Investing can be a double-edged sword. On the one hand, it gives you the potential for impressive returns. But on the other, it also brings the risk of financial loss. This is where risk management comes into play, and here, portfolio diversification proves its worth to protect investors. By spreading your investment portfolio across various asset classes, industries, and geographical locations, you can minimize the impact of market fluctuations and protect your hard-earned savings.

In this article, we will delve into the many benefits of diversification and how it can help to succeed in investment. Here, you can learn the risks of concentrated investing and how portfolio diversification will protect your investment. Besides, I will also introduce how to implement diversification strategy step by step. By the end of this article, you’ll be equipped with enough knowledge to manage risk through diversification effectively.

What is diversification?

Diversification is a key concept in the world of investment and risk management. Simply put, it involves spreading investment dollars across different assets, industries, and geographies rather than putting all your eggs in one basket. The goal of diversification is to reduce the risk of a single investment, event, or market sector affecting your overall portfolio.

What type of risk does diversification eliminate?

Market risk

Market risk refers to the possibility that the value of your investments will decrease due to changes in the overall market. This risk is present in all markets, such as stocks and bonds. Thus, market risks can impact the value of your portfolio, regardless of the specific stock, bond, or any other single asset you have invested in. Various factors, such as economic recessions, changes in interest rates, and geopolitical events, can impact the market and create market risk.

Credit risk

Credit risk is an unsystematic risk that a borrower will default on a loan or bond. When investing in bonds, you essentially lend money to the issuer. So, the issuer’s creditworthiness can seriously impact your investment. Be careful about this! A company with low credit ratings is more likely to default on its debt, which could result in losing some or all of your investment.

Liquidity risk

Liquidity risk refers to the possibility that you may not be able to sell your assets timely when you need to. This can be a particular concern in assets that trade infrequently or have limited market depth, such as small company stocks or real estate.

When making investment decisions, paying attention to liquidity is very important. This article details several assets with poor liquidity, which you can take note of.

Currency risk

Currency risks are associated with changes in the value of a currency relative to other currencies. This can be particularly relevant for global investments since fluctuations in currency values can impact overall returns.

Inflation risk

The buying power of your investment returns may be eroded by inflation over time. That is inflation risk. This risk is particularly relevant for investments with long-term horizons, such as retirement savings.

Types of diversification

Asset class diversification

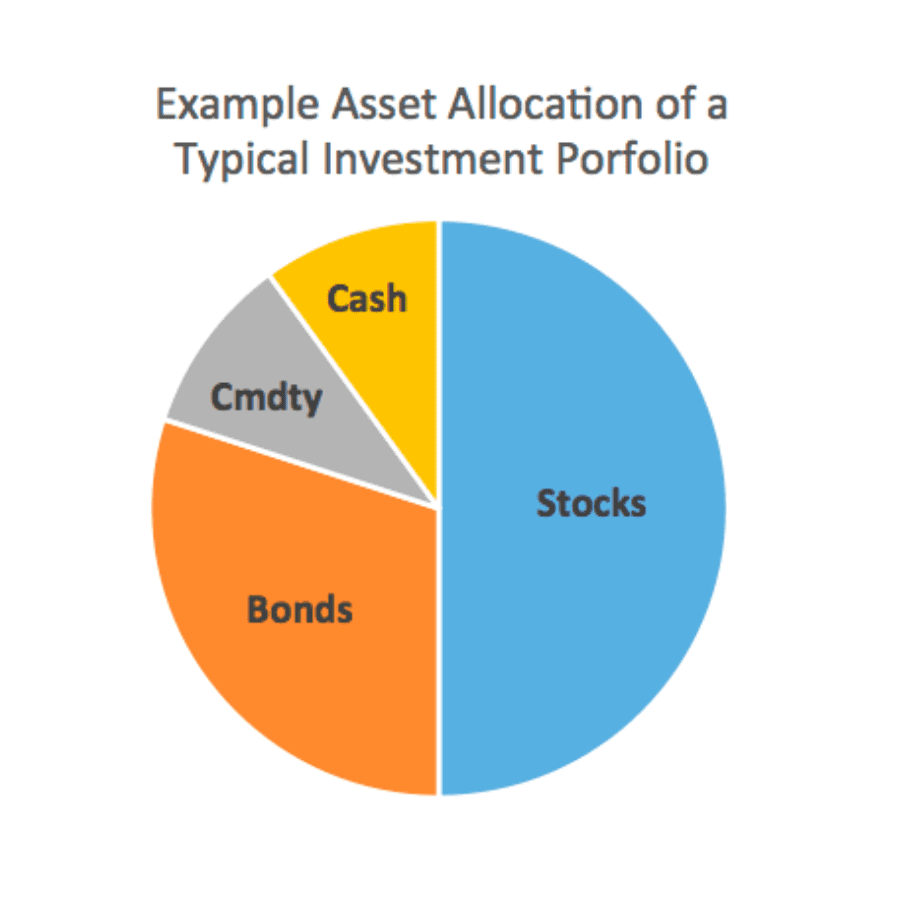

Asset class diversification is investing in different types of investments, such as stocks, bonds, real estate, commodities, etc. This way, you spread risk as each asset class may perform differently in various market conditions.

