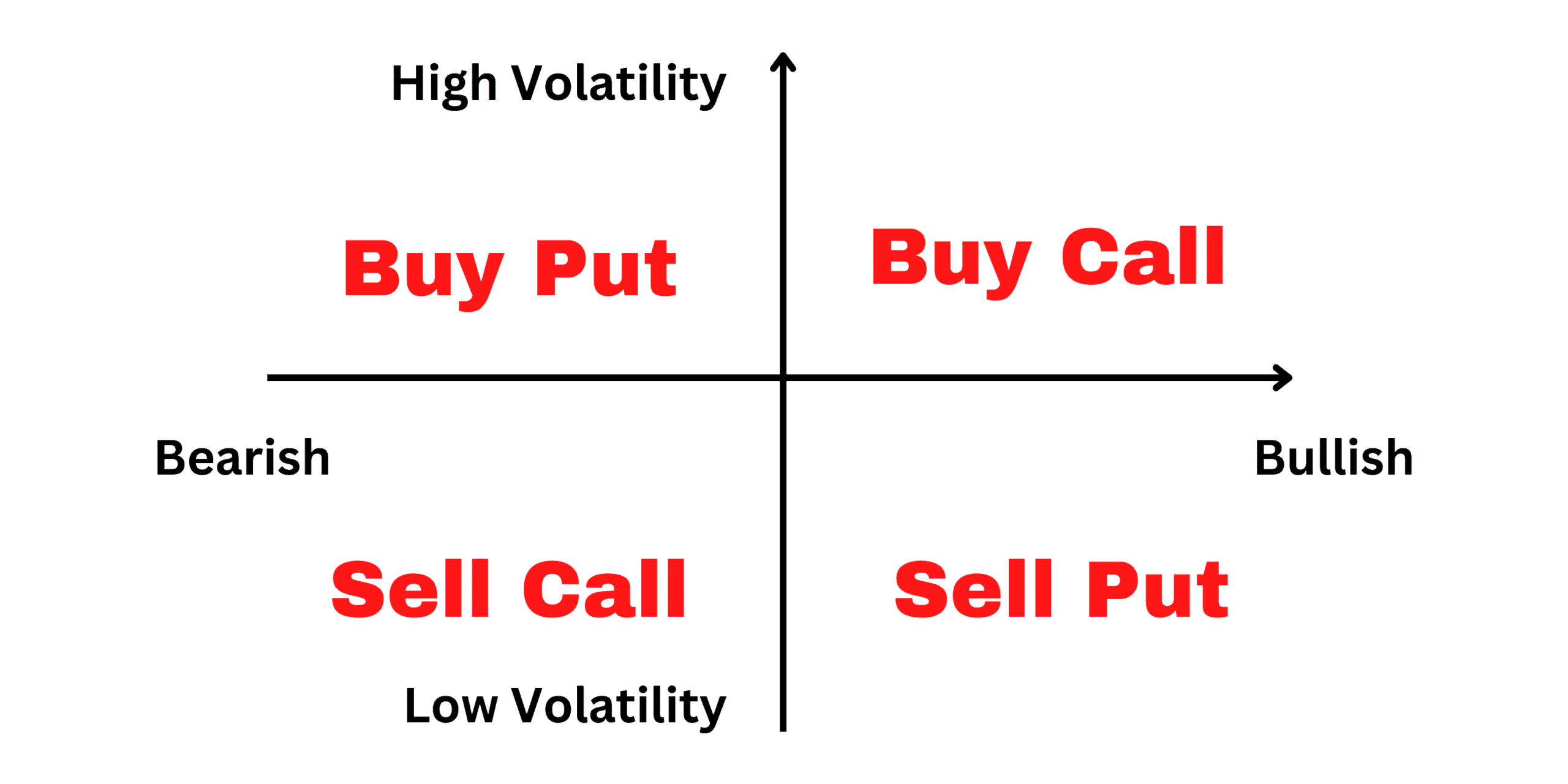

In the previous post, we have already understood the definition and principle of options. However, when you start options trading for the first time, you may encounter problems. Which one should I choose between a call and a put option? Should I buy or sell an option?

