With the advancement in artificial intelligence (AI), concerns have arisen regarding whether AI will replace traders. However, are these fears grounded in reality, or is this a case of undue anxiety? In this article, we will dissect why AI, like ChatGPT, despite its impressive capabilities, can’t supersede traders. We’ll also illuminate the unique value that human traders offer, a value that extends beyond the reach of AI.

Why Can’t AI Replace Traders?

The Limitations of Data

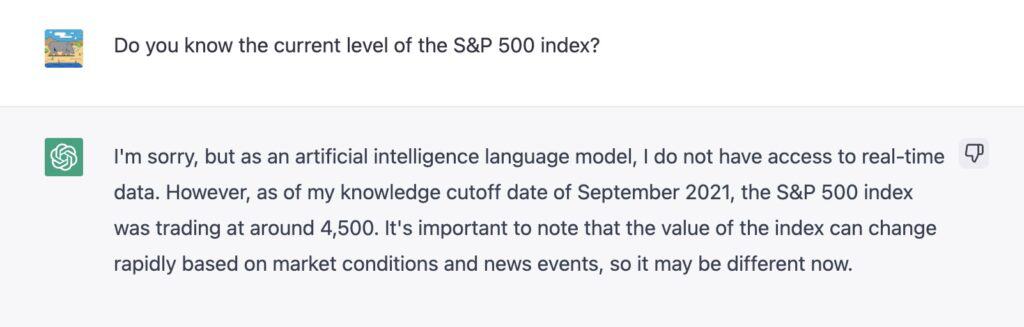

AI, like ChatGPT, as an impressive technological development, has its limitations – chief among them is its dependency on the data it has been trained on. Notably, this data may not be timely or reflective of the current market climate.

For example, as of now, the data reservoir of ChatGPT only stretches up to 2021. So, it’s not capable of providing updated insights. To illustrate, if asked about the present status of the S&P 500 index, ChatGPT would be at a loss!

Some might argue, predicting that ChatGPT will eventually gain internet access. However, the reality is, even with this connectivity, ChatGPT’s data training would still be time-consuming, ruling out real-time updates. Consider Google Bard, an AI with internet connectivity – if asked about yesterday’s closing price of the S&P 500 index, Bard wouldn’t be able to provide a precise response. How can we expect successful trading if it can’t even accurately relay the index position?

Moreover, the data on which AI has been trained may not encompass the full spectrum of market conditions that traders encounter.

For example, if an unprecedented event like a global pandemic occurs, AI’s market response prediction will not be accurate. Human traders, on the other hand, can provide a timely market analysis based on unfolding conditions. They factor in a multitude of elements, including economic news, political shifts, and changes in market sentiment. This ability to dissect the market and make real-time trading decisions is a skill set that AI cannot mimic.

The Lack of Emotion

Emotion also represents a critical facet that makes the prospect of AI replacing traders a remote one. Human traders are emotional beings, and these emotions significantly influence their decision-making process. Influences such as fear and greed can dramatically impact the entire market, and savvy traders can factor this sway into their trading strategies.

On the other hand, AI, being devoid of emotions, lacks the capability to factor them into its analysis. This absence of emotional understanding makes AI’s predictions about market movements less precise and effective.

The Absence of Relationship

In the world of trading, the significance of relationships can’t be understated. Establishing connections with fellow traders, brokers, and market analysts often leads to valuable insights and opportunities hidden from the public’s view. This is where AI falls short – it can’t cultivate human relationships, thus lacking a critical trading component.

To elucidate, let’s consider a personal anecdote. Years ago, I was an intern at an investment bank. One day, while I was on an errand for my boss, I had a chance conversation with a broker in the elevator. We discussed market trends, and he shared a promising tip about a company’s upcoming product on the verge of going public. This information, when shared with my boss, resulted in a sizeable profit from purchasing shares in that company before the product launch.

Such golden opportunities arise from interpersonal communication, a domain where AI can’t operate.

The Inability to Innovate

The domain of trading demands a level of creativity and innovation. Although AI can scrutinize historical data and provide insights, it lacks the capacity for ‘out-of-the-box’ thinking. This creative cognition is a unique human trait, enabling us to devise innovative solutions to problems.

Staying ahead in the fiercely competitive trading sphere necessitates constant innovation. Traders are relentlessly creating new techniques and strategies to gain an edge in the market – a feat requiring a level of originality that AI can’t replicate.

Therefore, in the foreseeable future, human traders will retain their indispensable role in financial markets and the trading world.

Related Reading: Use ChatGPT to Invest? Here’s the Result!

AI and its Role in Trading

While AI will not replace traders, it is set to become a collaborative partner in the foreseeable future, assuming an increasingly crucial role in the financial industry. AI holds promising potential, given the rapid expansion of data, advanced machine learning models, and swift computational capabilities. It could unlock insights and opportunities that have remained elusive to human traders.

Efficient Data Analysis

A primary way in which AI is revolutionizing trading lies in its quick analysis of massive data from multiple sources.

For instance, AI can deploy natural language processing techniques to dissect various types of data swiftly. These include news, social media content, and financial reports. Through this process, AI identifies and extracts pivotal insights and key points from the vast information. Moreover, AI can process data from sensors, satellites, and other sources. This capability allows it to track supply and demand shifts for commodities like oil and natural gas.

These analyses result in increased work efficiency for traders and the ability to make more informed decisions.

High-Speed Trading Opportunities

The realm of trading teems with opportunities. However, in areas such as arbitrage and high-frequency trading, these opportunities can vanish in an instant.

With countless chances appearing and disappearing rapidly, humans simply can’t capture them all – our bandwidth is limited. This is where AI enters the scene. Employing the strength of parallel analysis, AI has the prowess to swiftly spot and exploit every fleeting trading opportunity.

Final Words

Despite the significant advantages, AI cannot replace traders. The unique skills and expertise of human traders remain irreplaceable.

As AI continues to evolve, we foresee a future with more intelligent and sophisticated tools available to traders. Leveraging these advanced tools, traders will be capable of analyzing data more swiftly and accurately, making more informed decisions, and reacting to market shifts more promptly than ever.

Therefore, we envision a balanced coexistence between AI, such as ChatGPT, and human traders in the foreseeable future.