Hey there, fellow investors. When it comes to the most profitable sectors in the U.S. stock market, semiconductors are definitely one of them. Will semiconductor stock make a comeback in 2023?

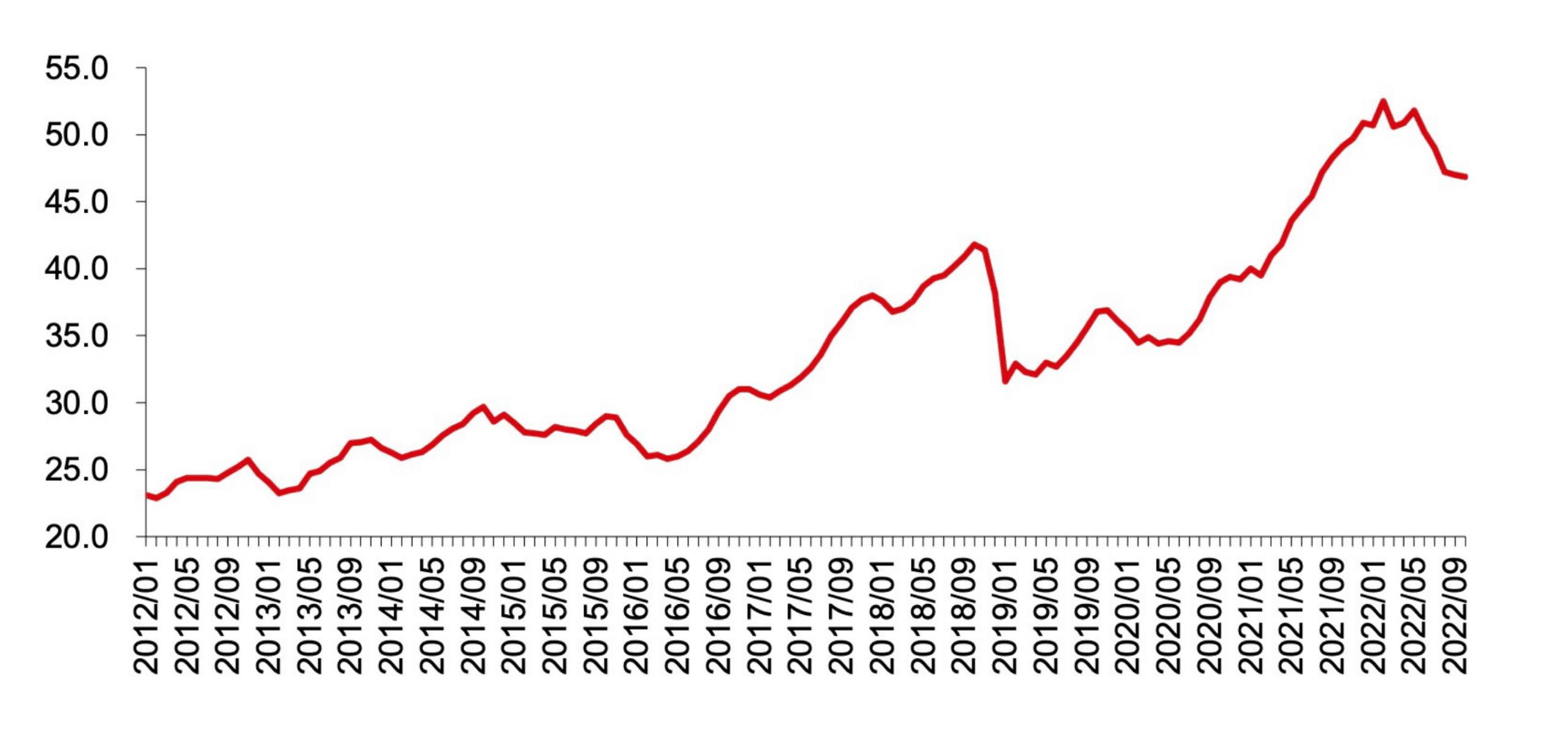

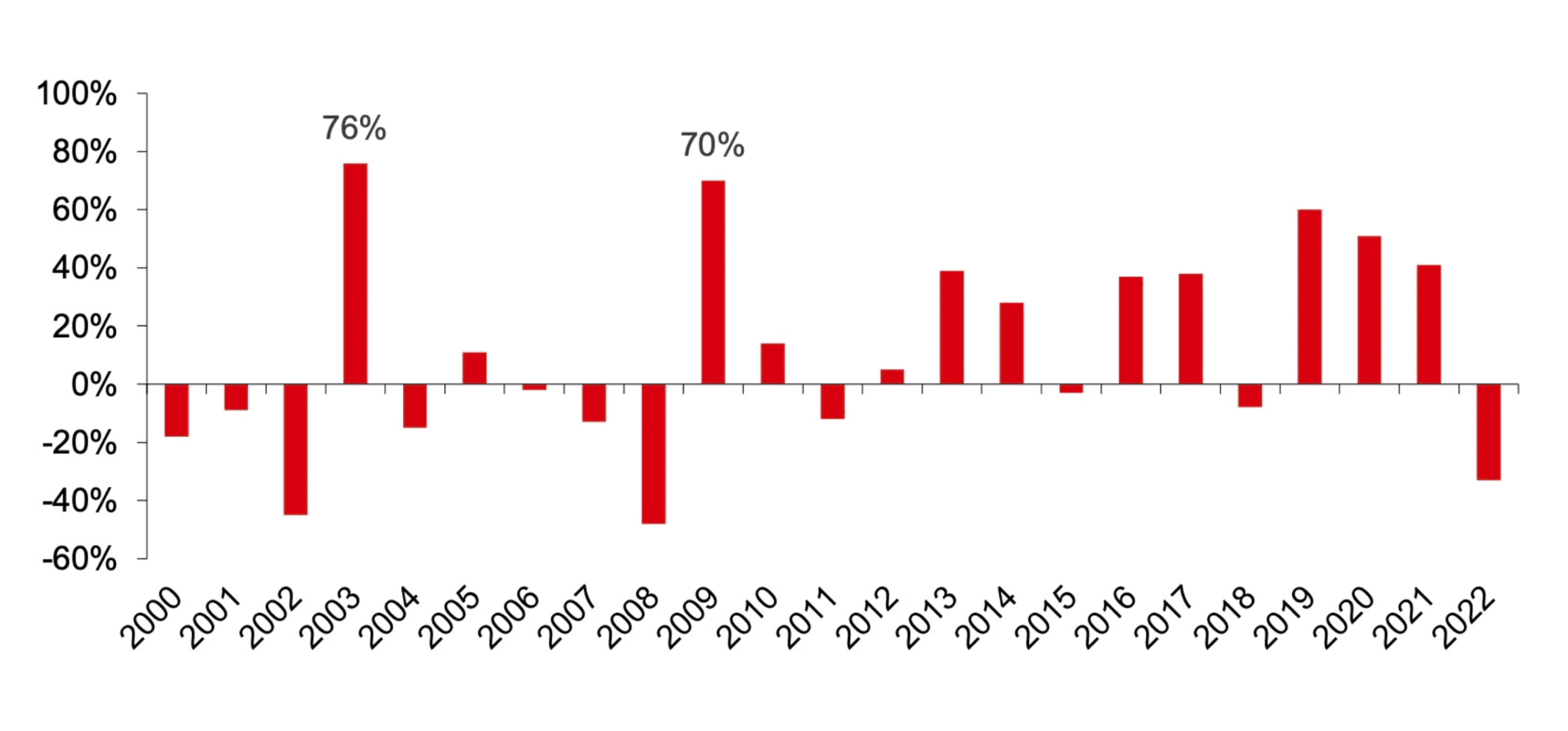

Over the past decade, the Philadelphia Semiconductor Index (SOX) has seen an impressive average annual return of 20.6%, significantly outpacing the S&P 500 (10.4%) and the NASDAQ (13.2%). But it’s not just the overall returns that catch our attention. It’s also the violent rebound following a downturn. Historically, the semiconductor industry tends to bounce back strongly in the second year following a significant drop. Will semiconductor stock follow the same pattern this year?

In this post, we’ll analyze industry trends, examine historical performance, and discuss potential opportunities and risks for semiconductor stocks in 2023. This post will provide valuable insights and information to help your decision-making. So, please grab a cup of coffee, sit back and let’s dive in together!

Semiconductor stock review for the year 2022

2022 was a tough year for the semiconductor industry. The market experienced a significant downturn. The Philadelphia Semiconductor Index (SOX), a representative industry index, saw a 33.4% decline over the year. A few key factors lead to this decline, including the industry’s cyclical downturn and the Federal Reserve’s rising interest rates.

One of the biggest challenges that the semiconductor industry faced in 2022 was the cyclical nature of the industry. Typically, a semiconductor cycle lasts for several years. As 2022 began, the industry was entering a downturn phase clearly. From this perspective, the decline of semiconductor stocks in 2022 is normal.

Despite the downward trend, there were a couple of short-lived rebounds throughout the year. In July, the market saw a brief uptick. It results from optimism in U.S. inflation. However, this optimism was short-lived as the market continued to decline. In October, the market experienced another brief rebound, primarily driven by the semiconductor industry’s inventory cycle and a peak in U.S. inflation data. But this rebound was also short-lived. Concerns about a recession in Europe and the United States and the FED’s hardline stance on monetary policy plagued the market.

Will semiconductor stock rebound in the short term?

Will semiconductor stock rebound in the short term? No one can give a sure answer. There are a lot of uncertainties. The stock prices have already bounced back a lot from their lows. Besides, the current macroeconomic environment is so unpredictable. Thus, making predictions becomes more difficult than when the stock hit its lowest in October last year. To build a reliable investment strategy, thoroughly considering today’s primary concerns and conflicting factors is a must.

