In the trading world, options strategies provide a more diverse possibility than stock trading alone. By combining stocks with various options, you can create some interesting strategies. Covered put and cash-secured put are two such popular options trading strategies. While they share some similarities, they have key differences that make them suitable for different risk preferences and investment goals.

In this article, we’ll dive into the nuances of covered put and cash-secured put, exploring how they work, and helping you decide which one is the right fit for your needs.

Covered Put

Definition and General Concept

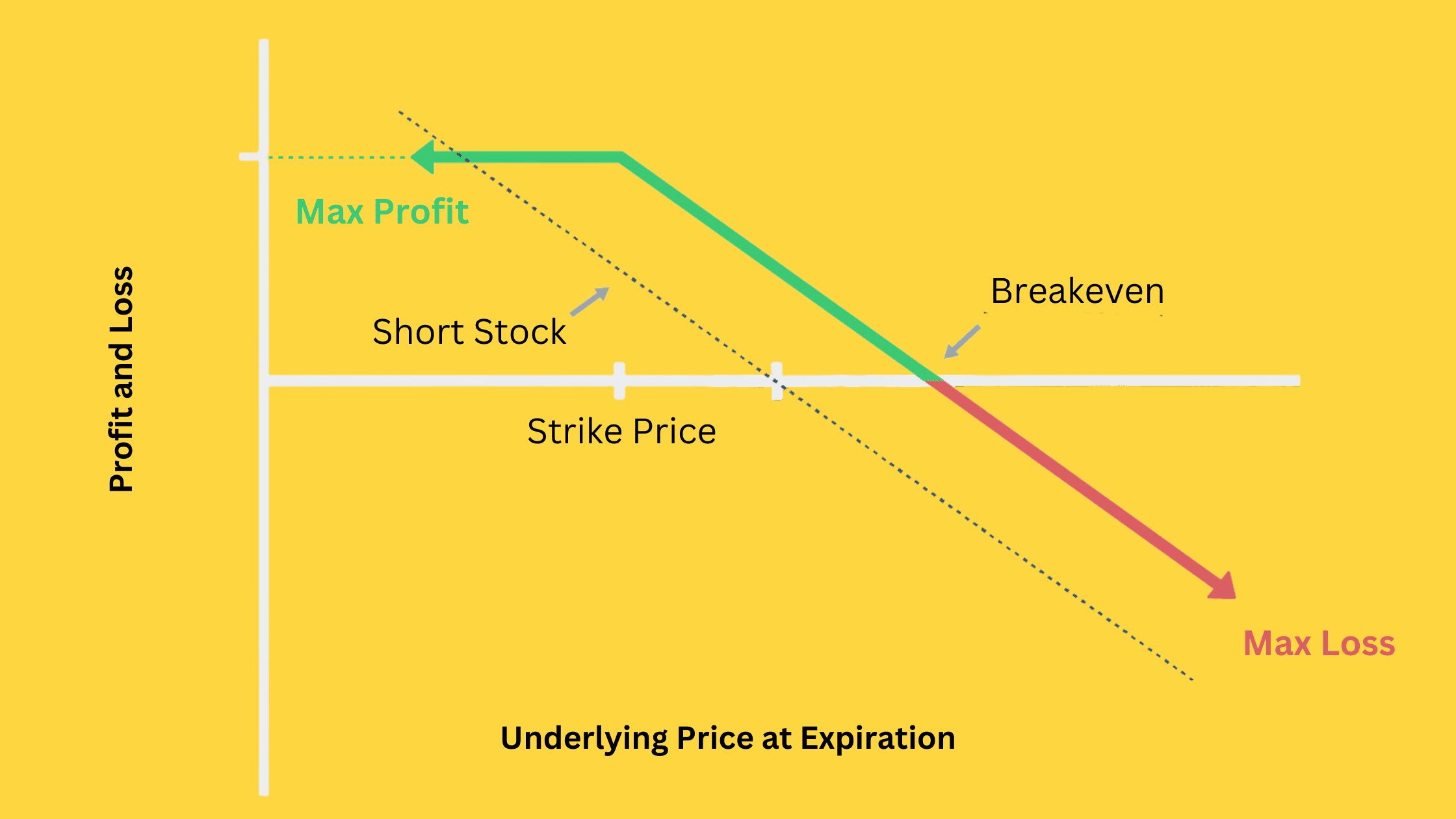

A covered put is an options strategy in which an investor shorts the underlying stock while selling a put option simultaneously. By selling the option, you can collect a premium. Thus, this approach can generate extra income besides the short-selling position and offer some protection if the stock doesn’t drop as expected but instead rises.

