When anticipating a stock or market decline, bearish options strategies become essential tools for profiting from the expected price movement. This article compares two widely-used bearish strategies: the bear call spread and the bear put spread. While these strategies might seem similar at first, they have significant differences. By comprehending these key distinctions, you can make well-informed decisions and optimize your potential gains in a bearish market.

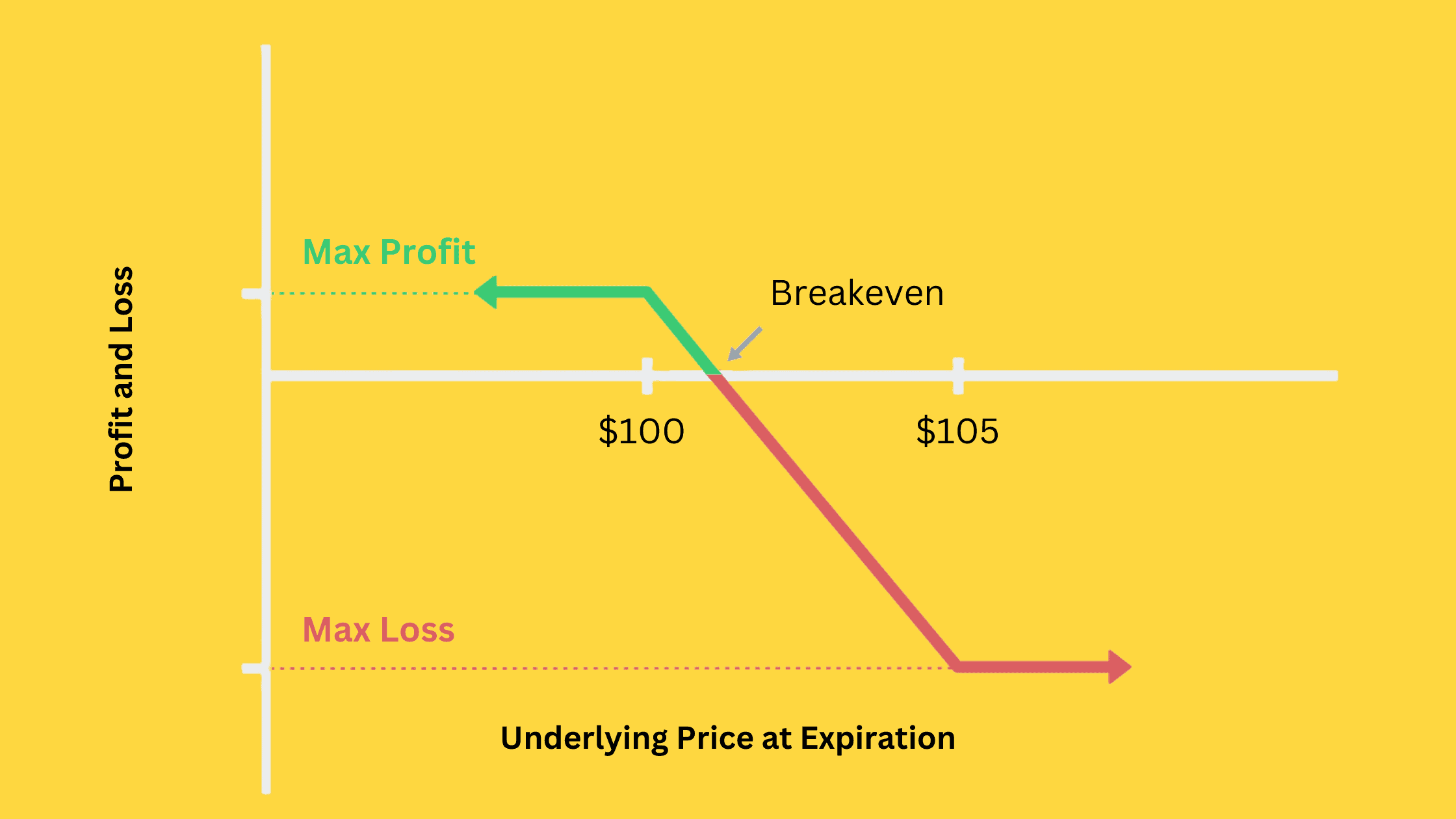

Bear Call Spread

The bear call spread is a strategic credit spread approach that involves two call options:

- Selling a call option with a lower strike price. (short call)

- Purchasing a call option with a higher strike price. (long call)

In this strategy, you obtain an initial net credit, representing the maximum profit you can achieve. This happens when the underlying asset’s price stays below the short call’s strike price at expiration.

