Accompanying the Earnings Per Share (EPS) Calculator is this comprehensive guide. We aim to clarify the concept of EPS, provide a detailed breakdown of its formula, and illustrate how it can be a pivotal factor in making informed investment decisions.

What is Earnings Per Share?

Earnings Per Share, often abbreviated as EPS, calculates the net earnings available to each outstanding share of a company’s stock at the close of a particular fiscal year. To break it down, the EPS ratio denotes the potential amount of money a company could distribute to every outstanding share if it opted to allocate all of its net earnings among its existing shares.

The value of EPS offers insights into a company’s profitability in relation to its shareholder count. Essentially, it delineates how productive a company is in generating profits relative to the number of shares it has in circulation. An added advantage of the EPS metric is its utility in benchmarking companies of various sizes. This is achieved by assessing their profit generation capacity on a per-share basis. As a general rule of thumb, a higher EPS value indicates a company’s enhanced profitability.

Earnings Per Share Formula

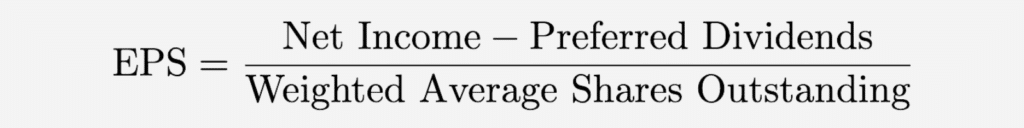

The formula for calculating EPS is:

Components of the EPS Formula:

- Net Income: This represents the company’s total profits after deducting all operational expenses, taxes, interest, and other financial obligations. It’s the “bottom line” on an income statement and gives a clear picture of the overall profitability of the firm.

- Preferred Dividends: These are payouts made to preferred stockholders. Unlike common stockholders, preferred stockholders receive their dividends before any dividends are distributed to common stockholders. Since EPS focuses on common stockholders’ earnings, it’s necessary to subtract the preferred dividends from net income to determine the earnings available for them.

- Weighted Average Shares Outstanding: This number represents the average number of shares a company had outstanding over a certain period, taking into account any changes in that number due to events like stock splits, buybacks, or issuance of new shares. Weighting the shares is crucial because the number of shares can change over a period, and this ensures that the EPS calculation is an accurate representation of the entire period in question.

Impact of Transactions on EPS:

- Stock Buybacks: When a company repurchases its own shares from the open market, it’s called a stock buyback. This reduces the number of shares outstanding. As a result, even if the net income remains constant, the EPS can increase because the denominator (number of shares) decreases.

- Issuance of New Shares: Companies can issue new shares for various reasons, such as to raise capital or as part of an acquisition deal. When new shares are issued, the number of outstanding shares increases. This can lead to a dilution of EPS if the net income doesn’t increase proportionately.

Earnings Per Share Calculation Example

Let’s delve into a hypothetical scenario involving Company A to shed light on the practical application of Earnings Per Share (EPS).

At the close of its fiscal year, Company A presents a net income of $10 million. Concurrently, it has 1 million shares in circulation or “outstanding.” Additionally, the company decides to distribute $1 million as preferred dividends. To determine the EPS, we employ the following formula:

EPS = (Net Income – Preferred Dividends) / Number of Outstanding Shares

Inserting the provided figures, we find:

EPS = ($10 million – $1 million) / 1 million = $9

Interpreted, this means that for this fiscal year, each share of Company A’s stock has effectively produced earnings worth $9.

Introducing a twist to our scenario, let’s assume that halfway through the year, Company A undertook a strategic decision to buy back 100,000 of its shares. This action diminishes the number of outstanding shares to 900,000. Given the timing of this buyback, the weighted average for shares outstanding over the year equates to 950,000.

Recomputing the EPS with this new data:

EPS = ($10 million – $1 million) / 950,000 ≈ $9.47

It’s noteworthy to observe the shift in EPS from the initial $9.00 to $9.47, attributable solely to the stock buyback initiative. This bolstered EPS could potentially render Company A a more appealing prospect to discerning investors, especially when one considers that the company not only repurchased its stocks but also sustained its earnings momentum.

Final Words

We’ve journeyed through the mathematical landscape of EPS, unraveling its formula, examining real-world applications, and understanding the nuances that transactions bring to the table. However, it’s pertinent to highlight that EPS doesn’t stand alone in financial metrics. It often serves as a fundamental element in the computation of other pivotal financial ratios, such as the Price-to-Earnings (P/E) ratio. The P/E ratio, in turn, magnifies the utility of EPS, enabling analysts and investors to assess a company’s valuation in relation to its earnings.

Yet, as with all financial instruments, diligence is paramount. It’s imperative to be cautious of factors that might offer a skewed perception of earnings. For instance, transactions such as unique asset sales can provide a fleeting boost to EPS, potentially painting an over-optimistic image of continual profitability. As always, prudence lies in dissecting the constituents of net income, ensuring the earnings reflected are not just ephemeral, but sustainable.