Maximum Profit, Maximum Loss, and Breakeven Point Calculations

The maximum profit for a covered put includes the premium from selling the put option and the earnings from shorting the stock.

Maximum Profit = Premium received + (Short sale price – Strike price)

The unlimited maximum loss can occur if the stock price keeps climbing, as there’s theoretically no limit to the risk when shorting a stock.

Maximum Loss = Unlimited (Theoretically)

The breakeven point is reached when the stock price at expiration equals the short sale price plus the premium received.

Breakeven Point = Short sale price + Premium received

At this point, the premium earned from selling the put option perfectly offsets the loss due to the stock price increase.

Cash-Secured Put

Definition and General Concept

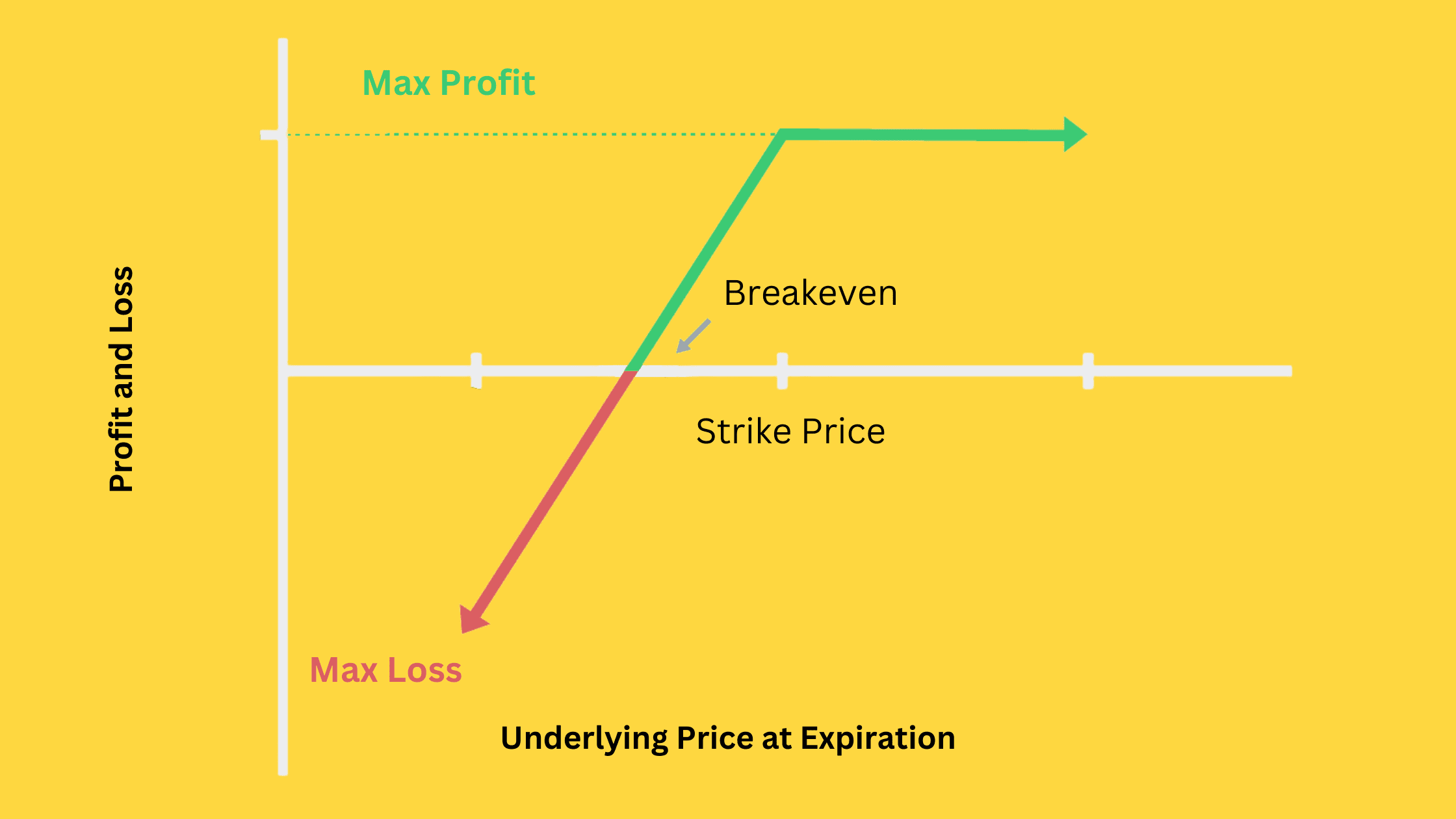

Unlike a covered put, a cash-secured put strategy involves selling a put option without shorting the underlying stock. However, when selling the put option, you must have enough cash available to buy the related stock if the option is exercised. This differs from a naked put, where the seller may not have sufficient cash to fulfill their contractual obligations, resulting in a significant default risk.

Maximum Profit, Maximum Loss, and Breakeven Point Calculations

With a cash-secured put, you’re only selling a put option. So, your maximum profit is limited to the premium received from selling the put option.

Maximum Profit = Premium received

The maximum loss occurs when the stock price drops to zero. In this situation, you’ll have an obligation to buy the underlying stock at the strike price. Thus, your maximum loss equals the strike price minus the premium received.

Maximum Loss = Strike price – Premium received

The breakeven point is reached when the stock price at expiration equals the strike price minus the premium received.

Breakeven Point = Strike price – Premium received

At this point, the falling stock price leads to a loss on your short put option position. However, the premium earned from selling the put option will exactly offset this loss.

Cash-Secured Put vs Covered Put: How to Choose

While both covered puts and cash-secured puts involve selling put options, they’re different strategies with distinct purposes, capital requirements, and risk exposures. To make the best decision for your trading strategy, it’s essential to understand the differences between these two options:

