Options trading can be intricate, as various factors affect option prices. One such factor is Delta, a Greek representing the sensitivity of an option’s price to changes in the underlying asset’s price. Understanding Short Delta is essential for mastering basic hedging strategies and more advanced multi-leg options strategies.

In this comprehensive guide, we’ll explore the concept of Short Delta, its importance, various strategies, and real-life applications. We’ll also discuss its role in hedging and risk management.

Delta in Options Trading

Delta in options trading measures the sensitivity of an option’s price to changes in the price of the underlying asset, usually a stock. In simpler terms, Delta indicates how much the price of an option will change when the underlying stock’s price changes by $1.

Options can have positive or negative Delta values. Positive Delta indicates that the option’s price will increase as the underlying stock’s price increases, while negative Delta suggests that the option’s price will decrease as the stock’s price increases.

Call options generally have positive Delta values. As a call option moves from out-of-the-money (OTM) to in-the-money (ITM), its Delta value increases. Conversely, put options usually have negative Delta values. As a put option moves from OTM to ITM, its Delta value becomes more negative.

Understanding Short Delta

Short Delta refers to positions with an overall negative delta. When you hold a Short Delta position, your position will increase as the underlying stock’s price falls. This makes it an essential tool for traders looking to profit from bearish market conditions.

Short Delta Strategies

A Short Delta position can be developed through various strategies. In this section, we will discuss five common methods to achieve it.

Shorting Stocks

When you short a stock, you borrow shares, sell them, and hope the stock price will decline so you can buy the shares back at a lower price and profit from the difference. Shorting a stock creates a position with a Delta of -1. The negative Delta signifies that the position will profit from a decrease in the underlying stock’s price.

Buying Put Options

Purchasing put options inherently creates a Short Delta position due to their negative Delta. As the stock price declines, the value of the put option increases, allowing you to profit from the stock’s downturn.

Selling Call Options

Selling call options generates a Short Delta position by capitalizing on the positive Delta of call options. When you write a call option, you collect a premium from the option buyer. If the stock price declines, the call option’s value decreases, and you profit from the premium received.