Sector diversification

Sector diversification involves investing in different industries within the stock market. For example, an investor may allocate their portfolio to a mix of technology, healthcare, and finance industries.

Geographical diversification

Geo diversification means investing in different countries or regions. This helps to spread out the risk of a single country’s economy affecting the entire portfolio.

How does portfolio diversification protect investors?

Investing in a diversified portfolio brings many benefits that can reduce risk and improve overall returns. Here are a few of the key benefits of diversification in investment.

Portfolio diversification eliminates risks

The primary purpose of portfolio diversification is to reduce risks. Investing in various assets spreads your risk across different markets and industries. Thus, any potential losses in any area will have less impact on your portfolio.

For example, suppose you were to invest your entire portfolio in the technology sector. If the industry were to experience a downturn, your entire portfolio would be impacted. Having a diversified investment portfolio makes a big difference. If you have included your investments in other sectors, such as healthcare or real estate, portfolio diversification will eliminate the impact of the tech sector downturn.

Portfolio diversification may improve long-term returns

Diversification can also benefit returns. By allocating money to various assets, you get the potential to benefit from the growth of different markets.

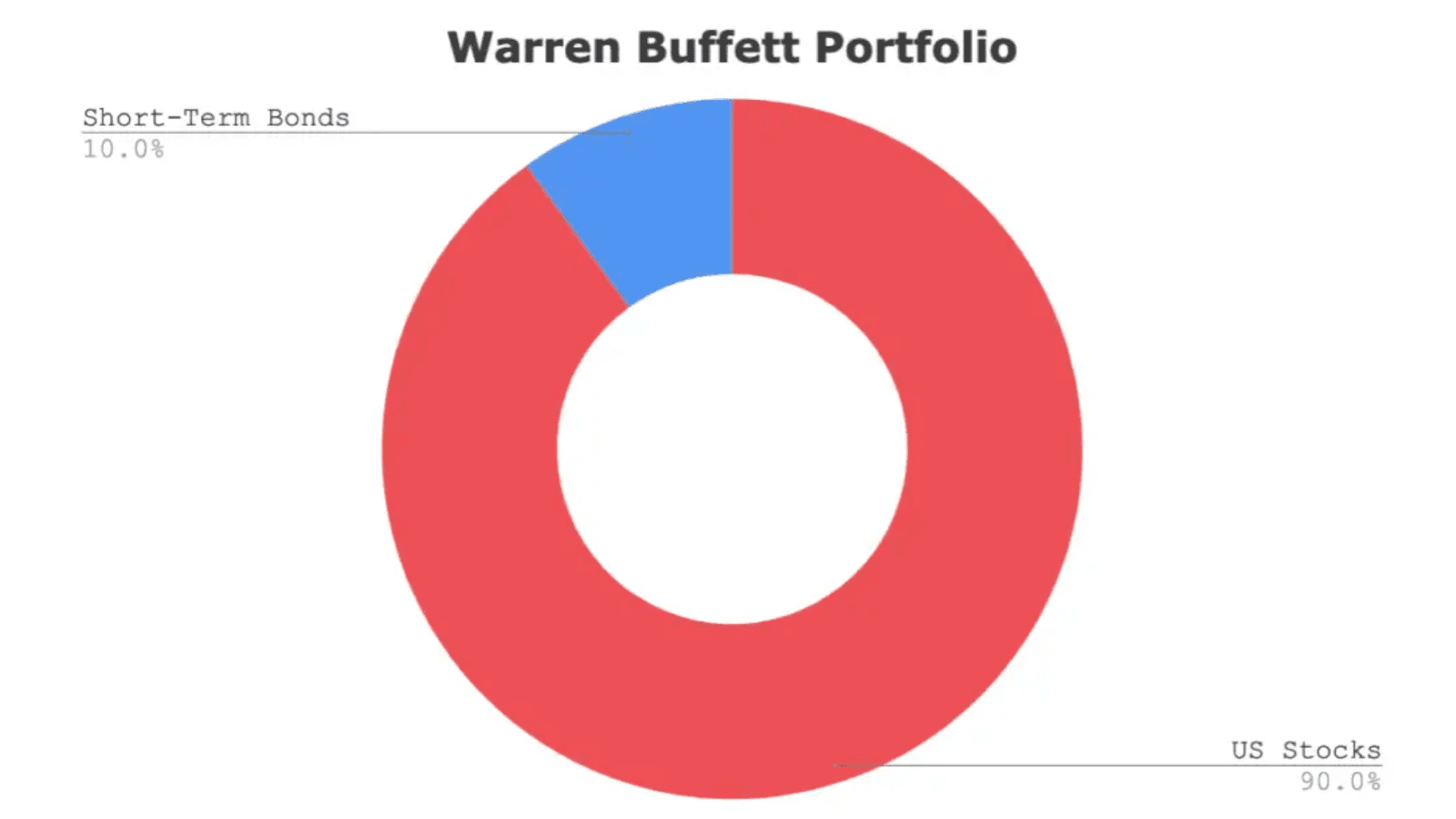

For example, portfolios with both stocks and bonds will benefit from the stocks’ high return potential while also receiving a steady income stream from bonds. You may have heard of Warren Buffett’s 90/10 investing strategy, a classic example of a stock-bond hybrid strategy. With such a portfolio, you will access a more stable, potentially higher, overall return in the long term.

Portfolio diversification improves peace of mind

Investing can be stressful, especially when involving a significant amount of risk. By diversification, you will know you are less likely to experience substantial losses. Thus, you can have improved peace of mind with a well-diversified portfolio.

How to implement diversification strategy?

