New Jersey REITs: Leading Investments for The Garden State

Best New Jersey REITs: Essential Properties Realty Trust, Inc. (EPRT), Alexander’s, Inc. (ALX), UMH Properties, Inc. (UMH).

Best New Jersey REITs: Essential Properties Realty Trust, Inc. (EPRT), Alexander’s, Inc. (ALX), UMH Properties, Inc. (UMH).

Best Massachusetts REITs: American Tower, Iron Mountain, Boston Properties, Stag Industrial, Service Properties Trust, Plymouth Industrial REIT…

This TradeSanta review will delve deep into the platform’s usability, types of bots supported, pricing, and performance of its mobile app.

Best Maryland REITs: Host Hotels & Resorts, Federal Realty Investment Trust, Omega Healthcare Investors, AGNC Investment……

Get free, real-time GBTC candlestick charts. Make smart investment decisions by tracking the Grayscale Bitcoin Trust’s market trends.

Access real-time IBIT candlestick chart for free. Keep track of iShares Bitcoin Trust’s market movements to inform your investment strategy.

Best Illinois REITs: Equity Residential, Ventas, Equity LifeStyle Properties, First Industrial Realty Trust, Equity Commonwealth, InvenTrust Properties.

Moving averages change on different timeframes because software calculates them based on the recent candles within the current timeframe.

Learn why AI, like ChatGPT, cannot replace traders, the limitations of AI, and the unique value that human traders bring beyond AI’s limit.

Here, you can learn the meaning of oversold stock, the various indicators used to identify them, and the corresponding trading strategies.

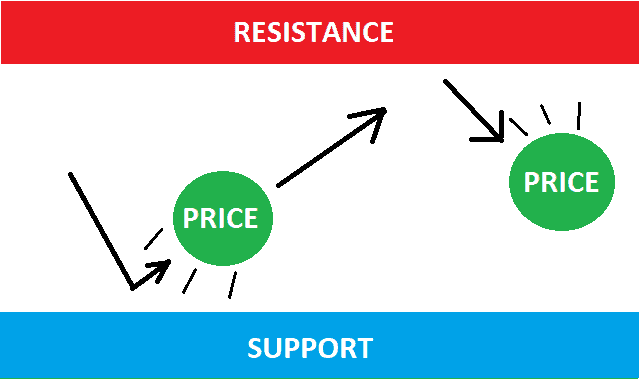

Support and resistance are two important technical indicators that can help us grasp the trend, identify trade signals, and guide our trading.