Fundamental analysis

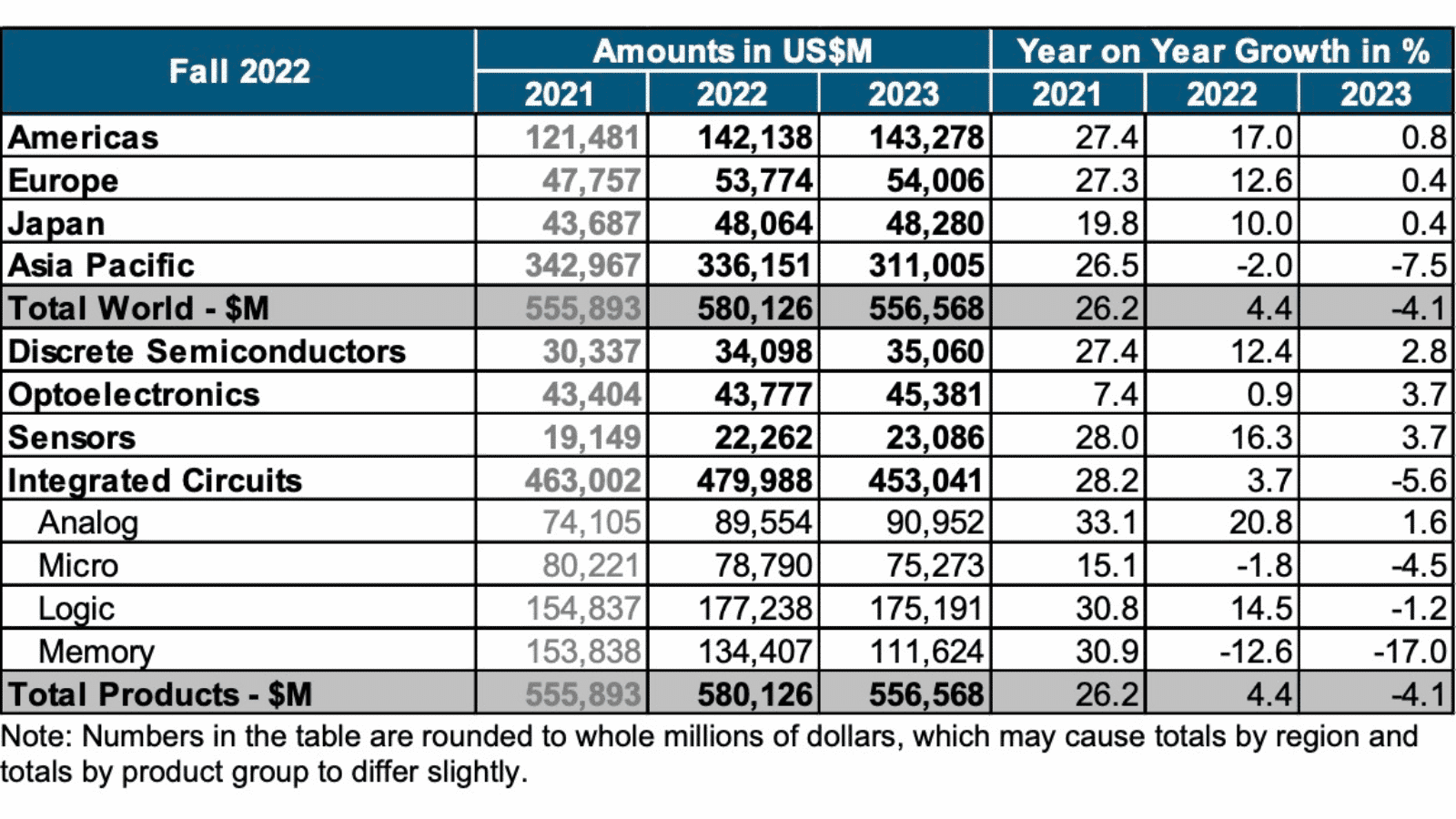

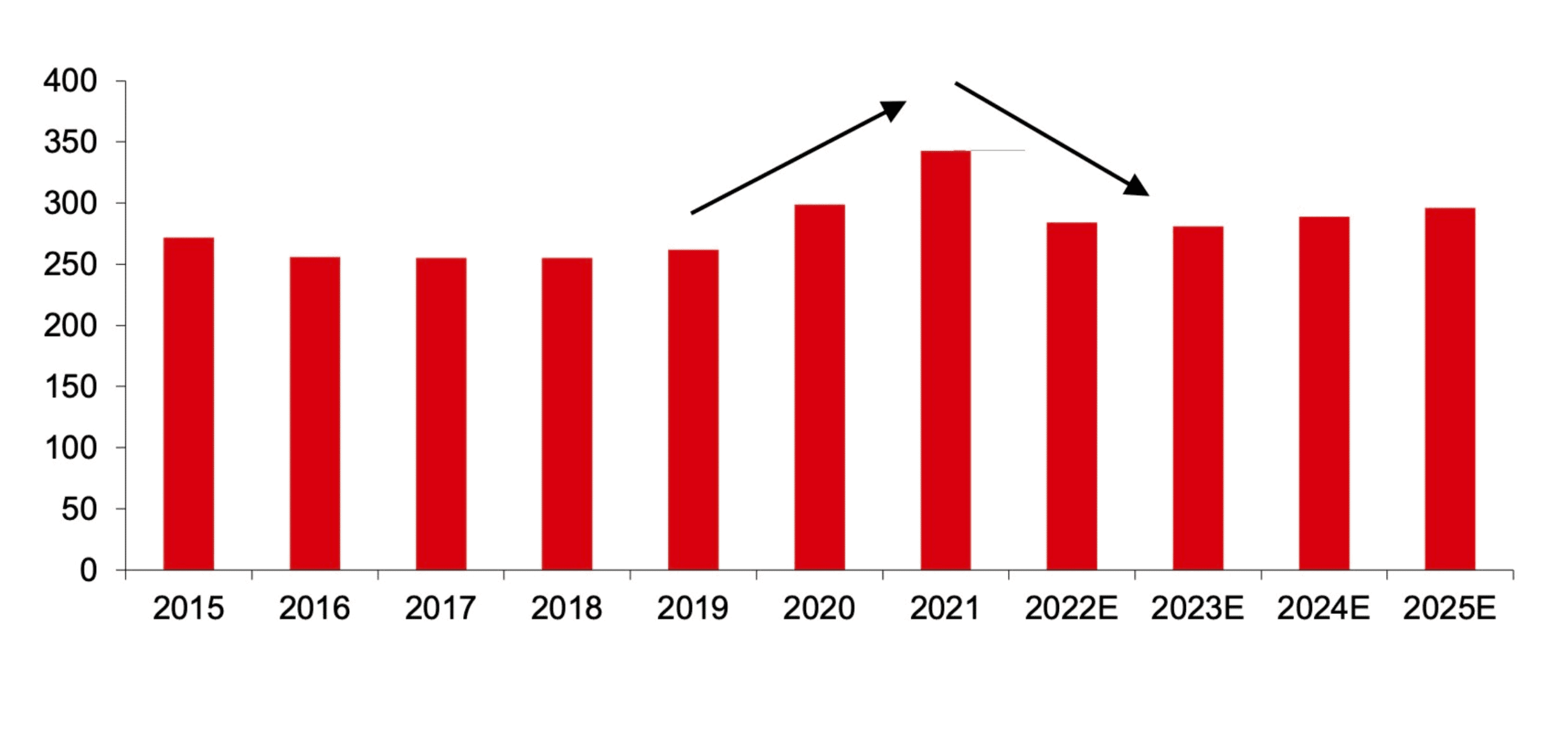

According to WSTS predictions, the global semiconductor market is expected to grow by 4.4% in 2022. In 2023, they predict the market will decrease by 4.1%. Considering the current risks of economic recession and tight monetary policies, the market may continue downwards.

Historically, semiconductor stocks’ price cycles were always before their performance cycles. But for sustained upward movement in stock prices, it is still required to wait for the bottom reversal of performance. Besides, the sector’s weak demand and high inventory levels bring uncertainty to the performance bottom.

