Are you seeking an options trading strategy that allows you to profit under various stock price scenarios? The deep in-the-money (ITM) covered call strategy could be an ideal choice. This neutral or volatile approach is distinct from the bullish covered call strategy. It aims to generate stable profit whenever the underlying stock remains stagnant, moves up, or moves down within specific limits.

Limitations of the Regular Covered Call

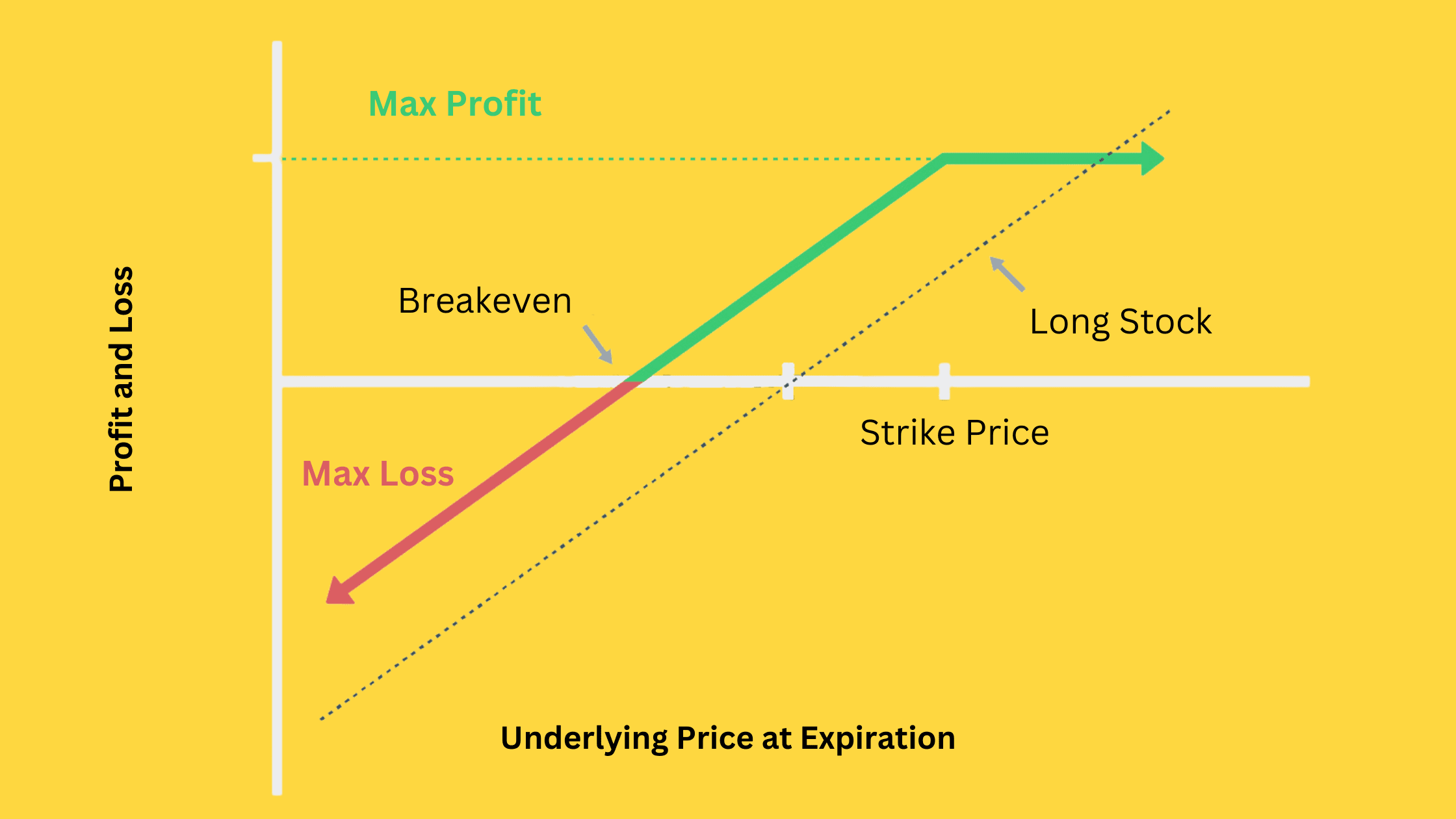

One popular options strategy among investors is the regular covered call, which involves selling out-of-the-money call options on a stock you already own.

The regular covered call strategy works well when you expect a slow and steady increase in the underlying stock’s price. This is because the maximum profit from this strategy is achieved when the stock price rises to the strike price of the call option sold. In this scenario, you benefit from both the stock appreciation and the premium received from selling the call option. However, this strategy has some limitations.

Imagine a stock that has already experienced significant growth and has a high probability of a price pullback. Using the regular covered call strategy might not be your best option in such cases. The chances of achieving maximum profit are diminished, as the stock price may not continue to rise steadily up to the strike price of the sold call option.

Furthermore, if the stock price does experience a pullback, you could face losses. This occurs when the decline in the stock’s value exceeds the premium received from selling the call option, resulting in a net loss.