Basically, you have four strategies: buying call options, selling call options, buying put options, and selling put options. In this article, I will teach you how to choose among these four strategies step by step.

Step 1: Predict the direction of the market

The most important thing about options trading is to consider the future trend of the underlying securities price and make profits from this trend. Even if the stock price falls, you can still use options trading to make lots of money!

The characteristic of investing in options is that the more accurate your judgment on the direction is, the higher the income you will get.

For example, if you think a house price will rise, you can use a strategy such as buying a call option or selling a put option (these two strategies represent the same idea: you will get high profits from the house price rising). On the contrary, if you believe the house price will fall in the future, you can sell a call option or buy a put option (similarly, these two strategies represent the same idea: you will get high profits from the house price falling).

Step 2: Analyze the market volatility

Besides the market’s direction, volatility is also crucial in options trading.

Market volatility is the speed of the rise or fall of the underlying security price. For example, suppose Jack bought an option of stock A (the stock price is 5 dollars at this time), which would expire in June with a premium of 5 dollars, and the strike price is 20 dollars. Stock A did rise but only rose to 12 dollars in June. If Jack exercised the option, he would lose 13 dollars (the current price of 12 dollars – the exercise price of 20 dollars – the premium of 5 dollars). To reduce the loss, Jack could only “tear up” the option contract tearfully, losing 5 dollars in premium.

However, Jack was stubborn and believed the stock market was bullish and stock B would rise sharply. Then he used 5 dollars (the premium) to buy an option of stock B (the stock price is 15 dollars at this time), which would expire in September with a strike of 20 dollars. Finally, in September, stock B skyrocketed to 28 dollars, and Jack exercised the option, earning 3 dollars (the current price of 28 dollars – the exercise price of 20 dollars – the premium of 5 dollars).

Summary: It can be found here that although Jack’s market judgment is correct, he lost 2 dollars (3 dollars – 5 dollars) in September. This is because Jack misjudged the rising speed of stock A, which led to a loss of 5 dollars due to time value decay when he bought the option of stock A for the first time.

Therefore, it is critical to analyze the level of market fluctuations. Especially for option buyers because the premium paid by the buyer has a time value decay. If the market volatility prediction is not in place or the deviation is too large, even if you predict the direction right, it may cause losses.

Step 3: Decide on an options trading strategy

If you can predict the market trend’s direction and the rising or falling speed. Congratulations, you are one step closer to success.

According to the analysis of Step 1 and Step 2, the long position can be divided into the fast rise and slow rise; the short position can be divided into fast fall and slow fall.

If the underlying price will rise quickly, you should choose to buy call options instead of selling put options. Similarly, if the underlying price will fall quickly, you should choose to buy put options instead of selling call options. The logic behind these decisions is explained below:

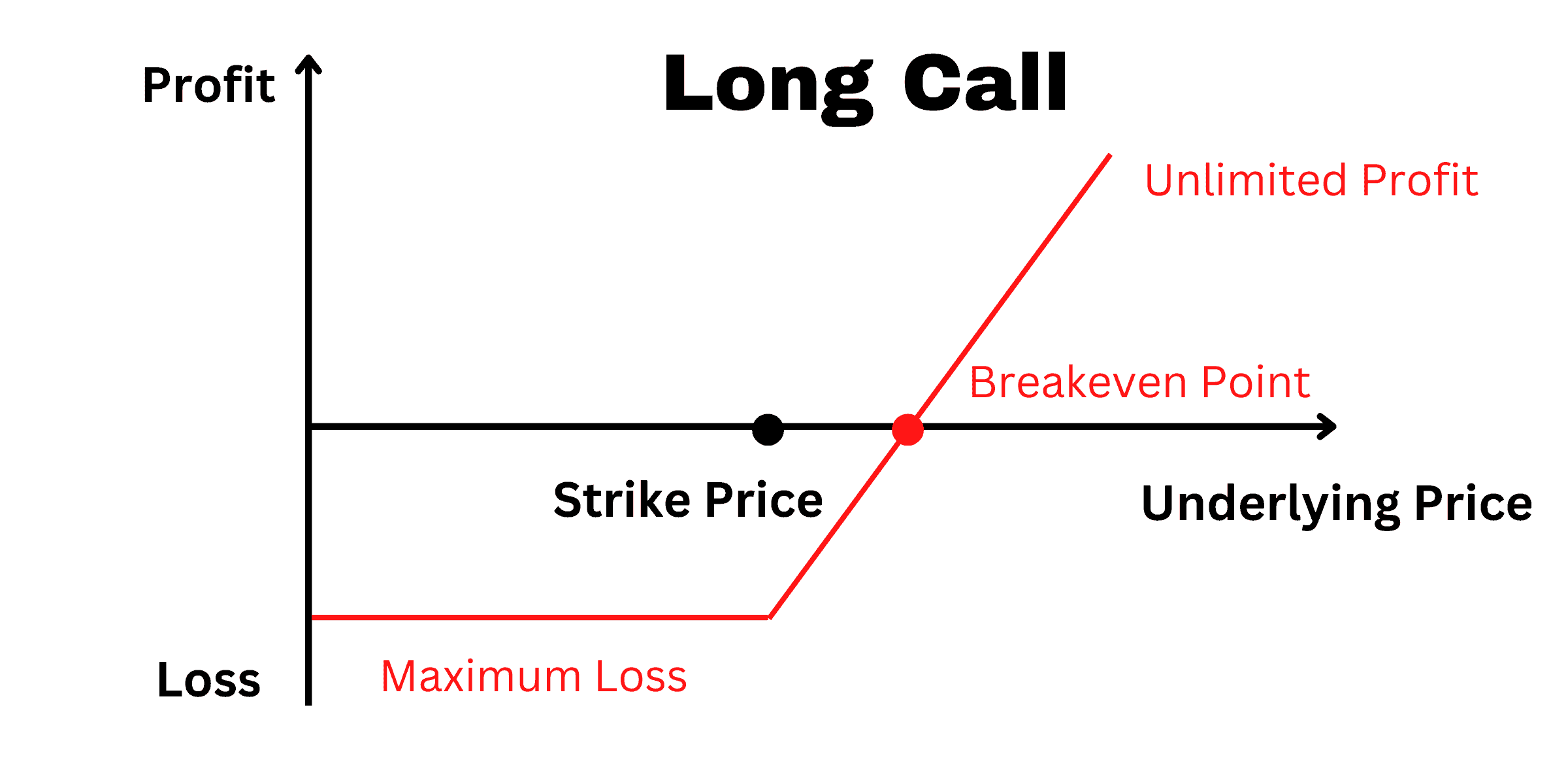

Buying call options

The suitable timing for buying call options:

1. The price of the underlying securities is expected to rise sharply in the future.

2. Market volatility is expanding (not applicable to market conditions where market volatility is narrowing).

The figure below shows the profit and loss of the buying call option strategy at maturity. The loss from buying call options is limited, and the maximum loss is the paid premium, but the profit is unlimited. It rises as the price of the corresponding underlying securities rises.

For example: Suppose Jack thinks stock B will be bullish and believes it will rise rapidly, so he buys a call option of stock B with a premium of 5 dollars, and the strike price is 20 dollars. Then the stock price of B stock skyrockets to X dollars. At this time, Jack will earn X-25 dollars (the current price of X dollars – the exercise price of 20 dollars – the premium of 5 dollars). The higher the X stock price, the more money he can make, and there is no upper limit.

If the price of stock B rises to 1,000 dollars, Jack will earn 975 dollars, which is 195 times (975 ÷ 5). Thinking about it makes me excited. The biggest loss is Jack “tears up” the option contract tearfully, which results in a loss of 5 dollars in premium.

Advantages of buying call options:

Investment in call options is risky, but the risk is fixed. The biggest risk is the loss of the premium, but there is no upper limit on the return.

