Options trading involves several vital elements that traders need to focus on, including exercise price, buyer’s bid, seller’s ask, price fluctuations, trading volume, and open interest. Among them, open interest is often the most confusing concept. Understanding what it means in options and how it differs from trading volume is often challenging. In this discussion, we’ll break down the concept to help you gain a better understanding.

What is “Open Interest” in Options Trading?

When you trade an options contract, you either create a new position or close an existing one. When placing an options order, you need to specify whether you’re buying or selling the options to “open” or “close” a position.

Open interest is the total number of outstanding options that have been purchased but not yet closed by the options buyer or sold but not yet closed by the options seller.

If more options contracts are traded as “open” than “close,” the open interest will increase. Conversely, if more options contracts are traded as “close” than “open,” the open interest will decrease.

Why Do Options Have Open Interest While Stocks Don’t?

Investors who have not dealt with derivatives are usually unfamiliar with open interest, as it is a term specific to options and futures contracts. So why do options have open interest while stocks don’t?

Unlike stocks, the number of outstanding options contracts is not fixed and can vary based on the demand. There is also no upper or lower limit to the number of options contracts that can be traded. This means that specialized Options Clearing Company (OCC) needs to keep track of the outstanding contracts on the current market as open interest.

In the stock market, outstanding shares are similar to open interest in options. However, once a company has issued its shares, the number of shares remains constant. Therefore, there’s no need to keep track of “open interest” in the stock market.

