When it comes to investing, liquidity is an essential factor to consider. Investments with low liquidity can be risky, as they are more challenging to sell timely if the investor needs to access their money or if market conditions change. However, these types of investments may also offer the potential for higher returns since few people hold them, thus potentially undervalued by the market. This blog post will delve into identifying which investment has the least liquidity and discuss the risks and considerations associated with investing in these assets. We will also provide tips for managing low liquidity risk and explain the importance of considering liquidity when making investment decisions.

What is liquidity?

Liquidity refers to the ease with which an asset can be bought or sold in the market without affecting the asset’s price. You can convert a liquid asset quickly and easily into cash at a stable price. In contrast, an illiquid asset is difficult to sell or requires a significant discount to sell.

You can consider liquidity as a glass of water. Water is a very liquid substance because it can be poured easily from one container to another without affecting its price. On the other hand, a diamond is an example of an illiquid asset since it is difficult to sell and its price can vary significantly based on factors such as its quality, size, and demand.

Why do you need to consider liquidity when making investment decisions?

Considering liquidity is important when making investment decisions since it can impact your ability to buy and sell assets as needed. For investors who may need to access their money quickly, such as in the case of an emergency or if market conditions change unexpectedly, they should carefully examine liquidity.

Imagine investing a significant portion of your portfolio in a private company. One day, you receive an unexpected medical bill that you need to pay immediately. In this situation, you must sell some of your investments to access the cash you need. However, since your assets are not liquid, it isn’t easy to sell them quickly. It could cause delays and potentially result in financial hardship.

On the other hand, if you have invested in highly liquid assets, such as stocks listed on a public exchange, you can sell them quickly and without difficulty as long as numerous buyers are willing to purchase them. It is flexible without worrying about finding a buyer or incurring significant losses in the process.

In addition to providing access to cash when needed, liquidity can also impact an investment’s price. For example, if an asset is highly liquid, it may be less vulnerable to price fluctuations since there are typically many buyers and sellers in the market. On the other hand, if an asset is illiquid, it may be more prone to price volatility because it may take longer to find a buyer or seller. Sometimes you need to give a big discount to sell your goods if you need money urgently.

How to measure the liquidity of an investment?

There are several ways to measure liquidity, depending on the type of asset. Here are some standard methods to measure liquidity:

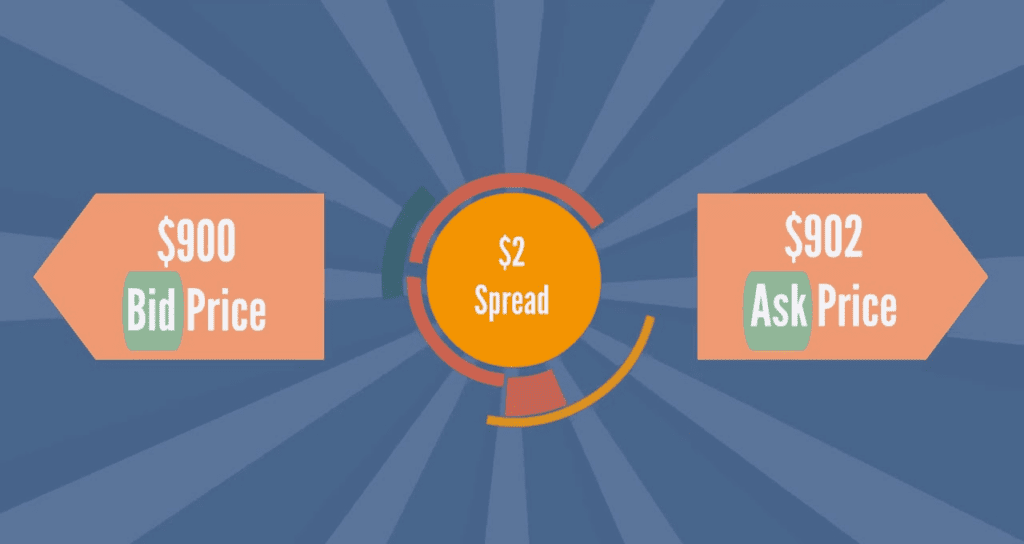

Bid-ask spread

The bid-ask spread is the difference between the highest price that a buyer is willing to pay for an asset (the “bid price”) and the lowest price that a seller is willing to accept (the “ask price”). The smaller the bid-ask spread, the more liquid the asset is.

