In options trading, you might come across two popular strategies: Cash-Secured Put and Covered Call. While they have some similarities, these strategies have unique differences catering to specific risk profiles and investment objectives. In this article, we’ll dive into an in-depth comparison of cash-secured put and covered call, highlighting their mechanics, similarities, differences, and use cases.

Cash-Secured Put Strategy

Definition and General Concept

Cash-Secured Put is an options strategy where you sell a put option while setting aside enough cash to buy the underlying stock if the option is exercised. This approach avoids some risks associated with selling naked puts, where the seller does not have sufficient cash to fulfill the obligation.

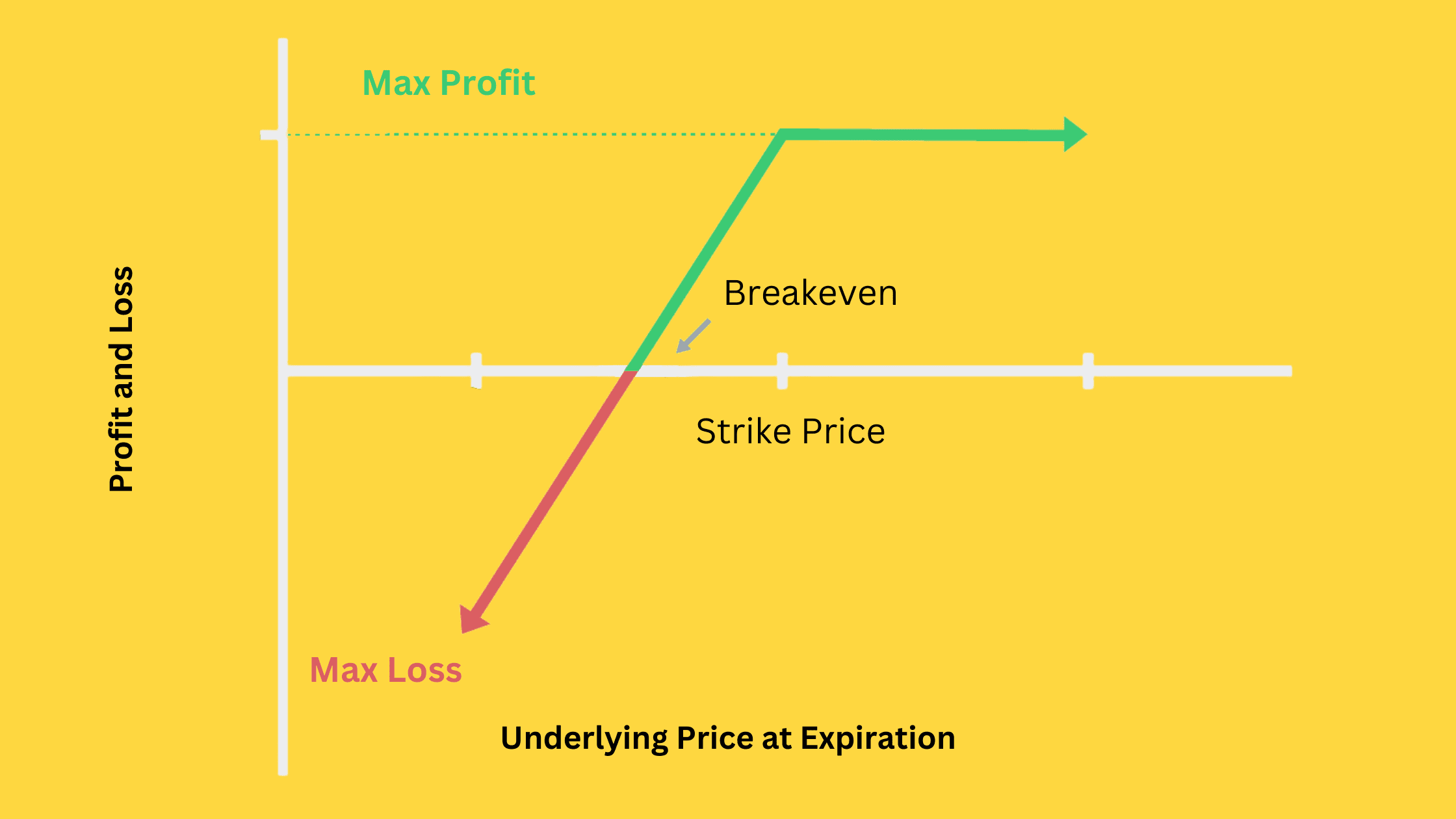

Maximum Profit, Maximum Loss, and Breakeven Point Calculations

Cash-secured put’s maximum profit is limited to the premium you receive when selling the put option.

