Covered call is a smart technique to make extra money from long-term investments. Basically, it involves owning stocks and simultaneously selling call options on the same underlying stocks. However, this method requires some money upfront, since you need to hold at least 100 shares to sell the call options. If you’re dealing with cheaper stocks, then it’s not a big deal. But if you’re working with pricier stocks like TSLA or QQQ, you might need more than $10,000 to buy 100 shares, making it a bit expensive. So, if you’re an investor with limited funds, the “poor man’s covered call” strategy can be a better option.

What is Poor Man’s Covered Call Option Strategy?

The poor man option strategy involves buying a long-term call option contract while simultaneously selling a short-term call option contract on the same underlying asset. This strategy is similar to the vertical/spread options strategy, but the expiration dates of these two call options are different.

Related Reading: Covered Call Options Strategy – Deep Analysis

How to Do Poor Man’s Covered Call?

First, you should buy long-term call options. It’s best to choose “deep in the money” options with a Delta value typically of 0.8 or higher. This means the option’s strike price is significantly lower than the asset’s current market price.

Because the option’s delta is close to 1, the option’s price will move in lockstep with the underlying asset’s price. This lets you profit from the rise in the asset’s price.

Next, you need to sell short-term out-of-the-money call options periodically. It would be best if you chose options with a closer expiration date and a strike price that is 5-10% higher than the current market price of the underlying asset.

You keep the premium without any cost if the option is not exercised before expiration. Then, you can continue to sell short-term otm call options periodically to increase your income before your long-term call option expires.

Example of Poor Man’s Covered Call

Let’s say you’re interested in investing in ABC stock, which is currently trading at $50 per share. You believe the stock will rise over the long term. But $50 per share is too expensive for you.

Besides, you also want to make some money in the short term. That’s where the poor man’s covered call strategy comes in.

The first step is to buy a deep-in-the-money call option with a strike price of $30 and an expiration date of one year from now. This gives you the right to buy the stock at $30 per share for the next year. You’ll pay around $25 per share for this option, or $2,500 for 100 shares.

Next, you sell a short-term call option with a strike price of $55, which expires one month from now. This obligates you to sell the stock at $55 per share if the stock price rises above that level by the expiration date. For selling this option, you’ll get paid a premium of, let’s say, around $3 per share or $300 for 100 shares.

Now, what could happen? If the stock price stays below $55 per share by the expiration date of the short-term call option, you get to keep the $300 premium, and you can sell another short-term call option. You can repeat the process to generate more income as long as your long-term call option hasn’t expired.

But what if the stock price rises above $55 per share? In this case, the short-term call option will be exercised, and you’ll have to sell the stock at $55 per share. However, you still have the long-term call option, which lets you buy the stock at $30 per share. This means you’re protected against further upside in the stock price.

Lastly, if the stock price drops below $30 per share, the long-term call option will lose value. You might not be able to sell another call option at a higher strike price. But still, you would keep the premiums from selling the short-term call options.

Poor Man’s Covered Call vs Covered Call

The poor man option strategy differs from the traditional covered call strategy in that it doesn’t require the purchase of at least 100 shares of stock. Instead, it utilizes long-term call options.

The rest of the strategy is similar to the traditional covered call strategy, which involves continuously selling short-term call options.

By using long-term call options, investors can reduce their upfront costs.

However, long-term call options can be more volatile and may expire before the underlying stock has a chance to appreciate in value.

Lower Capital Requirement

The price of options is much lower than stocks. Therefore, even if buying deep itm call options, the poor man option strategy is still more affordable than normal covered calls. Let’s continue to illustrate this with the previous example.

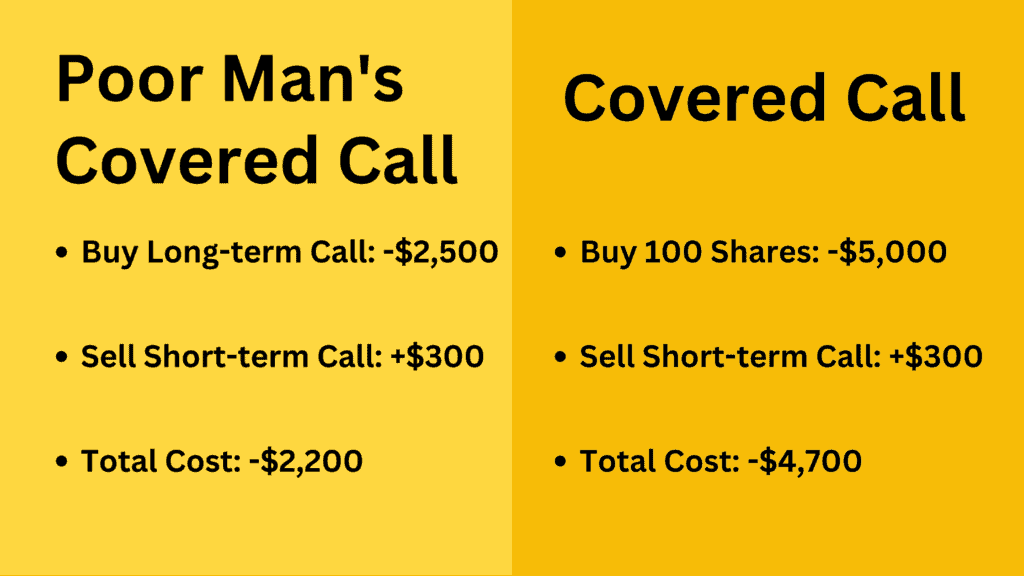

The cost of implementing the poor man’s covered call strategy would be as follows:

Buy a deep-in-the-money call option with a strike price of $30 and an expiration date of one year from now, which costs $25 per share or $2,500 for 100 shares.

Sell a short-term call option with a strike price of $55 and an expiration date of one month from now, which generates a premium of $3 per share or $300 for 100 shares.

The net cost of this strategy would be $2,200 ($2,500 for the long call option minus $300 for the short call option premium).

On the other hand, if we implement a traditional covered call strategy, we would need to buy 100 shares at $50 per share for a total cost of $5,000. Then selling the short-term call option generates $300.

The net cost of this normal covered call strategy would be $4,700 ($5,000 for the stock purchase minus $300 for the short call option premium).

Higher Risks

With options instead of stocks, the poor man option strategy can potentially bring greater risk. If the stock price drops significantly and the long-term call option expires worthless, the investor could lose most of their initial investment.

In the scenario above, if the stock price drops to $25 per share by the expiration date of the long-term call option, the option will be worthless, and the investor will lose the entire $2,500 they paid for it. Additionally, because the long-term call option has expired, the investor no longer has the option to wait for a potential rebound.

On the other hand, with a regular covered call strategy, even if the stock price drops to $25 per share, the investor would still own the stock. They could continue holding the stock and wait for a rebound.