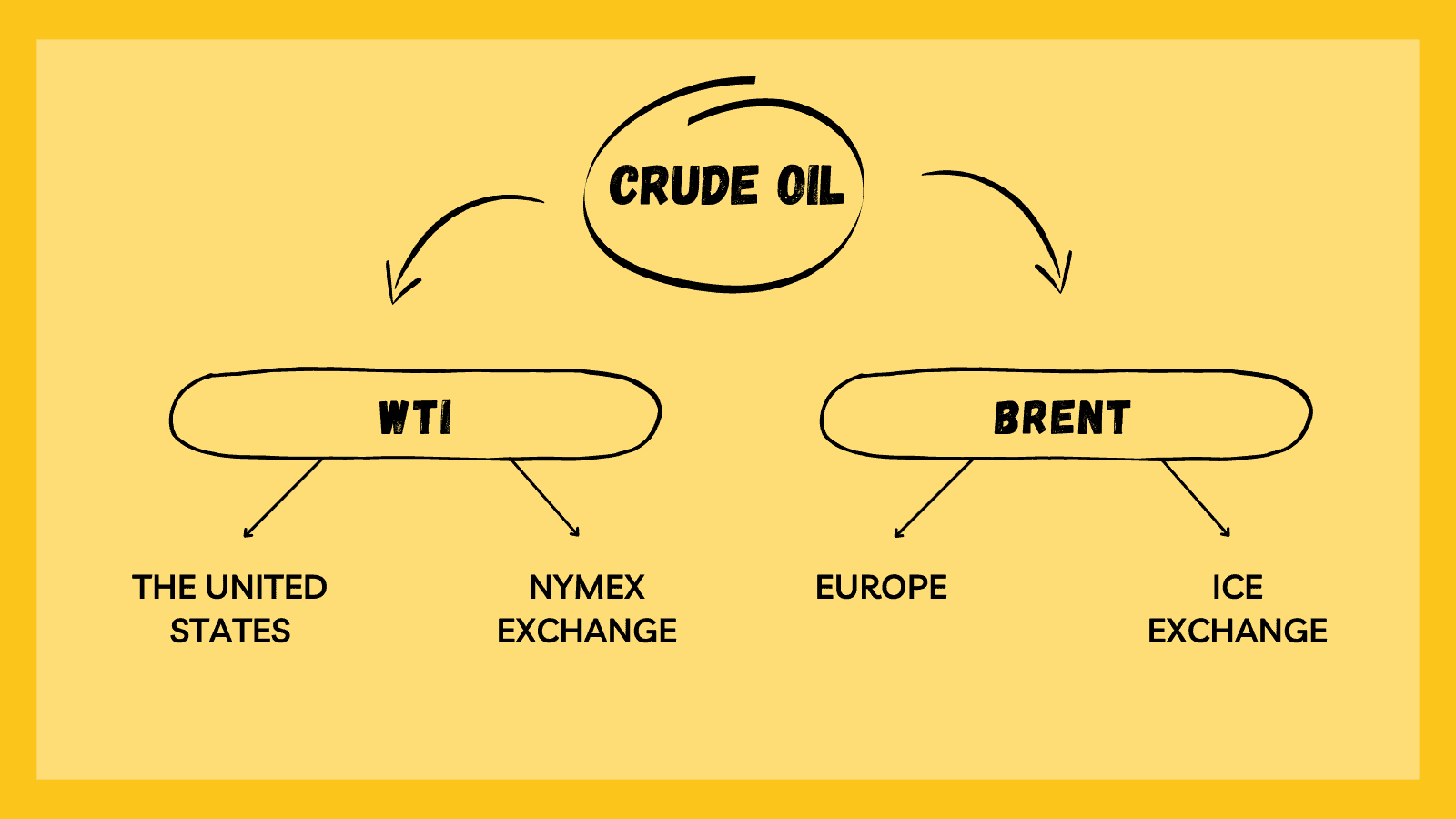

Choosing Between WTI and Brent Crude Oil

There are two primary types of crude oil traded worldwide, West Texas Intermediate (WTI) and Brent. WTI is produced in the Permian Basin and other locations in the United States, while Brent is extracted from over ten oil fields in the North Atlantic region.

Although they come from different regions, the price trends of WTI and Brent tend to be very similar. For most day traders, choosing which type of crude oil to trade can depend mainly on their time zone.

Both WTI and Brent crude oil futures can be traded for nearly 24 hours per day, but the most active trading times tend to coincide with local stock market hours. For example, if you are based in the United States, you might choose to trade WTI crude oil (on the NYMEX exchange), as trading is most active between 9:00 am and 4:00 pm Eastern Time. This time frame will provide you with plenty of opportunities to trade.

If you are based in a European time zone, you might consider trading on the North Sea Brent crude oil futures market (on the ICE exchange) during the daytime hours, when there is higher trading volume and more movement in the market.

