In Excel, calculating the present value of an annuity is a common financial task. There are two types of annuities to consider: an ordinary annuity and a growing annuity. Each type requires a different approach in Excel. In this article, let’s explore the methods for both.

Calculating Present Value of Ordinary Annuity in Excel

The PV function in Excel calculates the present value of a series of future payments or cash flows, which is what an ordinary annuity would offer. The full syntax of the PV function is:

=PV(rate, nper, pmt, [fv], [type])

Let’s explain each element:

- rate: The interest rate per period. For annual payments, use the annual interest rate. For monthly payments, use the monthly rate (annual rate/12).

- nper: The total number of payment periods in the annuity. For annual payments over 10 years, this would be 10.

- pmt: The payment made each period. It remains consistent in an ordinary annuity.

- [fv]: The future value, or a cash balance you want to attain after the last payment. This is optional. If omitted, Excel assumes it to be 0 (zero), meaning the future value of the loan or investment is 0.

- [type]: This indicates when payments are due. Use 0 (or omit) for payments at the end of the period, or 1 for payments at the beginning.

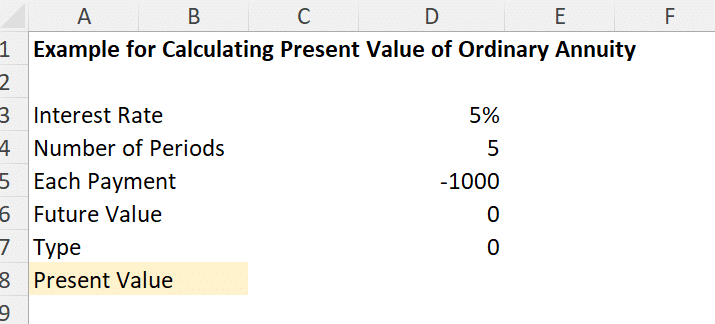

Calculation Example

Imagine you want to calculate the present value of an annuity where you receive $1,000 annually for 5 years, and the annual interest rate is 5%. In this case, the elements you need for your calculation will be:

- rate: 5%.

- nper: 5 (years).

- pmt: -$1,000 (if you set the pmt as a negative number, the resulting PV will be positive; if the pmt is positive, then the resulting PV will be negative).

- [fv]: Omit this or enter 0 if the future value is not factored into your calculation.

- [type]: Use 0 if these payments are at the end of each year.

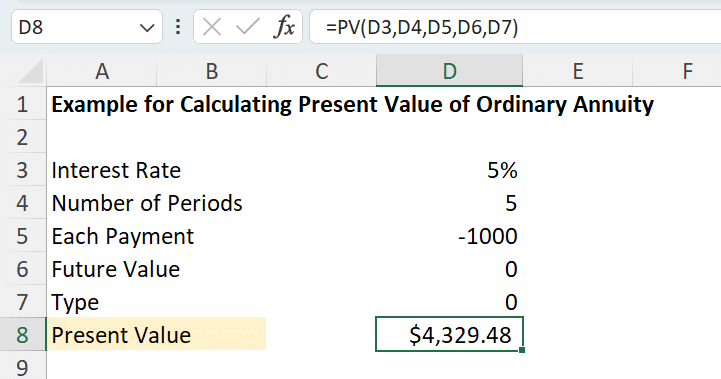

Input the PV function in the cell where you want the present value. Plug the element cells into this function and press Enter. The PV value will immediately show up.

Calculating Present Value of Growing Annuity in Excel

Excel doesn’t have a built-in function specifically to calculate the present value of a growing annuity. Therefore, we need to write the formula by ourselves. The formula for calculating the present value of a growing annuity is:

Where:

- Pmt: The initial payment or cash flow amount in the series. For a growing annuity, this amount increases over time at a steady growth rate. It’s important to input this amount as it is at the start of the annuity period.

- g: The rate at which the annuity payments grow each period. It should be consistent across all periods.

- i: The rate discounting future annuity payments back to their present value. It reflects the time value of money, essentially what rate of return you could expect if you invested the money elsewhere.

- n: The total number of annuity payments or periods. It could be years, months, or any other time interval, but it needs to match the time frame used for the growth rate and discount rate.

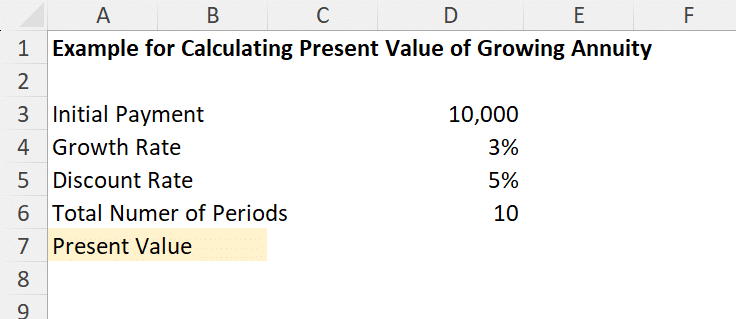

Calculation Example

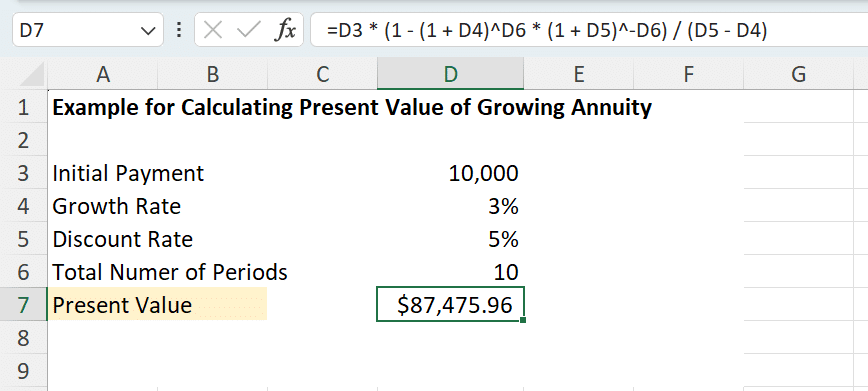

Suppose you’re evaluating an investment opportunity where you’ll receive annual payments for the next 10 years. The first payment will be $10,000 and is expected to grow by 3% each year. The discount rate for the present value calculation is 5%. You need to input your data like:

- Pmt: The initial payment = 10,000.

- g: Growth rate = 3%.

- i: Discount rate = 5%.

- n: The total number of periods = 10.

In this case, we input the initial payment in D3, the growth rate in D4, the discount rate in D5, and the total number of periods in D6. So, based on the formula we introduced above, the present value of this annuity should be calculated by “=D3 * (1 – (1 + D4)^D6 * (1 + D5)^-D6) / (D5 – D4)”. Press Enter, and you will see the final present value. Isn’t it easy?

These two calculations are useful in financial planning, especially when considering investments or retirement plans. It helps in comparing different investment opportunities by understanding their current value.

Remember, Excel is a tool that significantly aids in these calculations, but understanding the financial concepts is key to interpreting the results correctly.