Max Profit = Premium Received

On the other hand, the maximum loss occurs when the stock price falls to zero, which is the strike price minus the premium received.

Max Loss = Strike Price – Premium Received

The breakeven point happens when the stock price at expiration equals the strike price minus the premium received.

Breakeven = Strike Price – Premium Received

At this point, the premium you received perfectly offsets the loss of the short put option due to the stock price’s decline.

Covered Call Strategy

Definition and General Concept

Covered Call is an options strategy where you sell a call option on a stock you already own. This allows you to generate premium income but also requires you to sell the underlying stock if the call option is exercised.

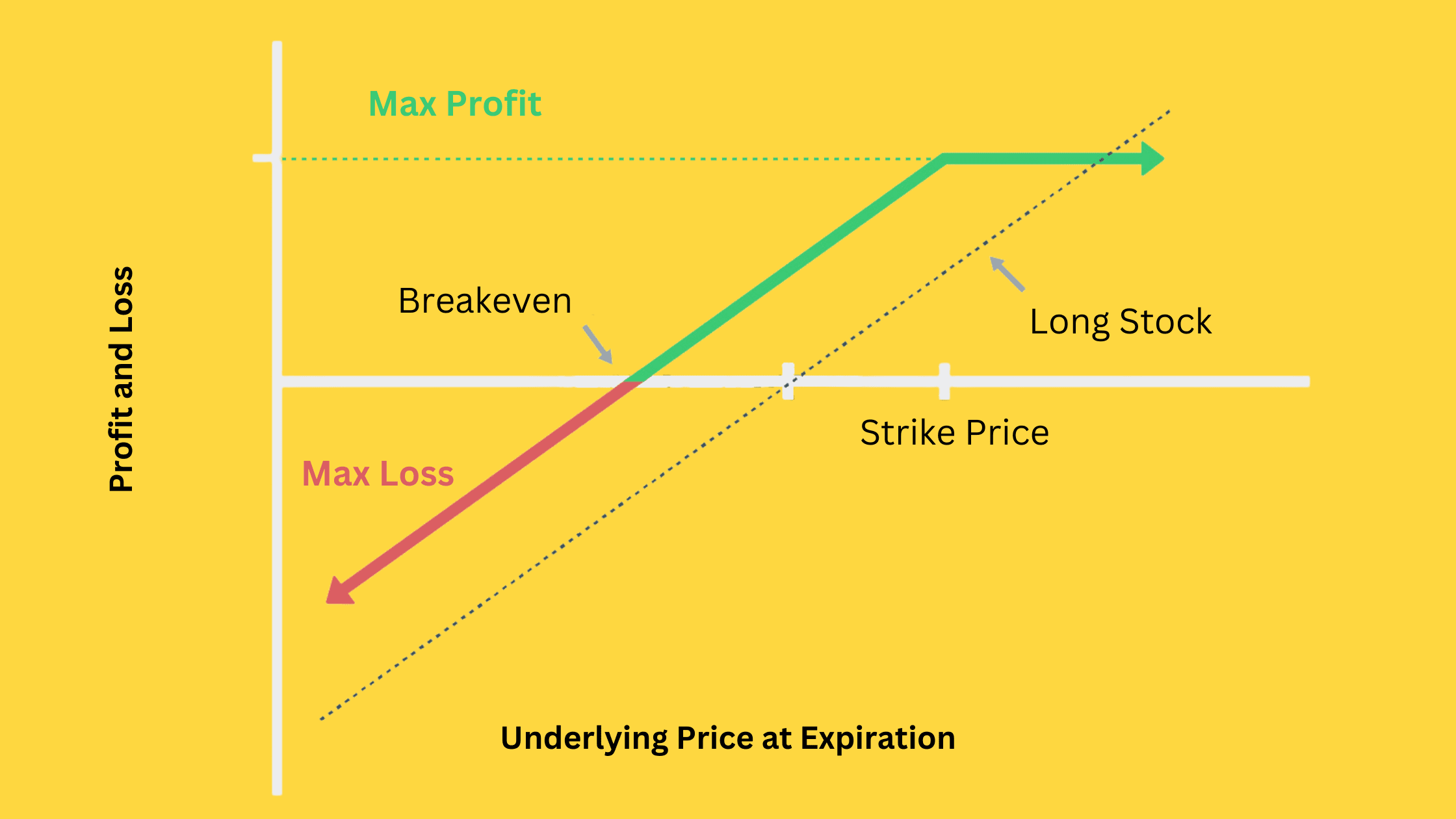

Maximum Profit, Maximum Loss, and Breakeven Point Calculations

Your maximum profit for covered call is the premium received from selling the call option plus the stock price appreciation up to the strike price.

Max Profit = Premium Received + (Strike Price – Stock Purchase Price)

The maximum loss occurs when the stock price falls to zero, which is the cost of the long stock position minus the premium received.

Max Loss = Stock Purchase Price – Premium Received

The breakeven point happens when the stock price at expiration equals the purchase price minus the premium received.

Breakeven = Stock Purchase Price – Premium Received

At this point, the premium you received from selling the call option perfectly offsets the loss due to the stock price’s decline.

Cash-Secured Put vs Covered Call: How to Choose