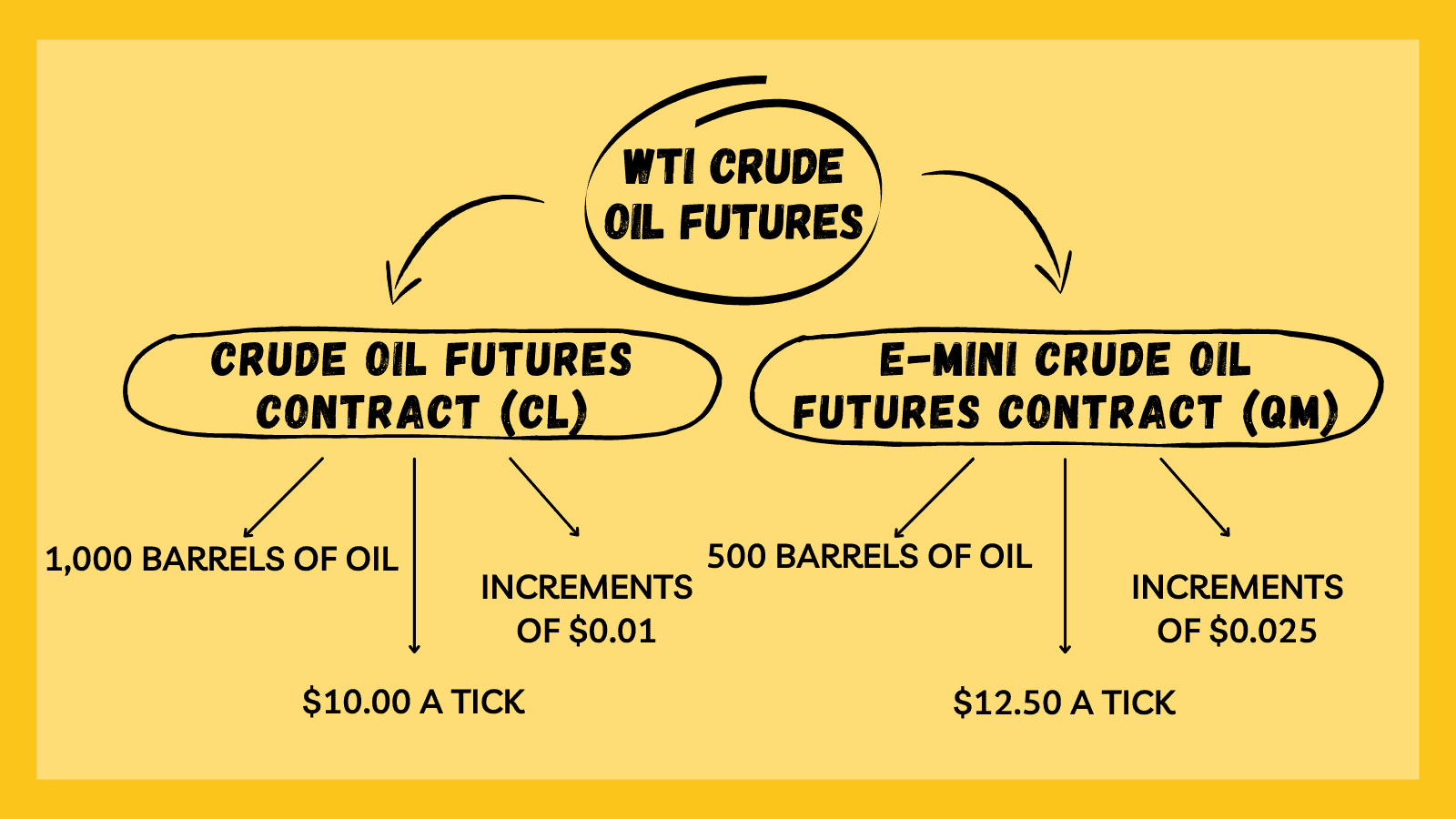

Choosing the Right Contract Size

Be aware that there are different contract sizes available, even for the same type of oil. For example, in the U.S., WTI crude oil has several contracts available for trading. The two most commonly traded contracts are the crude oil futures contract (CL) and the mini crude oil futures contract (QM).

The CL contract represents 1,000 barrels of oil, while the QM represents 500. The price of these contracts changes in small increments called “ticks.” The CL contract changes in increments of $0.01, while the QM contract changes in increments of $0.025.

The tick is the minimum price movement of a futures contract. When you buy or sell a futures contract, your profit or loss is calculated based on the number of ticks. For example, for a standard crude oil contract, each tick is worth $10, as each contract represents 1,000 barrels of oil, and each tick represents a $0.01 change in the oil price per barrel.

