EBITDA Definition & Formula

EBITDA, which stands for Earnings Before Interest, Taxes, Depreciation, and Amortization, is a financial metric used to assess a company’s operating performance. It measures a company’s profitability by excluding items that can be seen as unrelated to the core operations of the business.

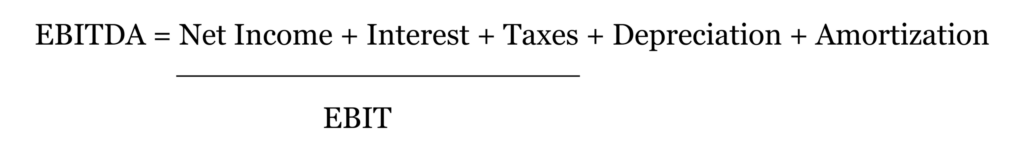

For our EBITDA calculator, the formula to calculate EBITDA is as follows:

EBIT = Net Income + Interest + Taxes

EBITDA = EBIT + Depreciation + Amortization (Method 1 we used in this calculator)

so,

EBITDA = Net Income + Interest + Taxes + Depreciation + Amortization (Method 2 we used in this calculator)

Now, let’s discuss the components:

- Net Income: Net Income is a company’s profit after all expenses have been deducted from its revenue. It is at the bottom line of an income statement.

- Interest: This is the cost of borrowed money. Adding back interest expenses to net income removes the costs associated with the company’s debt, focusing solely on operational performance.

- Taxes: Including taxes back into net income helps to ascertain a company’s operational performance without the influence of its tax obligations.

- Depreciation: This refers to the reduction in the value of an asset over time, often due to wear and tear. For accounting purposes, businesses spread out the cost of a tangible asset over its useful life.

- Amortization: Similar to depreciation, but it’s for intangible assets like patents or copyrights. It’s the process of spreading out the cost of an intangible asset over its expected useful life.

EBITDA Calculation Example

Let’s delve into a practical example to understand its calculation, using a hypothetical company, BizCorp, as our subject.

The data of this company is like:

- Net Income: $500,000

- Interest: $50,000

- Taxes: $100,000

- Depreciation: $30,000

- Amortization: $20,000

We use the EBITDA formula:

Therefore, the EBITDA of BizCorp is:

EBITDA = $500,000 + $50,000 + $100,000 + $30,000 + $20,000 = $700,000

An EBITDA of $700,000 reveals the operational earnings of BizCorp, undistorted by interest, tax, depreciation, and amortization expenses. This figure clarifies the company’s operational profitability and cash generation capability from core operations.