Annuities, a series of equal payments made at regular intervals, are common in financial planning and investments. In this guide, we will explore two key types of annuities: Ordinary Annuities and Growing Annuities. Ordinary Annuities assume payments remain constant throughout the term, whereas Growing Annuities account for payments that increase at a steady rate. We’ll use different Excel functions to calculate the future value for each annuity.

Calculating Future Value of Ordinary Annuity in Excel

The FV (Future Value) function in Excel is essential for calculating the future value of investments, especially annuities. The full formula in Excel is:

FV(rate, nper, pmt, [pv], [type])

Each component of this formula plays a specific role:

- rate: The interest rate for each period. If you have an annual interest rate but make monthly payments, divide the annual rate by 12.

- nper: The total number of payment periods in the annuity. For instance, if you contribute to a retirement plan for 30 years with monthly payments, the nper is 30*12 (360).

- pmt: The payment made in each period. It remains constant throughout the annuity period. It’s usually a negative number because it represents an outflow of cash.

- [pv]: Present value, or the current total value of future payments. It’s optional and is usually left as 0 unless there’s an initial lump sum investment.

- [type]: This is an optional value indicating when payments are due. Use 0 (or omit) for payments at the end of the period, and 1 for payments at the beginning of the period.

Calculation Example

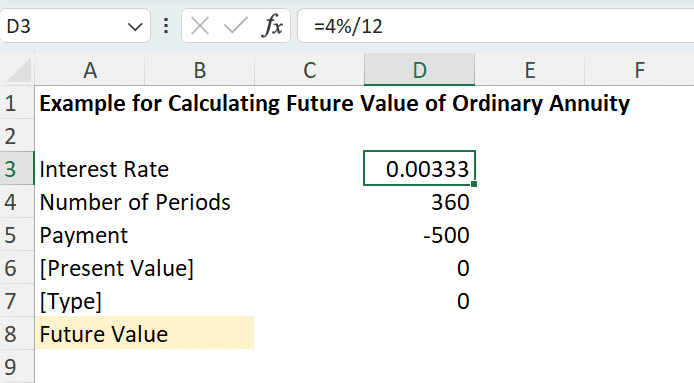

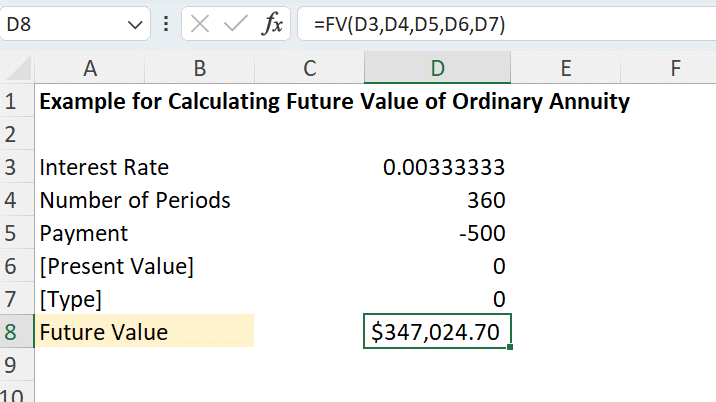

Imagine you plan to save for retirement. You decide to deposit $500 monthly into a retirement account that offers an annual interest rate of 4%, compounded monthly. You want to continue this for 30 years. Let’s calculate the future value of your retirement savings using the FV function.

- rate (interest rate per period): Since the annual rate is 4% and compounds monthly, the monthly rate is 4%/12 ≈ 0.0033.

- nper (total number of payment periods): You plan to save for 30 years, with monthly contributions, so there are 30*12 = 360 periods.

- pmt (payment per period): You’re depositing $500 per month. In Excel’s FV function, this is typically entered as a negative number to represent cash outflow.

- [pv] (present value): We’ll assume you’re starting from scratch, so this is $0.

- [type] (timing of payment): We’ll assume payments are made at the end of each period, which is the default, so this can be omitted or set to 0.

To calculate the future value of this annuity, you can simply type “=FV” in the cell where you want the result. Then, select the rate, nper, pmt, [pv] (if applicable), and [type] (if applicable) in this function. Press Enter, and Excel will immediately return the future value of your annuity.

Calculating Future Value of Growing Annuity in Excel

To calculate the future value of a growing annuity in Excel, we’ll need to write a formula ourselves, as there isn’t a direct built-in function like FV for ordinary annuities. The future value formula for a growing annuity is:

FV = P * [((1+i)^n – (1+g)^n) / (i-g)]

Where:

- P is the initial amount of the periodic payment. It’s the starting point for the payments, which will grow at a constant rate over time.

- i is the interest rate per period. If you have an annual interest rate but the payments are made monthly, you’ll need to divide the annual rate by 12. The interest rate must align with the payment frequency for accurate calculations.

- g is the growth rate of the payments. Please note that this rate is also applied per period, similar to the interest rate.

- n is the total number of payments or periods the annuity grows. For instance, if you plan to make monthly payments for 10 years, your number of periods would be 10 years x 12 months = 120 periods.

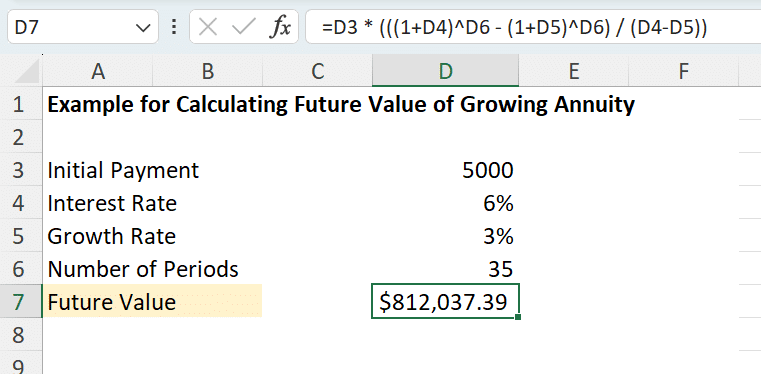

Calculation Example

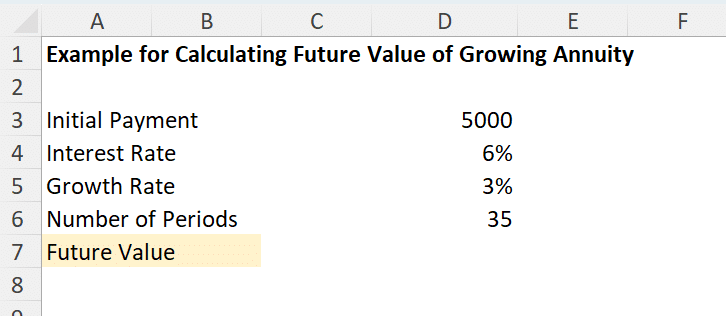

Let’s go through a practical example using the formula for the future value of a growing annuity. Suppose you start saving for retirement at age 30. You plan to retire at 65, giving you 35 years to save. You decide to start with an annual contribution of $5,000 to your retirement account and plan to increase this amount by 3% each year to account for salary increases. The retirement account offers an annual interest rate of 6%.

So, the components you will need to calculate the future value of your retirement savings are:

- P (Initial Periodic Payment): $5,000

- i (Interest Rate per Period): 6% annually

- g (Growth Rate of Payments): 3% annually

- n (Number of Periods): 35 years

Since both the interest rate and growth rate are annual, no conversion is needed. You can directly use the formula we introduced and plug the values into the formula. Press Enter, and you will get your intended future value at once!