Similarly, for a mini crude oil contract, the tick value is $12.50, as each tick represents a $0.025 change in the price per barrel, and each contract represents 500 barrels of oil. Therefore, for each contract you hold, one tick will result in a profit or loss of $12.50.

Minimum Futures Account Balance

Futures trading involves leverage, which means you’ll need to have some funds in your account to meet the margin requirements. To start day trading crude oil futures, you’ll need to deposit enough money into your account as initial margin. The amount required will depend on your futures broker, but a conservative estimate is about $1,000.

However, keep in mind that you might have to deal with maintenance margin restrictions if you don’t close all your positions by the end of the trading day. That means if you experience losses that cause your account balance to fall below the required maintenance margin, you’ll have to deposit more cash quickly to meet the margin requirements. Otherwise, your brokerage might sell your assets.

Day Trading Crude Oil ETF

You can also consider using a Crude Oil ETF. One popular Crude Oil ETF is the United States Oil Fund, also known as USO.

What’s great about trading Crude Oil ETFs is that it’s a straightforward process perfect for beginners. Trading ETFs is almost the same as trading stocks, so you don’t need any specialized knowledge or experience to get started. All you need is to open an account with a stockbroker, and you’re good to go!

The price of a Crude Oil ETF is also linked to the price of futures contracts, so there’s no need to worry about the ETF’s price behaving differently from the underlying commodity. As long as you keep an eye on the price of crude oil futures, you’ll have a good sense of the Crude Oil ETF’s performance.

Minimum Account Balance

Although many stock brokers do not require a minimum account balance, this is different if you want to engage in day trading. Day trading is a risky business. Thus, the U.S. Securities and Exchange Commission (SEC) has set a rule to protect investors.

The SEC requires pattern day traders (PDT) to have a minimum account balance of $25,000 to engage in day trading. This means that if you want to make more than THREE day trades in a FIVE-DAY period, you must have at least $25,000 in your account.

Understanding Factors Affecting Intraday Price Changes of Crude Oil

To understand the factors that influence intraday price changes of WTI crude oil, here are three key things to keep in mind.

First, there’s fundamental information that’s released at specific times. For example, the EIA report comes out every Wednesday at 9:30 am Central Time and tells you about crude oil’s inventory status. This report is a big deal, and when it’s released, the crude oil market goes through some wild ups and downs. It’s important to know when the report is coming out so you can be prepared, and it’s usually best to stay out of the market while it’s being released because it’s so unpredictable.

Second, WTI crude oil futures are one of the products in the Chicago Mercantile Exchange’s (CME) energy portfolio. It is highly related to other energy products like Gasoline (RB) and Heating Oil (HO). If these other products have significant price fluctuations, WTI crude oil will likely be affected. Thus, you need to pay attention to the broader energy market, not just crude oil.

Third, there’s a lot of high-frequency and quantitative trading going on with WTI crude oil. This means that computers do a lot of the buying and selling every moment. While these trades can’t change the market’s long-term trend, they can definitely affect the intraday price movement.

Learning Technical Analysis for Day Trading

One of the biggest mistakes in day trading is relying too much on fundamental analysis. Many people believe that you must pay close attention to economic indicators, such as supply and demand. But in reality, day trading can be completely independent of these factors. Because you only hold a position for a few hours, any influence from fundamentals is minimal. If you try to use fundamental analysis for short-term futures trading, you’ll be a slave to it and never truly in control of your trades.

Regarding technical analysis, there are two critical things to consider: technical indicators and trading volume.