Maximum Profit = Net credit received

The maximum loss occurs when the price surpasses the long call’s strike price.

Maximum Loss = (Strike price of the long call – Strike price of the short call – Net credit received) x 100

The breakeven point is the underlying asset’s price, where the short call’s value increase is exactly offset by the net credit received. At this point, the short call’s loss equals the initial net credit. Use this formula to calculate the breakeven point:

Breakeven point = Strike price of the short call + Net credit received

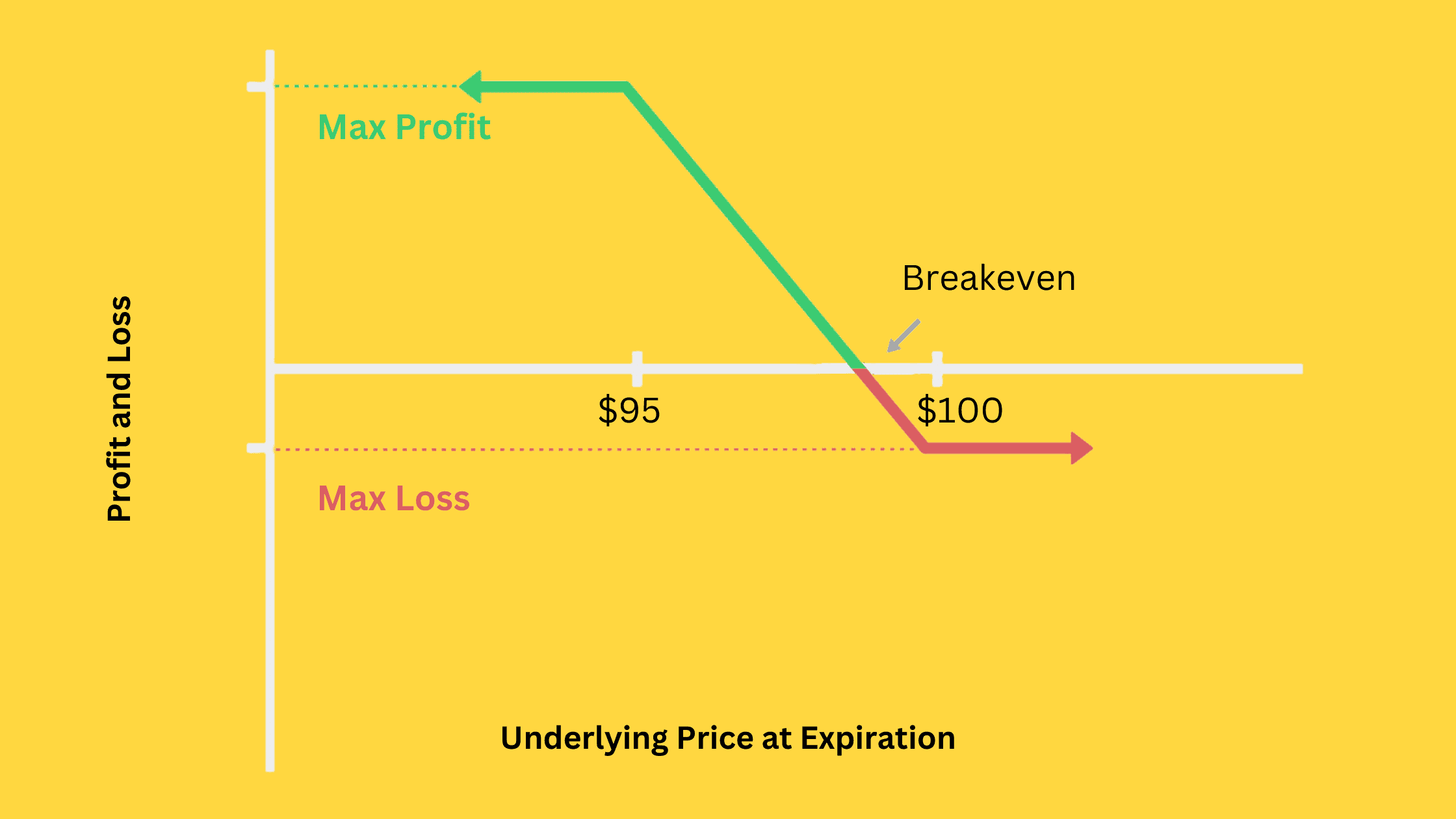

Bear Put Spread

A bear put spread is a strategic debit spread approach involving two put options:

- Selling a put option with a lower strike price. (short put)

- Buying a put option with a higher strike price. (long put)

In this strategy, you pay an initial net debit, representing the maximum loss you can incur. This happens when the underlying asset’s price remains above the long put’s strike price at expiration.

