Trading meme stocks has taken the internet by storm since 2021. It provides traders and investors with a unique form of entertainment while providing a glimpse into market sentiment. GameStop, Dogecoin, and AMC are prime examples of how a social media post can cause a financial frenzy.

In this post, we’ll dive into the world of trading memes and their impact on the market. Although the volatility is high and the hype surrounding these stocks is fleeting, there are tips and strategies for making informed investment decisions.

The story of meme stocks

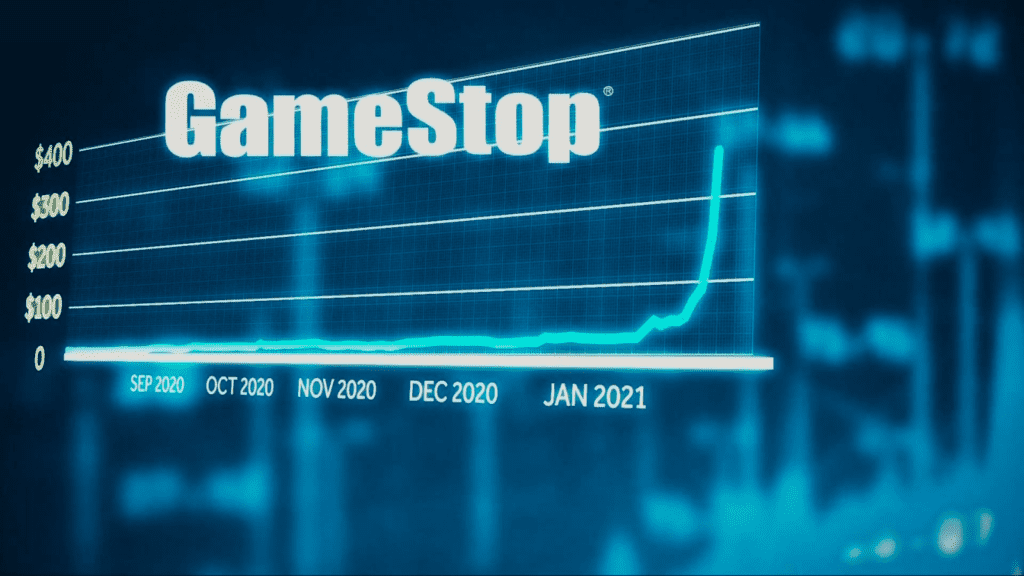

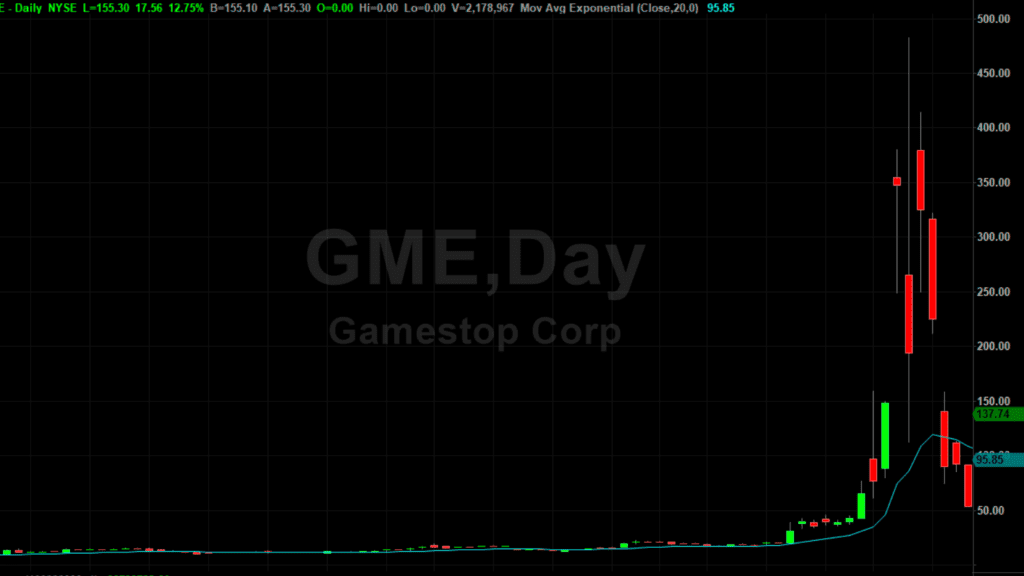

The “meme stock” story began on Reddit’s r/WallStreetBets in early 2021. A group of amateur investors discussed GameStop, a struggling brick-and-mortar video game retailer heavily shorted by hedge funds. They saw potential and began buying shares, causing a “short squeeze” that forced hedge funds to cover their short positions and buy shares at a higher price. This caused the stock to soar even more. GameStop’s stock price went from $20 to $347 in just a few weeks. Hedge funds lost, and Redditors gained.

The event brought attention to the power of social media and online communities to influence the stock market and the potential risks and rewards of investing in meme stocks. It also prompted a review of stock trading regulations. The event showed the power of retail investors, who giant financial institutions often overlook. Still, their collective buying power can drive the market, as also the power of online communities and how they can influence the market. The GameStop short squeeze also raised questions about the role of hedge funds and their impact on the market.

List of top meme stocks

- GameStop (GME) – Video game retailer, known for its brick-and-mortar stores and various games, consoles, and accessories.

- AMC (AMC) – Movie theater chain, located in multiple countries, offers its customers a wide range of entertainment options.

- Blackberry (BB) – Mobile technology company, a past leader in the smartphone market, famous for its secure communication and enterprise services.

- Nokia (NOK) – Telecommunications equipment provider, founded in 1865, provides innumerable services such as mobile networks and advanced technologies.

- Express (EXPR) – Retail clothing company, targeting the young professional demographic, offers a wide range of fashionable clothing and accessories.

- Koss (KOSS) – Headphone manufacturer, founded in 1958, known for its high-quality audio products and plenty of options for music lovers.