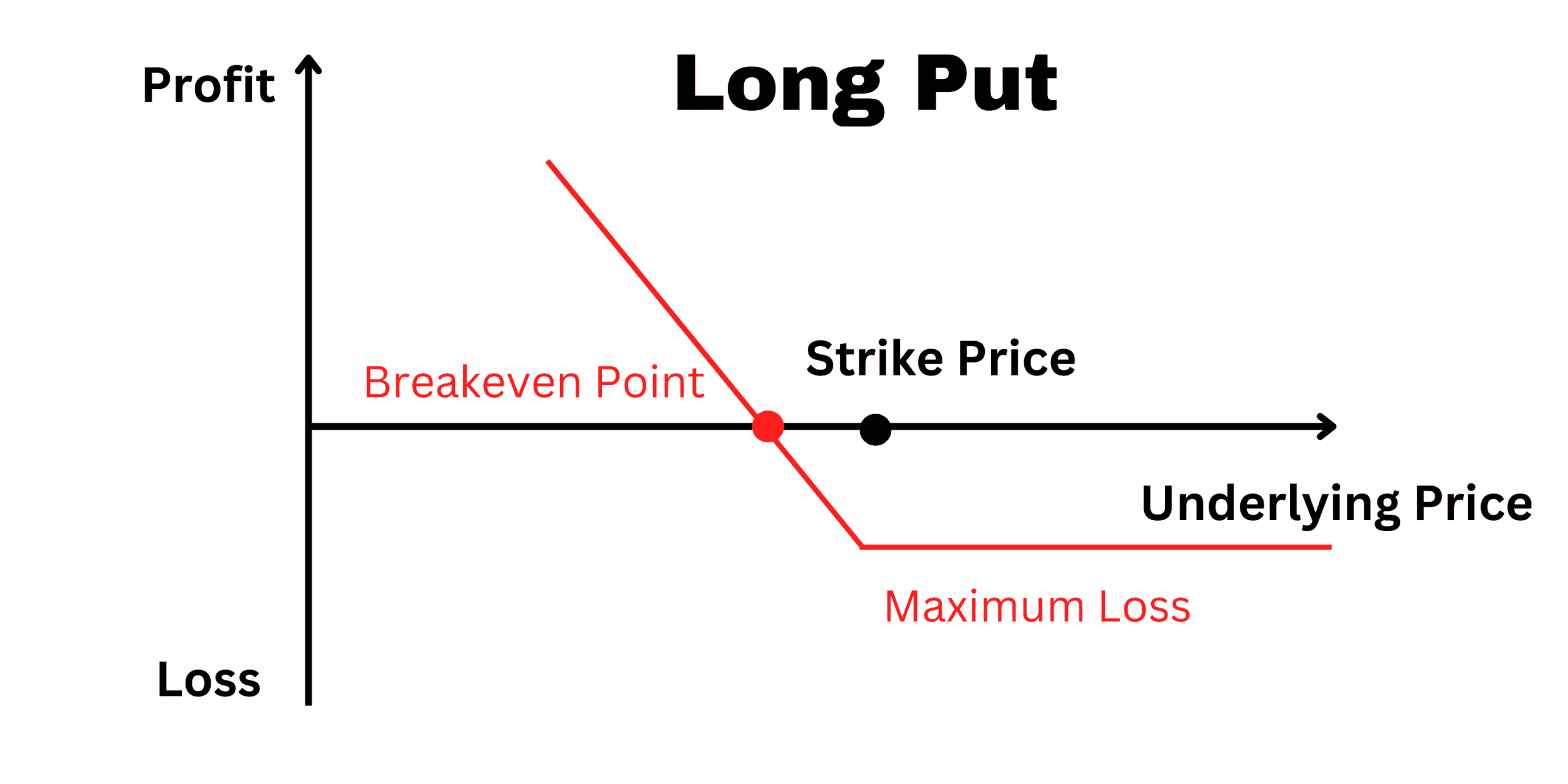

Buying put options

The suitable timing for buying put option strategy:

1. The price of the underlying securities is expected to fall sharply in the future.

2. Market volatility is expanding (not applicable to market conditions where market volatility is narrowing).

The figure below shows the profit and loss of buying put options at maturity. The loss from buying put options is limited, and the maximum loss is the premium paid. That is, when the price of the underlying securities rises above the strike price, the loss is the largest. Profit is greatest when the underlying security falls to zero.