Cash-Secured Put and Covered Call are similar strategies. Both allow you to earn extra option premiums in low-volatility market environments. They even have comparable profit and loss graphs. However, still, there are key differences you should consider when choosing the right option trading strategy for your needs.

Distinct Primary Objectives

Besides aiming to obtain the premium from selling options, traders often use cash-secured puts to create opportunities to purchase stocks at a lower price by selling out-of-the-money cash-secured puts. On the other hand, covered calls are commonly employed on stocks that traders already own. They consistently sell out-of-the-money covered calls to boost investment returns.

Varying Cost and Return Characteristics

Cash-secured puts have a lower cost since they don’t require holding shares. However, this also means their potential returns are limited to the premiums received.

In contrast, covered calls have a higher cost as you must at least buy 100 shares of the underlying asset first and then sell the call options. As a result, the potential returns for covered calls are not limited to the premiums received. You can also benefit from the appreciation of the underlying asset.

Differing Market Outlooks

Both strategies work well in moderately bullish market conditions. However, cash-secured puts have a wider range of applicability, as they are also suitable for mildly bearish market outlooks. As long as the underlying asset’s price at expiration remains above the strike price of the sold put option, you can retain all the premiums received, representing the strategy’s maximum profit.

Additionally, suppose the underlying asset’s price dips below the strike price but not significantly. Then, you can effectively acquire the underlying asset at a discounted price, which can also be an attractive investment.

