Saving for retirement is essential, and 401(k) plans have been a popular way for Americans to build their nest egg for decades. According to a recent study by the Investment Company Institute, Americans held over $6.3 trillion in 401(k) plans in 2022. But with high inflation and ongoing economic uncertainty, it’s tough to feel confident about your financial future. Thus, in this article, I will examine whether a 401(k) is worth it anymore in 2023.

What is a 401(k) Plan?

In the US, a 401(k) plan is a popular retirement savings option employers offer their workers. It can help employees save for retirement in a tax-advantaged account.

When you sign up for a 401(k) plan, you decide how much of your pre-tax salary to contribute to the account. This money is then invested in different options, such as stocks, bonds, and mutual funds. Since it’s pre-tax income, you don’t have to pay taxes on it until you withdraw it.

The government sets the maximum amount you can contribute to your 401(k) account each year. As of 2023, the limit is $22,500. If you’re 50 or older, you can contribute an additional $7,500, totaling $30,000.

Many employers go above and beyond by adding extra money to their workers’ 401(k) accounts. This could be in the form of matching contributions, where the employer matches a portion of what the employee contributes, or profit-sharing contributions, where the employer shares a percentage of their profits with employees. For example, if you put $10,000 into your 401(k) account, your employer might add an extra $5,000, which your employer gives you for free.

It’s important to note that you can’t withdraw money from your 401(k) account until you reach age 59 and a half, except under exceptional circumstances. If you do take money out early, you may have to pay penalties and taxes. Also, when you start taking money out of your account, it’s considered regular income and taxed accordingly.

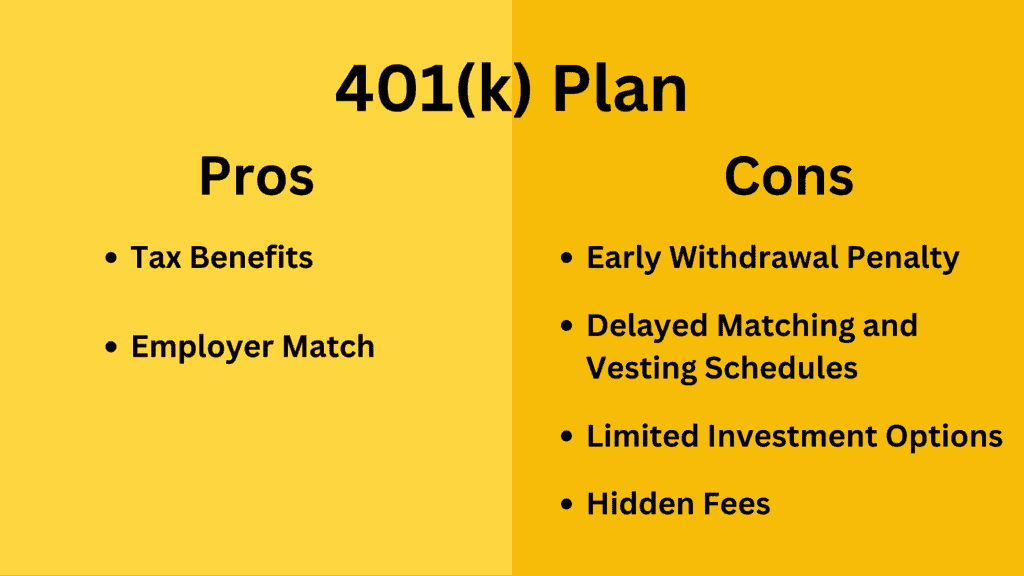

The Pros of 401(k)

Tax Benefits

When you join a 401(k) plan, the money you put in each year is taken out of your taxable income. This means you pay less in taxes each year. For example, if you make $50,000 a year and put $5,000 in your 401(k) plan, you’ll only have to pay taxes on $45,000 of income.

In addition, any earnings in your 401(k) account are tax-deferred, meaning you don’t have to pay taxes on them until you withdraw the money. So the funds in your 401(k) account can grow tax-free until you take them out. Considering the power of compounding, even slight initial differences in funding can lead to vastly different outcomes, making 401(k) a great investment vehicle.

If you’re a high-income earner, the tax benefits of a 401(k) plan can be even more significant. By contributing to your 401(k), you can lower your taxable income and potentially avoid paying extra taxes.

Employer Match

Did you know that almost 90% of employers who offer 401(k) plans also provide employer matching? So, if you contribute to your retirement savings, your employer may match your contribution up to a certain percentage. It’s like free money!

