In investment circles and financial news, we often hear “Nonfarm Payrolls” (NFP). Every time the nonfarm payroll report is released, it will cause significant fluctuations in the foreign exchange, stock, futures, and cryptocurrency markets. For example, after the U.S. Bureau of Labor Statistics (BLS) released the nonfarm payroll report last Friday, the three most widely followed indexes in the U.S. (S&P 500, Dow Jones Industrial Average, and Nasdaq Composite) and many cryptocurrencies plunged. At the same time, the U.S. dollar index rose sharply. What are the nonfarm payrolls that everyone is discussing? Why is better-than-expected nonfarm payrolls data bad news for the market? This article will introduce the nonfarm payroll report and its impact on the market in detail.

What are Nonfarm Payrolls?

Nonfarm payrolls are the measure of the number of workers in the U.S., excluding farm workers and workers in a handful of other job classifications.

Nonfarm Payrolls (NFP) can reflect the development and growth of the manufacturing and services industries. A decrease in the number means that companies have reduced production and the economy has entered a recession. On the contrary, when the Nonfarm Payrolls (NFP) increase, it means that the manufacturing and services industries are relatively good. The overall economic situation of the United States is pretty great.

There are three values involved in the non-agricultural data. What do they mean?

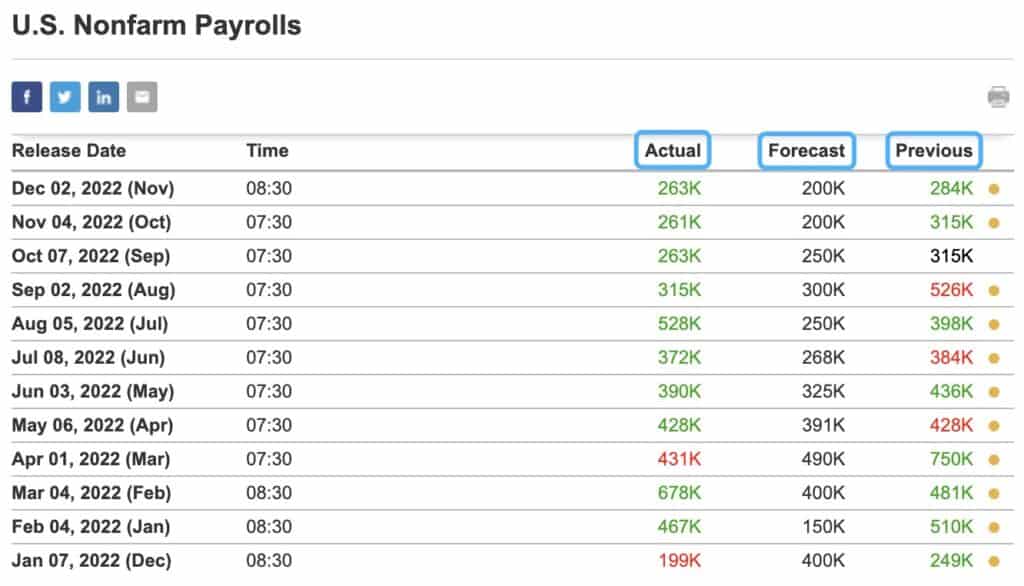

The previous value is the actual value released last month, which is a basis for predicting the actual data this month. The forecast value (expected value) refers to the value that economists predict based on the performance of the U.S. economy in the past month. The actual values (current values) refer to actual published values.

The market has priced in the forecast before the data is released. The gap between forecast and actual values can judge the market reaction. From this, you can predict whether the market will be bullish or bearish.

What is the impact of nonfarm payrolls on the market?

Whenever the Nonfarm Payroll Report is released, it will cause significant fluctuation in the stock market, futures, foreign exchange, and other markets! What is the specific impact? Below is a list of markets that investors most closely watch:

Foreign exchange market

A good Nonfarm Payroll Report can drive interest rates higher, making the U.S. dollar more attractive to foreign investors. The U.S. dollar is extremely sensitive to the payroll employment data. If the nonfarm payrolls are higher than expected, the U.S. dollar will be bullish. If the nonfarm payrolls are lower than expected, the U.S. dollar will be bearish.

Precious metals market

Nonfarm payrolls considerably impact the price trend of precious metals, especially gold and silver. Gold and silver often fluctuate significantly before and after the release of data. The reserves of gold in the United States rank first among all countries. Gold is priced in U.S. dollars, and they are negatively correlated.

In general, better nonfarm payrolls show the U.S. economy is improving. Then the U.S. dollar rises, and gold falls. Worse nonfarm payrolls show the U.S. economy is deteriorating. Then the U.S. dollar falls, and gold rises.

Stock market

The impact of nonfarm payrolls data on the stock market is more complicated.

In general, better-than-expected nonfarm payrolls indicate that the U.S. economy is developing healthier, which is good news for the stock market. If the nonfarm payrolls are less than expected, the economic development is not as good as expected, leading to a decline in the stock market. If the data is heavily inferior, it may cause panic in the stock market. Many investors panicked, causing the stock market to plummet.

But under exceptional circumstances, such as the current period of high inflation, good nonfarm payroll employment data is bad news for the stock market.

Why is Nonfarm Payrolls good news bad for the stock market in 2022?

In 2022, one of the more critical macroeconomic issues is the high inflation in the United States. To curb the inflation rate in the United States, the Federal Reserve needs to keep raising interest rates to curb people’s demand for goods and services.

Therefore, the Fed’s interest rate hike expectation is the main factor affecting the stock market trend. The higher the interest rate hike expectations, the worse it is for the stock market. Conversely, the lower the interest rate hike expectations, the better it is for the stock market.

Relationship between nonfarm payrolls and interest rate hike expectations

As mentioned above, the number of nonfarm payrolls is higher than expected, indicating that the U.S. economy is relatively strong and the labor market is tight. The Fed can raise interest rates boldly without worrying about causing an economic recession. That will raise market expectations for the interest rate level. So at this time, good payroll employment is terrible news for the stock market.

What else to watch besides nonfarm payrolls?

It is worth noting that the U.S. Bureau of Labor Statistics releases the unemployment rate simultaneously with payroll employment. Nonfarm payroll reflects the short-term job market growth, while the unemployment rate represents the long-term trend. The unemployment rate also has a significant impact on financial markets.

The high unemployment rate is bearish for the U.S. dollar and bullish for precious metals. The low unemployment rate is bullish for the U.S. dollar and bearish for precious metals. Like payroll employment, the impact of the unemployment rate on the stock market is more complicated. Still, the principle is the same as the impact of payroll employment on the stock market. Interested readers can think for themselves.

Conclusion

Through the analysis of this article, we can clearly know why the stock market plummeted when the U.S. Bureau of Labor Statistics released the nonfarm payrolls data last Friday. On December 2nd, the U.S. Bureau of Labor Statistics announced that the number of nonfarm payroll employment in November increased by 263,000, higher than the expected 200,000 and the previous value of 261,000. It shows that the U.S. economy is still relatively strong, and interest rate hike expectations have been strengthened after the data release. It directly led to the dive of U.S. stocks after releasing the nonfarm payrolls data.

If you want to know more about stock market analysis and strategies, you can visit Canny Trading.