Today we’ll talk all about the “benefits of long-term investment.” You may have heard this term floating around before and wondered what it means, so let’s start by breaking it down. Essentially, when you make a long-term investment, you’re putting your money into something with the goal of holding onto it for several years, if not decades.

Now, you might be thinking, “Why would I want to tie up my money for that long?” It’s a valid concern. But the truth is, there are tons of benefits to making a long-term investment that you might not be aware of.

This blog post aims to outline why investing for the long term is a smart move. By the end, you’ll solidly understand why long-term investment can be a game-changer for your financial future. So, let’s get started!

The Magic of Long-Term Investment: Compound Interest

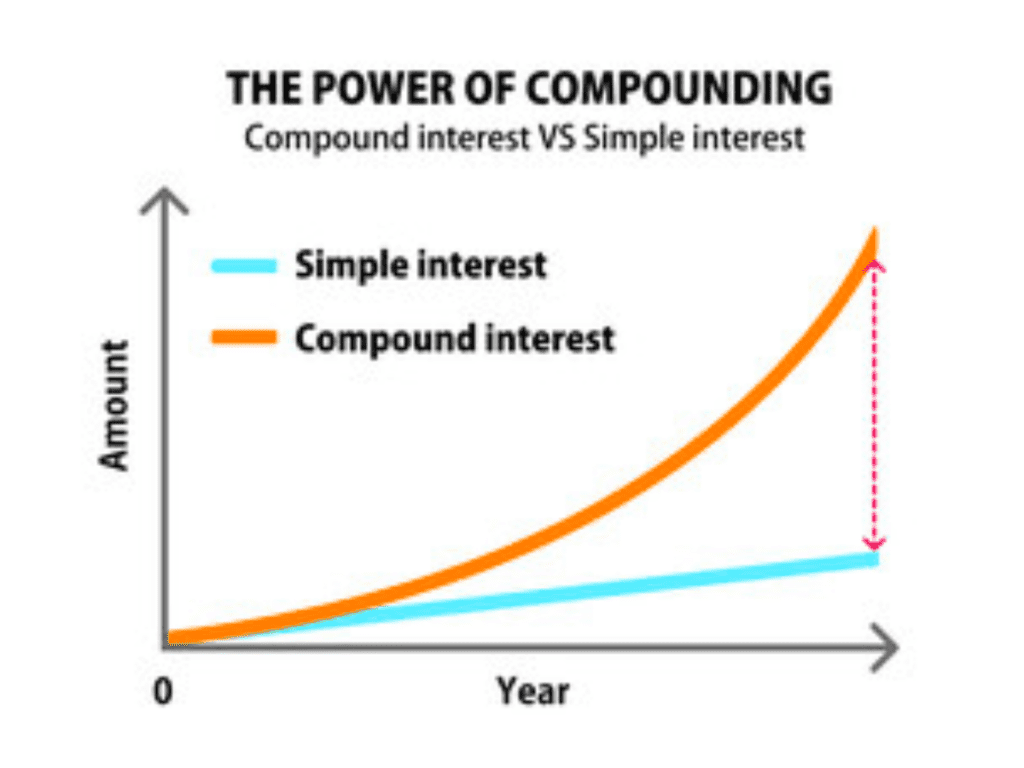

One common advantage of a long-term investment is compound interest, and it’s like a superpower when it comes to building wealth. But why does it work so well? Let’s dive in.

The Power of Compound Interest

Compound interest is interest on interest, which means your money earns interest not only on the initial investment but also on the accumulated interest over time. The longer the time, the more powerful the compound interest becomes.

So, let’s imagine you invested $1000 in a savings account that earns a 5% annual interest rate compounded annually. After the first year, you would have earned $50 in interest, bringing your total to $1050. In the second year, the interest would be calculated on the new total, giving you $52.50 in interest. And so on.

You might think that 5% doesn’t seem like much, but the growth will be substantial over time. After 10 years, your initial $1000 would have grown to $1,628.89. And if you let that investment grow for 30 years, the amount would have ballooned to $4,482.54!