Bear Call Spread

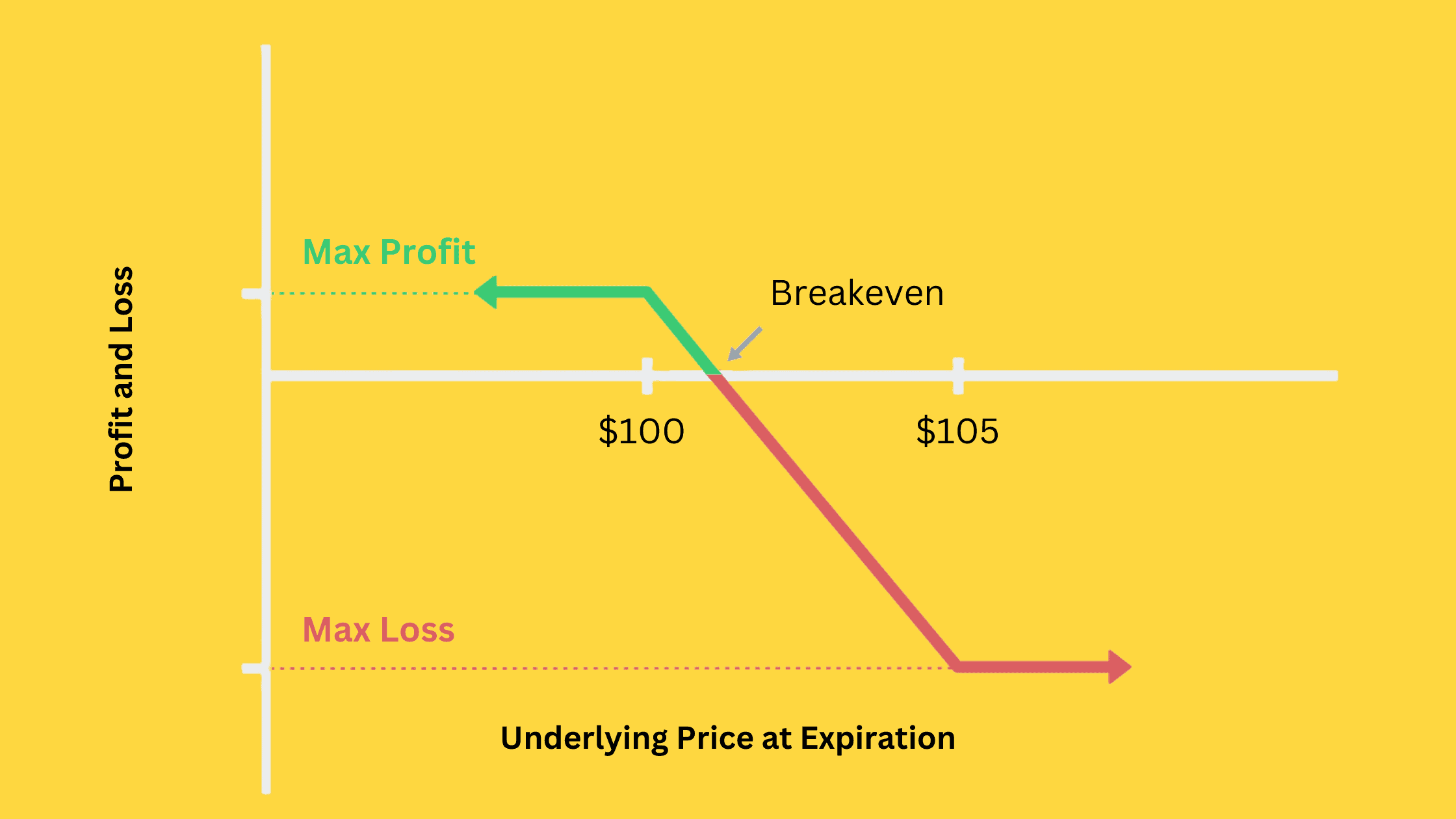

This advanced strategy involves selling a call option with a lower strike price (in-the-money or at-the-money) and buying another call option with a higher strike price (out-of-the-money) on the same underlying stock with the same expiration date. The premium received from the sold call option is greater than the premium paid for the purchased call option, resulting in a net credit.

This strategy creates a Short Delta position because the short call option has a higher positive Delta than the long call option, resulting in an overall negative Delta position.