The Difference Between Open Interest and Trading Volume

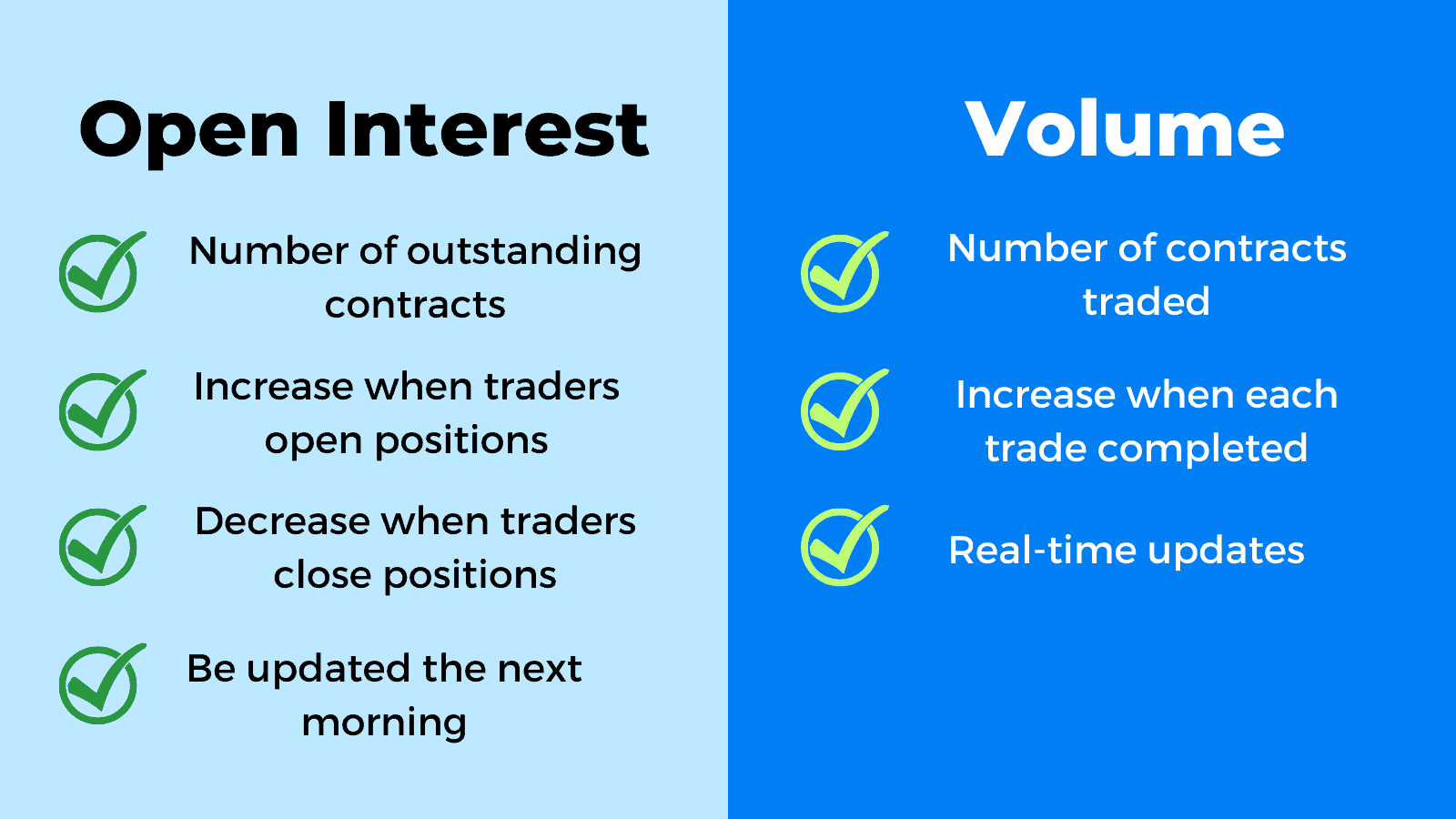

Many people confuse open interest with trading volume. Although both provide information on market liquidity and market participation, they are different.

In simple terms, options trading volume refers to the number of contracts traded during a particular period. On the other hand, open interest refers to the number of contracts that have not yet been settled and are still active.

Let’s take an example of an options market to make it easier to understand.

Suppose there are only two options traders, A and B, and no outstanding options are available. This means that the open interest is currently at 0.

On the first day, A buys 10 call options from B. A total of 10 options are traded in the market. This means the trading volume for the first day was 10. Since all 10 options are still active, the open interest is also 10.

The second and third days pass by, and neither A nor B trade any options. As a result, the trading volume becomes 0. However, since A’s call options are still active and haven’t been closed, the open interest remains at 10.

On the fourth day, A decides to sell 3 out of the 10 options back to B to close out their position. 3 options were traded that day, making the trading volume for that day 3. With 7 options remaining (A’s 7 call options), the open interest drops to 7.

Finally, on the fifth day, A sells the remaining 7 options back to B to close out their position. A total of 7 options are traded that day, making the trading volume 7. Since no active options are left in the market after this day, the open interest becomes 0.

Please note that while you can track the volume of any given option in real-time during a trading day, you cannot track open interest in real-time. The open interest is a lagging number updated by the Options Clearing Corporation (OCC) the following morning. The open interest figure will remain unchanged during the trading day.

The Meaning of Open Interest in Options

Checking Liquidity

One of the most straightforward functions of open interest is that it helps you determine how liquid an option is. Simply put, the more open interest there is for a particular option, the more liquid it is. That means buying and selling the option at a fair price is easier. On the other hand, if there’s low open interest, it may be harder to find a buyer or seller, and you may have to accept a less desirable price.

For example, if you hold 50 units of a certain option, but the contract has only 100 units of open interest, it will be difficult to sell your options at an ideal price when you want to close your position. This indicates that the option has poor liquidity. However, if you hold 50 call options of Tesla with a strike price of $210, there is a corresponding open interest of 28,600 units. You can easily sell them at the market price.

Tracking the Money

As shown in the chart, the open interest of the call option for Tesla with a strike price of $210 is 28,600 units today. If this number was only 10,000 units yesterday, it means that today many people have bought a large number of these call options. These buyers will profit only if the Tesla stock price rises above $210. Otherwise, these call options will become worthless. It’s a bit of a gamble, but clearly, a lot of people are feeling optimistic about Tesla’s prospects.

Therefore, open interest can also give you insights into the fund flow. If the open interest for a call option suddenly spikes, it may indicate that investors are bullish on the stock and expect the price to rise. Conversely, if the open interest for a call option drops, it may be a sign that investors expect the stock price to fall or trade sideways.

Predicting the Volatility

Let’s take Tesla as an example again. Suppose the open interest of Tesla options usually stays at a few thousand units. Over time, more and more people are getting interested in Tesla options, and the open interest increases continuously to tens of thousands of units. What does this all mean?

Well, it’s a good indication that people expect something to happen with Tesla’s stock price in the near future. Maybe they think it’s going to go up, or perhaps they think it’s going to go down – either way, the increased activity in options suggests that investors are anticipating some kind of movement.

Thus, by tracking the open interest, we can get a sense of the market and use that information to inform our own trading decisions.