Valuation analysis

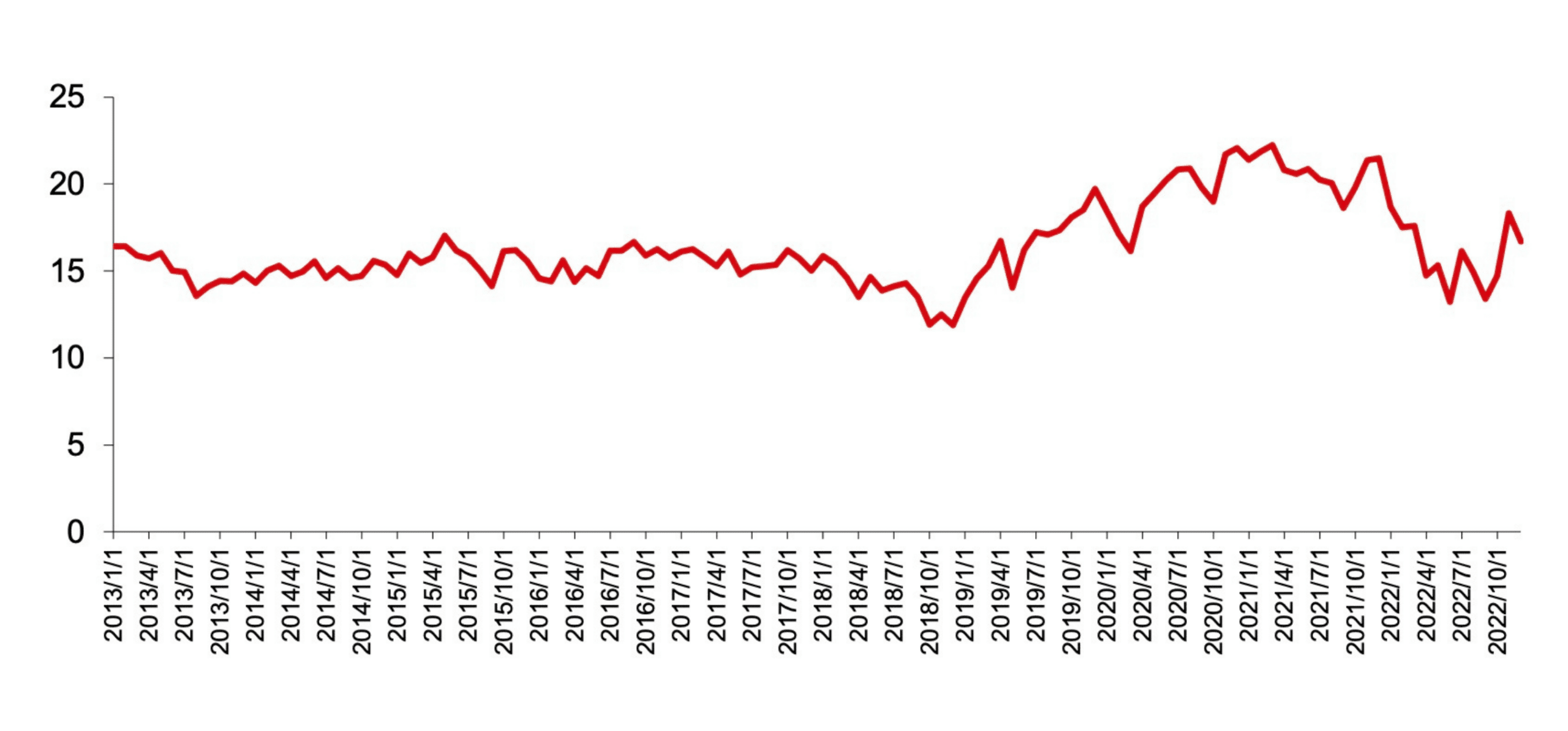

The P/E ratio is one of the most essential parts of valuation analysis. After the recent rebound, the current P/E ratio of the SOX is at 16x, significantly higher than historical lows in the range of 11-13x. Due to the high P/E ratio, the current 4.25% FED policy rate, and uncertainty in the sector’s clearance cycle, the current market valuations are obviously not attractive.

Demand analysis

The global semiconductor market is facing uncertainty due to macroeconomic factors, weak demand during the off-season, and deteriorating performance from some companies. Historically, the first quarter of one year is typically a weak period for semiconductor demand. Thus, the short-term oversupply situation is unlikely to improve.

Besides, the semiconductor demand is closely tied to the global economy. The current economic slowdown in the U.S. and Europe, coupled with sticky service inflation, is making investors hard to shake off their worries about the semiconductor industry’s demand in the short term. Meanwhile, the unexpected decline in the performance of companies like Micron is also shrinking the market’s risk appetite further. Therefore, if short-term macroeconomics continues to be chaotic, the U.S. semiconductor sector will likely remain volatile.