The same example: Suppose Jack is bearish on stock B and expects stock B to fall rapidly. Then he buys a put option of stock B with a premium of 5 dollars, and the strike price is 20 dollars. If stock B plummets to X dollars, Jack will earn 15-X dollars (the exercise price of 20 dollars – the premium of 5 dollars – the current price of X dollars). The lower the stock price of X, the more money he earns. When the price of stock B falls to nearly 0 dollars, Jack earns the most. The biggest loss is that Jack “tears up” the option contract tearfully, losing 5 dollars in premium.

Advantages of buying a put option:

If the underlying price falls, you can profit from the put option. The risk is fixed, the biggest risk is the loss of the premium, but the upper limit of the profit is very high.

Points to note when choosing to buy call options and buy put options:

①The option buyer has limited losses. He can achieve the goal of making a big fortune with a small amount. However, the volatility of the value of an option is huge. Therefore, it is not suitable to hold heavy positions on options.

②Option buyers are not suitable to enter the market when market volatility narrows. Because they may lose money even if they look in the right direction.

Selling call options

The suitable timing for selling call options:

1. You expect the price’s uptrend to end and fall soon.

2. You expect the stock price will consolidate around the strike price, with little fluctuation.

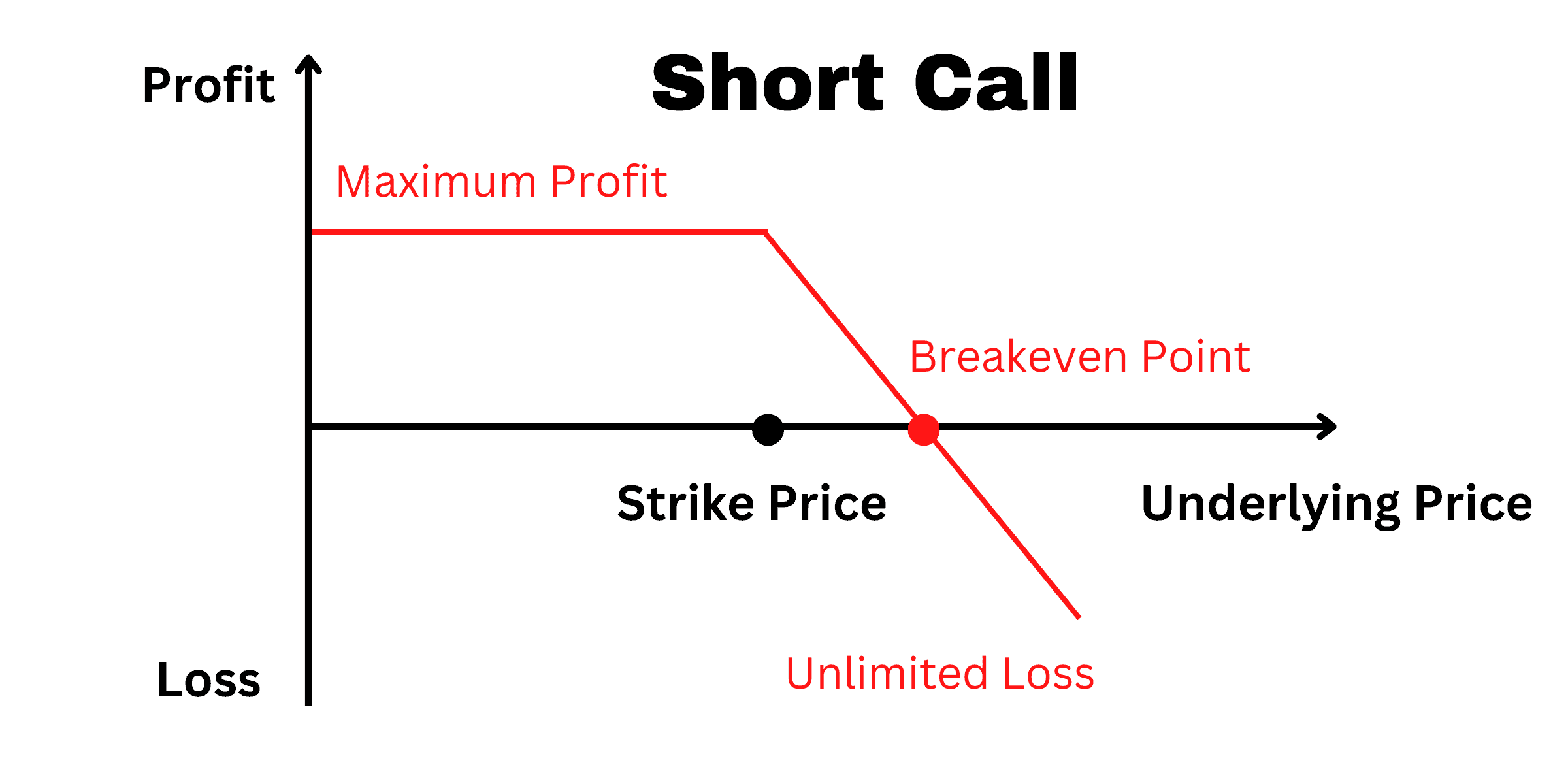