- Bed Bath & Beyond (BBBY) – Home goods retailer, offers a wide selection of products for the home, such as bedding, bath, kitchen, furniture, etc.

Advantages of trading meme stocks

One of the key advantages of meme stocks is the potential for very high returns in a relatively short period. The viral nature of memes on social media can create a self-fulfilling prophecy, where a surge in buying activity drives up the stock price. The high returns attract more buyers, further driving up the price. This creates a snowball effect that can result in significant gains in a short period of time.

Another advantage of meme stocks is the opportunity to own a stake in a new and potentially lucrative investment idea before the rest of the market catches on. As a community of individual investors coordinates the buying and selling activity on social media platforms, they can identify and act on new investment ideas before they become mainstream. It could be a unique opportunity to get in on the ground floor of a promising investment.

Furthermore, the rise of meme stocks is indicative of a shift in the investing landscape, as the younger generation raised on social media is entering the market. This demographic is known to be tech-savvy and comfortable with online platforms, making them more inclined to share and act on investment information on social media. As a result, the meme stock movement could have staying power, offering continued opportunities for investors.

Disadvantages of trading meme stocks

The trend of skyrocketing stock prices, as seen in meme stocks, may not be a sustainable phenomenon in the long term. As traders return to work and spend less time on social media platforms, the buying activity that drives up stock prices will not be sustainable. The prices may plummet just as quickly as they rose. This can lead to significant losses for investors who had bet on the trend continuing.

Additionally, like other highly volatile investments, such as cryptocurrencies, meme stocks have a high degree of price unpredictability. It is supply and demand that drive short-term trends. Thus, price moves can be highly volatile and lead to failure for investors. The high level of volatility can make it challenging for investors to make rational decisions. If the price moves against their position, significant losses happen.

Furthermore, some meme stocks’ value is not based on the company’s financial performance or growth prospects. Their price has little relationship with its fundamentals. This can make returns highly unreliable, as they can suddenly reverse course, causing the company to lose its luster among individual investors. Significant losses would happen to those who had invested in the stocks.