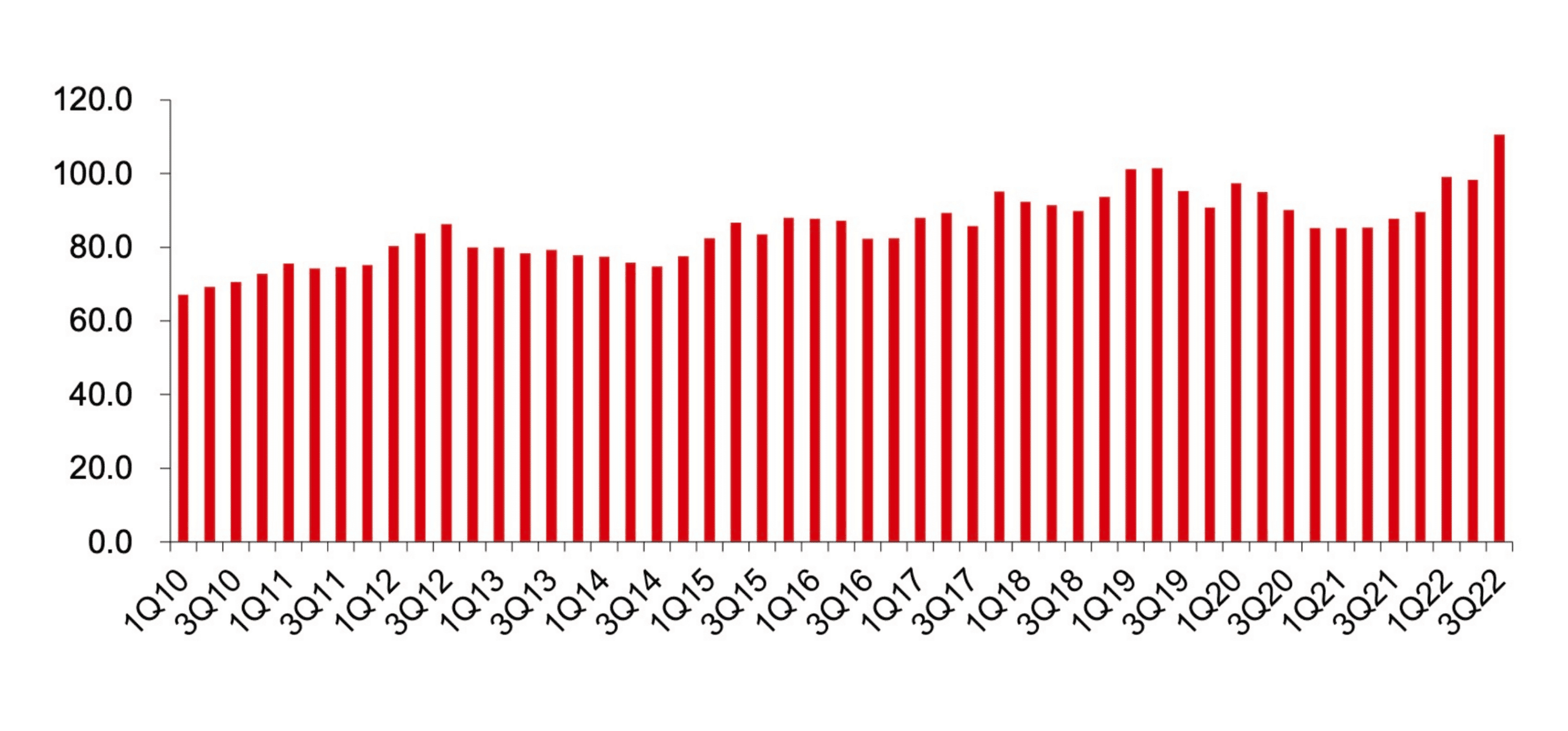

Supply analysis

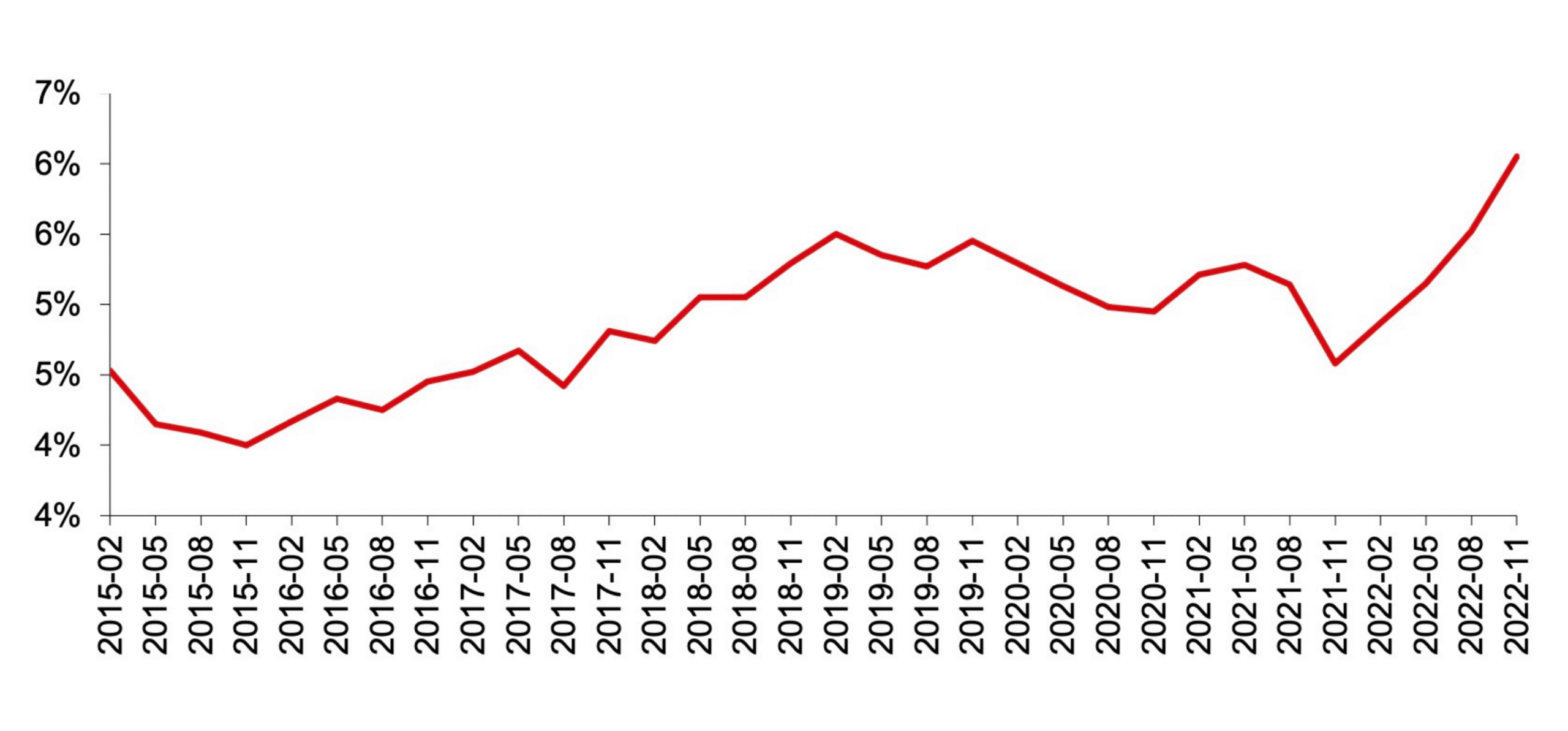

High inventory levels make it challenging to reduce stock and may cause short-term unpredictability in corporate operations. According to the financial statements of relevant companies and our calculations, the DOI (Days of Inventory) of U.S. semiconductor companies has reached 111 days in Q3 2022. The number is 30% higher than the past decade’s average level and the highest level in the past decade, also significantly higher than the level during the last 2018/19 downturn. High inventory levels and weak market demand may lead to slow inventory clearance.

Besides, some companies may adopt more aggressive business strategies to help them get out of trouble or to expand their market share. For example, Qualcomm might break the price agreement with MediaTek in the mobile chip market. They want to adopt more aggressive pricing strategies in the low-end 5G mobile chip market to speed up inventory clearance and expand market share. If more companies decide to take bold measures, they will significantly further lower the bottom of the performance cycle.

Short-term analysis conclusion

As mentioned above, the semiconductor industry faces many short-term challenges. For instance, weak demand and high inventory levels make it harder to clear stores. Some companies may have to adopt aggressive strategies to grab market shares.

Besides, the tight labor market and sticky service inflation constrain the Federal Reserve’s monetary policy. This quantitative tightening impacts the economy, leading to a decrease in market risk appetite. Only after clearer macro signals appear can we make a judgment. Alternatively, the trend will show up when people fully revise their earning expectations through the quarterly statements.