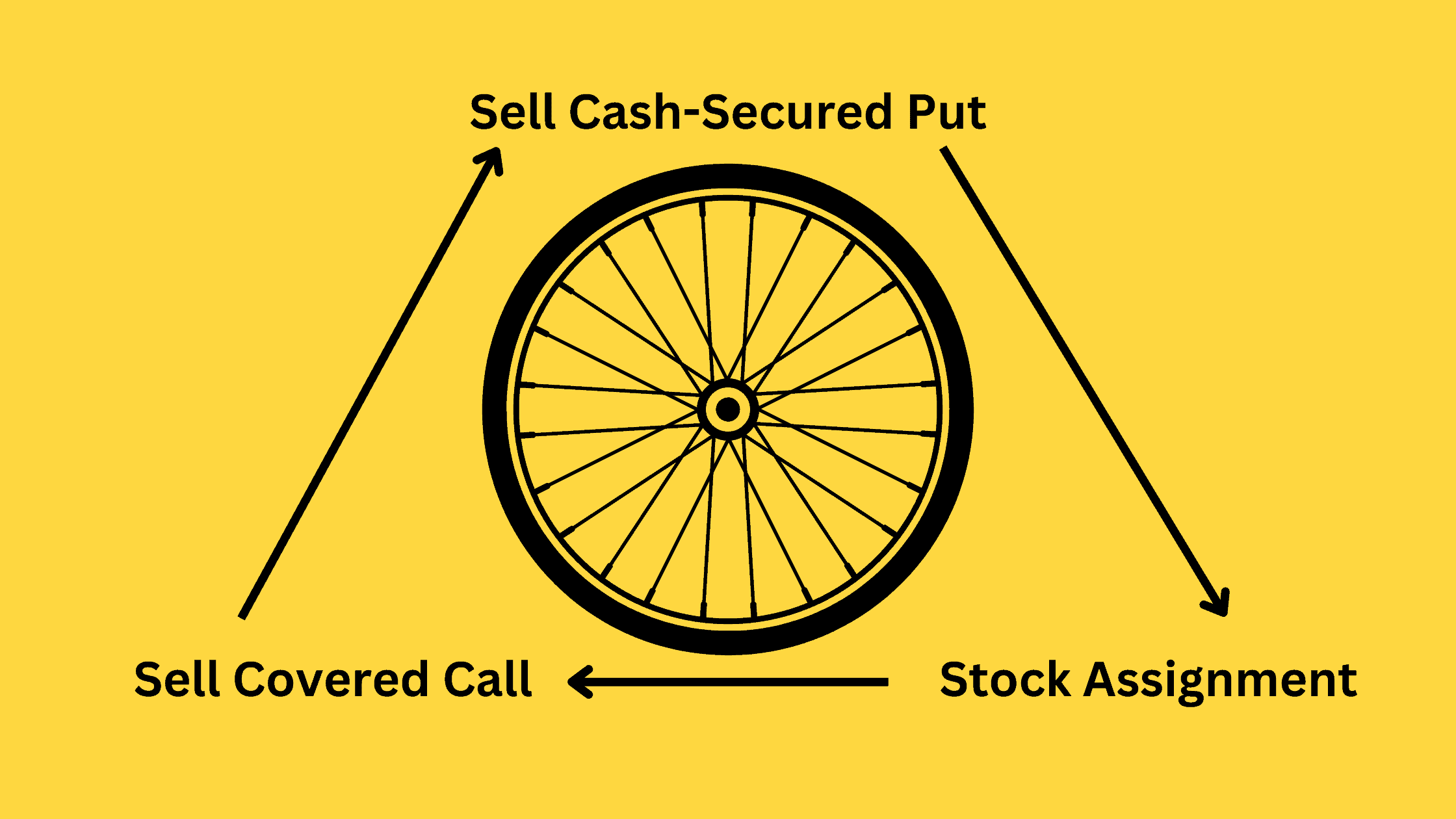

Combining Covered Call and Cash-Secured Put: The Wheel Options Strategy

Both Covered Call and Cash-Secured Put are excellent strategies for generating stable income in low-risk scenarios. Fortunately, these two strategies are not mutually exclusive. They can even complement each other effectively to help you maximize your profits. One approach that combines both strategies is the Wheel Option Strategy.

The Wheel Option Strategy, also known as the Triple Income Strategy, involves implementing both Cash-Secured Put and Covered Call sequentially. This three-step process begins by selling cash-secured puts on a stock you’re interested in owning. If the stock price remains above the put option’s strike price at expiration, you retain the premium and can sell another put option. And, if the stock price falls below the strike price and the option is exercised, you’ll acquire the shares.

Once you own the shares, you can start selling covered calls on the same stock, generating additional income through call option premiums. If the stock price stays below the call option’s strike price at expiration, you keep the premium, and your shares remain in your possession. You can then sell another covered call. If the stock price rises above the call option’s strike price and the option is exercised, you’ll be obligated to sell the shares at the agreed-upon strike price.

By consistently cycling through these steps, the Wheel Option Strategy enables you to capitalize on both Cash-Secured Put and Covered Call, generating a continuous stream of premiums while potentially acquiring stocks at a discount and profiting from their appreciation. This strategy can be particularly beneficial for long-term, income-focused investors who are comfortable owning the underlying stock and are seeking to enhance their returns through options trading.

Related Reading: Wheel Options Strategy: Profit & Loss, Examples, and Best Stocks