In this article, we will delve deep into the concept of Book Value Per Share (BVPS). We’ll demystify its formula, provide a step-by-step walkthrough using a practical example, and equip you with a handy Book Value Per Share Calculator.

What is Book Value Per Share?

Book Value Per Share, often abbreviated as BVPS, provides a snapshot of the equity attributable to common shareholders in relation to the total number of shares they hold. Put simply, it’s a measure that helps us understand the intrinsic value of a company on a per-share basis.

When evaluating potential investments, many investors turn to BVPS. It serves as a valuable tool in gauging whether a company’s stock might be undervalued or overvalued. For instance, when the BVPS exceeds the stock’s current market price, it often suggests that the stock might be trading at a discount. On the other hand, if the BVPS is lower than the market price, the stock might be considered overpriced.

Book Value Per Share Formula

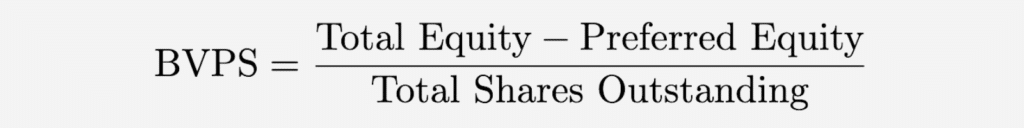

To calculate Book Value Per Share (BVPS), you’ll need to use the formula:

In this formula:

- Total Equity: This represents the net value or worth of the company from an accounting perspective. Mathematically, it is the difference between the company’s total assets and its total liabilities. In other words, it’s what’s left for the owners (shareholders) after all debts and obligations are paid off.

- Preferred Equity: Companies may have different classes of shares, and preferred stock is one such class. Preferred stockholders have a higher claim on dividends and assets than common stockholders, hence their equity is subtracted to determine what’s available for common stockholders.

- Total Shares Outstanding: This includes all the shares of a company’s stock that have been issued and are held by investors, including institutional holdings, retail investors, and even company insiders. Shares that a company has repurchased or treasury shares are usually not included in this count.

Book Value Per Share Calculation Example

To get a clear grasp on how the Book Value Per Share (BVPS) demonstrates a company’s value, let’s delve into an illustrative case study with a hypothetical company named XYZ Corp.

XYZ Corp’s Financial Data:

- Total Equity: $50 million

- Preferred Equity: $10 million

- Total Shares Outstanding: 4 million

Step-by-Step BVPS Calculation:

- Determine Common Equity: To ascertain the equity available to common shareholders, we need to exclude the preferred equity from the total equity.

Common Equity = Total Equity – Preferred Equity = $50 million – $10 million = $40 million

- Compute BVPS: Once we have the common equity, the next step is to divide it by the total number of shares outstanding. This gives us the BVPS.

BVPS = Common Equity ÷ Total Shares Outstanding = $40 million ÷ 4 million = $10

From this calculation, we learn that XYZ Corp’s BVPS stands at $10. This implies that if XYZ Corp were to wind up its operations and liquidate, every common share would, in theory, be worth $10 — given that its assets are sold at the stated book value.

Scenario: Share Buyback by XYZ Corp:

Imagine a situation where XYZ Corp chooses to repurchase 500,000 of its shares. This would alter the total shares outstanding, reducing them to 3.5 million. Let’s see how this impacts the BVPS:

BVPS (post buyback) = Common Equity ÷ New Total Shares Outstanding = $40 million ÷ 3.5 million = $11.43

Post buyback, the BVPS climbs to $11.43 per share. This increase in BVPS indicates that the stock has grown more valuable on a per-share basis after the buyback event.

Final Words

We’ve delved deep into the definition, calculation, and practical usage of BVPS. However, it’s essential to underscore that BVPS holds varied importance across different sectors. For instance, in industries heavily reliant on assets—like real estate and natural resources—BVPS emerges as a particularly vital metric due to the intrinsic nature of these businesses.

Yet, it’s imperative to understand that BVPS, while insightful, is only a fragment of the broader financial landscape. You shouldn’t overlook metrics such as Earnings Per Share (EPS), Return on Equity (ROE), and the Debt-to-Equity ratio for a more in-depth analysis of a company’s financial robustness. Employing these indicators alongside BVPS can give you a well-rounded perspective on the financial posture of a company.