In a nutshell, the semiconductor sector is unlikely to have a trend of upward movement in the short term. The market will remain volatile.

Will semiconductor stock rebound in the mid term?

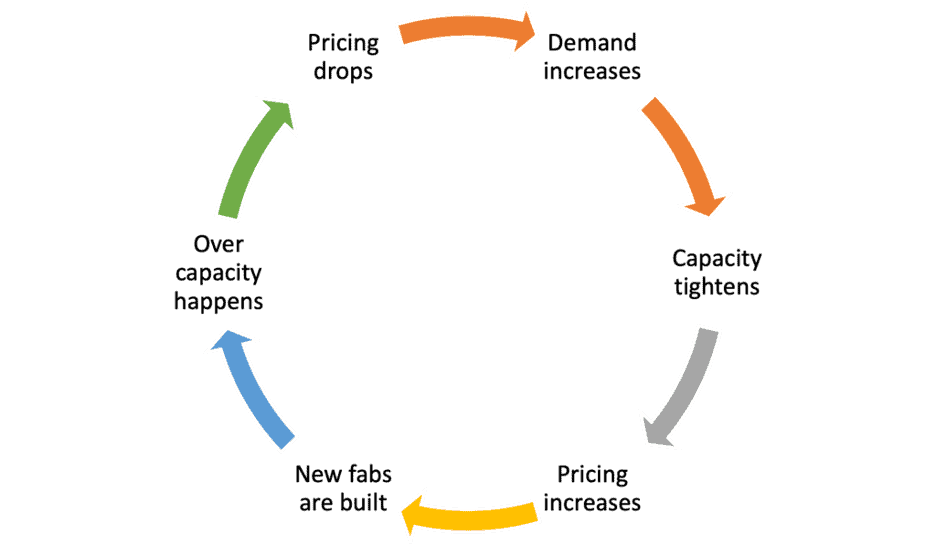

The semiconductor industry follows a basic pattern of cycles, repeating over and over again. Although each cycle may look different, the basic structure is similar. The industry is still facing various disruptions and constraints in the short term. Still, the supply and demand structure will eventually return to balance and enter a new upward trend after inventory is cleared out. Although the macro environment is complex and challenging to predict, everything will ultimately return to common sense. The Fed’s continuing interest rate hikes will not impact the economy for too long. The market’s judgment on the macro environment will gradually become clearer.

Based on the analysis of the short-term situation above, we will continue to follow the supply and demand logic and try to make mid-term predictions.

Right now, the global semiconductor inventory level has peaked in Q3 2022. Still, there are apparent differences in the inventory cycle and terminal demand among different sub-segments, such as logic, storage, analog, and discrete devices. The same situation exists in different end-markets like consumer electronics, data centers, cars, and industry.

The stocks of cyclical companies are sold in the order they were acquired. Based on the knowledge, subsegments that performed poorly in 2022 may recover first, while those that performed well in 2022 may enter a down cycle. Therefore, in the following content, we will analyze and discuss the mid-term running logic of subsegments starting from the downstream terminal market.

Consumer electronics semiconductor stock

The downstream inventory of the consumer electronics sector will likely return to normal levels around the end of Q1 2023. Since Q2 2022, upstream IC manufacturers, like Qualcomm, have been reducing downstream inventory levels through “sell-through” strategies. Thus, the inventory level of downstream companies is not high now. From Q2 2023, new demand from downstream will gradually recover the supply. At the same time, from the cycling perspective, the Android phone industry chain is expected to be more stable than the Apple industry chain. Therefore, starting from Q2 2023, consumer electronics semiconductor stocks, like Qualcomm, maybe a good investment option.