Maximum Loss = Net debit paid

The maximum profit is achieved when the price drops below the short put’s strike price.

Maximum Profit = (Strike price of the long put – Strike price of the short put – Net debit paid) x 100

The breakeven point is the underlying asset’s price where the long put’s value increase is exactly offset by the net debit paid. At this point, the long put’s gain equals the initial net debit. Use this formula to calculate the breakeven point:

Breakeven point = Strike price of the long put – Net debit paid

Bear Call Spread vs Bear Put Spread: How to Choose?

Both Bear Call Spread and Bear Put Spread are commonly used bearish options trading strategies. They provide limited risk and reward, making them suitable for conservative investors. However, it is essential to examine their differences to determine the most appropriate strategy for a particular situation.

Costs and Risks Comparison

The Bear Call Spread is a credit strategy involving a net premium received when establishing the position. This strategy allows for the possibility of profit even if the stock price experiences a slight increase. However, it is essential to note that as the stock price continues to rise, your gains will decrease until reaching the maximum loss point.

Conversely, the Bear Put Spread is a debit strategy, requiring an initial payment. For this strategy to be profitable, the stock price must decline by a specific amount. However, the upfront payment represents the maximum loss for the Bear Put Spread, eliminating any additional risk exposure. This approach may be more suitable for investors who prefer paying a premium in exchange for well-defined risks.

Return Potential and Success Rates Analysis

There are some notable differences regarding the return potential and success rates of these two strategies. The Bear Call Spread strategy typically offers a lower profit potential but boasts a higher success rate for realizing gains. On the other hand, the Bear Put Spread strategy presents a higher profit potential, but its success rate for achieving gains is comparatively lower.

As a result, when you have a higher degree of confidence in a bearish outlook, the Bear Put strategy may be the better choice. However, if you have less certainty regarding future stock price movements, opting for the Bear Call Spread strategy might be a more cautious approach.

Implied Volatility Impact

Bear call spread and bear put spread differently influenced by volatility. Long options benefit from increased volatility, while short options gain from decreased volatility. However, due to differences in strike prices, the effects of volatility on these two strategies are not entirely offset.

Generally, the Vega of both strategies increases as stock prices rise and decreases as they fall. However, in the beginning, a bear put spread typically has a positive Vega, while a bear call spread usually has a negative Vega.

Positions with negative Vega benefit from falling volatility, while those with positive Vega gain from rising volatility. Consequently, the bear call spread strategy benefits from a decrease in implied volatility at the outset, while the bear put spread strategy profits from an increase in implied volatility.

This makes sense, as the bear call spread strategy starts with the maximum profit and prefers minimal stock price fluctuations to maintain that profit. On the other hand, the bear put spread strategy begins at the maximum loss and hopes for larger stock price fluctuations to accelerate declines and achieve greater profits.

Thus, you need to determine the suitability of either strategy based on your expectations for future volatility.

Time Decay Impact

Like implied volatility, time decay also differently affects bear call spread and bear put spread. The Theta of these strategies typically increases as stock prices fall and decreases as stock prices rise. However, at the beginning, a bear call spread usually has a positive Theta, while a bear put spread typically has a negative Theta.

A positive Theta implies that the strategy will make money from time decay as time passes, while a negative Theta means the strategy will lose money from time decay over time. Therefore, in the beginning, the bear call spread strategy generates profit due to time decay, while the bear put spread strategy incurs a loss.

This logic aligns with that the bear call spread strategy begins with the maximum profit and prefers time to pass quickly to maintain its profitability. Conversely, the bear put spread strategy starts at the maximum loss and wishes for time to pass slowly, allowing more opportunities for the stock price to decline and the strategy to become profitable.

Thus, if you believe the stock price will fall in the short term, you may want to consider the bear put spread strategy. However, if you think the stock price will require more time to decline, the bear call spread strategy might be a more suitable choice.