Tips for trading meme stocks

Researching meme stocks can be tricky, as they are often associated with struggling companies. The hype surrounding them can be short-lived. However, there are several key factors to consider when studying this kind of stock.

Pay attention to social media

First, pay attention to social media platforms like Reddit and Twitter. For meme stocks, high activity on social media is a fundamental factor in their rapid rise. Experienced meme investors often share their thoughts and emotions about the market there. Thus, these platforms can provide valuable insights into the market. You can get information on which stocks are generating buzz and which are likely to be the focus of collective buying.

Look for stock performance

Second, look for patterns and volume in the stock’s performance. Sometimes, just an upward trend or a sudden spike can indicate that the stock is gaining momentum. Additionally, carefully monitor the stock’s trading volume. If there is a sudden increase in trading volume, it can indicate a high level of interest in the stock.

Diversify your portfolio

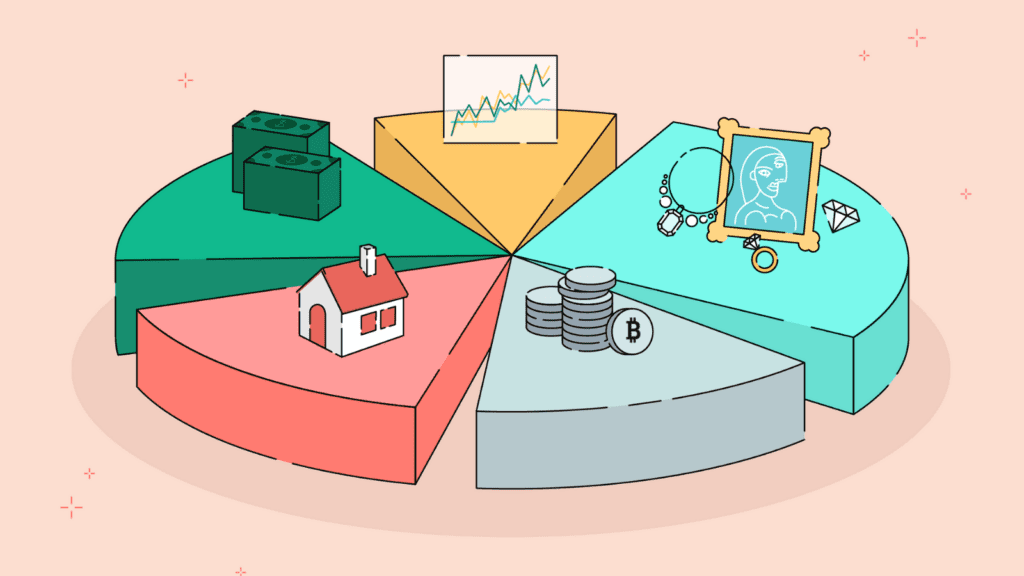

Holding a large position in meme stocks is extremely risky and unwise. Do not put all of your eggs in one basket. You can diversify your portfolio by spreading your investments across different types of stocks or even other types of financial instruments. For example, when you buy meme stocks, you can also buy some value stocks like McDonald’s, Walmart, etc. This way, if your meme stocks are performing poorly, your overall portfolio will not be affected as much.

Be careful of the risk

Finally, please be aware of the risks associated with trading meme stocks. Do not invest more than you can afford to lose. Investing in meme stocks should be approached with caution. Trading meme stocks is a high-risk investment, especially for stock market novices. To reduce risk, you can use special orders such as stop-loss or take-profit orders. Always carefully research and consider the risks before making any investments.

Final Words

Trading memes can be a fun and exciting way to invest, but always remember that it’s also a highly risky endeavor. To invest in such risky assets, you need to stay informed, be prepared for volatility, and have a risk management strategy in place.

The market is unpredictable, and past performance doesn’t guarantee future results. Please stay humble, as it’s easy to get caught up in the hype and make mistakes.

In the end, if you decide to invest in meme stocks, be aware of the risks and rewards that come with it and approach it with caution and a well-informed perspective. Happy trading!