In investing, pursuing minimizing risk while maximizing returns is the ultimate objective for investors. Navigating the intricacies of financial markets can be daunting. However, there are strategies designed to assist in achieving these goals. One such method is the fiduciary call options strategy.

The fiduciary call strategy combines call options with risk-free financial instruments, allowing you to secure stable returns while keeping investment costs manageable.

What Is a Fiduciary Call Options Strategy?

If you have adequate funds, employing a fiduciary call strategy can prove cost-effective. It lets you control the same number of shares as if you were buying stocks directly, but through call options instead. Rather than using all your funds to buy 100 shares of a stock, you use a smaller portion to purchase a call option contract (which represents 100 shares).

You might wonder, isn’t this simply buying call options? The key distinction lies in investing the present value of the strike price in risk-free, interest-bearing instruments like term deposits or money market instruments. This approach helps you minimize the costs associated with exercising call options.

The fiduciary call strategy can be an alternative to the protective put option (also known as a married put), which generally requires a larger upfront investment and higher costs.

Fiduciary Call vs Protective Put

When comparing fiduciary calls and protective puts, you may notice that their payoff graphs appear pretty similar at expiration. If the call options in fiduciary calls and the put options in protective puts share the same strike price and expiration date, their payoff graphs will indeed be identical. This can be demonstrated using the principle of put-call parity.

Put-Call Parity

Put-call parity dictates that the difference in prices between call and put options with identical strike prices and expiration dates should equal the difference between the underlying stock price and the present value of the strike price. Consider the formula for put-call parity:

C – P = S – PV(K)

By rearranging this formula:

C + PV(K) = S + P

You can see that the fiduciary call is on the left side, while the protective put is on the right side. This shows that their payoffs are identical in this specific scenario.

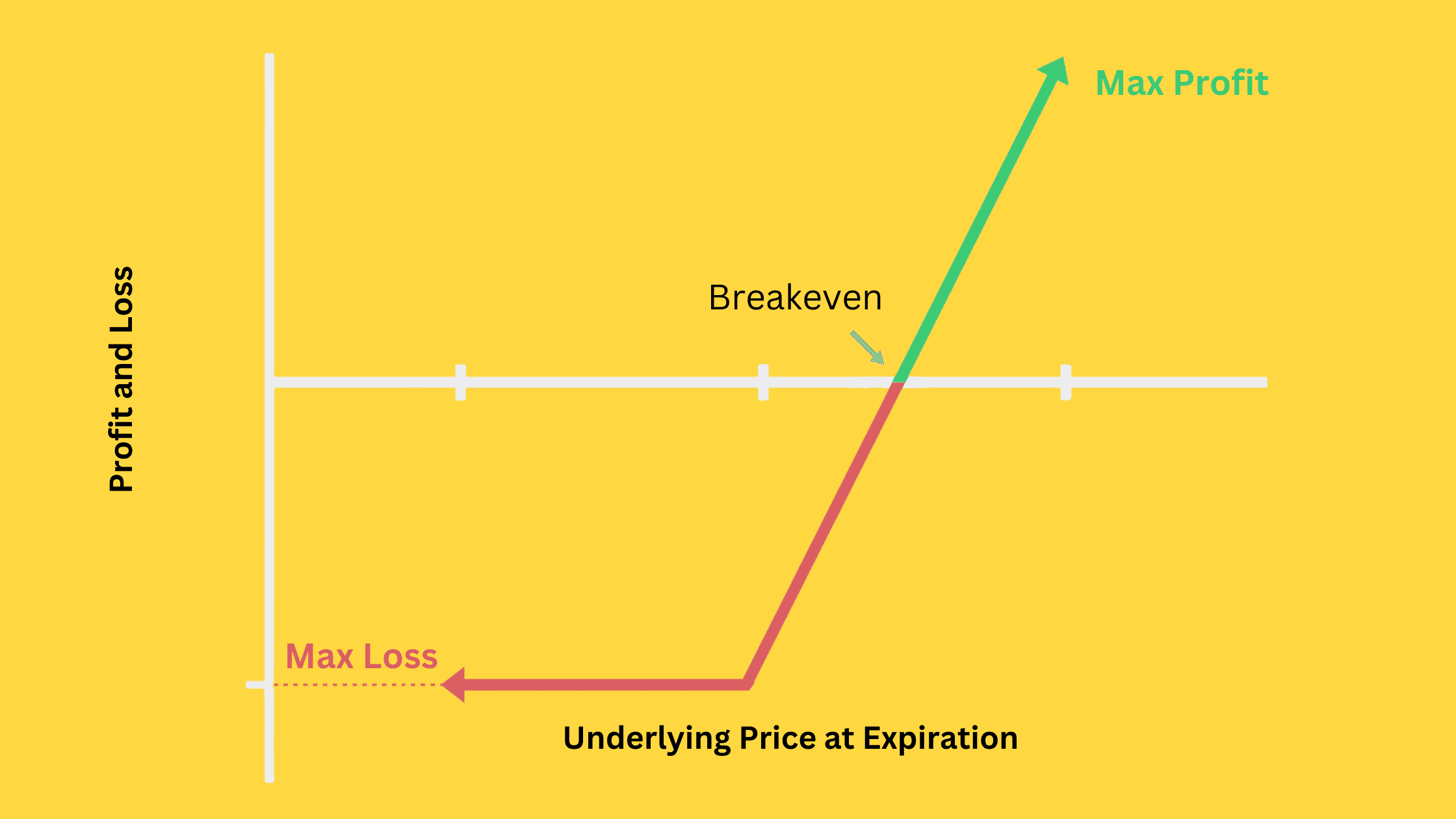

However, you don’t always have to use call and put options with the same strike price or expiration date in these strategies, so their payoffs will often differ. Nonetheless, their payoffs share similarities, as both strategies offer unlimited potential profits when the underlying asset rises and simultaneously limit downside risk.

The protective put strategy can be compared to purchasing insurance. As an investor, you pay for the put option to limit potential losses within an acceptable range should the stock price decline. If the stock price increases, you can enjoy the profits generated by the rising stock without any negative impact.

On the other hand, the fiduciary call strategy involves allocating a small portion of your funds to purchase call options, while investing most of the remaining funds in low-risk, guaranteed-return financial instruments. This approach also lets you earn profits by exercising call options when stock prices increase. If stock prices don’t rise as anticipated, the assets in the risk-free account help safeguard most of your funds.

Benefits of Fiduciary Call

Given their similarities, you might wonder why you should choose a fiduciary call over a protective put. There are several compelling reasons to consider.

Lower Costs

Fiduciary calls and protective puts may be similar, but this comparison doesn’t account for transaction costs. In practice, fiduciary calls often have lower transaction costs than protective puts. With a fiduciary call, you only need to purchase call options. However, a protective put requires you first to buy the stock and then the put options, resulting in higher fees.

Convenience and Psychological Comfort

A fiduciary call could be a better fit for you if you’re a risk-averse investor who prefers to keep most of your funds in savings accounts. This strategy only requires you to use a small portion of your savings to buy call options, allowing most of your assets to remain in a risk-free savings account. Even if the call option doesn’t yield profits, the loss feels limited to the money spent on the option.

In contrast, a protective put requires you to move a significant amount of money from your savings account to buy stocks, which can be inconvenient and create psychological discomfort.