Short-Term vs Long-Term Investment: Why Compound Interest Doesn’t Work for Short-Term Investment

Short-term speculation doesn’t give the compound interest time to work its magic compared to long-term investment. If you’re constantly moving your money in and out of different investments, you’re not giving the compound interest a chance to accumulate.

Truly, if you can succeed in every short-term investment, compound interest might even give you higher returns than long-term investments. But are you solidly sure you’ll succeed each time?

No one can be a winner forever, especially for short-term speculations, which usually come with greater volatility and higher risks. Once you fail, you may end up losing much of the wealth you’ve accumulated. At this point, your money has decreased, and compound interest can’t play a big role anymore.

Why Long-Term Investment is Good: Lower Volatility

What do I mean by volatility? It’s just a fancy word for ups and downs in the value of your investment. Imagine you put $10,000 into a stock today, and tomorrow it’s worth $9,000. That’s a big swing in just one day! But, if you hold onto that stock for several years, those daily ups and downs will smooth out. And you’re more likely to see a gradual increase in value over time.

Lower Volatility: The Realities

J.P. Morgan Asset Management found that over a 20-year period, the average annual return for the S&P 500 was 9.8%, with an average annual volatility of 15.5%. However, if you looked at a 5-year period within that 20-year span, the average annual return was still 9.8%, but the volatility jumped up to 21.3%.

So, as you can see, the longer you stay invested, the smoother the ride becomes. And that’s not just a one-time fluke. It’s a typical pattern that holds for most investments over the long term.

Lower Volatility: The Benefits

Here’s the really cool part: history shows that the longer you stay invested, the more likely you will see positive returns. In fact, even over the past 90 years, the stock market still has returned an average of about 10% per year.

And don’t forget that time is also your friend regarding long-term investments. The power of compound interest means your money has the opportunity to grow and grow, even if there are short-term dips in value.

So, to sum it up, low volatility is one of the biggest benefits of long-term investment in stock market.

The Benefits of Long-Term Investment: Better Diversification

Diversification is critical when it comes to investing. It’s a bit like not putting all your eggs in one basket – spreading your money out over different types of investments can help reduce the risk of losing everything if one investment doesn’t perform well. Obviously, long-term investment allows for more diversification opportunities.

Related Reading: How Does Portfolio Diversification Protect Investors?

Let’s break it down. With short-term investments, you often look for quick profits and may be in a hurry to play with them. This can limit your options for diversification. You might only be able to invest in one or two types of investments, which increases the risk if one of them doesn’t perform as expected.

On the other hand, with a long-term investment plan, you have more time to slowly and steadily build up a diverse portfolio. You can choose to invest in a mix of stocks, bonds, real estate, and other types of instruments. And as you continue to invest, you can re-balance your portfolio to ensure you’re always maximizing your returns and reducing your risk.

Long-Term Investment Means Lower Trading Fees

You see, when you’re a short-term investor, you need constantly buy and sell stocks, bonds, or other instruments. This means you’re paying trading fees every time you make a transaction. And those fees can really add up over time!

On the other hand, as a long-term investor, you’re not making as many trades. You might only make one or two trades per year, or even less. This means that you’re paying significantly fewer trading fees. And when you carefully think about it, those fees can deeply impact your overall returns.

Final Words

So there you have it, folks, the ultimate guide to the benefits of long-term investment. I hope you’ve learned a thing or two about why tying up your money for a longer period of time can be a smart move. From the power of compound interest to reducing volatility to better diversification opportunities, long-term investment offers a whole host of benefits that can help grow your wealth.

Don’t forget, the longer you invest, the smoother the ride becomes, and the more likely you will see positive returns.

So, if you’re ready to take your finances to the next level, it might be time to consider a long-term investment strategy. Like Warren Buffett, one of the world’s most successful investors, famously said, “Someone’s sitting in the shade today because someone planted a tree a long time ago.” Happy investing!