In 2022, the average employer match was 4.7% of your salary. For example, if you make $50,000 a year and contribute 6% of your salary ($3,000) to your 401(k), your employer may match 50% of that contribution. That’s an additional FREE $1,500 that your employer will add to your account.

Over time, these contributions can add up to a significant amount, especially when considering compound interest. In fact, employees who receive employer matching tend to have higher account balances than those who don’t. According to data from the Employee Benefit Research Institute, in 2019, the average 401(k) account balance for those who received employer matching was $139,943, compared to $76,047 for those who did not receive matching.

The Cons of 401(k)

Early Withdrawal Penalty

The government has imposed a 10% early withdrawal penalty on any money taken out of a 401(k) before age 59.5, in addition to the regular income tax on the withdrawn amount.

This penalty can be a real headache for people who might need to tap into their retirement savings early, such as unexpected medical bills or losing their job. In these situations, you might be tempted to use your retirement savings to cover the costs, but the penalty fee can seriously cut into the money you have saved up.

Delayed Matching and Vesting Schedules

Delayed matching is when an employer waits a certain period before matching an employee’s contributions to their 401(k) plan. So, if you start a new job and your employer has a delayed matching policy, you may have to wait six months or a year before your employer starts contributing to your retirement account. The employer’s average 401(k) contribution rate is 4.7%. Thus, if you have to wait a year to receive the employer’s matching contribution, you may miss 4.7% of your salary.

Vesting schedules are another essential factor to consider. Vesting refers to the process by which an employee becomes entitled to the employer’s contributions to their retirement account. Some employers use vesting schedules that require an employee to work for a certain number of years before fully vested in their retirement account.

For example, an employer might use a vesting schedule that provides 25% vesting after two years, 50% vesting after three years, and full vesting after four years. If you leave your job before you’re fully vested, you may lose some or all of your employer’s contributions to your retirement account.

While the typical vesting schedule is three to five years, the average American worker changes jobs around 12 times throughout their career. This means that most employees in America may miss out on a significant amount of money that they would have received from their employer’s contributions.

Limited Investment Options

In a 401(k) plan, your employer usually picks a few investment options for you to choose from, such as mutual funds, target-date funds, and company stock.

However, the number of investment options in a 401(k) plan is typically limited, with an average of 8-12 options available. This is relatively small compared to the thousands of investment options in the broader financial markets. Limited selection can make it challenging to create a well-diversified portfolio that meets your investment needs and risk tolerance.

Related Reading: How Does Portfolio Diversification Protect Investors? – A Full Guide

Besides, you may miss out on new investment opportunities or technologies that could potentially benefit you. For example, if a new investment trend arises that’s not available in your 401(k) plan, you will be unable to take advantage of it.

Hidden Fees

With 401(k) plans, you pay fees that can chip away at your retirement savings over time.

Here’s the deal: there are various fees associated with 401(k) plans, such as administrative fees, investment management fees, and other costs. Unfortunately, these fees are often not explicitly disclosed, leaving many employees in the dark.

Even if you’re aware of the fees, you may not fully understand the impact they can have on your savings. For example, these fees can be as much as 0.5% to 2% of your account balance annually. While this might not sound like much, it can add up over time, potentially costing you thousands of dollars in lost savings. In fact, a mere 1% increase in fees could reduce your retirement savings by up to 28% over 35 years. That’s a huge difference!

Is a 401(k) Worth It Anymore?

In my previous analysis, I talked about the two advantages and four disadvantages of 401(k), but that doesn’t mean I think 401(k) don’t worth it anymore. Actually, I think 401(k) still has huge value, despite the drawbacks.

Let’s take a closer look at the advantages. These two advantages of 401(k) can bring in a lot of REAL money for your retirement. On the other hand, the disadvantages can be discouraging. For instance, fees can affect your savings, but there’s a solution. You can talk to your employer and see if they’re willing to share the cost of 401(k). That way, you’ll have less stress and more money saved.

Also, you can’t withdraw your funds until you’re 59.5 years old. However, this can be seen as a positive aspect for some people. You won’t be able to spend your retirement money impulsively. Instead, your savings will continue to grow and compound, helping you meet your retirement goals in the long run.

In conclusion, while 401(k) has some disadvantages, its benefits are too big to ignore. With careful planning, you can take advantage of its benefits and make the most of your retirement savings.