When the underlying securities fall or have horizontal price movement, you can obtain the profit from time value decay. The figure below shows the profit and loss of the selling call options at maturity. The maximum profit from selling call options is the premium, while the loss is unlimited.

The same example: Suppose Jack is bearish on stock B (assuming that the stock price is 25 dollars at this time), he sells a call option on stock B with a premium of 5 dollars, and the strike price is 20 dollars. Stock B falls slowly, as he expected. When it falls to 21 dollars, Jack earns 4 dollars (the exercise price of 20 dollars – the current price of 21 dollars + the premium of 5 dollars). When the stock price falls below 20 dollars, Jack could earn 5 dollars.

Of course, if stock B is always at 22 dollars, and the sideways market does not rise or fall, Jack can earn 3 dollars (the exercise price of 20 dollars – the current price of 22 dollars + the premium of 5 dollars).

If the stock price does not fall as expected but rises, when the stock price rises to 25 dollars (equal to the exercise price of 20 dollars + the premium of 5 dollars), there will be neither loss nor profit. However, after the price of B stock exceeds 25 dollars, losses begin to occur, and the amount is 25-X dollars (X is the stock price of B stock). The more the stock price rises, the greater the loss, and there is no upper limit.

Advantages of selling call options:

You can get the premium immediately. As long as the price falls, even if the decline is not much, you can earn.

Selling put options

The suitable timing for selling put options:

1. You expect that the price’s downtrend will end and rise soon.

2. You expect the stock price will consolidate around the strike price, with little fluctuation.

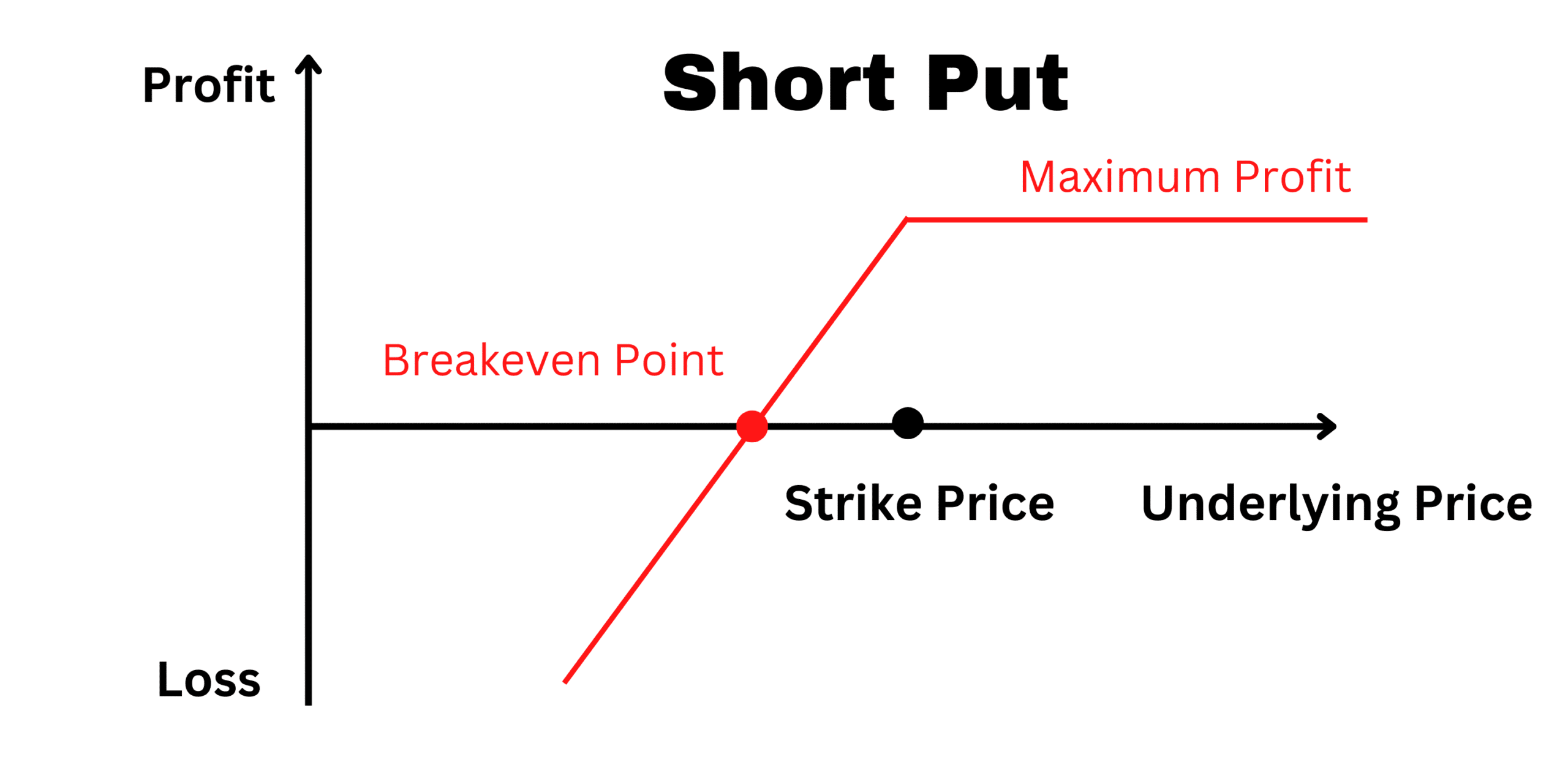

You can have income from time value decay when the underlying securities rise or go sideways. The figure below shows the profit and loss at maturity of the selling put strategy. The maximum profit from selling put options is the premium, but the upper limit of loss is very high.

The same example: Suppose Jack is bullish on stock B and sells a put option of stock B with a premium of 5 dollars (assuming the stock price is 15 dollars at this time), and the strike price is 20 dollars. If stock B rises slowly, when it rises to 18 dollars, Jack earns 3 dollars (the current price of 18 dollars – the exercise price of 20 dollars + the premium of 5 dollars). When the stock price rises to 20 dollars, Jack can earn 5 dollars premium (the current price of 20 dollars – the exercise price of 20 dollars + the premium of 5 dollars).

Of course, if stock B has horizontal price movement at 22 dollars, Jack can earn a premium of 5 dollars.

But if the stock price does not rise as expected but falls, when the stock price is in a sideways market of 15 dollars (equal to the exercise price of 20 dollars – the premium of 5 dollars), there is neither loss nor profit. However, after the price of B stock falls below 15 dollars, it begins to generate losses, and the amount is X-15 dollars (X is the price of B stock).

Advantages of selling put options:

Even if you are wrong about the market’s direction, you can still make money from the premium as long as the market is not volatile.

Points to note when choosing to sell call options and sell put options:

①As an option seller, the profit is limited, and the upper limit of loss is relatively high. Therefore, holding some underlying securities or buying a call option with a lower strike price for protection while selling a call option is best.

②You need to pay the margin first, which leads to a decrease in the return on investment. The seller has no chance of “making a big fortune with a small amount.”

Conclusion

After these three steps, a classic options trading pattern is shown up:

- Expect the underlying stock price to rise rapidly: buy call options.

- Expect the underlying stock price to fall rapidly: buy put options.

- Expect the underlying price to fall slowly or go sideways: sell call options.

- Expect the underlying price to rise slowly or go sideways: sell put options.

However, this classic pattern is just a one-leg options trading strategy. If you want to know more complicated options trading strategies, welcome to follow me and keep reading articles I will post on Canny Trading.