Options trading offers a versatile way to invest in the stock market. While standard options are familiar to most investors, corporate actions can create non-standard options, which present unique risks and complexities. This guide will introduce you to non-standard options and discuss how corporate actions can impact these options. Additionally, you will understand the risks associated with non-standard options to protect your investments from potential losses.

What Are Non-Standard Options?

Non-standard options, also known as adjusted or NS options, are equity options that have undergone modifications due to corporate actions, such as stock splits, mergers, acquisitions, spin-offs, or special dividends. When these events transpire, the Options Clearing Corporation (OCC) adjusts the option contract terms to ensure the options’ value is maintained, and the option holders are not adversely affected.

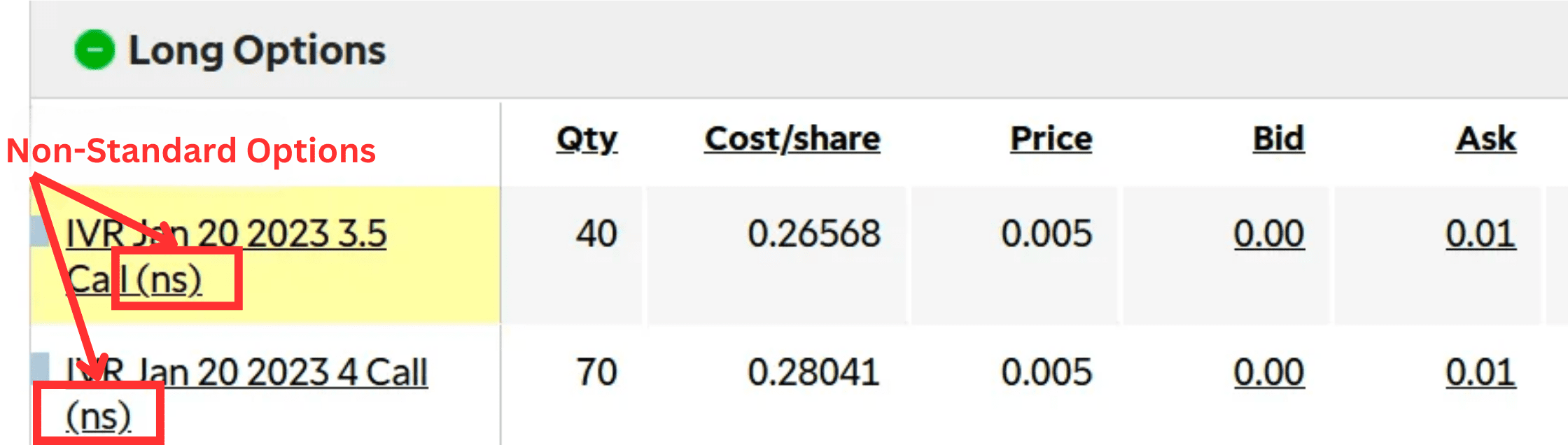

Standard stock option contracts represent 100 shares of the underlying stock. However, due to the adjustments made, non-standard options may represent a different number of shares. This variability in the number of shares can add an extra layer of complexity. Thus, brokerage platforms typically add an “NS” notation to non-standard options in the options chain to help investors identify these adjusted contracts.

The Impact of Corporate Actions on Non-Standard Options

In this section, we’ll explore various corporate actions and their impact on non-standard options in detail:

Stock Splits and Reverse Splits

Stock splits and reverse stock splits involve a company adjusting the number of its outstanding shares and the stock price accordingly. In a stock split, the company increases the number of shares while decreasing the stock price, whereas, in a reverse stock split, it decreases the number of shares and increases the stock price.

When such an event occurs, the OCC adjusts the strike price and the number of shares underlying the options contract to maintain its value. For example, consider a company that undergoes a 2-for-1 stock split. If an investor holds a call option with a strike price of $200, the OCC may adjust the option contract to reflect the new terms: the strike price would become $100 (half of the original), and the number of shares the option controls would double from 100 to 200.

Mergers and Acquisitions

Mergers and acquisitions can have significant implications for option contracts. If your option is in-the-money when the merger or acquisition is completed, your option will likely be converted into cash or stock equivalent to the deal terms. However, if your option is out-of-the-money, it may expire worthless when trading ceases. In this situation, it’s advisable to liquidate your option before trading stops to potentially capture any remaining time value, as even a small amount is better than nothing.

Spin-offs

A spin-off occurs when a company separates a subsidiary or division, creating a new, independent company. The parent company distributes shares of the new entity to its existing shareholders. The OCC adjusts the option contract to account for the new shares, protecting the option holder’s rights.

Suppose Company X spins off its subsidiary, Company Y. Shareholders of Company X receive one share of Company Y for every two shares of Company X they own. If you hold a call option on Company X, the OCC will adjust the option contract to include both Company X and Company Y shares. The new contract will represent 100 shares of Company X and 50 shares of Company Y, maintaining the option’s overall value.

Special Dividends

When a company issues a sizable special dividend, the stock price will decrease, potentially affecting the option’s value. The Options Clearing Corporation (OCC) adjusts the strike price of the option contract to account for the dividend payment.

However, For cash dividends, the OCC will adjust only if the cash dividend per option contract exceeds $12.50. In other words, the cash dividend per share must be greater than $0.125 (since a standard option contract usually represents 100 shares) for the OCC to adjust.

Imagine Company Z announces a special dividend of $5 per share. If an investor holds a call option with a strike price of $80, the OCC will adjust the strike price to account for the dividend’s impact on the stock price. The new strike price would be $75 ($80 – $5), ensuring the option’s value is maintained after the dividend payment.

Risks of Non-Standard Options

Non-standard options, like their standard counterparts, can be bought, sold, and exercised. However, these options also come with their own risks that investors should be aware of before engaging in trading activities. In this section, we’ll explore two major risks associated with NS options: liquidity issues and the potential for misunderstanding the nature of these options.

Liquidity Issues

One of the primary risks associated with non-standard options is the potential for reduced liquidity. NS options typically have a smaller market and fewer participants than standard options. This lower level of liquidity can make it more challenging to buy or sell non-standard options at desirable prices, resulting in wider bid-ask spreads and possibly longer waiting times to execute a trade.

Misunderstanding Non-Standard Options

Another significant risk associated with non-standard options is the potential for misunderstanding their true nature. Investors who are not familiar with non-standard options or who overlook the adjustments made to these contracts may end up with an investment that doesn’t align with their expectations.

For example, an investor might notice a seemingly attractive call option on a stock with a strike price that appears significantly lower than the current market price. Unaware that the option is a non-standard contract adjusted due to a special dividend, the investor may purchase the option expecting to profit from the difference between the strike price and the market price. However, when the special dividend is taken into account, the actual value of the option is much lower than anticipated, resulting in a disappointing investment.