Introduction to Deep In-The-Money Covered Call

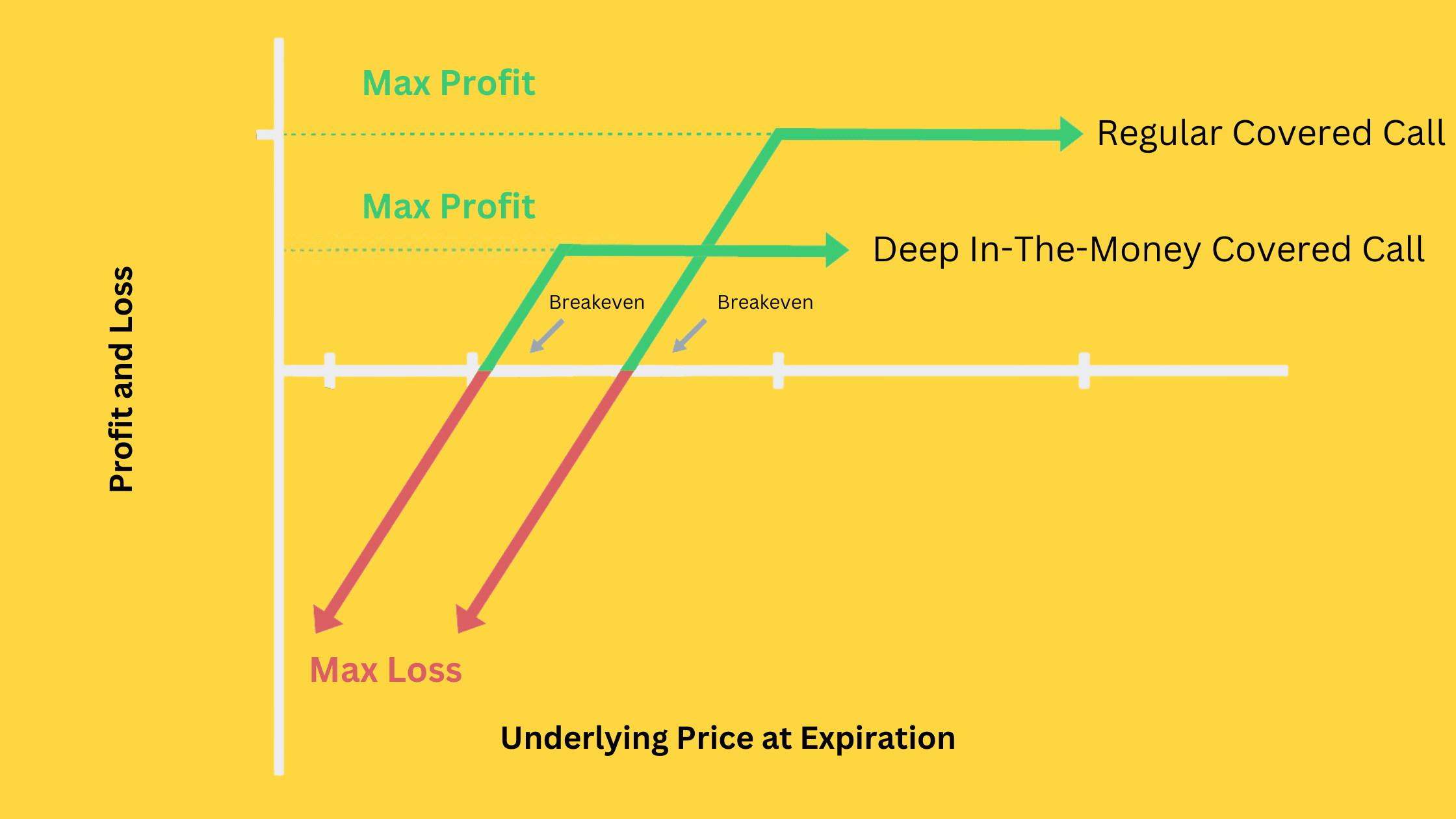

The main difference between a deep in-the-money covered call and a regular covered call lies in the type of call options sold. With a deep in-the-money covered call, you sell call options that are deep in the money, while in a regular covered call, you sell out-of-the-money call options.

But what exactly does “deep in the money” mean? Generally, call options are considered deep in the money if their strike price is at least 10% below the current market price of the underlying stock. This results in a high delta value for the option, typically close to 1.

A high delta value (close to 1) indicates that the option’s price moves almost in tandem with the underlying stock. Thus, it can provide better protection against price fluctuations than out-of-the-money call options used in the regular covered call strategy.

When to Use a Deep In-The-Money Covered Call?

- Protecting against a likely pullback after a substantial stock price increase

A deep in-the-money covered call strategy provides you with more significant downside protection than a regular covered call strategy. The break-even point for both strategies is calculated as the stock purchase price minus the option premium received.

However, the premium for a deep in-the-money call option is considerably higher than that of an out-of-the-money call option. As a result, the break-even point for a deep in-the-money covered call is much lower. In the event of a pullback, you have a higher probability of making a profit instead of incurring a loss.

- Pursuing consistent, small profits without speculating on stock trends

A deep in-the-money covered call strategy offers you more stability because the call option you sell has a delta close to 1. With this strategy, the gains or losses in the stock will generally be offset by the profits or losses in the sold call option, as long as there are no significant stock price declines. This results in very few instances when the strategy would incur a loss.

But, still, you can capture the time value of the sold call option, enabling you to achieve consistent, small gains over time.

Tips on Trading Deep In-The-Money Covered Calls

Adapting as the market evolves is crucial to using a deep in-the-money covered call strategy. Instead of passively waiting for the sold call option to expire, stay alert to the changing market conditions and adjust your approach accordingly.

For instance, if the stock price experiences a rapid decline and you believe the pullback is nearly over with a potential rebound, consider buying back the sold call option. This way, your stock position won’t be called away upon option expiration, allowing you to benefit from any potential future price increases.

However, suppose you sense there’s a risk of further considerable declines in the stock price. You can consider purchasing a put option to create a protective put strategy. This way, you can shield your portfolio from significant losses due to sharp stock price drops.

Flexibility and adaptability are key components when trading deep in-the-money covered calls. It’s essential not to blindly follow a fixed plan when using options strategies. Continuously assess the market and make necessary adjustments to optimize your strategy. This adaptability can improve each strategy’s success rate and enhance your investments’ overall performance.