A diversified portfolio combines various investment tools, such as stocks, bonds, mutual funds, and real estate, to minimize risk. But how to diversify a portfolio? Here are the steps you can follow to build a diversified portfolio:

Step 1: Assess your financial goals and risk tolerance

Before you start investing, be sure to understand your goals and risk tolerance entirely. Ask yourself questions like: How much risk am I comfortable taking on? Am I want to grow wealth long-term, generate income, or both? Am I saving for a specific purpose, such as retirement, or just looking to invest for the future? Knowing these will help you determine what kind of portfolio you should build.

For example, If you’re a conservative investor, you may prefer to stick with low-risk investments like bonds. On the other hand, if you’re willing to take on more risk, you may consider investing more in stocks.

Step 2: Decide on a mix of investments

Now, you know the goals you’re working towards and the risk you’re comfortable taking. It’s time to start researching different investment options. There are a ton of different types of instruments out there, from stocks and exchange-traded funds (ETFs) to bonds and cash. Do your due diligence and familiarize yourself with each option to determine which might be right for you.

A good starting point includes a mix of stocks, bonds, and cash. Stocks have the potential for high returns but also come with higher risks. Bonds are generally lower-risk but offer lower returns. And cash is the safest option, but it also has almost zero returns.

Step 3: Diversify among asset classes

Once done your research, you can start building your portfolio! Aim for a mix of different types of instruments, including both growth-oriented tools (e.g., stocks) and income-generating tools (e.g., bonds). These tools could include stocks, bonds, real estate, commodities, etc. This will help spread out your risk and ensure your portfolio is well-diversified. By spreading, even if a kind of investment doesn’t perform well, the others can help balance out your returns.

The exact allocation will depend on your investment goals and risk tolerance. Still, for a newbie, a common strategy is to allocate 60-70% of your portfolio to stocks, 20-30% to bonds, and 5-10% to real estate or other alternative investments.