Suitable Situations

Covered puts work better in a moderately bearish trend on the underlying asset. Usually, people use this strategy when they have already shorted a stock but believe it won’t drop significantly in the short term. So, they then sell a put option to form the covered put strategy. As long as the stock doesn’t fall below the put option’s strike price, they can earn the entire option premium, boosting their short-selling profits.

Conversely, cash-secured puts are suitable for moderately bullish and mildly bearish situations. In a moderately bullish environment, the sold put option will expire worthless if the asset’s price is above the strike price, allowing the investor to keep the entire premium.

If the market is moderately bearish, the cash-secured put strategy can still earn the entire premium as long as the asset’s price doesn’t fall below the strike price. Even if the price dips below the strike price, you can purchase the asset at a discount, which can also be a smart investment move.

Asset Selection

The best underlying assets for covered puts are usually those with a long-term pessimistic outlook, allowing you to profit from short-selling.

In contrast, cash-secured puts generally involve assets with a long-term optimistic outlook. Your goal is either to collect option premiums when the asset performs well in the short term or to buy the asset at the strike price if the put option is exercised after a short-term drop. In the latter case, you’ll effectively purchase the asset at a discount, so choosing assets you believe have a bright long-term future is crucial.

Risk Exposure

Covered puts include short-selling stocks, which can lead to a potentially infinite maximum loss if the stock price rises indefinitely.

In contrast, cash-secured puts only involve selling put options, limiting the risk. The maximum loss occurs when the asset price drops to zero, but even in that scenario, your loss is only the strike price minus the premium received.

Capital Requirements

Covered puts demand a higher capital since you need to maintain a margin account for short-selling at least 100 shares. On the other hand, cash-secured puts only require enough cash to cover the potential obligation to purchase stocks in case the put option is exercised. This makes cash-secured puts more accessible for investors with lower capital resources.