Delving into options trading can be an exhilarating journey, particularly when mastering advanced strategies like the calendar straddle. As one of the most complex techniques, which entails the simultaneous trading of four options, the calendar straddle might initially appear intimidating. However, this comprehensive guide will assist you in understanding and implementing this strategy effectively.

What is Calendar Straddle Options Strategy?

In the calendar straddle options strategy, you will sell a short-term straddle, which consists of a call and a put option with the same strike price and expiration date, while simultaneously buying a long-term straddle with an identical strike price. The primary goal of this strategy is to capitalize on the time decay of the short-term options while benefiting from potential price movements in the long-term options.

As a trader, you would typically consider implementing the calendar straddle when you believe the underlying stock will experience little to no price movement in the short term, yet may undergo a clear bullish or bearish trend in the long term.

Profits and Losses of the Calendar Straddle Options Strategy

Profit Potential

The maximum profit you can achieve with the calendar straddle options strategy can be either limited or unlimited. It depends on how you manage your position.

When the short-term straddle reaches its expiration, the maximum profit in a calendar straddle strategy primarily comes from the time decay of the short-term options. Due to their shorter expiration dates, these options lose value more quickly than their long-term counterparts.

Ideally, this situation arises when the underlying stock price is close to the options’ strike price at the short-term expiration. In this scenario, the short-term straddle expires worthless, while the long-term straddle maintains its time value. Your profit results from the difference between the premium received for the short-term straddle and the time value loss of the long-term straddle.

Related Reading: Intrinsic Value and Time Value of Options – An In-Depth Guide

However, if you decide not to close the long-term straddle position when the short-term straddle expires, the profit potential becomes similar to that of the long-term straddle alone. Consequently, your profit from the calendar straddle options strategy can be unlimited at the long-term straddle’s expiration. As long as the stock price continues to rise after the short-term straddle’s expiration, your long-term straddle can keep generating profits for you.

Loss Risk

Similarly, the potential losses for the calendar straddle options strategy can be either limited or unlimited. If you close both the short-term and long-term options at the first expiration, your maximum loss is equal to the net debit paid to enter the trade (the cost of the long-term straddle minus the premium received for the short-term straddle).

However, suppose the stock has experienced significant price movement. If you still choose to keep the long-term straddle open after the short-term straddle expires, the risk profile changes, and the potential loss becomes significant.

This is because your long-term straddle has already generated substantial profits that were offset by the short-term straddle’s losses before its expiration. However, the short-term straddle also provides a hedging effect against risk. Once the short-term straddle expires, you lose this protection. If the stock price reverses direction, the long-term straddle will lose the previously gained profits, resulting in significant losses.