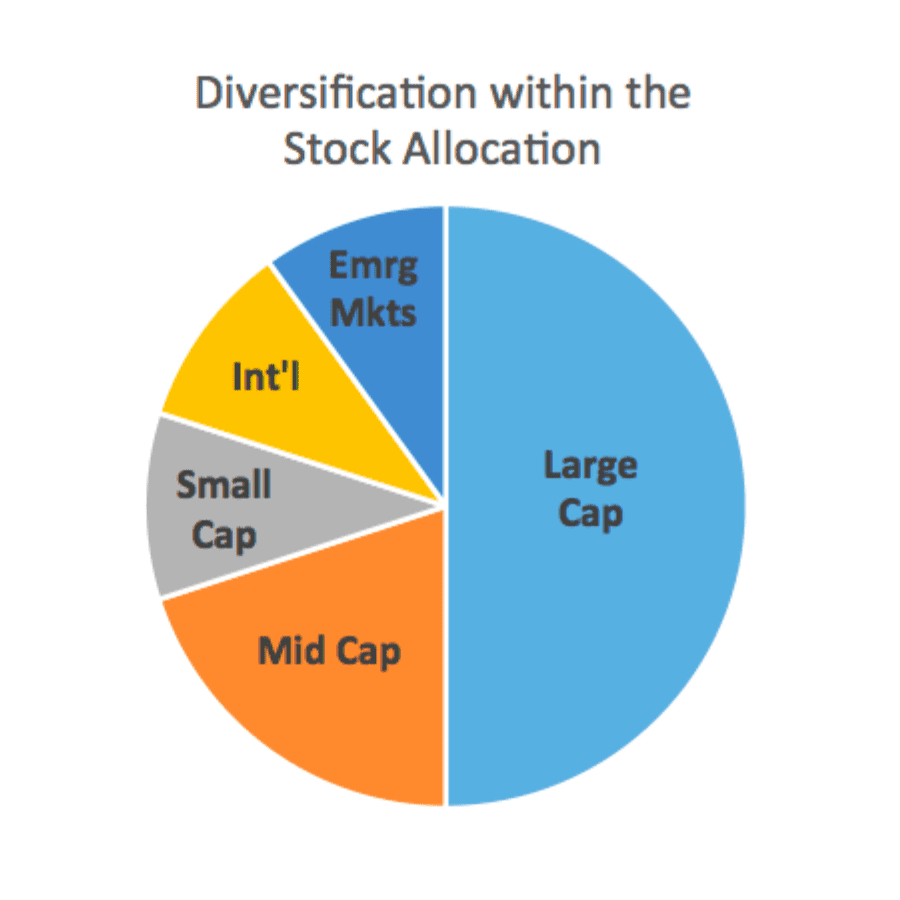

Step 4: Diversify within asset classes

With such diverse investment tools on the market, it is easy to forget to diversify within each asset class. For example, if you invest in stocks in S&P 500, make sure you invest in a mix of large, medium, and small companies. Besides, you can also diversify your portfolio by investing in different industries’ stocks.

Step 5: Review and rebalance your portfolio

As markets change and your investment goals evolve, your portfolio mix may become unbalanced. Don’t forget to regularly rebalance your portfolio to ensure it aligns with your risk tolerance and investment goals. This may mean selling some investments and buying others to maintain your desired asset allocation.

Last but not least, staying informed and updated about the markets. Keep an eye on your portfolio and make changes as necessary.

The two biggest drawbacks of diversification

Diversification is not a magic bullet. It has its own set of drawbacks that you should be aware of. Here are the two biggest ones.

Diversification sometimes reduces short-term returns

One big drawback of diversification is that it may lead to reduced short-term returns.

This appears to contradict what we said before. As we mentioned earlier, diversification is a great growth strategy for increasing returns, but it is from the perspective of the long term. From the short-term perspective, it reduces the probability of obtaining large returns.

Holding a concentrated portfolio with just a few investments gives you the potential for bigger returns if those investments do well in the short term luckily.

However, diversifying means you spread your money across many different assets, reducing the potential for huge gains. Since the probability of all the different types of assets you hold rising simultaneously is very low. It’s like trying to bake a cake using just a handful of ingredients. Sure, you’ll still get a cake, but it won’t be as rich or flavorful as if you used a whole bunch of ingredients.

The same goes for investing. By diversifying, sure, you reduce your potential for significant losses, but you also reduce your possibility for big gains. So, it’s a trade-off.

Diversification can be expensive

Another drawback of diversification is that it can be expensive. To diversify effectively, you need to invest in a variety of assets, which means you’ll need to pay brokerage fees for each investment.

Besides, multiple mutual funds or ETFs are usually a must-have for a diversified portfolio. However, you’ll also need to pay an annual management fee to invest in them.

These fees can quickly add up, eating into your returns.

So, as you can see, diversification is not without its own set of drawbacks. Before diversifying, weigh the pros and cons and decide if it is the right strategy for you.

Final words

So, there you have it, folks, a full guide to the world of diversification in investment. By now, you should solidly understand the many benefits of diversifying your investment portfolio. The advantages are clear, from reducing the risk of market fluctuations to improving overall returns and providing peace of mind.

But, the key to success lies in knowing how to diversify your portfolio effectively. Following the simple steps outlined in this article, you can build a well-balanced and diversified portfolio that meets your financial goals and risk tolerance.

Still, as mentioned earlier, diversification is not without disadvantages. A diversification strategy costs more money and may lower short-term returns. But more importantly, it reduces your risk. After all, risks are the most important thing to pay attention to in trading.

With the right strategy in place, your investment will be well protected. So, start diversifying your portfolio today and sleep well at night!