Data center semiconductor stock

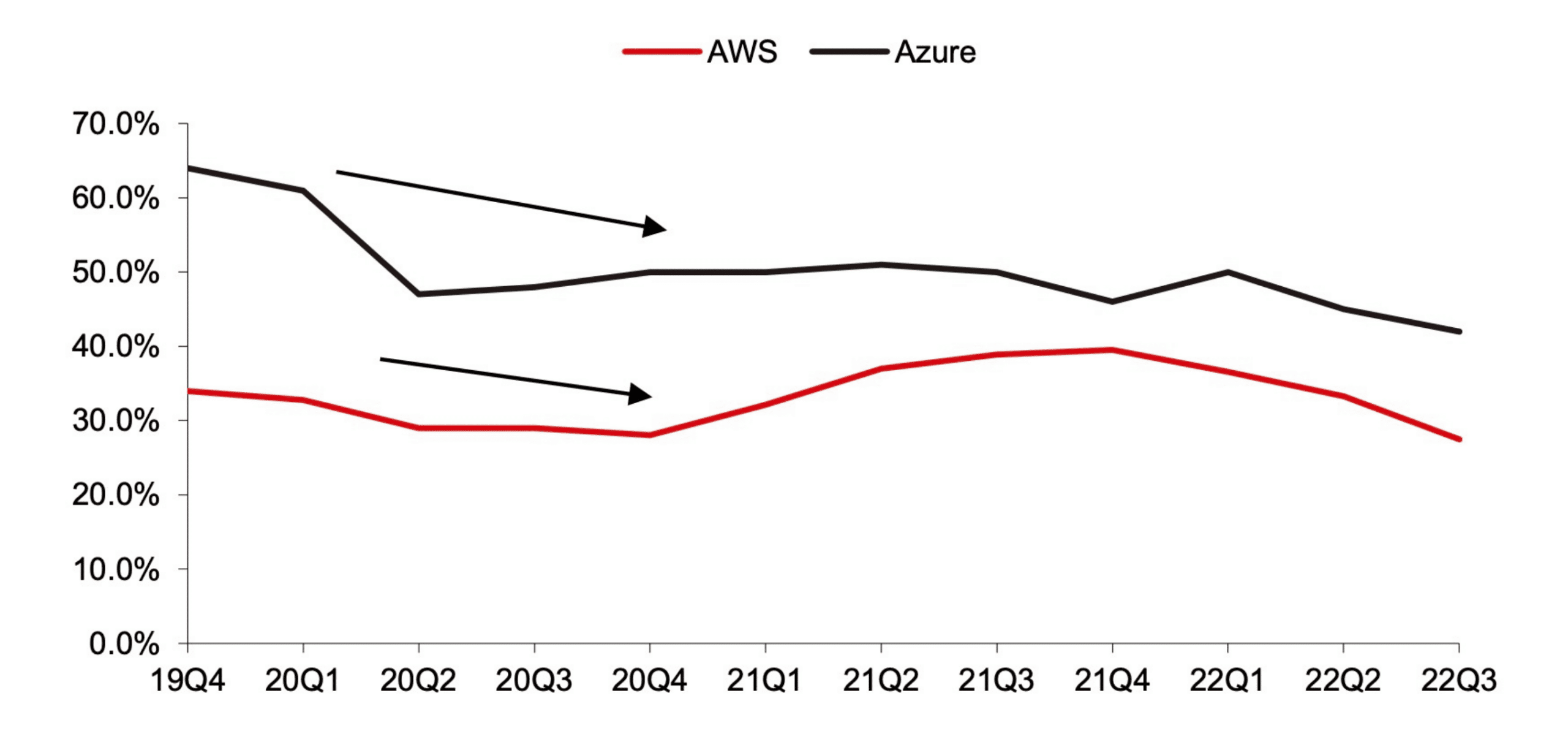

The demand for cloud providers is facing short-term adjustments. Due to the tight supply chain in the past two years and the support from cloud computing giants, the inventory level of data center semiconductors (CPU, GPU, etc.) stays at normal levels. However, since Q3 2022, market concerns about cloud computing giants have been increasing due to the rise in macroeconomic uncertainty. Considering the weakness of cloud computing demand in the short term, the demand growth rate for data center semiconductors will slow down.

Suppose there will be just a mild economic recession in the United States. According to historical experience, the demand adjustment generally lasts about three quarters. Intel’s new generation of server CPUs in the second half of the year may boost the market. China’s economic recovery will also provide support. Also, AMD may continue to grab market share in the server CPU market with its new product in the second half of 2023. For AI, which is still in a high-growth stage, the stimulation of demand for large models and the new product cycle continues to drive NVIDIA’s data center business.

Therefore, the second half of 2023 may be an excellent opportunity to invest in data center giants such as NVIDIA and AMD.

Automotive and industrial semiconductor stock

Be cautious with automotive and industrial semiconductor stocks in 2023. The global automotive semiconductor market remained strong in 2022, with an annual revenue growth rate of over 20%. However, this is primarily due to stockpiling in some areas. More evidence shows that industrial demand has weakened since Q4 2022.

Besides, current mortgage loan rates in Europe and America have reached a new high. As a rate-sensitive industry, high interest rates affect the automotive sector easily. Therefore, unless confident, it’s best to avoid investing in automotive and industrial semiconductor stocks in 2023.

Will semiconductor stock rebound in 2023? Historical perspective analysis

After a significant drop, there is usually a big rise. From the performance of the semiconductor index SOX in the past 25 years, we can find two typical patterns:

- The index usually sees a significant rise the year after a big drop. For example, 2002/2003 (-45%/+76%) and 2008/2009 (-48%/+70%). The SOX index fell 33% in 2022, so we can have a positive expectation in 2023;

- The rise from each cycle’s low to the next cycle’s high is significantly greater than the fall from the high to the low. During bull markets, the average increase of SOX is 123%.

Therefore, based on history, semiconductor stocks will have a strong performance in 2023.

Final words

The semiconductor industry is complex. Different sub-sectors experience different cycle and inventory patterns which impact stock prices directly. Therefore, to make an accurate stock price analysis, an analysis of the inventory cycles of each sub-sector is necessary. While the global semiconductor inventory peaked in Q3 2022, different sub-sectors are at different stages of the inventory cycle. As analyzed before, the consumer electronics sector might be the first to recover and could potentially see improvement as early as Q2 2023. Close behind is the data center sector, which may recover in mid-2023. However, the automotive and industrial sectors may face challenges in 2023.

Besides, we can gain some insights from history. Historically, SOX generally has a significant rebound after a period of decline. Therefore, we can answer your question, “Will Semiconductor Stock Rebound in 2023?” now. Although the U.S. semiconductor market may still face many disturbances in the short term, from a medium-term perspective, the current market opportunities and subsequent upward space will be attractive enough. I hope you enjoy this post~