Bear Put Spread

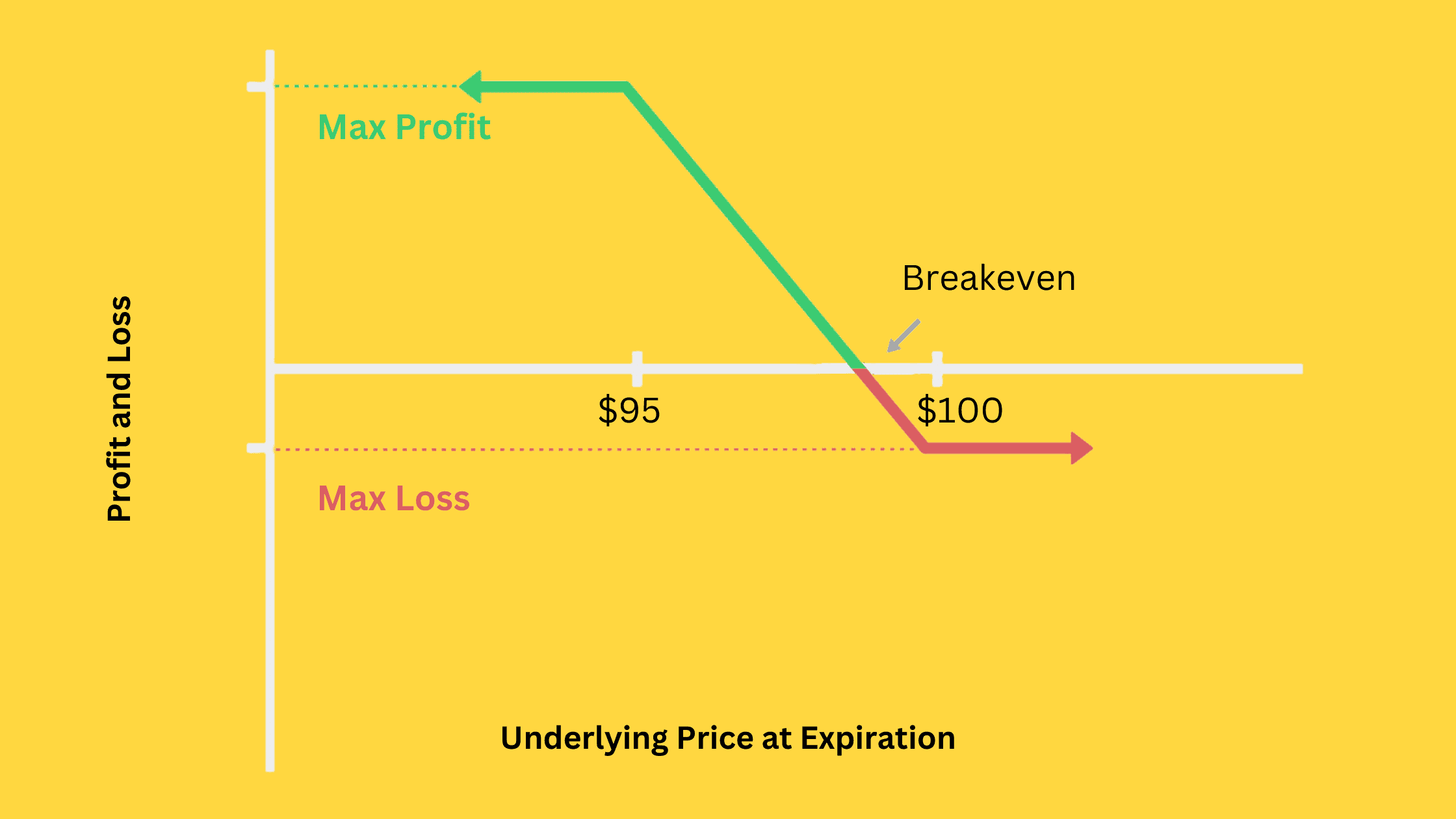

This advanced method involves purchasing a put option with a higher strike price (in-the-money or at-the-money) and selling another put option with a lower strike price (out-of-the-money) on the same underlying stock with the same expiration date. The premium paid for the purchased put option is greater than the premium received from the sold put option, resulting in a net debit.

This strategy results in a Short Delta position because both the purchased and sold put options have negative Delta values. However, the long put option has a higher absolute Delta value than the short put option, leading to an overall negative Delta for the position.

Related Reading: Bear Call Spread vs Bear Put Spread: Which is Better for You?

Short Delta and Hedging

Short Delta is not only for downside speculation. Its true value lies in using short delta positions to hedge and control risk. By understanding the relationship between an option’s Delta and the underlying stock’s price movement, you can strategically use Short Delta positions to protect your investments and minimize risk. In the following, we will discuss how to use Short Delta to manage your risk exposure.

For example, you want to maintain a position where your portfolio profits when the stock price declines. However, you do not wish to suffer significant losses if the stock price does not fall as expected and instead rises. Therefore, you plan to set your position’s delta at -0.5, meaning that for every dollar the stock price increases, the position will lose 0.5 dollars per share, and vice versa.

You can achieve this goal by shorting the stock and buying call options. Suppose you short 1000 shares of a stock trading at $50 per share, creating a delta of -1 per share. You can then purchase ten call option contracts with a delta of 0.5, to achieve a net delta of -0.5 for your entire position.

The Importance of Continuous Adjustments

In the ever-changing financial markets, it is essential to monitor and adjust your Short Delta positions regularly. An option’s Delta changes with fluctuations in the price of the underlying asset, the passage of time, and changes in implied volatility. This phenomenon is known as Gamma, which measures the rate of change of Delta concerning the underlying asset’s price.

As the underlying stock’s price changes and the option’s Delta varies, you must adjust your positions to maintain the desired net delta.

Continuing the previous example, suppose the stock price increases to $55. The delta of the short stock position remains constant at -1 per share. However, the call option’s Delta increases to 0.6 due to the increased price of the underlying stock. Your overall position delta now stands at -0.4 (-1 for the short stock position and 0.6 for the call option), deviating from the desired net delta of -0.5.

To restore the desired net delta of -0.5, you could either sell some of the call options or short additional shares of the stock. By continuously monitoring and adjusting your positions, you can ensure that your portfolio remains optimally hedged, protecting your investments, and minimizing risk.