Volume of trades

The volume of trades reflects the number of buyers and sellers in the market for a particular asset. For example, even every stock usually has thousands of traders simultaneously in the stock market, so stocks are assets with high liquidity.

Time to sell

The time it takes to sell an asset is the primary measure of liquidity. Investors can access their money by selling liquid assets without waiting. On the contrary, we can consider an investment less liquid if it takes a long time to sell.

Which investment has the least liquidity?

There are a variety of types of investments that tend to have low liquidity. Here are a few examples:

Real estate

Real estate investments, such as commercial or residential properties, are illiquid assets since they take a long time to sell. For example, an investor needs to sell a rental property quickly, but it may still take several months to find a buyer and close the sale. During this period, the investor must continue paying property taxes and insurance expenses. Additionally, the selling process for real estate can be complex. Sometimes it requires hiring a real estate agent, which can also add to the time and expense of the sale.

Art, collectibles, and other rare items

Art, collectibles, and other rare items are illiquid since there are a limited number of buyers. Finding a buyer willing to pay the desired price can take a long time. You may have to pay for storage and insurance costs during that time.

Agricultural land

Agricultural land is also a non-liquid asset because it may take a long time to sell, and there is a limited number of buyers. Additionally, agricultural land is often tied to specific conditions and locations, which makes it harder to find a buyer.

Private company stocks

Private company stocks are illiquid since you can’t trade them on a public exchange such as NYSE. Thus, there are usually a limited number of buyers and sellers. Imagine you have invested in a small startup company that is not yet listed on a public exchange and has only a few shareholders. You can hardly find a buyer for your shares, and even if you do, you might have to offer a significant discount to sell them to get your money in time.

Tips for managing the risk of low liquidity

Investing in assets with low liquidity is risky. It’s important to take steps to manage the associated risks. Here are a few tips for managing the risk of low liquidity:

Diversify your investment portfolio

According to financial theory, diversifying your investment portfolio can help mitigate the risk of low liquidity by spreading your investment across various assets. For example, suppose you have a portion of your portfolio invested in illiquid assets such as real estate or private company stocks. In that case, balancing this with investments in liquid assets such as stocks or bonds is helpful. This way, even if one part of your portfolio is difficult to sell quickly, you will have other assets that you can access to meet your financial needs.

Avoid overconcentration

Avoid putting too much of your investment in one single illiquid asset. Even if an asset may have high potential returns, it is essential not to put all your eggs in one basket. If you overconcentrate, you could put yourself in a position where you cannot sell the asset timely without incurring significant losses.

Set a deadline for specific investment

When you purchase an illiquid asset, set a deadline for selling the investment regardless of the market conditions. This will give you a plan for when to expect the returns and help you make more informed decisions about buying and holding such assets. For example, you can set a deadline five years after purchasing a piece of real estate in case you don’t see the desired return.

Understand your exit plan

If necessary, you should make a detailed strategy on how to exit the low-liquid investment. There are many methods to deal with it, such as identifying potential buyers or developing a plan for renting or repurposing the asset.

Say you invest in a commercial property with the intent of renting it out to generate income. However, the area where the property is located ends up facing an economic downturn, and the property becomes difficult to rent. In this case, having an exit plan in place, such as seeking out alternative uses for the property or identifying potential buyers in advance, can help mitigate the potential losses. You can also act quickly if the market conditions change unexpectedly.

Seek professional advice

If you are new to illiquid investment, I would recommend you seek advice from a professional financial advisor. Financial advisors can guide the types of investments that may be appropriate for a given situation and help investors understand the risks and rewards associated with different investments. These tailored recommendations and expert analyses are fundamental ways for beginners to avoid trouble.

Conclusion

In this blog post, we have discussed the concept of liquidity and its importance when making investment decisions. We have also highlighted types of investment with the least liquidity, such as real estate, private company stocks, art, collectibles, and agricultural land, and why we consider them as such. Additionally, we have provided detailed tips for low liquidity risk management, such as diversification, avoiding over-concentration, setting a deadline, understanding your exit plan, and seeking professional advice.

It’s important to note that investing in low-liquidity assets can present unique challenges and potential risks. Still, with a well-thought-out strategy, investors can navigate these challenges and make informed decisions. By diversifying their portfolio, having a clear exit plan, and seeking expert guidance, investors can mitigate the risk of low liquidity while potentially reaping such investments’ rewards. Understanding illiquid investments’ characteristics and potential challenges are key to a successful long-term investment strategy.