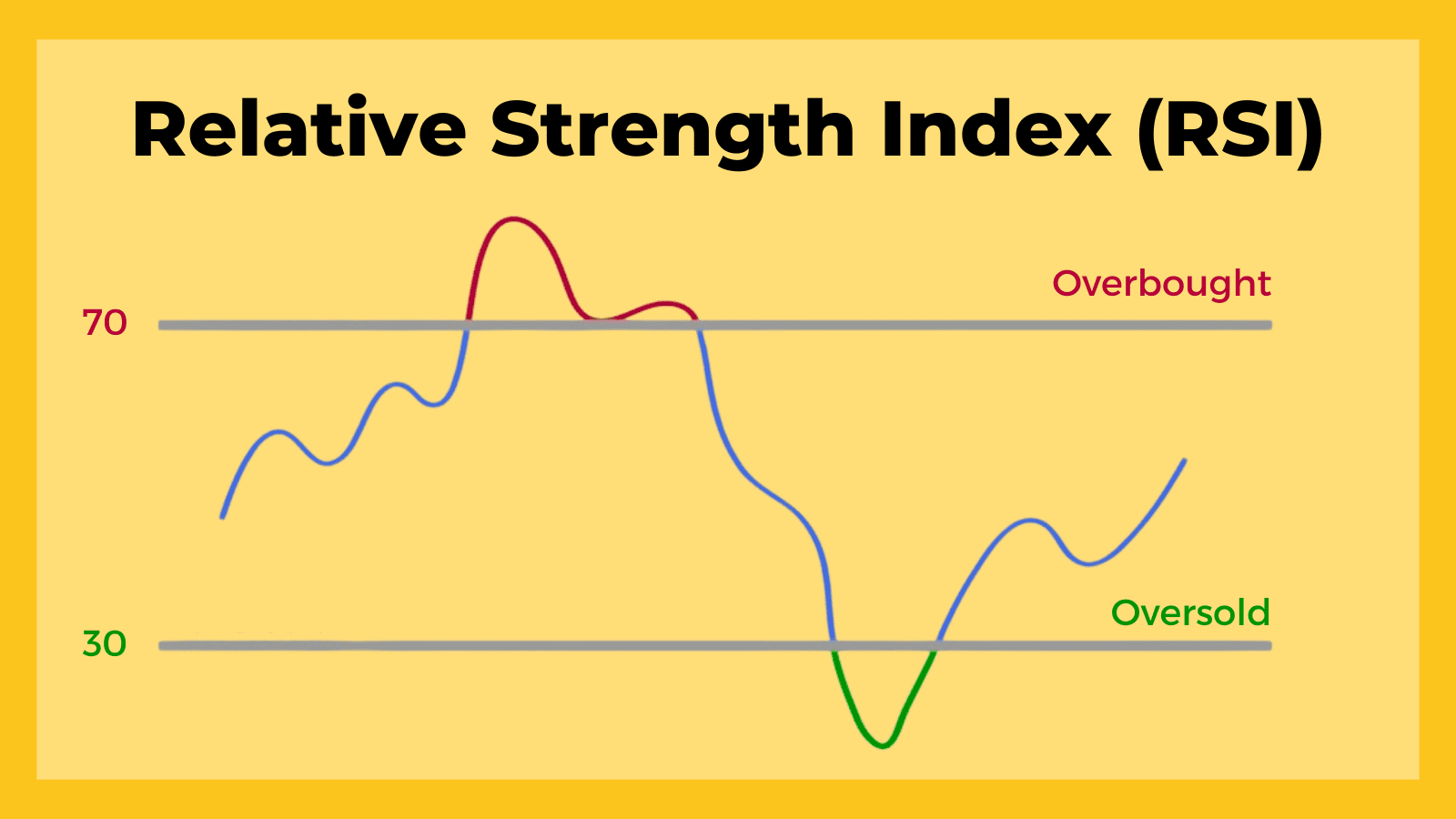

Technical Indicators

Technical indicators are tools that traders use to analyze market trends and identify potential entry and exit points for trades. There are many technical indicators, enough to fill a book.

As a trader, I personally find the RSI to be a helpful tool when deciding when to enter or exit a trade. By keeping an eye on the RSI, I can better understand the current state of the market.

The RSI is used to determine whether a market is overbought or oversold. If the RSI value is above 70, this indicates that the market is overbought and may be due for a correction. On the other hand, if the RSI value is below 30, the market is considered oversold, and may present a buying opportunity.

Related Reading: Oversold Stock: Understanding the Meaning and Making the Profit

Trading Volume

Trading volume is another crucial aspect of analyzing the market.

When we look at price indicators alone, we might get a false impression of the market’s direction. For example, a good buy signal may appear on a price chart, but if the market is slow and the trading volume is low, it might just be a trap.

Think about it this way: imagine you’re in a busy market where lots of people buy and sell goods. It’s easier to get a sense of which products are popular and which ones aren’t. But if the market is quiet and only a few people are buying and selling, it’s hard to know what’s really going on.

Designing an Effective Stop-Loss Strategy

Everyone tells you that successful trading requires an effective stop-loss strategy. So, how do you set your stop loss when you’re day trading?

Day traders make a lot of trades each day. Putting a stop loss on every trade can be expensive. Instead, it’s recommended that you use short-term option strategies, which are options that expire weekly, to protect your portfolio. Whether you’re day trading crude oil using futures or ETFs, corresponding weekly options are available.

But, what makes using weekly options so great?

The main advantage is that weekly options are cheaper than other options. The price of an option is affected by the time left until the expiration date. The less time remaining until expiration, the cheaper the option. Since weekly options expire weekly, they are more affordable.

Options are complex financial instruments, so there are many different approaches to using them. For example, you can use protective puts or bear spreads to build stop-loss strategies after buying crude oil.

When the price of crude oil falls, put options and bear spreads can generate positive returns. Thus, they can offset some of the losses from buying crude oil futures or crude oil ETFs. In other words, these option strategies can provide excellent protection for your portfolio.

Related Reading: How to Use Protective Put Strategy to Protect Your Portfolio?