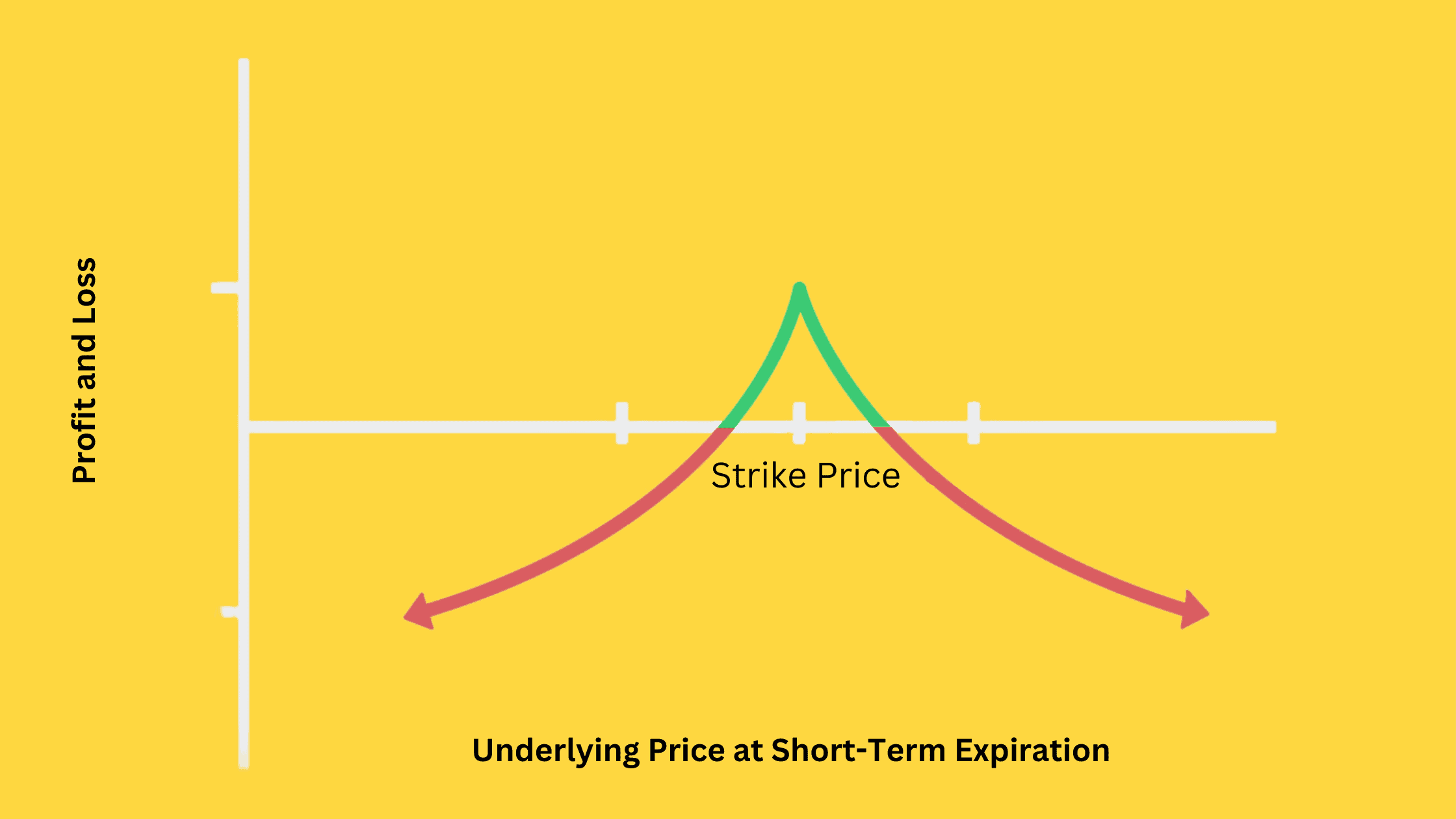

The following diagram illustrates the profit and loss chart at the short-term options’ expiration.

Calendar Straddle Trade Example

Assume that the underlying stock, XYZ, is currently trading at $100. You believe the stock will experience little price movement in the short term but may see significant price fluctuations in the long term. Therefore, you decide to implement a calendar straddle strategy.

First, you sell a short-term straddle with a strike price of $100 and an expiration date one month away. You receive a premium of $5 for the short-term call option and another $5 for the short-term put option, totaling $10.

Simultaneously, you buy a long-term straddle with the same strike price of $100 but an expiration date one year away. The long-term call option costs you $50, and the long-term put option costs you $50, totaling $100.

Your net debit to enter the trade is $90 ($100 long-term straddle cost – $10 short-term straddle premium).

Scenario 1: Stock price closes at $100 at short-term straddle expiration, and you close all positions

In this scenario, the short-term call and put options expire worthless, and you keep the $10 premium. The long-term call and put options still have large time values. Let’s say you can sell them for approximately $48 each. Your overall profit would be $6 ($96 long-term options value – $90 net debit).

Scenario 2: Stock price closes at $100 at short-term straddle expiration, you hold the long-term straddle, and the stock price eventually rises to $800

In this ideal scenario, your short-term call and put options expire worthless, and you keep the $10 premium. The long-term call option value would bring you $700 ($800 stock price – $100 strike price), while the long-term put option would expire worthless. Your overall profit would be $610 ($700 long-term call option gain – $90 net debit).

Scenario 3: Stock price reaches $600 at short-term straddle expiration, and you close all positions

In this case, the short-term call option’s intrinsic value increases to $500 ($600 stock price – $100 strike price), and the short-term put option expires worthless. To close the position, you need to buy back the short-term call option for $500. Meanwhile, the long-term call option value increases to approximately $510, while the long-term put option value decreases to around $0. Your overall loss in this scenario is $80 ($510 long-term call option gain – $500 short-term call option loss – $90 net debit).

Scenario 4: Stock price reaches $600 at short-term straddle expiration, you hold the long-term straddle, and the stock price eventually drops back to $100

In this lousy case, the short-term call option makes you lose $500, and the short-term put option expires worthless. At this point, the long-term call’s gain can offset the loss. However, as the stock price drops back, the long-term call option would eventually lose value and become worthless, while the long-term put option would also expire worthless. Your overall loss would equal the net debit of $90 plus the $500 loss from the short-term call option, totaling $590.

Calendar Straddle vs Calendar Spread

One key distinction between a calendar straddle and a calendar spread is that a calendar straddle comprises four options contracts, while a calendar spread involves only two. You can view a calendar straddle as a mix of a call calendar spread and a put calendar spread, both having the same strike price and expiration dates. As both calendar spreads are debit trades, the cost of a calendar straddle is higher than a calendar spread.

However, in the long run, this increased cost gives you a higher probability of profit. When the short-term options expire, a calendar straddle allows you to profit regardless of the stock’s significant price movement in either direction. In contrast, a calendar spread can benefit only from one direction.

As a result, a calendar straddle is a better fit for investors who are unsure about the direction of long-term price fluctuations. In contrast, a calendar spread caters more to investors with a clearer view of whether the stock price will rise or fall in the future.

Tips on Trading Calendar Straddle

Adjusting a Calendar Straddle

Once you’ve set up a calendar straddle, remember that you can still adjust your positions. You can enhance your income by adapting to short-term market fluctuations.

For example, if the stock price drops sharply, the call option’s value will decrease. You can buy back your short-term call option and wait for the stock price to recover. Then, you can sell another short-term call option. As the stock rebounds, the call option will become more valuable. As a result, you can consistently profit from these price fluctuations.

Rolling a Calendar Straddle

When the short-term straddle position in your calendar straddle strategy expires, and you believe that the stock price hasn’t reached a point of significant fluctuation yet, don’t just wait idly. Aim to capture the potential income from the time value of the options as much as possible. Continuously roll the short-term straddle position until you think the stock price is about to experience substantial fluctuations. By doing this, you can consistently collect the net credit from shorting short-term straddle, increasing the potential profit for the overall strategy.